|

시장보고서

상품코드

1498833

ALD/high-k 금속 전구체 시장(중요 재료)(2024-2025년)ALD / High K Metal Precursors Market Report 2024-2025 (Critical Materials Report) |

||||||

※ 본 상품은 영문 자료로 한글과 영문 목차에 불일치하는 내용이 있을 경우 영문을 우선합니다. 정확한 검토를 위해 영문 목차를 참고해주시기 바랍니다.

이 보고서는 반도체 디바이스 제조에 사용되는 전구체 시장 전망과 공급망을 다룹니다. 또한 주요 공급업체 정보, 재료 공급 체인 문제 및 동향, 공급업체 시장 점유율 추정 및 예측, 재료 부문 예측 등의 정보를 게시합니다.

SAMPLE VIEW

목차

제1장 주요 요약

제2장 조사 범위,목적,수법

제3장 반도체 산업: 시장의 현황과 전망

- 세계경제와 전망

- 반도체 산업과 세계 경제의 연결

- 반도체 매출 성장

- 대만 아웃소싱 제조업체의 월간 매출 동향

- 칩 판매 동향 : 전자 제품 부문별

- 일렉트로닉스의 전망

- 자동차 산업의 전망

- 스마트폰의 전망

- PC의 전망

- 서버/IT 시장

- 반도체 제조의 성장과 확대

- 칩 확장에의 거액 투자의 한가운데

- 미국의 새로운 공장

- 세계 각지에서의 공장 확대가 성장을 견인

- 설비투자 동향

- 고도 로직의 기술 로드맵

- 공장 투자 평가

- 정책,무역 동향과 그 영향

- 반도체 재료의 개요

- 웨이퍼의 투입 매수: 예측(-2028년)

- 재료 시장 예측(-2028년)

제4장 재료 시장 동향

- CVD,ALD 금속 및 high-k,고도 유전체 전구체 시장 동향

- 전구체 시장(2023년) : 2024년에의 연결

- 전구체 시장 전망

- 금속 및 high-k 전구체의 출하량의 예측 : 부문별(향후 5년간 분)

- 전구체공급 능력과 수요,투자

- 주요 공급자의 금속 및 high-k 전구체의 생산 능력

- 금속 및 high-k의 생산량 : 지역별

- ALD/CVD 재료의 생산 능력 확대

- 투자 발표: 개요

- 전구체의 수급 밸런스: 개요

- 가격 동향

- 기술 동향/기술 촉진요인: 개요

- 전구체의 전반적인 기술 개요:기술 동향

- 고객 주도형 기술

- NAND 로드맵 및 과제: 스택/티어가 있는 3D NAND 레벨

- 3D NAND 프로세스의 진보의 필요성

- 새로운 재료와 에칭 화학이 3D NAND의 스케일링을 가능하게 한다 - PF3(G)와 MOO2CL2(S)

- 몰리브덴 : 램 조사에 의한 반도체 메탈라이제이션의 새로운 프론티어

- DRAM 프로세스의 진보가 필요

- DRAM 미래의 기술과제

- Micron이 획기적인 NVDRAM을 발표:DRAM에 필적하는 성능을 가지는 듀얼 레이어 32기가비트 비휘발성 강유전체 메모리

- 고도 로직의 로드맵과 과제: 로직 트랜지스터 EST. 로드맵

- 고급 로직(파운드리) 노드 HVM 추정

- ADV 로직 프로세스의 진보의 필요성

- 고도 로직: 미래의 기술적 과제

- 포토리소그래피에 있어서의 기술 진보의 영향

- CFET 아키텍처: CFET 스케일링의 장점

- 무기 EUV 레지스트: ALD 증착

- 분자층 증착(MLD)

- 영역 선택 침착(ASD)

- 특수/신흥금속과 그 용도

- 특수/신흥 HIGH-K와 그 응용

- 지역적 고려사항: 금속 및 high-k

- 지역적 측면과 촉진요인

- EHS와 무역/물류 문제: 금속 및 high-k,유전체

- ESH 금속

- ESHhigh-k

- ESH 재활용

- 무역/물류 문제: 금속재료

- 무역/물류 문제: high-k 재료

- high-k 시장 동향에 관한 분석가의 평가

- 금속 시장 동향에 관한 분석가의 평가

제5장 공급측 시장의 정세

- 전구체 재료 시장 점유율

- 최근 분기 활동: MERCK

- 최근 분기 활동 : AIR LIQUIDE

- 최근 분기 활동: ENTEGRIS

- ADEKA

- 기업 합병,인수(M&A) 활동과 파트너십

- 공장 폐쇄

- 신규 진출기업

- MSP가 TURBO II(TM) 기화기를 발매 : 반도체 제조의 차세대 효율

- 새로운 ZR 전구체 웨이퍼 스케일 이산화지르코늄막

- 몰리브덴 박막의 진보: 새로운 액체 전구체가 기상 퇴적을 촉진

- Hanwha, 메모리 용도용 몰리브덴 증착 ALD 장치를 공급

- 제조 중단의 우려가 있는 공급자 또는 부품/제품 라인

- 애널리스트에 의한 선행 공급자의 평가

제6장 하층 공급 체인: 전구체

- 하층(서브티어) 공급 체인: 공급원과 시장 개요

- 하층 공급망: 공급원 및 시장 개요 - Tier 2의 예: NOURYON과 GELEST

- 하층 공급망: 공급업체 및 시장 개요 - 화학 및 가스 관리 시스템

- 하층 공급망: 공급원 및 시장 개요 - 화학물질 배송 캐비닛

- 하층 공급망: 공급원 및 시장 개요 - 밸브 매니폴드 박스(VMB)

- 하층 공급망: 공급원 및 시장 개요 - 대량 사양 가스 시스템

- 하층 공급망: 공급원 및 시장 개요 - 가스 캐비닛

- 하층 공급망: 공급원 및 시장 개요 - 포밍 가스와 도펀트 가스 블렌더

- 하층 공급망: 공급업체 및 시장 개요: 화학 - 모니터링 및 분석 시스템

- 하층 재료 : CVD?ALD 전구체의 동향

- 하층 재료 : 공업용 vs 반도체 그레이드

- 반도체 등급 하층 재료 공급업체의 국제 네트워크: Merck

- 반도체 등급 하층 재료 공급업체의 국제 네트워크: Air Liquide

- 반도체 등급의 하층 재료 공급업체의 최신 정보

- 하층 공급 체인의 혁신(파괴)

- 하층 공급망 공장의 최신 정보

- 하층 공급망 공장의 최신 정보 : HAFNIA와 REO(DUBBO PROJECT)

- 반도체 산업에서 사용되는 광물의 의존도

- 하층 공급 체인의 동향 : 코발트

- 하층 공급 체인의 동향 :지르코늄,하프늄

- 하층 공급 체인의 동향 : 하프늄

- 하층 공급 체인의 동향 : 갈륨

- 알루미늄

- 티타늄

- 텅스텐

- 몰리브덴

- 니오브?탄탈

- 희토류(희토류)

- 하층 공급 체인의 동향 :PGM

- 하층 공급 체인의 동향 :게르마늄

- 하층 공급망: 분석가의 평가

제7장 공급자 프로파일

- ADEKA CORPORATION

- AIR LIQUIDE(MAKER, PURIFIER, SUPPLIER)

- AZMAX CO., LTD

- CITY CHEMICAL LLC

- DNF CO., LTD

- 기타 20사 이상

This report covers the market landscape and supply-chain for Precursors used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

SAMPLE VIEW

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 PRECURSORS BUSINESS - MARKET OVERVIEW

- 1.2 PRECURSORS MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT: METAL AND HIGH-K PRECURSORS

- 1.4 PRECURSOR TRENDS

- 1.5 PRECURSOR TECHNOLOGY TRENDS

- 1.6 COMPETITIVE LANDSCAPE METAL & HIGH-K PRECURSORS

- 1.7 PRECURSOR EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

- 1.8 ANALYST ASSESSMENT OF METAL AND HIGH-K PRECURSORS

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 MATERIAL MARKET TRENDS

- 4.1 CVD, ALD METAL & HIGH-K AND ADVANCED DIELECTRIC PRECURSORS MARKET TRENDS

- 4.1.1 2023 PRECURSOR MARKET LEADING INTO 2024

- 4.1.2 PRECURSOR MARKET OUTLOOK

- 4.1.3 METAL AND HIGH-K PRECURSORS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

- 4.2 PRECURSORS SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.2.1 METAL & HIGH-K PRECURSOR PRODUCTION CAPACITY OF TOP SUPPLIERS

- 4.2.2 METAL & HIGH-K PRODUCTION BY REGION

- 4.2.3 ALD/CVD MATERIAL PRODUCTION CAPACITY EXPANSIONS

- 4.2.4 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.2.5 PRECURSORS SUPPLY VS. DEMAND BALANCE - OVERVIEW

- 4.3 PRICING TRENDS

- 4.4 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 4.4.1 PRECURSOR GENERAL TECHNOLOGY OVERVIEW & TECHNOLOGY TRENDS

- 4.4.2 CUSTOMER DRIVEN TECHNOLOGIES

- 4.4.3 NAND ROADMAPS AND CHALLENGES - 3D NAND LEVELS W/ STACKS/TIERS

- 4.4.4 3D NAND PROCESS ADVANCES REQUIRED

- 4.4.5 NEW MATERIALS AND ETCH CHEMISTRIES ENABLE 3D NAND SCALING - PF3(G) AND MOO2CL2(S)

- 4.4.6 MOLYBDENUM: THE NEW FRONTIER IN SEMICONDUCTOR METALLIZATION ACCORDING TO LAM RESEARCH

- 4.4.7 DRAM PROCESS ADVANCES REQUIRED

- 4.4.8 DRAM FUTURE TECHNOLOGY CHALLENGES

- 4.4.9 MICRON UNVEILS BREAKTHROUGH NVDRAM: A DUAL-LAYER 32GBIT NON-VOLATILE FERROELECTRIC MEMORY WITH NEAR-DRAM PERFORMANCE

- 4.4.10 ADVANCED LOGIC ROADMAPS AND CHALLENGES - LOGIC TRANSISTOR EST. ROADMAP

- 4.4.11 ADVANCED LOGIC (FOUNDRY) NODE HVM ESTIMATE

- 4.4.12 ADV LOGIC PROCESS ADVANCES REQUIRED

- 4.4.12.1 THE SEMICONDUCTOR SHOWDOWN: SAMSUNG AND TSMC'S GAA FETS VS. INTEL'S RIBBONFET

- 4.4.13 ADV LOGIC FUTURE TECHNOLOGY CHALLENGES

- 4.4.14 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY

- 4.4.14.1 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY - DSA

- 4.4.14.2 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: CENTURA SCULPTA BY APPLIED MATERIALS: SHAPING THE FUTURE OF SEMICONDUCTOR MANUFACTURING

- 4.4.14.3 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: LINE EDGE ROUGHNESS REDUCTION THRU DEPOSITION

- 4.4.15 CFET ARCHITECTURE: CFET SCALING ADVANTAGE

- 4.4.15.1 CFET ARCHITECTURE: COMPLEMENTARY FETS (CFETS)

- 4.4.15.2 CFET ARCHITECTURE: CFET FUTURE PROSPECTS

- 4.4.16 INORGANIC EUV RESIST - ALD DEPOSITED

- 4.4.17 MOLECULAR LAYER DEPOSITION (MLD)

- 4.4.17.1 TREND IS MLD COMBINED WITH ALD

- 4.4.17.2 DIFFERENT TYPES OF MLD PRECURSORS AND MATERIALS

- 4.4.17.3 MLD APPLICATIONS

- 4.4.18 AREA SELECTIVE DEPOSITION (ASD)

- 4.4.18.1 AREA SELECTIVE DEPOSITION (ASD) - ADEKA PRESENT ASD HF-PRECURSOR

- 4.4.18.2 AREA SELECTIVE DEPOSITION (ASD) - TU EINDHOVEN SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- 4.4.20 SPECIALTY/EMERGING METAL AND APPLICATIONS

- 4.4.21 SPECIALTY/EMERGING HIGH-K AND APPLICATIONS

- 4.5 REGIONAL CONSIDERATIONS - METAL AND HIGH-K

- 4.5.1 REGIONAL ASPECTS AND DRIVERS

- 4.6 EHS AND TRADE/LOGISTIC ISSUES - METALS, HIGH-K AND DIELECTRICS

- 4.6.1 ESH METALS

- 4.6.2 ESH HIGH-K

- 4.6.3 ESH RECYCLING

- 4.7 TRADE/LOGISTICS ISSUES - METAL MATERIALS

- 4.7.1 TRADE/LOGISTICS ISSUES - HIGH-K MATERIALS

- 4.8 ANALYST ASSESSMENT OF HIGH-K MARKET TRENDS

- 4.8.1 ANALYST ASSESSMENT OF METAL MARKET TRENDS

5 SUPPLY-SIDE MARKET LANDSCAPE

- 5.1 PRECURSOR MATERIAL MARKET SHARE

- 5.1.1 CURRENT QUARTER ACTIVITY - MERCK

- 5.1.1.1 MERCK

- 5.1.2 CURRENT QUARTER ACTIVITY - AIR LIQUIDE

- 5.1.2.1 AIR LIQUIDE

- 5.1.3 CURRENT QUARTER ACTIVITY -ENTEGRIS

- 5.1.3.1 ENTEGRIS

- 5.1.4 ADEKA

- 5.1.4.1 ADEKA

- 5.1.1 CURRENT QUARTER ACTIVITY - MERCK

- 5.2 M&A ACTIVITY AND PARTNERSHIPS

- 5.3 PLANT CLOSURES

- 5.4 NEW ENTRANTS

- 5.4.1 MSP LAUNCHES TURBO II(TM) VAPORIZERS: NEXT-GEN EFFICIENCY FOR SEMICONDUCTOR FABRICATION

- 5.4.2 A NEW ZR PRECURSOR WAFER-SCALE ZIRCONIUM DIOXIDE FILMS

- 5.4.3 ADVANCES IN MOLYBDENUM THIN FILMS: NEW LIQUID PRECURSORS BOOST VAPOR PHASE DEPOSITION

- 5.4.4 HANWHA TO SUPPLY ALD EQUIPMENT FOR MOLYBDENUM DEPOSITION FOR MEMORY APPLICATIONS

- 5.5 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.6 TECHCET ANALYST ASSESSMENT OF PRECURSOR SUPPLIERS

6 SUB-TIER SUPPLY-CHAIN, PRECURSORS

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - TIER 2 EXAMPLES NOURYON AND GELEST

- 6.1.2 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - CHEMICAL & GAS MANAGEMENT SYSTEMS

- 6.1.3 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - CHEMICAL DELIVERY CABINETS

- 6.1.4 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW VALVE MANIFOLD BOXES (VMB)

- 6.1.5 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - BULK SPEC GAS SYSTEMS

- 6.1.6 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - GAS CABINETS

- 6.1.7 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - FORMING GAS & DOPANT GAS BLENDERS

- 6.1.8 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW CHEMICAL - MONITORING AND ANALYTICAL SYSTEMS

- 6.2 SUB-TIER MATERIAL CVD & ALD PRECURSOR TRENDS

- 6.3 SUB-TIER MATERIAL INDUSTRIAL VS. SEMICONDUCTOR-GRADE

- 6.4 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER GLOBAL NETWORK MERCK

- 6.5 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER GLOBAL NETWORK AIR LIQUIDE

- 6.6 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER NEWS

- 6.7 SUB-TIER SUPPLY-CHAIN: DISRUPTIONS

- 6.8 SUB-TIER SUPPLY-CHAIN PLANT UPDATES

- 6.9 SUB-TIER SUPPLY-CHAIN PLANT UPDATES - HAFNIA AND REO FROM THE DUBBO PROJECT

- 6.10 MINERAL USED IN THE SEMICONDUCTOR INDUSTRY DEPENDENCIES

- 6.11 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - COBALT

- 6.12 SUB-TIER SUPPLY-CHAIN PRICING TRENDS: ZIRCONIUM AND HAFNIUM

- 6.13 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - HAFNIUM

- 6.14 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - GALLIUM

- 6.15 ALUMINUM

- 6.16 TITANIUM

- 6.17 TUNGSTEN

- 6.18 MOLYBDENUM

- 6.19 NIOBIUM AND TANTALUM

- 6.20 RARE EARTHS

- 6.21 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - PGM

- 6.22 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - GERMANIUM

- 6.23 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 SUPPLIER PROFILES

- ADEKA CORPORATION

- AIR LIQUIDE (MAKER, PURIFIER, SUPPLIER)

- AZMAX CO., LTD

- CITY CHEMICAL LLC

- DNF CO., LTD

- ...AND 20+ MORE

FIGURES

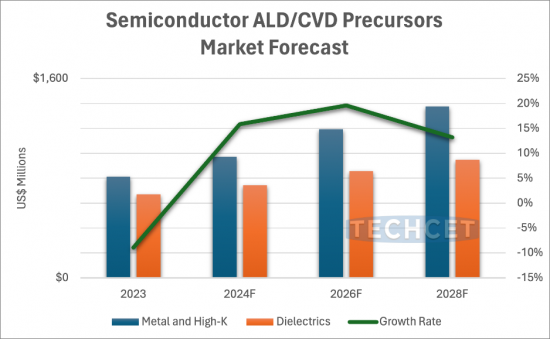

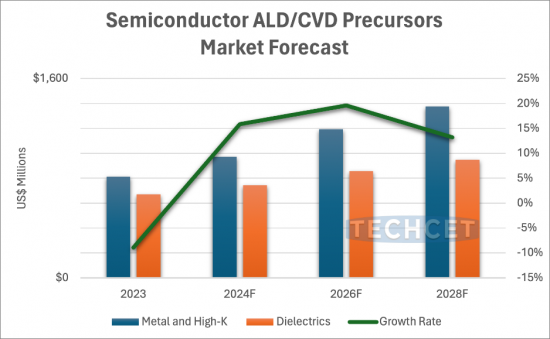

- FIGURE 1.1: METAL & HIGH-K PRECURSOR REVENUE (M USD) FORECAST BY SEGMENT

- FIGURE 1.2: WW MARKET SHARE - METAL & HIGH-K PRECURSORS 2023 (U$ 811 M)

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2023-2028

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: METAL & HIGH-K PRECURSOR REVENUE (M USD) FORECAST BY SEGMENT

- FIGURE 4.2: MEMORY SUPPLY/DEMAND SITUATION 2024

- FIGURE 4.3: WW MARKET SHARE - METAL & HIGH-K PRECURSORS 2023 (U$ 811 M)

- FIGURE 4.4: REGIONAL MARKET SHARES

- FIGURE 4.5: END USE APPLICATIONS DRIVING NEW DEVICE PROCESSES

- FIGURE 4.6: 3D NAND STACKING DRIVES DIELECTRICS AND METALS PRECURSOR VOLUME

- FIGURE 4.7: 3D NAND PROGRESSION

- FIGURE 4.8: ETCH DEPTH PERFORMANCE

- FIGURE 4.9: TOKYO ELECTRON'S NEW CRYOGENIC ETCH TOOL

- FIGURE 4.10: DRAM MESH BY MICRON

- FIGURE 4.11: IMEC CAPACITORLESS IGZO CELL FOR 3D STACKED DRAM

- FIGURE 4.12: TRANSITION FROM 2D TO 3D DRAM

- FIGURE 4.13: 32 GB NVDRAM WITH 1T 1C MEMORY LAYERS

- FIGURE 4.14: GATE STRUCTURE ROADMAP

- FIGURE 4.15: ADVANCED LOGIC (FOUNDRY) NODE ROAD MAP

- FIGURE 4.16: LOGIC TRANSISTOR PROGRESSION

- FIGURE 4.17: RIBBON FET

- FIGURE 4.18: MONO LAYER NANO SHEETS CHANNELS

- FIGURE 4.19: NANO IMPRINT LITHOGRAPHY PROCESS FLOW

- FIGURE 4.20: ALD/ALE ENHANCEMENT OF NANO IMPRINT LITHOGRAPHY

- FIGURE 4.21: DIRECTED SELF-ASSEMBLY

- FIGURE 4.22: DSA PATENT FILING BY COMPANY

- FIGURE 4.23: DSA PATEN FILING SINCE 2023

- FIGURE 4.24: WHAT IS PATTERN SHAPING?

- FIGURE 4.25: REFINING EUV PATTERNING BY APPLIED MATERIALS

- FIGURE 4.26: COMPLEMENTARY FET (CFET)

- FIGURE 4.27: CFET IMPROVES PERFORMANCE IN TRACK SCALING

- FIGURE 4.28: MONOLITHIC CFET PROCESS FLOW EXAMPLE

- FIGURE 4.29: MCFET NEW FEATURE: MIDDLE DIELECTRIC ISOLATION

- FIGURE 4.30: LOW TEMPERATURE GATE STACK OPTION EXAMPLES

- FIGURE 4.31: LOW TEMPERATURE SD/CONTACT OPTION EXAMPLES

- FIGURE 4.32: BSPDN ADVANTAGE: IR DROP REDUCTION

- FIGURE 4.33: INCREASING NUMBER OF ALD STEPS REQUIRED BY NEXT GENERATION GAA-FET AND CFET

- FIGURE 4.34: IMEC SUB-1NM TRANSISTOR ROADMAP, 3D-STACKED CMOS 2.0 PLANS

- FIGURE 4.35: PATENT FILING FOR MLD DEPOSITED EUV RESIST - SEARCH PERFORMED IN PATBASE

- FIGURE 4.36: MOLECULAR LAYER DEPOSITION VS ATOMIC LAYER DEPOSITION

- FIGURE 4.37: INCREASING TREND OF ALD/MLD PUBLICATIONS

- FIGURE 4.38: ADEKA ASD-HF PRECURSORS

- FIGURE 4.39: SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- FIGURE 4.40: SPECIALTY/EMERGING METAL APPLICATIONS

- FIGURE 4.41: SPECIALTY/EMERGING HIGH-K APPLICATIONS - NVM DRAM (MICRON IEDM2023)

- FIGURE 4.42: 2023 METAL & HIGH-K REVENUE SHARE BY REGION

- FIGURE 4.43: EHS ISSUES - HIGH-K: MINING IN CHINA

- FIGURE 4.44: SK HYNIX'S RECYCLED AND RENEWABLE MATERIALS TARGETS

- FIGURE 5.1: 2023 PRECURSOR MATERIAL SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 5.2: MERCK ELECTRONICS REVENUE 2022-2023 (M EUR), LEFT - SEMICONDUCTOR SOLUTIONS ANNUAL REVENUE FORECAST (M EUR), RIGHT

- FIGURE 5.3: AIR LIQUIDE ELECTRONICS REVENUE FORECAST (M EUR)

- FIGURE 5.4: THE MS (MATERIAL SOLUTIONS) DIVISION OF ENTEGRIS REVENUE FORECAST

- FIGURE 5.5: ADEKA REVENUE ELECTRONICS REVENUE FORECAST (100M JPY)

- FIGURE 5.6: NEW ZIRCONIUM PRECURSOR CLASS

- FIGURE 5.7: ADVANCES IN MOLYBDENUM THIN FILMS: NEW LIQUID PRECURSORS BOOST VAPOR PHASE DEPOSITION

- FIGURE 6.1: FORMING GAS BLENDER CONFIGURATION

- FIGURE 6.2: TOP COUNTRIES/REGIONS THAT SUPPLY VERSUM MATERIALS US LLC (PANJIVA APRIL 2024)

- FIGURE 6.3: TOP COUNTRIES/REGIONS THAT SUPPLY AIR LIQUIDE AMERICA CORP. (PANJEIVA APRIL 2024)

- FIGURE 6.4: TOP COUNTRIES/REGIONS THAT SUPPLY H.C. STARCK INC. (USA)

- FIGURE 6.5: PRICE TREND IN COBALT

- FIGURE 6.6: HAFNIUM 5-YEAR PRICING

- FIGURE 6.7: GALLIUM PRICE, 5 YEAR HISTORICAL

- FIGURE 6.8: RUTHENIUM AND PLATINUM, 5-YEAR HISTORICAL PRICING

- FIGURE 6.9: GERMANIUM PRICE, 5-YEAR HISTORICAL

TABLES

- TABLE 1.1: METAL AND HI-K PRECURSORS REVENUES AND GROWTH RATES

- TABLE 1.2: ESTIMATED METAL AND HIGH-K PRECURSOR MARKET SHARE BY SUPPLIER 2023

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: PRECURSORS REVENUE AND GROWTH RATES

- TABLE 4.2: METAL AND HI-K PRECURSORS REVENUES AND GROWTH RATES

- TABLE 4.3: ESTIMATED METAL AND HIGH-K PRECURSOR MARKET HARE BY SUPPLIER 2023

- TABLE 4.4: METAL & HIGH-K PRECURSOR MARKET REGIONAL ASSESSMENT 2023

- TABLE 4.5: OVERVIEW OF ANNOUNCED 2023/2024 MATERIAL SUPPLIER INVESTMENTS

- TABLE 4.6: LEADING EDGE LOGIC DESCRIPTIONS BY NODE (TSMC, INTEL)

- TABLE 4.7: SELECTIVE DEPOSITION - SELECTIVELY DEPOSITED MATERIALS

- TABLE 4.8: REGIONAL PRECURSOR MATERIAL MARKETS

- TABLE 4.9: REGIONAL PRECURSOR MATERIAL MARKETS, CONTINUED

- TABLE 5.1: MERCK QUARTER FINANCIALS

- TABLE 5.2: AIR LIQUIDE CURRENT QUARTER FINANCIALS

- TABLE 5.3: ENTEGRIS SUPPLIER CURRENT QUARTER FINANCIALS

- TABLE 6.1: CVD AND ALD PRECURSOR

- TABLE 6.2: ORIGIN OF MINERALS USED TO MAKE PRECURSORS

- TABLE 6.3: COBALT MINING AND PRODUCTION BY LOCATION

- TABLE 6.4: ZIRCONIUM AND HAFNIUM MINERAL PRODUCTION BY LOCATION

- TABLE 6.5: GALLIUM MINERAL PRODUCTION DESCRIPTION AND DEPENDENCIES

- TABLE 6.6: ALUMINUM MINERAL REFINING AND PRODUCTION BY LOCATION

- TABLE 6.7: TITANIUM ORE (ILMENITE AND RUTILE) PRODUCTION LOCATIONS

- TABLE 6.8: TUNGSTEN ORE PRODUCTION BY LOCATION

- TABLE 6.9: MOLYBDENUM PRODUCTION AND IMPORT AND EXPORTS

- TABLE 6.10: MOLYBDENUM PRODUCTION DESCRIPTIONS

- TABLE 6.11: NIOBIUM AND TANTALUM PRODUCTION BY LOCATION

- TABLE 6.12: RARE EARTHS PRODUCTION BY LOCATION, I.E. LANTHANUM

- TABLE 6.13: PGM PRODUCTION BY LOCATION

- TABLE 6.14: GERMANIUM APPLICATIONS BY PERCENTAGE VOLUME

샘플 요청 목록