|

시장보고서

상품코드

1706272

DevSecOps, OTA, 옵저버빌리티 : 시큐어로 측정할 수 있는 IoT 실현DevSecOps, OTA & Observability: Enabling Secure, Scalable IoT |

||||||

소프트웨어 DevSecOps, 배포, 가시성, OTA 솔루션은 IoT 기기 및 시스템을 위한 소프트웨어 개발 및 출시 방식의 변화에 대응하기 위해 진화하고 있으며, IoT 시장에서의 경쟁이 치열해짐에 따라 개발 조직은 소프트웨어 개발에서 배포까지 더 빠르게 전환해야 합니다. 개발 조직은 소프트웨어를 개발에서 배포까지 보다 빠르게 전환해야 하며, 이를 위해 가능한 한 많은 프로세스를 자동화하여 시장 출시 시간을 단축해야 합니다. 또한, 표준 및 규제 강화로 인해 장비의 보안 및 건전성에 대한 책임이 제조업체로 옮겨가고 있으며, 이에 따라 장비의 지속적인 모니터링과 소프트웨어 유지보수 및 업데이트를 지속적으로 제공할 수 있는 견고한 상용 솔루션에 대한 수요가 증가하고 있습니다.

IoT용 소프트웨어 DevSecOps, 배포, 가시성, OTA 솔루션 시장을 조사했으며, 시장 규모 추이 및 예측, 주요 동향, 신흥국 시장, 지역 시장, 주요 벤더에 대해 조사했으며, 임베디드 디바이스 엔지니어와 연구개발자를 대상으로 엄선된 인사이트를 제공합니다. 통찰력을 제공합니다.

어떤 질문에 대응하고 있나요?

- IoT용 소프트웨어 DevSecOps, Deployment, Observability, OTA 솔루션 시장 규모는 어느 정도이며, 2029년까지 얼마나 성장할 것인가?

- 가장 빠르게 성장하는 산업 및 지역 시장은?

- 주요 파트너십, 인수합병, 표준화, 규제가 이 시장에 어떤 영향을 미치고 있는가?

- OTA 솔루션을 광범위하게 도입하기에 적합한 시장은 어디인가?

- AI와 ML(머신러닝)은 소프트웨어 개발 및 배포 자동화에 어떻게 활용되고 있는가?

- IoT 시스템용 소프트웨어 DevSecOps, Deployment, Observability, OTA 솔루션 시장을 선도하는 벤더는 누구인가?

주요 조사 결과:

- 다양한 산업의 디바이스 제조업체 및 사업자들은 확장 기능 및 패치를 배포하는 주요 수단으로 OTA를 선택하는 경향이 증가하고 있으며, 이러한 흐름은 정부 및 표준화 단체의 규제와 감시를 강화하는 결과를 낳고 있습니다.

- 개발 조직의 19.3%가 IoT 기기 및 임베디드 시스템에 소프트웨어 배포 및 OTA 업데이트를 위한 수단으로 컨테이너 기술에 주목하고 있습니다.

- 소프트웨어 DevSecOps, 배포, 가시성, OTA 솔루션 시장에서는 M&A의 움직임이 활발히 일어나고 있으며, 주요 업체들의 통합이 진행되고 있습니다. 이러한 툴 영역과 기능의 융합은 전체 플랫폼의 성능과 기능성을 크게 향상시키고 있습니다.

- 유럽의 CRA(Cyber Resilience Act)와 같은 규제는 IoT 시스템용 소프트웨어 DevSecOps, 배포, 가시성, OTA 솔루션에 대한 수요를 크게 증가시키고 있습니다.

목차

본 보고서의 내용

어떠한 질문이 다루어는가?

본 보고서를 읽어야 할 사람은 누구인가?

본 보고서에 게재되어 있는 조직

주요 요약

- 주요 조사 결과

서론

- 배포 접근 방식은 다양합니다

- 성공적인 배포는 강력한 소프트웨어 개발 수명 주기를 확립

- 관찰 가능성

- 수명 주기 관리 고려 사항

세계 시장 개요

수직 시장

- 항공우주 및 방위

- 차량내

- CE 제품

- 산업 자동화

- 의료기기

- 운송

지역 시장

- 아메리카

- 유럽, 중동 및 아프리카

- 아시아태평양

최근 시장 동향

- AI 기반 업데이트 캠페인 관리

- 성숙한 관행으로 프로세스 간소화

- 디바이스 수명 증가

- IoT 시장 내 컨테이너에 대한 관심을 높이는 애플리케이션 확장성

- 인수, 파트너십 및 시장 피벗

- 조직

- 아키텍처와 프레임워크

- 관련 규격

- OTA 도입을 촉진하는 규제

경쟁 구도

- 주요 벤더 인사이트

- Aeris

- Balena

- CloudBees

- Elektrobit(Continental)

- Excelfore

- GitLab

- HARMAN

- JFrog

- Memfault

- Sibros

- Telit Cinterion

- Vector Informatik

- Wind River

최종사용자 통찰

- 원격 IoT 애플리케이션 배포의 지속적인 증가

- OTA 구매 결정을 유도하는 보안 문제

- SDLC 통합

저자에 대해

LSH 25.05.07Inside this Report

Software DevSecOps, deployment, observability, and over-the-air (OTA) solutions are evolving to keep pace with the changing methods of building and releasing software for IoT devices and systems. As competition in IoT markets intensifies, developer organizations must accelerate the transition of software from development to deployment, automating as many processes as possible to achieve rapid time-to-market. Rising standards and regulations have shifted the responsibility for device security and health to manufacturers, creating a demand for robust commercial solutions that continuously monitor device fleets and provide ongoing software maintenance and updates.

This report explores and sizes the IoT market for software DevSecOps, deployment, observability, and OTA solutions. It discusses trends, vertical and regional markets, leading vendors, and provides selected insights from VDC Research's survey of embedded device engineers and developers.

What Questions are Addressed?

- What is the size of the IoT market for software DevSecOps, deployment, observability, and OTA solutions and how fast will it grow through 2029?

- Which vertical and regional markets are growing the fastest?

- How are key partnerships, acquisitions, standards, and regulations shaping the market?

- Which markets are primed for widespread adoption of OTA solutions?

- How are Artificial Intelligence and Machine Learning used to automate software development and deployment?

- Which vendors are leading the software DevSecOps, deployment, observability, and OTA solutions for IoT systems market?

Who Should Read this Report?

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and strategy leaders

- Channel management and channel strategy leaders

Organizations Listed in this Report:

|

|

|

Executive Summary

As DevSecOps methodologies and continuous integration/continuous delivery (CI/CD) practices mature, developers integrate faster feedback loops into the earlier stages of the software and device development lifecycle, improving time to market, product quality, and software deployment in IoT. This blending of development processes is evident in the commercial market for deployment and maintenance solutions, where platforms now combine software testing with deployment features, offering developers a unified solution for automation across the design, build, test, and deploy phases.

DevSecOps observability enables teams to continuously monitor, measure, and analyze the health, performance, and security of applications and infrastructure throughout the software development lifecycle. It includes a combination of metrics, logs, and traces to provide insights into the system's operational and security aspects, allowing teams to detect issues early and respond quickly. The secure wireless distribution of software updates supports the continuous delivery aspect of the CI/CD pipeline.

OTA updates, initially introduced for mobile phones, expanded into the consumer electronics and automotive sectors. Vendors help fuel the wider adoption of updates by integrating OTA solutions across diverse IoT industries, offering both specialized solutions for specific applications and versatile platforms designed to serve multiple IoT market segments. The combination of regulations mandating the updatability of connected devices and the growing adoption of CI/CD and DevSecOps practices within development organizations is increasing the demand for commercial solutions to replace in-house developed alternatives.

Key Findings

- Device manufacturers and operators across multiple industries are choosing OTA updates as their primary means to deliver enhanced features and rollout patches, a trend which is bringing increased scrutiny and regulations from governments and standardization bodies.

- 19.3% of developer organizations are looking toward container technology as an emerging method of deploying software and delivering OTA updates to IoT devices and embedded systems.

- Merger and acquisition activity in the software DevSecOps, deployment, observability, and OTA solutions market has led to increased consolidation among key players. This convergence of tool domains and functionalities has significantly enhanced platform capabilities.

- Regulations like the European Cyber Resilience Act (CRA) are significantly driving the demand for software DevSecOps, deployment, observability, and OTA solutions for IoT systems.

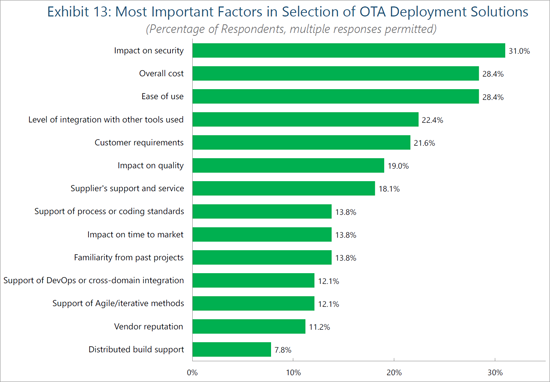

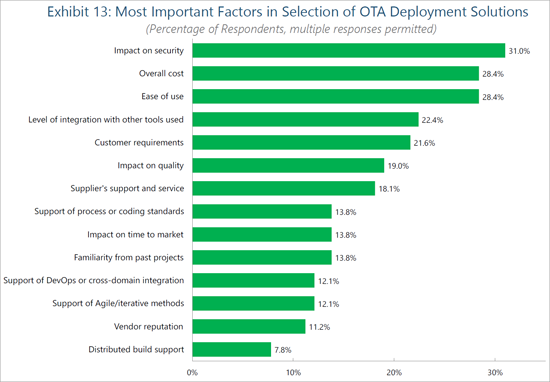

Security Concerns Driving OTA Purchasing Decision

Tied with cost sensitivity, ease of use ranks as the second-most important factor influencing the selection of OTA deployment solutions [See Exhibit 13]. The deployment of OTA update campaigns is oftentimes a very manual task, requiring engineers to weigh multiple factors including rollout timing, device downtime, and potential versioning issues. This is one area where AI-driven OTA campaigns and the pairing of monitoring solutions can introduce increased ease of use to OTA solutions. By intelligently connecting update campaigns to real-time device status and analytics, device manufacturers/fleet managers can minimize the potentially costly consequences of failed update campaigns. Vendor reputation noticeably ranks amongst the lowest purchasing decision factors, suggesting a yet-to-be-determined competitive positioning of embedded OTA solution vendors. This consumer sentiment offers a considerate opportunity for new entrants seeking to deliver OTA capabilities to embedded markets. For those seeking to enter or increase their positioning within this segment of the IoT, focus should be dedicated towards enabling seamless yet confident deployment capabilities, bolstered by real-time capabilities and insights into campaign rollouts.

As with many areas of the IoT, the impact of integrating OTA solutions into toolchains and software stacks remains the topmost priority for development organizations. Failed software deployments can not only cause monetary and opportunity costs in the form of patches and downtime but also increase the attack surface for exploitation. Furthermore, an insecure OTA solution can enable threat actors to deploy malware alongside software packages to devices. Other opportunities for exploitation within the deployment process include hijacking and interrupting updates mid-deployment, leading to corrupted devices and systems. Partnerships with IoT security vendors (e.g., public key infrastructure (PKI) vendors) offer one avenue for OTA solution providers to bolster the security of their solutions (such as those between Excelfore/IIJ Global, Karma Automotive (Airbiquity)/QNX, and Telit Cinterion/Thales).

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Introduction

- Deployment Approaches Vary

- Successful Deployment Establishes a Robust Software Development Life Cycle

- Observability

- Lifecycle Management Considerations

Global Market Overview

Vertical Markets

- Aerospace and Defense

- Automotive In-Vehicle

- Consumer Electronics

- Industrial Automation

- Medical Devices

- Transportation

Regional Markets

- The Americas

- Europe, the Middle East & Africa (EMEA)

- Asia-Pacific (APAC)

Recent Market Developments

- AI-driven Update Campaign Management

- Maturing Practices Streamline Processes

- Device Fleet Longevity Increasing

- Application Scalability Driving Interest in Containers Within the IoT Market

- Acquisitions, Partnerships and Market Pivots

- Karma Automotive Acquires Airbiquity to Bring OTA In-house

- Aurora Labs Pivots Away From OTA

- Excelfore Partners With Microsoft to Deploy AI-driven Update Campaigns

- Qualcomm Acquires Foundries.io

- JFrog Acquires Qwak AI

- Sibros Partners with Harbinger Motors and ZM Trucks to Deploy OTA to Medium-Duty Vehicles

- CloudBees Acquires Launchable

- Organizations

- Cloud Native Computing Foundation

- Continuous Delivery Foundation

- eSync Alliance

- Architectures & Frameworks

- AUTOSAR

- SOAFEE

- Eclipse Kanto

- Pantavisor Linux

- Uptane

- Relevant Standards

- Regulations Driving OTA Adoption

- AUTOMOTIVE

- MEDICAL DEVICES

- OTHER IOT

Competitive Landscape

- Selected Vendor Insights

- Aeris

- Balena

- CloudBees

- Elektrobit (Continental)

- Excelfore

- GitLab

- HARMAN

- JFrog

- Memfault

- Sibros

- Telit Cinterion

- Vector Informatik

- Wind River

End-User Insights

- Sustained Increases in Remote IoT Application Deployments

- Security Concerns Driving OTA Purchasing Decision

- Unifying the SDLC

About the Authors

List of Exhibits

- Exhibit 1: Worldwide Revenue for Software DevSecOps, Deployment, Observability, and OTA Solutions for IoT Systems

- Exhibit 2: Worldwide Revenue for Software DevSecOps, Deployment, Observability, and OTA Solutions for IoT Systems 2024 & 2029, Share by Vertical Market

- Exhibit 3: Worldwide Revenue for Software DevSecOps, Deployment, Observability, and OTA Solutions for IoT Systems 2024 & 2029, Share by Geographic Region

- Exhibit 4: Software Design Methodologies Used and Expected to Be Used

- Exhibit 5: Software DevSecOps, Deployment, Observability, and OTA Solutions for IoT Systems Forecast Scope

- Exhibit 6: Estimated Number of Years of Useful Life for Product Once Deployed, 2022 & 2024

- Exhibit 7: Factors Driving Organization to Adopt Container Technology in Current Project

- Exhibit 8: Worldwide Revenue for Software DevSecOps, Deployment, Observability, and OTA Solutions for IoT Systems, Share by Vendor

- Exhibit 9: Over-the-air (OTA) Software/Firmware Deployment Solutions Used on Current Project

- Exhibit 10: Most Important Factors in Selection of OTA Deployment Solutions, by Solution Source

- Exhibit 11: Current & Expected Use of Remote Application Deployment & Management

- Exhibit 12: Current Use of Remote Deployment & Management by Vertical Market

- Exhibit 13: Most Important Factors in Selection of OTA Deployment Solutions

- Exhibit 14: Most Important Factors in Selection of Release Management/Continuous Deployment Tools