|

시장보고서

상품코드

1615494

리튬 이온 커패시터 및 기타 배터리 슈퍼커패시터 하이브리드 : 시장 및 기술(2025-2045)Lithium-ion Capacitors and Other Battery Supercapacitor Hybrids: Markets, Technology, 2025-2045 |

||||||

열핵반응로, 전자병기, 토목기계, 스마트미터에 공통되는 것은 무엇인가? 이것은 모두 리튬 이온 커패시터(LIC)를 사용하고 있습니다. 종종 두 가지 장점을 결합합니다.

이 중요성은 하이브리드 슈퍼커패시터와 슈퍼 배터리와 같은 혼란스러운 용어로 간과되기 쉽지만, 세계는 LIC의 방향으로 진행되고 있으며, 그 예로는 AI 데이터센터가 전력과 신뢰성을 중시하게 되었습니다. 보다 안전하고, 보다 긴 수명으로, 보다 고속으로 동작·회복하는 무정전 전원장치로서 사용되고 있습니다. 다른 배터리 슈퍼커패시터 하이브리드(BSH)를 포함하면 매출은 20년 이내에 연간 100억 달러 이상에 달할 것으로 예상됩니다.

이 보고서는 리튬 이온 커패시터(LIC) 및 기타 배터리 슈퍼커패시터 하이브리드(BSH) 시장 및 기술을 조사하고 기술 유형 및 개요, 시장 요구 사항 및 그 변화, 시장 영향요인 분석, 기술 로드맵 연구개발 동향, 용도별 전망, 용도·기술별 시장 예측, 주요 기업의 분석 등을 정리했습니다.

목차

제1장 주요 요약·결론

- 이 보고서의 목적

- 이 분석의 조사 방법

- 정의

- 에너지 저장 툴킷

- 13의 주요 결론 : LIC를 포함한 BSH 시장

- 인포그램 : 가장 영향력있는 시장 요구

- 인포그램: BSH와 슈도 커패시터의 상대적인 상업적 중요성

- LIC를 포함한 EDLC와 BSH의 제공 가치와 용도

- EDLC와 BSH 기술의 사용 예 : 응용 분야

- 대형 기기용 LIC와 EDLC공급과 잠재력의 분석

- 18의 주요 결론 : 기술과 제조 업체

- 인포그램: 에너지 밀도, 전력 밀도, 수명, 사이즈, 중량의 타협

- 저장 용량을 줄이는 전략에 의해 BSH의 채용 가능성이 높아진다

- 연구 방향 전환의 필요성 : 5 칼럼· 7 라인

- 2024년 BSH와 EDLC의 연구활동 : 국가별 및 기술별

- SWOT 평가 및 로드맵

- 시장을 움직이는 BSH 이벤트 로드맵 : 기술, 산업, 시장

- 배터리 슈퍼커패시터 하이브리드 : 30 라인별 예측

제2장 배터리 슈퍼커패시터 하이브리드(BSH) : 요구, 툴킷, 제조 개요

- 에너지 저장 툴킷

- 에너지 저장 시장

- 기술 최적화와 기술 경쟁 문제: 소개

- LIC, 리튬 이온 배터리, 슈퍼커패시터: 34 파라미터 비교

- LIC 포맷과 인접 기술의 비교

- 더 읽기

제3장 장래의 리튬 이온 커패시터의 설계와 경쟁적 위치 지정

- 개요

- 설계상의 문제

- 연구 진보의 분석

- 특허의 예

- 더 읽기

제4장 기타 금속 이온 커패시터의 설계와 진보: 납 이온, 니켈 이온, 칼륨 이온, 나트륨 이온, 아연 이온 커패시터

- 개요

- 납 이온 커패시터: 역사, 원리, 연구

- 니켈 이온 커패시터: 2024년의 진보

- 칼륨 이온 커패시터 : 2024년의 진보

- 나트륨 이온 커패시터 : 2024년의 진보

- 아연 이온 커패시터: 2024년의 진보

제5장 배터리 슈퍼커패시터 하이브리드 스토리지용 기타 새로운 화학물질

- 개요

- 근거

- 연구 파이프라인

제6장 연구 파이프라인 분석에 사용되는 신흥 재료

- 개요

- 매출을 견인하는 슈퍼커패시터의 주요 파라미터에 영향을 미치는 요인

- 일반적인 재료 선택

- 슈퍼커패시터 개선 전략

- 슈퍼커패시터와 그 변종에 있어서의 그래핀의 중요성

- 슈퍼커패시터의 기타 2D 및 관련 재료와 연구예

- 슈퍼커패시터 전극 재료 및 구조 연구

- 이전의 중요한 예

- 슈퍼커패시터용 전해질 및 그 변종

- 막의 난이도와 사용 및 제안된 재료

- 자기 방전 감소 : 큰 필요성이 있지만 연구는 적습니다

제7장 신흥 BSH 시장 : 에너지, 자동차, 항공우주, 군사, 전자기기, 기타 분야에서의 기본적 동향과 최상의 전망의 비교

- 시장에 미치는 영향

- 개요

- 슈퍼커패시터의 상대적인 상업적 중요성

- 가장 유망한 슈퍼커패시터 패밀리의 제공 가치

- 시장의 잠재력과 제조 규모의 불일치

- 대형 디바이스공급과 가능성의 분석

제8장 에너지 분야의 신흥 BSH 시장

- 개요 : 2024-2044년의 전망

- 핵융합 발전

- 간헐성이 적은 그리드 발전: 파력, 조류, 고고도 풍력

- 송전망외의 슈퍼커패시터 : 새로운 큰 기회

- 수력 발전

제9장 육상 차량 및 해양 용도의 대두: 자동차, 버스, 트럭 트레인, 오프로드 건설, 농업, 광업, 임업, 자재관리, 보트, 선박

- 육상 수송에 있어서의 슈퍼커패시터의 사용의 개요

- 온로드 용도는 감소 경향이 있지만, 오프로드 용도는 활황

- 육상 차량의 슈퍼커패시터와 그 파생 제품 : 온로드에서 오프로드로의 전환

- 대형 슈퍼커패시터를 탑재한 새로운 차량 및 관련 설계

- 노면 전철과 트롤리 버스의 재생과 가선 갭에의 대처

- 자재관리(인트라 로지스틱스) 슈퍼커패시터

- 대형 슈퍼커패시터의 광업 및 채석업에서의 사용

- 차량용 대형 슈퍼커패시터에 관한 연구

- 열차용 대형 슈퍼커패시터와 선로측 회생

- 대형 슈퍼커패시터의 해양이용과 연구 파이프라인

제10장 6G 통신, 일렉트로닉스, 소형 전기 기기에서의 새로운 용도

- 개요

- 소형 BSH와 슈퍼커패시터의 용도의 대폭적인 확대

- 웨어러블, 스마트 워치, 스마트폰, 노트북 등의 디바이스에 있어서의 BSH와 슈퍼 커패시터

- 6G 통신: 2030년부터 새로운 BSH 시장

- 자산 추적 성장 시장

- 배터리 지원 및 백업 전원 슈퍼커패시터

- 핸드헬드 단말 BSH와 슈퍼커패시터

- IoT 노드, 무선 센서, BSH와 슈퍼커패시터를 사용한 에너지 수집 모드

- 데이터 트랜스미션, 락, 솔레노이드의 기동, 전자 잉크의 갱신, LED 플래시용의 피크 전력

- 스마트 미터

- 스폿 용접

제11장 새로운 군사 및 항공우주 용도

- 개요

- 군사 용도 : 전기 역학 무기와 전자 무기가 큰 초점에

- 군사 용도 : 무인 항공기, 통신 기기, 레이더, 비행기, 선박, 탱크, 위성, 유도 미사일, 탄약 점화 장치, 전자기 장갑

- 항공우주 : 위성, 항공기 전기화(MEA), 기타 성장 기회

제12장 BSH(LIC 포함), 슈퍼커패시터, 슈도 커패시터, CSH116사의 평가

- 116사의 비교로부터 얻은 지표의 분석

- 116사의 슈퍼커패시터, 슈도 커패시터, BSH(LIC 포함) 제조업체

Summary

What do thermonuclear reactors, electromagnetic weapons, earthmoving machines and smart meters have in common? They all use lithium-ion capacitors LIC, something between a supercapacitor and a battery and often the best of both worlds. The new Zhar Research 476-page report, "Lithium-ion capacitors and other battery supercapacitor hybrids: markets, technology, 2025-2045" explains.

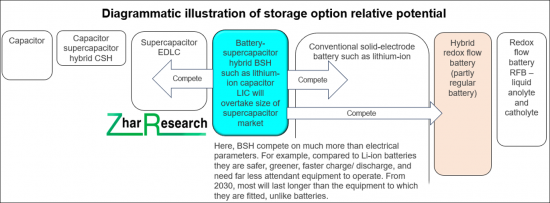

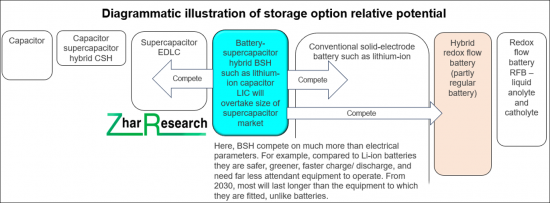

Their importance is often missed by confusing terms like hybrid supercapacitor and superbattery, but the world is going their way, an example being artificial intelligence data centers becoming power and reliability-oriented. Consequently, they appear there as safer, longer lived, uninterrupted power supplies that act and recover faster. While they will not match the market size of metal ion batteries, they will overtake supercapacitors. Include other battery-supercapacitor hybrids BSH and the analysis predicts over $10 billion yearly sales within 20 years.

Here are some of the questions answered:

- Gaps in the market?

- Next winners and losers?

- Full list of technology options?

- SWOT appraisals by technology?

- Evolving market needs 2025-2045?

- Where should research be redirected?

- Market forecasts by technology 2025-2045?

- Deep analysis of research advances in 2024?

- What follows LIC of the BSH choices and why?

- Technology readiness and potential improvement?

- Market drivers and forecasts of background parameters?

- Potential winners and losers by company and technology?

- Detailed technology parameter comparisons with comment?

- Detailed appraisal of all the leading proponents and their strategies?

- New applications and technology milestones in roadmaps by year 2025-2045?

This commercially-oriented report is both lucid and thorough, involving:

6 SWOT appraisals, 12 Chapters, 30 Forecast lines 2025-2045, 30 Key conclusions, 107 New infograms, over 116 Companies and 153 best research papers from 2023/4 reviewed.

The Executive summary and conclusions (38 pages) is sufficient in itself including roadmaps and those 30 forecasts. Chapter 2. Covers "Battery supercapacitor hybrids BSH: introduction to need, toolkit and manufacture" in 25 pages putting them in context of all evolving storage with many examples including e-bikes, wind turbines, trains, trams. Learn the chemistry and structure involved in tailoring them to be supercapacitor-like, battery-like or something in-between because there are commercial successes beginning for all of those options.

Chapter 3. "Future lithium-ion capacitor design and competitive position" takes 25 information-packed pages to reveal these specific constructions from the smallest electronics components to heavy engineering. Here are the issues and new market to be addressed. Chapter 4. "Other metal-ion capacitors design and progress: Lead-ion, nickel-ion, potassium-ion, sodium-ion, zinc-ion capacitors" , in 20 pages clarifies the best research and targetted markets for these with much advance in 2024. Why most work on sodium-ion capacitors? Why is nickel-ion capacitor NIC, particularly with cobalt receiving equal attention? Why considerable work on potassium-ion and zinc-ion capacitors? Involvement of graphene?

15 pages of Chapter 5. "Other emerging chemistries for battery-supercapacitor hybrid storage" concerns wild cards such as Zeolite Ionic Frameworks, MXene and MOFs composites for BSH and the relevance of metal alloys and manganese compounds. After these simpler chapters, you are ready for the dep dive of Chapter 6. "Emerging materials employed with 2024, 2023 research pipeline analysis" going closely into electrodes, electrolytes and membranes in 50 pages with a flood of new research analysed and many infograms clarifying choices and trends.

Because BSH can be tailored to such a wide range of size and performance, the emerging applications and competitive positioning needs careful investigation and that is provided in Chapter 7. Emerging BSH markets : basic trends and best prospects compared between energy, vehicles, aerospace, military, electronics, other. This is 11 pages because many applications have already been covered and more lie ahead.

Chapter 8. Energy sector emerging BSH markets (49 pages) reveals an extraordinary breadth of opportunity from recent adoption for the Japan Tokamak thermonuclear reactor, wind turbines and many uses in grids and microgrids, even electric vehicle fast chargers. This survey also includes supercapacitor applications likely to switch to BSH, initially LIC. Chapter 9. "Emerging land vehicle and marine applications: automotive, bus, truck train, off-road construction, agriculture, mining, forestry, material handling, boats, ships" (50 pages) is equally broad in reach. Chapter 10. Emerging applications in 6G Communications, electronics and small electrics (29 pages) is mainly revealing opportunities for small LIC. Chapter 11, "Emerging military and aerospace applications" (20 pages) often involves hand-held to very large equipment, even aircraft.

Chapter 12. "116 BSH (including LIC), supercapacitor, pseudocapacitor, CSH companies assessed in 10 columns and 112 pages" looks at most supercapacitor manufacturers because they are either making LIC or eyeing that opportunity. With many pictures, parameters and news items, you can see the commercial activities and objectives in detail.

Whether you wish to supply materials, devices or systems incorporating BSH, the report, "Lithium-ion capacitors and other battery supercapacitor hybrids: markets, technology, 2025-2045" is your essential reading.

CAPTION: Diagrammatic illustration of storage option relative potential. Source Zhar Research report, "Lithium-ion capacitors and other battery supercapacitor hybrids: markets, technology, 2025-2045".

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. Definitions

- 1.4. Energy storage toolkit

- 1.4.1. The basic options

- 1.4.2. BSH have some of superlatives of a supercapacitor combined with those of a battery

- 1.4.3. BSH and in particular LIC create some valuable tipping points

- 1.4.4. The many advantages of lithium-ion capacitors LIC and the energy density choices

- 1.4.5. How strategies for improving supercapacitors will benefit BSH including LIC

- 1.4.6. Prioritisation of active electrode-electrolyte pairings

- 1.5 13 Primary conclusions: BSH markets including LIC

- 1.6. Infogram: the most impactful market needs

- 1.7. Infogram: relative commercial significance of BSH and pseudocapacitors 2024-2044

- 1.8. Some market propositions and uses of EDLC and BSH including LIC 2024-2044

- 1.9. Technology uses by applicational sector for EDLC vs BSH - examples

- 1.10. Analysis of supply and potential of LIC and EDLC for large devices

- 1.11 18 primary conclusions: technologies and manufacturers

- 1.12. Infogram: the energy density-power density, life, size and weight compromise

- 1.13. How strategies to require less storage make BSH more adoptable

- 1.14. How research needs redirecting: 5 columns, 7 lines

- 1.17. BSH and EDLC research activity by country and technology 2024

- 1.18. SWOT appraisals and roadmap 2025-2045

- 1.18.1. SWOT appraisal of supercapacitors and BSH

- 1.18.2. SWOT appraisal of LIC and other BSH

- 1.18.3. SWOT appraisal of graphene LIC

- 1.18.4. SWOT appraisal of batteryless storage technologies generally

- 1.19. Roadmap of market-moving BSH events - technologies, industry and markets 2025-2045

- 1.20. Battery supercapacitor hybrids: forecasts by 30 lines 2025-2045

- 1.20.1. Competitors RFB beyond grid, EDLC, Pseudocapacitor and BSH $ billion 2025-2045

- 1.20.2. Battery supercapacitor hybrid storage BSH by type: BSH, Non-lithium, LIC, banks $ billion 2025-2045

- 1.20.3. Battery supercapacitor hybrids BSH value market percent by four regions 2025-2045

- 1.20.4. BSH value market percent by three performance categories 2025-2045

- 1.20.5. Battery supercapacitor hybrid BSH value market % by two Wh categories 2025-2045

- 1.20.6. BSH value market % by three electrode morphologies 2025-2045

- 1.20.7. BSH product life years and life of equipment to which it is fitted years 2014-2045

- 1.20.8. Market for seven types of equipment fitting BSH $ billion 2025-2045

- 1.20.9. Energy storage device market battery vs batteryless $ billion 2025-2045

2. Battery supercapacitor hybrids BSH: introduction to need, toolkit and manufacture

- 2.1. Energy storage toolkit

- 2.1.1. The basic options

- 2.1.2. How BSH will compete with other technologies

- 2.1.3. Electrochemical vs electrostatic storage

- 2.1.4. Examples of competition between capacitor, supercapacitor and battery technologies

- 2.1.5. Supercapacitors and BSH replacing batteries in ebikes

- 2.2. Energy storage market

- 2.2.1. Overview

- 2.2.2. Energy harvesting creates markets for BSH storage

- 2.2.3. The beyond-grid opportunity for large BSH

- 2.2.4. Need for conventional BSH formats but also structural electrics and electronics

- 2.3. Introduction to technology optimisation and technology competition issues

- 2.3.1. Overview

- 2.3.2. BSH internal design compared to others

- 2.3.3. Hot topics include LIB and graphene

- 2.3.4. BSH voltage, charge retention and ageing issues compared to competition

- 2.3.5. BSH competitive position on energy density vs power density

- 2.3.6. Days storage vs rated power return MW for storage technologies

- 2.4. 34 parameters for LIC, Li-ion battery and supercapacitor compared

- 2.5. LIC formats compared with adjacent technologies

- 2.6. Further reading

3. Future lithium-ion capacitor design and competitive position

- 3.1. Overview

- 3.2. Design issues

- 3.2.1. Basic structure

- 3.2.2. Current applications to optimise

- 3.2.3. Future applications to optimise

- 3.2.4. Performance issues being addressed

- 3.2.5. Lithium-ion capacitor LIC market positioning by energy density spectrum

- 3.3. Analysis of research advances through 2024

- 3.4. Examples of patents

- 3.5. Further reading -Zhar Research report putting LIB in supercapacitor context

4. Other metal-ion capacitors design and progress: Lead-ion, nickel-ion, potassium-ion, sodium-ion, zinc-ion capacitors

- 4.1. Overview

- 4.2. Lead ion capacitors: history, rationale , research

- 4.3. Nickel-ion capacitors: advances in 2024

- 4.4. Potassium-ion capacitors: advances in 2024

- 4.5. Sodium-ion capacitors: advances in 2024

- 4.5. Zinc-ion capacitors: advances in 2024

5. Other emerging chemistries for battery-supercapacitor hybrid storage

- 5.1. Overview

- 5.2. Rationale

- 5.3. Research pipeline

- 5.3.1. Zeolite Ionic Frameworks for BSH

- 5.3.2. MXene and MOFs composites for BSH

- 5.3.2. Metal alloys and manganese compounds in BSH

6. Emerging materials employed with 2024, 2023 research pipeline analysis

- 6.1. Overview

- 6.2. Factors influencing key supercapacitor parameters driving sales

- 6.3. Materials choices in general

- 6.4. Strategies for improving supercapacitors

- 6.4.1. General

- 6.4.2. Prioritisation of active electrode-electrolyte pairings

- 6.5. Significance of graphene in supercapacitors and variants

- 6.5.1. Overview

- 6.5.2. Graphene supercapacitor SWOT appraisal

- 6.5.3. Vertically-aligned graphene for ac and improved cycle life

- 6.5.4. Frequency performance improvement with graphene

- 6.5.5. Graphene textile for supercapacitors and sensors

- 6.5.6. Eleven graphene supercapacitor material and device developers and manufacturers compared in five columns

- 6.6. Other 2D and allied materials for supercapacitors with examples of research

- 6.6.1. MOF and MXene and combinations are the focus

- 6.6.2. Tantalum carbide MXene hybrid as a biocompatible supercapacitor electrodes

- 6.6.3. CNT

- 6.7. Research on supercapacitor electrode materials and structures in 2024

- 6.8. Research on supercapacitor electrode materials and structures in 2023

- 6.9. Important examples from earlier

- 6.10. Electrolytes for supercapacitors and variants

- 6.10.1. General considerations including organic electrolytes

- 6.10.2. Supercapacitor electrolyte choices

- 6.10.3. Focus on aqueous supercapacitor electrolytes

- 6.10.4. Ionic liquid electrolytes in supercapacitor research

- 6.10.5. Focus on solid state, semi-solid-state and flexible electrolytes

- 6.10.6. Hydrogels as electrolytes for semi-solid supercapacitors

- 6.10.7. Supercapacitor concrete and bricks

- 6.11. Membrane difficulty levels and materials used and proposed

- 6.12. Reducing self-discharge: great need, little research

7. Emerging BSH markets : basic trends and best prospects compared between energy, vehicles, aerospace, military, electronics, other

- 7.1. Implications for the market 2025-2045

- 7.2. Overview

- 7.3. Relative commercial significance of supercapacitor variants 2025-2045

- 7.4. Market propositions of the most-promising supercapacitor families 2025-2045

- 7.5. Mismatch between market potential and sizes made

- 7.6. Analysis of supply and potential for large devices

- 7.6.1. Overview

- 7.6.2. Largest lithium-ion capacitors offered by manufacturer with parameters and uses

- 7.6.3. Markets for the largest BSH

- 7.6.4. Market analysis for the six most important applicational sectors

8. Energy sector emerging BSH markets

- 8.1. Overview: poor, modest and strong prospects 2024-2044

- 8.2. Thermonuclear power

- 8.2.1. Overview

- 8.3.2. Applications of supercapacitors in fusion research

- 8.3.3. Other thermonuclear supercapacitors

- 8.3.4. Hybrid supercapacitor banks for thermonuclear power: Tokyo Tokamak

- 8.3.5. Helion USA supercapacitor bank

- 8.3.6. First Light UK supercapacitor bank

- 8.3. Less-intermittent grid electricity generation: wave, tidal stream, elevated wind

- 8.3.1. Supercapacitors in utility energy storage for grids and large UPS

- 8.3.2. 5MW grid measurement supercapacitor

- 8.3.3. Tidal stream power applications

- 8.3.4. Wave power applications

- 8.3.5. Airborne Wind Energy AWE applications

- 8.3.6. Taller wind turbines tapping less-intermittent wind: protection, smoothing

- 8.4. Beyond-grid supercapacitors: large emerging opportunity

- 8.4.1. Overview

- 8.4.2. Beyond-grid buildings, industrial processes, minigrids, microgrids, other

- 8.4.3. Beyond-grid electricity production and management

- 8.4.4. The off-grid megatrend

- 8.4.5. The solar megatrend

- 8.4.6. Hydrogen-supercapacitor rural microgrid Tapah, Malaysia

- 8.4.7. Supercapacitors in other microgrids, solar buildings

- 8.4.8. Fast charging of electric vehicles including buses and autonomous shuttles

- 8.5. Hydro power

9. Emerging land vehicle and marine applications: automotive, bus, truck train, off-road construction, agriculture, mining, forestry, material handling, boats, ships

- 9.1. Overview of supercapacitor use in land transport

- 9.2. On-road applications face decline but off-road vibrant

- 9.3. How the value market for supercapacitors and their variants in land vehicles will move from largely on-road to largely off-road

- 9.4. Emerging vehicle and allied designs with large supercapacitors

- 9.4.1. Industrial vehicles: Rutronik HESS

- 9.4.2. Heavy duty powertrains and active suspension

- 9.5. Tram and trolleybus regeneration and coping with gaps in catenary

- 9.6. Material handling (intralogistics) supercapacitors

- 9.7. Mining and quarrying uses for large supercapacitors

- 9.7.1. Overview and future open pit mine and quarry

- 9.7.2. Mining and quarrying vehicles go electric

- 9.7.3. Supercapacitors for electric mining and construction

- 9.8. Research relevant to large supercapacitors in vehicles

- 9.9. Large supercapacitors for trains and their trackside regeneration

- 9.9.1. Overview

- 9.9.2. Supercapacitor diesel hybrid and hydrogen trains

- 9.9.3. Supercapacitor regeneration for trains on-board and trackside

- 9.9.4. Research pipeline relevant to supercapacitors for trains

- 9.10. Marine use of large supercapacitors and the research pipeline

10. Emerging applications in 6G Communications, electronics and small electrics

- 10.1. Overview

- 10.2. Substantial growing applications for small BSH and supercapacitors

- 10.3. BSH and supercapacitors in wearables, smart watches, smartphones, laptops and similar devices

- 10.3.1. General

- 10.3.2. Wearables needing BSH and supercapacitors

- 10.4. 6G Communications: new BSH market from 2030

- 10.4.1. Overview with needs

- 10.4.2. New needs and 5G inadequacies

- 10.4.3. 6G massive hardware deployment: proliferation but many compromises

- 10.4.4. Objectives of NTTDoCoMo, Huawei, Samsung and others

- 10.4.5. Progress from 1G-6G rollouts 1980-2044

- 10.4.6. 6G underwater and underground

- 10.5. Asset tracking growth market

- 10.6. Battery support and back-up power supercapacitors

- 10.7. Hand-held terminals BSH and supercapacitors

- 10.8. Internet of Things nodes, wireless sensors and their energy harvesting modes with BSH and supercapacitors

- 10.8.1. Overview

- 10.8.2. Sensor inputs and outputs

- 10.8.3. Ten forms of energy harvesting for sensing and power for sensors

- 10.8.4. Supercapacitor transpiration electrokinetic harvesting for battery-free sensor power supply

- 10.9. Peak power for data transmission, locks, solenoid activation, e-ink update, LED flash

- 10.10. Smart meters

- 10.11. Spot welding

11. Emerging military and aerospace applications

- 11.1. Overview

- 11.2. Military applications: electrodynamic and electromagnetic weapons now a strong focus

- 11.2.1. Overview: laser weapons, beam energy weapons, microwave weapons, electromagnetic guns

- 11.2.2. Electrodynamic weapons: coil and rail guns

- 11.2.3. Electromagnetic weapons disabling electronics or acting as ordnance

- 11.2.4. Pulsed linear accelerator weapon

- 11.3. Military applications: unmanned aircraft, communication equipment, radar, plane, ship, tank, satellite, guided missile, munition ignition, electromagnetic armour

- 11.3.1. CSH sales increasing

- 11.3.2. Force Field protection

- 11.3.3. Supercapacitor- diesel hybrid heavy mobility army truck

- 11.3.4 17 other military applications now emerging

- 11.4. Aerospace: satellites, More Electric Aircraft MEA and other growth opportunities

- 11.4.1. Overview: supercapacitor numbers and variety increase

- 11.4.2. More Electric Aircraft MEA

- 11.4.3. Better capacitors sought for aircraft

12. 116 BSH (including LIC), supercapacitor, pseudocapacitor, CSH companies assessed in 10 columns and 112 pages

- 12.1. Analysis of metrics from the comparison of 116 companies

- 12.2. 116 supercapacitor, pseudocapacitor and BSH (including LIC) manufacturers assessed in 10 columns across 108 pages