|

시장보고서

상품코드

1672655

핀테크 산업 시장 : 핀테크 카드별, 솔루션별, 기술별, 최종 용도별, 지역별Fintech Industry Market, By FinTech Cards, By Solution, By Technology, By End User, By Geography |

||||||

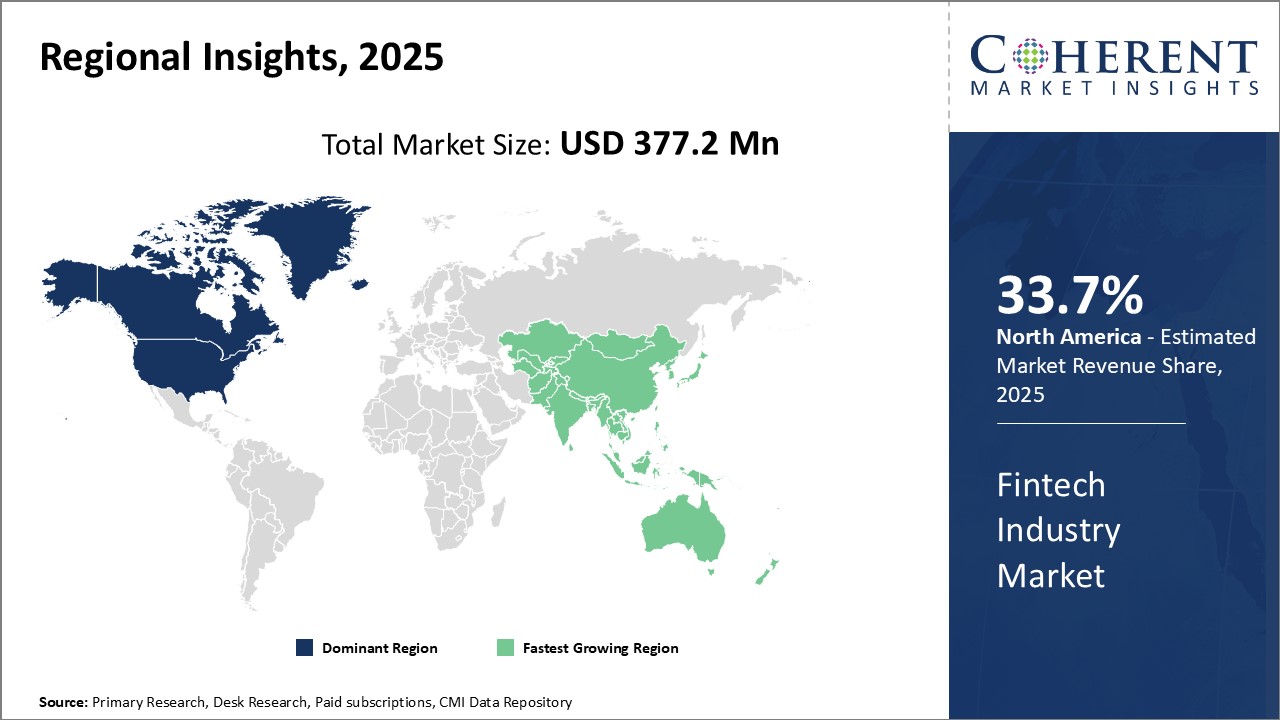

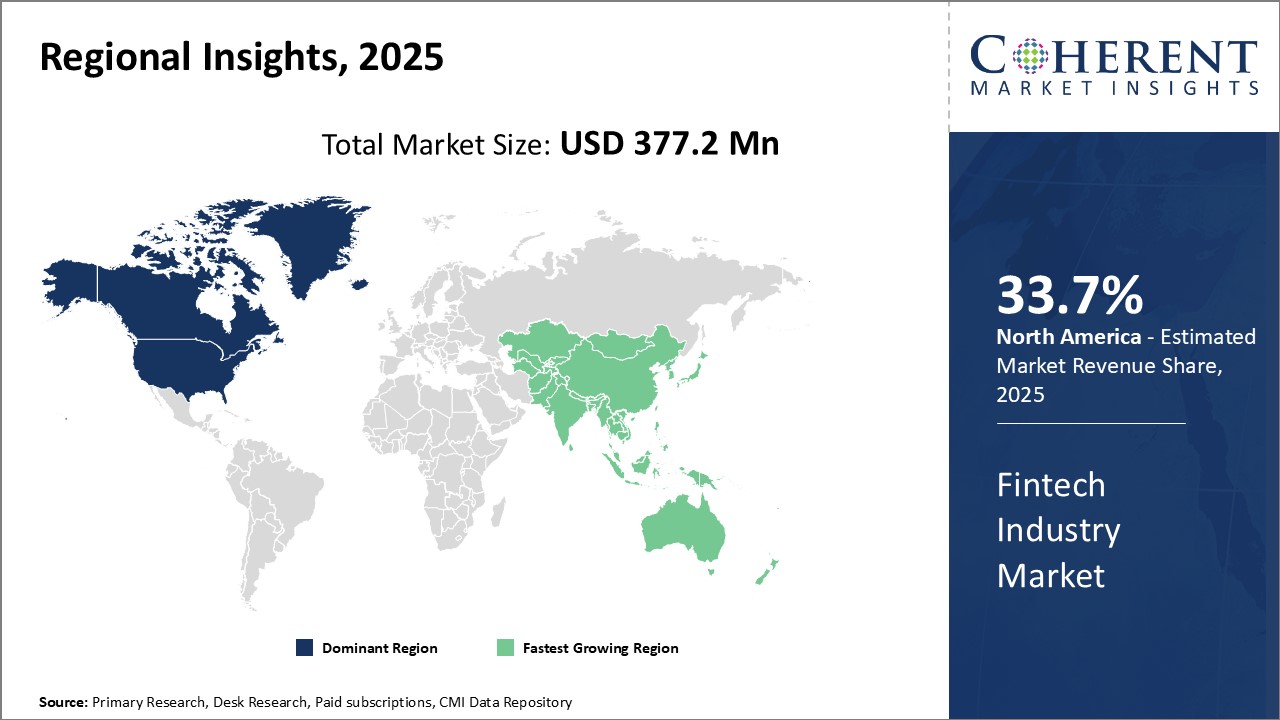

세계의 핀테크 산업 시장은 2025년에 3억 7,720만 달러로 추정되며, 2032년에는 7억 2,620만 달러에 달할 것으로 예측되며, 2025-2032년에 CAGR 9.8%로 성장할 것으로 예측됩니다.

| 보고 범위 | 보고서 상세 내용 | ||

|---|---|---|---|

| 기준연도 | 2024년 | 2025년 시장 규모 | 3억 7,720만 달러 |

| 실적 데이터 | 2020-2024년 | 예측 기간 | 2025-2032년 |

| 예측 기간: 2025-2032년 CAGR: | 9.80% | 2032년 가치 예측 | 7억 2,620만 달러 |

디지털 결제의 부상, E-Commerce 산업의 성장, 벤처 캐피탈의 자금 유입 등 다양한 요인들이 핀테크 분야의 세계 호황에 기여하고 있으며, AI, ML, 블록체인과 같은 첨단 기술의 활용으로 금융 서비스에 대한 접근성이 향상되고 효율성이 향상되고 있습니다. 그러나 보안과 프라이버시 문제는 핀테크 산업의 지속적인 성장에 있으며, 여전히 과제로 남아있습니다.

시장 역학:

세계 핀테크 산업 시장의 성장은 몇 가지 요인에 의해 주도되고 있습니다. 디지털화의 진전과 AI, ML, IoT 등의 기술의 출현으로 혁신적인 금융 상품 및 서비스 개발이 가능해졌습니다. 스마트폰과 인터넷 보급률 증가와 E-Commerce 산업의 성장은 디지털 결제와 온라인 대출을 촉진하고 있습니다. 이는 상품 혁신과 시장 확대에 박차를 가하고 있습니다. 그러나 데이터 프라이버시 및 보안에 대한 우려도 문제점으로 지적되고 있습니다. 또한 표준화 및 상호운용성 문제도 원활한 운영을 방해하고 있습니다. 그럼에도 불구하고 금융 서비스가 충분히 보급되지 않은 신흥 경제 국가들은 핀테크 업체들에게 큰 성장의 기회가 될 수 있습니다.

본 조사의 주요 특징

세계의 핀테크 산업 시장을 상세하게 분석하여 2024년을 기준 연도로 하여 예측 기간(2025-2032년) 시장 규모와 연평균 성장률(CAGR%)을 게재하고 있습니다.

또한 다양한 부문에 걸친 잠재적 매출 기회를 밝히고, 이 시장의 매력적인 투자 제안 매트릭스를 설명합니다.

또한 시장 성장 촉진요인, 억제요인, 기회, 신제품 출시 및 승인, 시장 동향, 지역별 전망, 주요 기업의 경쟁 전략 등에 대한 중요한 인사이트를 제공합니다.

세계 핀테크 시장의 주요 기업을 기업 하이라이트, 제품 포트폴리오, 주요 하이라이트, 재무 실적, 전략 등의 매개변수를 기반으로 프로파일링합니다.

주요 기업은 American Express Company, Square, Stripe, PayPal, Capital One, Citigroup Inc., JPMorgan Chase, Mastercard Inc., Visa Inc., Brex, Revolut, Pivot Payables 등입니다.

이 보고서의 인사이트를 통해 마케팅 담당자와 기업 경영진은 향후 제품 출시, 유형화, 시장 확대, 마케팅 전술에 대한 정보에 입각한 의사결정을 내릴 수 있습니다.

핀테크 세계 시장 보고서는 투자자, 공급업체, 제품 제조업체, 유통업체, 신규 시장 진출기업, 재무 분석가 등 다양한 이해관계자를 대상으로 합니다.

이해관계자들은 세계 핀테크 시장 분석에 사용되는 다양한 전략 매트릭스를 통해 의사결정을 쉽게 내릴 수 있습니다.

목차

제1장 조사의 목적과 전제조건

- 조사 목적

- 전제조건

- 약어

제2장 시장의 전망

- 리포트 설명

- 시장의 정의와 범위

- 개요

- Coherent Opportunity Map(COM)

제3장 시장 역학, 규제, 동향 분석

- 시장 역학

제4장 세계의 핀테크 산업 시장 - 코로나바이러스(COVID-19) 팬데믹의 영향

- 세계의 핀테크 산업 시장에 영향을 미치는 요인 - COVID-19

- 영향 분석

제5장 핀테크 카드별 세계의 핀테크 산업 시장(2020-2032년, (100만 달러))

- 상업 카드

- 가상 카드

제6장 세계의 핀테크 산업 시장, 솔루션별, 2020-2032년, (100만 달러)

- 결제와 송금

- 융자 솔루션

- 보험과 개인 금융

- 자산관리

- 디지털 뱅킹

- 기타(송금 솔루션, 암호 솔루션)

제7장 세계의 핀테크 산업 시장, 기술별, 2020-2032년, (100만 달러)

- 애플리케이션 프로그래밍 인터페이스(API)

- 빅데이터 분석

- 인공지능(AI)

- 블록체인

- 사이버 보안

제8장 세계의 핀테크 산업 시장, 최종 용도별, 2025-2032년, (100만 달러)

- 개인소비자

- 비즈니스 핀테크

- 기업 핀테크

제9장 세계의 핀테크 산업 시장, 지역별, 2020-2032년, 가치( 100만 달러)

- 북미

- 라틴아메리카

- 유럽

- 아시아태평양

- 중동

- 아프리카

제10장 경쟁 구도

- American Express Company

- Recent Developments/Updates

- Square

- Recent Developments/Updates

- Stripe

- Recent Developments/Updates

- PayPal

- Recent Developments/Updates

- Capital One

- Recent Developments/Updates

- Citigroup Inc.

- Recent Developments/Updates

- JPMorgan Chase

- Mastercard Inc.

- Visa Inc.

- Brex

- Revolut

- Pivot Payables

제11장 애널리스트의 권장사항

- 운명의 수레바퀴

- 애널리스트의 견해

- COM(Coherent Opportunity Map)

제12장 참고 문헌과 조사 방법

- 참고 문헌

- 조사 방법

- 출판사 소개

Global Fintech Industry Market is estimated to be valued at USD 377.2 Mn in 2025 and is expected to reach USD 726.2 Mn by 2032, growing at a compound annual growth rate (CAGR) of 9.8% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 377.2 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 9.80% | 2032 Value Projection: | USD 726.2 Mn |

Various factors such as rise of digital payments, growing e-commerce industry, influx of venture capital funding have contributed to the boom in the fintech sector globally. It has increased accessibility of financial services, driven efficiencies through use of advanced technologies like AI, ML and blockchain. However, security and privacy concerns continue to pose challenges for continued growth of the industry.

Market Dynamics:

The growth of the global fintech industry market is driven by several factors. The increasing digitization and emergence of technologies such as AI, ML and IoT have enabled development of innovative financial products and services. Rising smartphone and internet penetration along with growing ecommerce industry has boosted digital payments and online lending. This has fueled product innovation and market expansion. However, data privacy and security concerns pose challenges. Lack of standardization and interoperability issues also challenge seamless operations. Nevertheless, developing economies with underpenetrated financial services present huge opportunities for fintech players for growth.

Key features of the study:

This report provides in-depth analysis of the global fintech industry market, and provides market size (US$ Million) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global fintech market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include American Express Company, Square, Stripe, PayPal, Capital One, Citigroup Inc., JPMorgan Chase, Mastercard Inc., Visa Inc., Brex, Revolut, and Pivot Payables

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global fintech market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global fintech market

Market Segmentation

- FinTech Cards Insights (Revenue, USD, 2019 - 2032)

- Commercial Cards

- Virtual Cards

- Solution Insights (Revenue, USD, 2019 - 2032)

- Payment & Fund Transfer

- Lending Solutions

- Insurance & Personal Finance

- Wealth Management

- Digital Banking

- Others (Remittance Solutions, Crypto Solutions)

- Technology Insights (Revenue, USD, 2019 - 2032)

- Application Programming Interface (API)

- Big Data Analytics

- Artificial Intelligence (AI)

- Blockchain

- Cybersecurity

- End User Insights (Revenue, USD, 2019 - 2032)

- Individual Consumers

- Business FinTech

- Enterprise FinTech

- Regional Insights (Revenue, USD, 2019 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- American Express Company

- Square

- Stripe

- PayPal

- Capital One

- Citigroup Inc.

- JPMorgan Chase

- Mastercard Inc.

- Visa Inc.

- Brex

- Revolut

- Pivot Payables

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Fintech Industry Market, By FinTech Cards

- Global Fintech Industry Market, By Solution

- Global Fintech Industry Market, By Technology

- Global Fintech Industry Market, By End User

- Global Fintech Industry Market, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- PEST Analysis

- PORTER's Five Forces Analysis

- Market Opportunities

- Regulatory Scenario

- Recent Developments/Updates

- Industry Trend

4. Global Fintech Industry Market - Impact of Coronavirus (COVID-19) Pandemic

- Overview

- Factors Affecting the Global Fintech Industry Market - COVID-19

- Impact Analysis

5. Global Fintech Industry Market, By FinTech Cards, 2020-2032, (USD MN)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Commercial Cards

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Virtual Cards

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

6. Global Fintech Industry Market, By Solution, 2020-2032, (USD MN)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Payment & Fund Transfer

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Lending Solutions

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Insurance & Personal Finance

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Wealth Management

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Digital Banking

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Others (Remittance Solutions, Crypto Solutions)

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

7. Global Fintech Industry Market, By Technology, 2020-2032, (USD MN)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Application Programming Interface (API)

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Big Data Analytics

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Artificial Intelligence (AI)

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Blockchain

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Cybersecurity

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

8. Global Fintech Industry Market, By End User, 2025-2032, (USD MN)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Individual Consumers

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Business FinTech

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Enterprise FinTech

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

9. Global Fintech Industry Market, By Region, 2020 - 2032, Value (USD MN)

- Introduction

- Market Share Analysis, By Region, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- North America

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- U.S.

- Canada

- Latin America

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- South Africa

- North Africa

- Central Africa

10. Competitive Landscape

- American Express Company

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- Square

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- Stripe

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- PayPal

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- Capital One

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- Citigroup Inc.

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- JPMorgan Chase

- Mastercard Inc.

- Visa Inc.

- Brex

- Revolut

- Pivot Payables

11. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

12. References and Research Methodology

- References

- Research Methodology

- About us