|

시장보고서

상품코드

1699459

머천트 서비스 시장 : 서비스 프로바이더별, 용도별, 지역별Merchant Service Market, By Service Provider, By Application, By Geography |

||||||

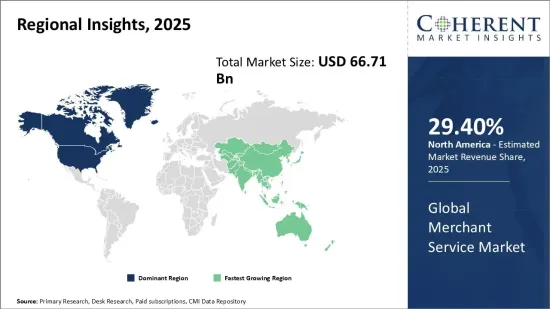

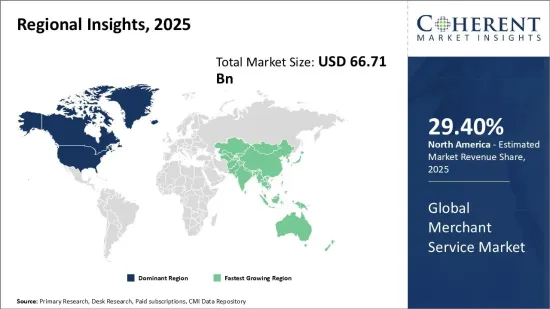

세계의 머천트 서비스 시장은 2025년에는 667억 1,000만 달러로 추정되며, 2032년까지는 2,014억 1,000만 달러에 달할 것으로 예측되며, 2025-2032년 연평균 성장률(CAGR)은 17.1%로 성장할 전망입니다.

| 리포트 범위 | 리포트 상세 | ||

|---|---|---|---|

| 기준연도 | 2024년 | 2025년 시장 규모 | 667억 1,000만 달러 |

| 실적 데이터 | 2020-2024년 | 예측 기간 | 2025-2032년 |

| 예측 기간 : 2025-2032년 CAGR : | 17.10% | 2032년 금액 예측 | 2,014억 1,000만 달러 |

세계의 머천트 서비스 시장은 디지털 결제 솔루션의 도입 확대, E-Commerce의 부상, 현금 없는 거래에 대한 소비자의 선호도 증가 등을 배경으로 최근 빠르게 성장하고 있습니다. 머천트 서비스 프로바이더는 신용카드 및 직불카드 거래, 모바일 결제, E-Commerce 결제 게이트웨이 등의 결제 처리 솔루션을 기업에 제공하여 원활한 금융 거래를 가능하게 하고 있습니다. 근거리무선통신(NFC) 기술, 모바일 지갑, POS 시스템의 보급이 시장 성장을 더욱 촉진하고 있습니다. 그러나 높은 처리 수수료, 데이터 보안에 대한 우려, 규제 환경의 변화 등 여러 가지 문제들이 시장 상황을 계속 변화시키고 있습니다.

시장 역학:

세계 머천트 서비스 시장은 디지털 거래로의 전환과 다양한 산업 분야에 핀테크 솔루션의 침투로 인해 성장세를 보이고 있습니다. 안전하고 효율적이며 확장성이 높은 결제 처리 솔루션에 대한 수요가 이 분야의 확장을 촉진하고 있으며, 모든 규모의 기업이 고급 가맹점 서비스를 업무에 통합하고 있습니다. 비접촉식 결제, 모바일 지갑, 국경 간 거래의 부상도 시장 성장을 가속화하고 있습니다. 그러나 거래 비용, 사이버 보안 위협, 진화하는 결제 규제에 대응하는 것은 기업 및 서비스 프로바이더에게 큰 도전이 되고 있습니다.

규제 개선, AI를 활용한 부정행위 감지, 블록체인 기반 결제, 생체인증 등의 기술 발전으로 시장의 효율성과 안전성이 높아질 것으로 예상됩니다. 또한 임베디드 금융, 분산형 결제 솔루션, 오픈 뱅킹 구상의 출현은 가맹점 서비스 산업의 기존 기업과 신규 시장 진출기업 모두에게 유리한 성장 기회를 제공할 것입니다.

본 조사의 주요 특징

세계의 가맹점 서비스 시장을 상세하게 분석했으며, 2024년을 기준 연도로 하여 예측 기간(2025-2032년) 시장 규모와 연평균 성장률(CAGR)을 조사하여 전해드립니다.

또한 다양한 부문에 걸친 잠재적 매출 기회를 밝히고, 이 시장의 매력적인 투자 제안 매트릭스를 설명합니다.

또한 시장 성장 촉진요인, 억제요인, 기회, 신제품 출시 및 승인, 시장 동향, 지역별 전망, 주요 기업의 경쟁 전략 등에 대한 중요한 인사이트을 제공합니다.

세계 머천트 서비스 시장의 주요 기업 개요을 기업 하이라이트, 제품 포트폴리오, 주요 하이라이트, 실적, 전략 등의 파라미터를 기준으로 정리했습니다.

주요 기업은 PayPal, Chase Payment Solutions, Stripe, Dharma Merchant Services, Fiserv, Flagship Merchant Services, Payment Cloud, Square, Helcim, Payment Depot, Stax, Instabill, Barclays, Paymentsense, SumUp 등입니다.

이 보고서의 인사이트를 통해 마케팅 담당자와 기업 경영진은 향후 제품 출시, 유형 업그레이드, 시장 확대, 마케팅 전술에 대한 정보에 입각한 의사결정을 내릴 수 있습니다.

이 보고서는 투자자, 공급업체, 제품 제조업체, 유통업체, 신규 시장 진출기업, 재무 분석가 등 업계의 다양한 이해관계자를 대상으로 합니다.

목차

제1장 조사 목적과 전제조건

- 조사 목적

- 전제조건

- 약어

제2장 시장의 전망

- 리포트 설명

- 시장의 정의와 범위

- 개요

제3장 시장 역학, 규제, 동향 분석

- 시장 역학

- 영향 분석

- 주요 하이라이트

- 규제 시나리오

- 제품 발매/승인

- PEST 분석

- PORTER의 산업 분석

- 시장 기회

- 규제 시나리오

- 주요 발전

- 업계 동향

제4장 세계의 머천트 서비스 시장, 서비스 프로바이더별, 2020-2032년

- 결제 서비스 프로바이더

- 은행 금융기관

- 결제 게이트웨이 프로바이더

- 비은행 금융기관

- 가맹점 어카운트 프로바이더

- 기타

제5장 세계의 머천트 서비스 시장, 용도별, 2020-2032년

- 결제 게이트웨이

- 모바일 결제 시스템

- 온라인 쇼핑 카트

- 신용카드 단말기

- 포트폴리오 관리

- 무역금융

- 기타

제6장 세계의 머천트 서비스 시장, 지역별, 2020-2032년

- 북미

- 라틴아메리카

- 유럽

- 아시아태평양

- 중동

- 아프리카

제7장 경쟁 구도

- PayPal

- Chase Payment Solutions

- Stripe

- Dharma Merchant Services

- Fiserv

- Flagship Merchant Services

- Payment Cloud

- Square

- Helcim

- Payment Depot

- Stax

- Instabill

- Barclays

- Paymentsense

- SumUp

제8장 애널리스트의 제안

- 운명의 수레바퀴

- 애널리스트의 견해

- Coherent Opportunity Map

제9장 참고 문헌과 조사 방법

- 참고 문헌

- 조사 방법

- 출판사 소개

Global Merchant Service Market is estimated to be valued at US$ 66.71 Bn in 2025 and is expected to reach US$ 201.41 Bn by 2032, growing at a compound annual growth rate (CAGR) of 17.1% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 66.71 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 17.10% | 2032 Value Projection: | USD 201.41 Bn |

The global merchant service market has experienced rapid expansion in recent years, driven by the increasing adoption of digital payment solutions, the rise of e-commerce, and growing consumer preference for cashless transactions. Merchant service providers offer businesses payment processing solutions, including credit and debit card transactions, mobile payments, and e-commerce payment gateways, enabling seamless financial transactions. The widespread use of near-field communication (NFC) technology, mobile wallets, and point-of-sale (POS) systems has further supported market growth. However, challenges such as high processing fees, data security concerns, and evolving regulatory frameworks continue to shape the market landscape.

Market Dynamics:

The global merchant service market is primarily driven by the shift towards digital transactions and the increasing penetration of fintech solutions across various industries. The demand for secure, efficient, and scalable payment processing solutions is fueling the expansion of the sector, with businesses of all sizes integrating advanced merchant services into their operations. The rise of contactless payments, mobile wallets, and cross-border transactions has also accelerated market growth. However, transaction costs, cybersecurity threats, and compliance with evolving payment regulations pose significant challenges for businesses and service providers.

Regulatory improvements and technological advancements, such as AI-driven fraud detection, Blockchain-based payments, and biometric authentication, are expected to enhance market efficiency and security. Additionally, the emergence of embedded finance, decentralized payment solutions, and open banking initiatives presents lucrative growth opportunities for both established players and new entrants in the merchant service industry.

Key Features of the Study:

This report provides in-depth analysis of the global merchant service market, and provides market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global merchant service market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include PayPal, Chase Payment Solutions, Stripe, Dharma Merchant Services, Fiserv, Flagship Merchant Services, Payment Cloud, Square, Helcim, Payment Depot, Stax, Instabill, Barclays, Paymentsense, and SumUp

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global merchant service market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Market Segmentation

- Service Provider Insights (Revenue, USD Bn, 2020 - 2032)

- Payment Service Providers

- Banking Financial Institutions

- Payment Gateway Providers

- Non-Banking Financial Institutions

- Merchant Account Providers

- Others

- Application Insights (Revenue, USD Bn, 2020 - 2032)

- Payment Gateway

- Mobile Payment Systems

- Online Shopping Carts

- Credit Card Terminals

- Portfolio Management

- Trade Financing

- Others

- Regional Insights (Revenue, USD Bn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Company Profiles

- PayPal

- Chase Payment Solutions

- Stripe

- Dharma Merchant Services

- Fiserv

- Flagship Merchant Services

- Payment Cloud

- Square

- Helcim

- Payment Depot

- Stax

- Instabill

- Barclays

- Paymentsense

- SumUp

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Merchant Service Market, By Service Provider

- Global Merchant Service Market, By Application

- Global Merchant Service Market, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Market Opportunities

- Regulatory Scenario

- Key Developments

- Industry Trends

4. Global Merchant Service Market, By Service Provider, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Payment Service Providers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Banking Financial Institutions

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Payment Gateway Providers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Non-Banking Financial Institutions

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Merchant Account Providers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

5. Global Merchant Service Market, By Application, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Payment Gateway

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Mobile Payment Systems

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Online Shopping Carts

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Credit Card Terminals

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Portfolio Management

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Trade Financing

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Merchant Service Market, By Region, 2020 - 2032, Value (USD Bn)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032, Value (USD Bn)

- Market Y-o-Y Growth Analysis (%), 2021 - 2032, Value (USD Bn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Service Provider, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Service Provider, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Service Provider, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Service Provider, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Service Provider, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Service Provider, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country/Region, 2020 - 2032, Value (USD Bn)

- South Africa

- North Africa

- Central Africa

7. Competitive Landscape

- PayPal

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Chase Payment Solutions

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Stripe

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Dharma Merchant Services

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Fiserv

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Flagship Merchant Services

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Payment Cloud

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Square

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Helcim

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Payment Depot

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Stax

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Instabill

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Barclays

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Paymentsense

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- SumUp

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. References and Research Methodology

- References

- Research Methodology

- About us