|

시장보고서

상품코드

1729700

기업 회생 서비스 시장 : 유형별, 지역별Corporate Recovery Service Market, By Type (Administrative Takeover, Compulsory Liquidation & Creditor Voluntary Liquidation, Voluntary Management, and Others), By Geography (North America, Latin America, Europe, Asia Pacific, Middle East & Africa) |

||||||

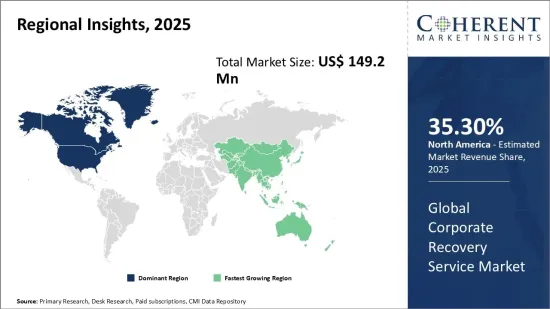

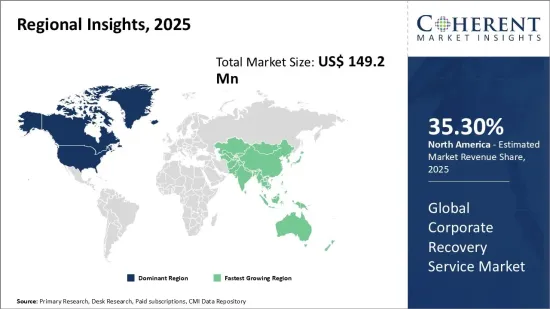

세계 기업 회생 서비스 시장은 2025년에는 1억 4,920만 달러로 추정되며, 2032년에는 2억 2,880만 달러에 달할 것으로 예상되며, 2025년부터 2032년까지 6.3%의 CAGR로 성장할 것으로 예상됩니다.

| 보고서 범위 | 보고서 상세 | ||

|---|---|---|---|

| 기준 연도 | 2024년 | 2025년 시장 규모 | 1억 4,920만 달러 |

| 실적 데이터 | 2020-2024년 | 예측 기간 | 2025-2032년 |

| 예측 기간 : 2025-2032년 CAGR | 6.30% | 2032년 가치 예측 | 2억 2,880만 달러 |

세계 기업 회생 서비스 시장은 지난 몇 년간 꾸준히 성장하고 있습니다. 기업 회생 서비스는 컨설팅, 회생 전략, 위기 관리 등을 제공함으로써 어려움을 겪고 있는 기업의 수익 회복을 돕습니다. 또한, COVID-19 사태로 인해 많은 기업들이 어려운 재정적 상황에 처해 있습니다. 이에 따라 실적 부진의 근본 원인을 파악하고 기업의 재무와 업무를 분석 및 최적화할 수 있는 전문적인 기업 회생 서비스에 대한 수요가 증가하고 있습니다.

시장 역학:

세계 기업 회생 서비스 시장은 거시경제의 역풍으로 인해 재정적 어려움에 직면한 기업의 증가, 세계 운영의 복잡성 증가, 산업별 규제 변화 등의 요인에 의해 주도되고 있습니다. 그러나 높은 회생 프로그램 비용과 회생 전략 채택에 대한 문화적 장벽이 시장 성장에 걸림돌로 작용하고 있습니다. 주요 비즈니스 기회로는 파트너십을 통한 신흥국 시장 진출, 맞춤형 디지털 솔루션 제공, 통합 M&A 자문 서비스 등을 꼽을 수 있습니다.

본 조사의 주요 특징

세계의 기업 회생 서비스 시장에 대해 조사 분석했으며, 2024년을 기준 연도로 하여 예측 기간(2025-2032년)의 시장 규모와 연평균 성장률(CAGR)에 대해 조사 분석하여 전해드립니다.

또한, 다양한 부문에 걸친 잠재적 수익 기회를 밝히고, 이 시장의 매력적인 투자 제안 매트릭스를 설명합니다.

또한 시장 촉진요인, 억제요인, 기회, 신제품 출시 및 승인, 시장 동향, 지역별 전망, 주요 기업의 경쟁 전략 등에 대한 중요한 인사이트를 제공합니다.

이 보고서는 기업 하이라이트, 제품 포트폴리오, 주요 하이라이트, 재무 성과, 전략 등의 매개 변수를 기반으로 세계 기업 회생 서비스 시장의 주요 기업을 프로파일링합니다.

이 보고서의 인사이트를 통해 마케팅 담당자와 기업 경영진은 향후 제품 출시, 유형화, 시장 확대, 마케팅 전략에 대한 정보에 입각한 의사결정을 내릴 수 있습니다.

이 보고서는 투자자, 공급업체, 제품 제조업체, 유통업체, 신규 진입자, 재무 분석가 등 업계의 다양한 이해관계자를 대상으로 합니다.

목차

제1장 조사 목적과 가정

- 조사 목적

- 가정

- 약어

제2장 시장 전망

- 보고서 설명

- 시장 정의와 범위

- 주요 요약

제3장 시장 역학, 규제, 동향 분석

- 시장 역학

- 영향 분석

- 주요 하이라이트

- 규제 시나리오

- 제품 발매/승인

- PEST 분석

- PORTER의 분석

- 시장 기회

- 규제 시나리오

- 주요 발전

- 업계 동향

제4장 세계의 기업 회생 서비스 시장, 유형별, 2020-2032년

- 인수

- 강제 청산과 채권자에 의한 자발적 청산

- 자주 관리

- 기타

제5장 세계의 기업 회생 서비스 시장, 지역별, 2020-2032년

- 북미

- 미국

- 캐나다

- 라틴아메리카

- 브라질

- 아르헨티나

- 멕시코

- 기타 라틴아메리카

- 유럽

- 독일

- 영국

- 스페인

- 프랑스

- 이탈리아

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- ASEAN

- 기타 아시아태평양

- 중동

- GCC 국가

- 이스라엘

- 기타 중동

- 아프리카

- 남아프리카공화국

- 북아프리카

- 중앙아프리카

제6장 경쟁 구도

- Deloitte

- PricewaterhouseCoopers(PwC)

- Ernst & Young(EY)

- KPMG

- Grant Thornton

- Alvarez & Marsal

- Baker Tilly

- BDO

- CBIZ, Inc.

- Buchler Phillips

- Hall Chadwick Melbourne Pty Ltd

- Moore Kingston Smith

- PKF International

- MENZIES LLP

- Business Victoria

제7장 애널리스트의 추천사항

- Wheel of Fortune

- 애널리스트의 견해

- Coherent Opportunity Map

제8장 참고문헌과 조사 방법

- 참고문헌

- 조사 방법

- 출판사 소개

Global Corporate Recovery Service Market is estimated to be valued at USD 149.2 Mn in 2025 and is expected to reach USD 228.8 Mn by 2032, growing at a compound annual growth rate (CAGR) of 6.3% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 149.2 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 6.30% | 2032 Value Projection: | USD 228.8 Mn |

The global corporate recovery service market has been growing steadily over the past few years. Corporate recovery services help struggling businesses return to profitability by providing consultation, turnaround strategies, and crisis management. To add to this, many businesses have been left in difficult financial situations by the COVID-19 pandemic. This has increased the demand for professional corporate recovery services that can analyze and optimize a company's financials and operations, identifying the root causes of underperformance.

Market Dynamics:

The global corporate recovery service market is driven by factors such as the rising number of businesses facing financial distress due to macroeconomic headwinds, increasing complexity of global operations, and regulatory changes across industries. However, high costs of recovery programs and cultural barriers in adopting turnaround strategies pose challenges to the market's growth. Key opportunities include expanding into developing markets through partnerships, offering customized digital solutions, and integrated M&A advisory services.

Key Features of the Study:

This report provides in-depth analysis of the global corporate recovery service market, and provides market size (US$ Million) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global corporate recovery service market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), KPMG, Grant Thornton, Alvarez & Marsal, Baker Tilly, BDO, CBIZ, Inc., Buchler Phillips, Hall Chadwick Melbourne Pty Ltd, Moore Kingston Smith, PKF International, MENZIES LLP, and Business Victoria

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global corporate recovery service market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Market Segmentation

- Type Insights (Revenue, US$ Mn, 2020 - 2032)

- Administrative Takeover

- Compulsory Liquidation & Creditor Voluntary Liquidation

- Voluntary Management

- Others

- Regional Insights (Revenue, US$ Mn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Company Profiles:

- Deloitte

- PricewaterhouseCoopers (PwC)

- Ernst & Young (EY)

- KPMG

- Grant Thornton

- Alvarez & Marsal

- Baker Tilly

- BDO

- CBIZ, Inc.

- Buchler Phillips

- Hall Chadwick Melbourne Pty Ltd

- Moore Kingston Smith

- PKF International

- MENZIES LLP

- Business Victoria

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Corporate Recovery Service Market, By Type

- Global Corporate Recovery Service Market, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Market Opportunities

- Regulatory Scenario

- Key Developments

- Industry Trends

4. Global Corporate Recovery Service Market, By Type, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Administrative Takeover

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Compulsory Liquidation & Creditor Voluntary Liquidation

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Voluntary Management

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

5. Global Corporate Recovery Service Market, By Region, 2020 - 2032, Value (US$ Mn)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032, Value (US$ Mn)

- Market Y-o-Y Growth Analysis (%), 2021 - 2032, Value (US$ Mn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country/Region, 2020 - 2032, Value (US$ Mn)

- South Africa

- North Africa

- Central Africa

6. Competitive Landscape

- Deloitte

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- PricewaterhouseCoopers (PwC)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Ernst & Young (EY)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- KPMG

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Grant Thornton

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Alvarez & Marsal

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Baker Tilly

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- BDO

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- CBIZ, Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Buchler Phillips

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Hall Chadwick Melbourne Pty Ltd

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Moore Kingston Smith

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- PKF International

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- MENZIES LLP

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Business Victoria

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

7. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

8. References and Research Methodology

- References

- Research Methodology

- About us