|

시장보고서

상품코드

1876795

커넥티드 트럭 시장 기회, 성장요인, 업계 동향 분석 및 예측(2025-2034년)Connected Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

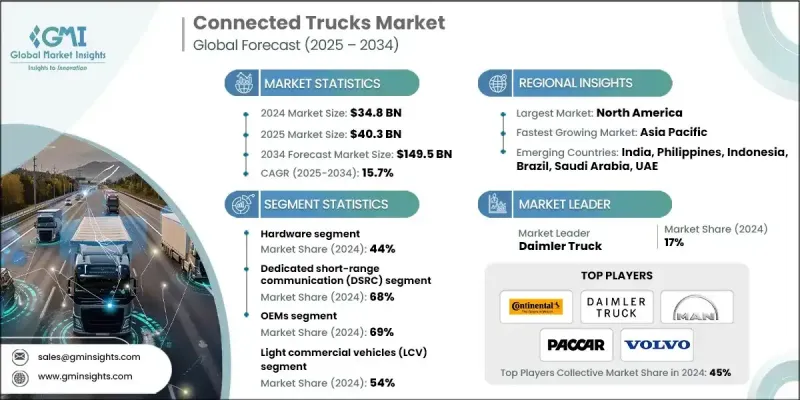

세계의 커넥티드 트럭 시장은 2024년에 348억 달러로 평가되었고, 2034년까지 연평균 복합 성장률(CAGR) 15.7%로 성장하여 1,495억 달러에 이를 것으로 예측됩니다.

커넥티드 트럭 기술에 대한 수요 증가는 전 세계 물류 및 장거리 운송 네트워크의 방식을 변화시키고 있습니다. 첨단 텔레매틱스, 예측적 차량 애널리틱스, 차량 내 커넥티비티를 통해 운전자가 경로를 모니터링하고, 배송 시간을 예측하고, 적재량을 최적화하고, 공회전 및 공차 운행을 최소화할 수 있는 방법을 변화시키고 있습니다. 디지털 트윈 시뮬레이션을 활용하면 차량 관리자와 OEM 제조업체는 운영 모델을 가상으로 테스트할 수 있어 비용 절감, 안전성 향상, 배송 신뢰성 향상으로 이어질 수 있습니다. 업계가 전기차와 저공해 차량으로 전환하는 가운데, 커넥티드 트럭 플랫폼은 에너지 배분 관리, 충전 스케줄 조정, 주행거리 효율 최적화를 위해 활용되고 있습니다. 스마트 충전 시스템과 V2G(차량에서 전력망으로의 통신) 시스템의 통합을 통해 에너지 사용의 균형을 맞추고 전력망에 대한 부하를 줄일 수 있습니다. 또한, 혼합 차량 운영 시 연결 시스템을 통해 동적 부하 분산 및 경로 최적화가 가능하여 배터리 수명 유지에 기여합니다. 자동 제동, 차선 유지, 트랙 플래토닝과 같은 ADAS의 빠른 통합은 신뢰할 수 있는 저지연 연결의 중요성을 더욱 강조하고 있습니다. OEM 및 차량 운영업체들은 센서 융합 및 클라우드 분석에 대한 투자를 확대하고 있으며, 실시간 데이터를 실용적인 안전 및 규정준수를 위한 통찰력으로 전환하고 있습니다.

| 시장 범위 | |

|---|---|

| 개시 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 348억 달러 |

| 예측 금액 | 1,495억 달러 |

| CAGR | 15.7% |

하드웨어 부문은 2024년 44%의 점유율을 차지했으며, 2034년까지 연평균 13.9%의 성장률을 보일 것으로 전망됩니다. 하드웨어는 연결성, 통신, 텔레매틱스 통합을 가능하게 하는 필수적인 기반을 형성하기 때문에 계속해서 시장을 선도하고 있습니다. 텔레매틱스 제어 유닛(TCU), GPS/GNSS 장치, 센서, 무선 통신 모듈 등의 주요 구성 요소는 실시간 운영 데이터를 수집하고 전송하는 기반이 됩니다. 이러한 시스템은 차량, 클라우드 플랫폼, 차량 관리 네트워크 간의 원활한 상호 운용을 지원하며, 디지털 운송 생태계를 구동하는 물리적 계층을 형성하고 있습니다.

전용 근거리 통신(DSRC) 부문은 2024년 68%의 점유율을 차지했으며, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 15.1%를 보일 것으로 예측됩니다. DSRC 기술은 견고한 성능과 낮은 지연시간으로 인해 커넥티드 트럭을 위한 우선적인 통신방식으로 자리매김하고 있습니다. 이러한 특성은 실시간 차량 간 통신(V2V) 및 차량과 인프라 간 통신(V2I)에서 매우 중요합니다. 이를 통해 충돌 감지, 차선 변경 경보, 비상 대응 시스템 등 안전성을 높이는 용도에서 즉각적인 데이터 교환이 가능합니다. 입증된 신뢰성과 규제 적합성은 현대의 트럭 운송 업무에 대한 채택을 더욱 강화시키고 있습니다.

미국 커넥티드 트럭 시장은 85%의 점유율을 차지하며 2024년 123억 달러 규모에 달했습니다. 미국 시장은 첨단 커넥티비티 시스템의 조기 도입, 광범위한 텔레매틱스 인프라, 세계 트럭 제조업체들의 적극적인 참여로 혜택을 누리고 있습니다. OEM 제조업체들은 실시간 모니터링, 원격 진단, 성능 최적화를 지원하는 공장 내장형 디지털 연결 플랫폼을 통합하고 있으며, 이는 시장의 급속한 침투를 촉진하고 있습니다. 또한, 차량 효율성 향상에 대한 수요 증가, 엄격한 안전 규제, 주요 텔레매틱스 제공업체들의 존재는 지역 내 전체 차량에 대한 기술 도입을 가속화하고 있습니다.

세계 커넥티드 트럭 시장에서 사업을 전개하는 주요 기업으로는 Trimble, Continental, Daimler Truck, BYD Company, Tata Motors, PACCAR, MAN Truck &&Bus, Scania, Geotab, Geotab, Volvo 등이 있습니다. Volvo 등을 들 수 있습니다. 커넥티드 트럭 시장의 주요 업체들은 시장에서의 입지를 강화하기 위해 다양한 전략을 실행하고 있습니다. 많은 기업들이 하드웨어, 소프트웨어, 텔레매틱스를 통합한 첨단 커넥티비티 에코시스템 개발에 주력하고 있으며, 통합적인 차량 인텔리전스 제공을 목표로 하고 있습니다. 제품 포트폴리오 확대 및 대규모 도입 실현을 위해 물류 사업자 및 OEM 업체와의 전략적 제휴도 추진되고 있습니다. 또한, 예측 정비, 운전자 안전, 에너지 최적화를 위해 AI 및 데이터 기반 분석 기술에 많은 투자를 하고 있습니다.

자주 묻는 질문

목차

제1장 조사 방법

- 시장 범위와 정의

- 조사 설계

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 정보원

- 세계

- 지역별/국가별

- 기본 추정치와 계산

- 기준연도 계산

- 시장 추정 주요 동향

- 1차 조사 및 검증

- 1차 정보

- 예측 모델

- 조사의 전제조건과 제한 사항

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급업체 상황

- 이익률 분석

- 비용 구조

- 각 단계 부가가치

- 밸류체인에 영향을 미치는 요인

- 파괴적 변화

- 업계에 대한 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크&과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신 동향

- 현재 기술 동향

- 신기술

- 특허 분석

- 가격 동향

- 지역별

- 제품별

- 생산 통계

- 생산 거점

- 소비 거점

- 수출과 수입

- 비용 내역 분석

- 지속가능성과 환경 영향 분석

- 수명주기 평가 및 환경 모델링

- 지속가능 설계와 최적화

- 환경 컴플라이언스와 보고

- 그린 기술 및 혁신

- 비즈니스 사례 및 투자수익률(ROI) 분석

- 총소유비용(TCO) 프레임워크

- ROI 산출 조사 방법

- 도입 스케줄과 주요 마일스톤

- 리스크 평가와 경감 전략

- 퍼포먼스 벤치마킹과 핵심성과지표(KPI)

- 업무 효율화 지표

- 안전성과 컴플라이언스 지표

- 재무 실적 벤치마크

- 운전자 퍼포먼스 평가 시스템

- 업계표준과 프로토콜

- SAE J1939 통신규격

- TMC 추천 프랙티스

- 상호운용성 및 데이터 교환 프로토콜

- 사이버 보안 및 기능 안전기준

- 도입 베스트 프랙티스

- 도입 전략과 조사 방법

- 변경 관리 및 운전자 연수

- 데이터 통합 및 분석 환경 구축

- 유지보수 및 지원 최적화

- 벤더 선정 및 평가 프레임워크

- 기술 평가 기준

- 통합 능력 평가

- 확장성과 장래성 배려

- 지원 및 서비스 레벨 요건

- 전망과 기술 로드맵

- 기술 진화 타임라인

- 자율주행 트럭 통합

- 전기 트럭 접속성

- 데이터 수익화 전략

- 규제 진화에 의한 영향

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 인수합병(M&A)

- 제휴 및 협업

- 신제품 발매

- 사업 확대 계획과 자금조달

제5장 시장 추산·예측 : 컴포넌트별, 2021-2034

- 주요 동향

- 하드웨어

- 텔레매틱스 제어 장치(TCU)

- 차량내 진단 장비(OBD)

- 통신 모듈(셀룰러, Wi-Fi, Bluetooth)

- 센서 및 데이터 수집 장비

- GPS/GNSS 측위 시스템

- 기타

- 소프트웨어

- 플릿 관리 소프트웨어 플랫폼

- 모바일 애플리케이션 및 운전자 인터페이스

- 애널리틱스 및 비즈니스 인텔리전스 툴

- 통합 및 API 관리 소프트웨어

- 사이버 보안 및 데이터 보호 소프트웨어

- 기타

- 서비스

- 설치 및 통합 서비스

- 데이터 분석 및 컨설팅 서비스

- 유지보수 및 기술 지원

- 연수 및 변경 관리 서비스

- 매니지드 서비스 및 아웃소싱

- 기타

제6장 시장 추산·예측 : 접속 방식별, 2021-2034

- 주요 동향

- 차량과 인프라간 통신(V2I)

- 신호기 통합

- 스마트 하이웨이 시스템

- 요금 징수 및 지불 시스템

- 계량 스테이션 통신

- 주차 및 하역 구역 관리

- 차량-클라우드간 통신(V2C)

- 플릿 관리 플랫폼

- 원격 진단 및 모니터링

- 무선 업데이트 및 설정

- 데이터 분석 및 비즈니스 인텔리전스

- 규제 준수 보고

- 차량간 통신(V2V)

- 플래투닝 및 호송 작전

- 충돌 방지 시스템

- 교통 흐름 최적화

- 긴급 차량 통신

- 협력형 적응형 크루즈 컨트롤

- 기타

제7장 시장 추산·예측 : 범위별, 2021-2034

- 주요 동향

- 전용 단거리 통신(DSRC)

- 장기

제8장 시장 추산·예측 : 차량별, 2021-2034

- 주요 동향

- 소형 상용차(LCV)

- 클래스 1-2 차량

- 픽업 트럭 및 화물 밴

- 소형 배송 차량

- 서비스 및 유틸리티 차량

- 도시 라스트 마일 배송 솔루션

- 중형 상용차(MCV)

- 클래스 3-5 차량

- 박스형 트럭 및 스텝 밴

- 푸드서비스 및 음료 트럭

- 유틸리티 차량 및 자치체 차량

- 지역별 분포 용도

- 냉장 운송 유닛(리퍼 유닛)

- 대형 상용차(HCV)

- 클래스 6-8 차량

- 장거리용 트랙터 및 세미 트레일러

- 대형 트럭 및 트레일러

- 건설 차량 및 특수 용도 차량

- 특수중기

제9장 시장 추산·예측 : 용도별, 2021-2034

- 주요 동향

- 플릿 관리

- 안전성 및 컴플라이언스

- 원격 진단 및 유지보수

- 인포테인먼트 및 커넥티비티

- 기타

제10장 시장 추산·예측 : 판매채널별, 2021-2034

- 주요 동향

- OEM

- 애프터마켓

제11장 시장 추산·예측 : 지역별, 2021-2034

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 필리핀

- 인도네시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카공화국

- 사우디아라비아

- 아랍에미리트(UAE)

제12장 기업 개요

- 세계 기업

- BYD Company

- Daimler Truck

- Iveco

- MAN Truck &Bus

- Navistar International

- PACCAR

- Scania

- Tata Motors

- Tesla

- Volvo

- Telematics Providers

- Fleet Complete

- Geotab

- MiX Telematics

- Omnitracs

- Platform Science

- Samsara Networks

- Teletrac Navman

- Trimble

- Verizon Connect

- Zonar Systems

- ADAS &Component Suppliers

- Aptiv

- Autoliv

- Continental

- DENSO

- Knorr-Bremse

- Magna International

- Mobileye

- Robert Bosch

- Valeo

- ZF Friedrichshafen

- Connectivity &Hardware

- HARMAN International

- Murata Manufacturing

- NXP Semiconductors

- Qualcomm Technologies

- Sierra Wireless

- TE Connectivity

The Global Connected Trucks Market was valued at USD 34.8 billion in 2024 and is estimated to grow at a CAGR of 15.7% to reach USD 149.5 billion by 2034.

The growing demand for connected truck technologies is reshaping logistics and long-haul transportation networks worldwide. Advanced telematics, predictive fleet analytics, and in-cabin connectivity are transforming the way operators monitor routes, forecast delivery times, optimize loads, and minimize idle or empty trips. The use of digital-twin simulations enables fleet managers and OEMs to test operational models virtually, leading to cost reduction, enhanced safety, and improved delivery reliability. As the industry transitions toward electric and low-emission fleets, connected truck platforms are being utilized to manage energy distribution, schedule charging, and optimize range efficiency. Integration of smart charging and vehicle-to-grid communication systems ensures balanced energy usage and reduced grid strain. Furthermore, in mixed fleet operations, connected systems enable dynamic load balancing and route optimization to preserve battery life. The rapid integration of advanced driver assistance technologies such as automated braking, lane keeping, and truck platooning further underscores the importance of reliable, low-latency connectivity. OEMs and fleet operators are increasingly investing in sensor fusion and cloud analytics to turn real-time data into actionable safety and compliance insights.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34.8 Billion |

| Forecast Value | $149.5 Billion |

| CAGR | 15.7% |

The hardware segment held a 44% share in 2024 and is projected to grow at a CAGR of 13.9% through 2034. Hardware continues to lead the market as it forms the essential framework that enables connectivity, communication, and telematics integration. Key components, including telematics control units (TCUs), GPS/GNSS devices, sensors, and wireless communication modules, serve as the backbone for collecting and transmitting real-time operational data. These systems support seamless interaction between vehicles, cloud platforms, and fleet management networks, forming the physical layer that powers digital transport ecosystems.

The dedicated short-range communication (DSRC) segment accounted for a 68% share in 2024 and is projected to grow at a CAGR of 15.1% from 2025 to 2034. DSRC technology remains the preferred communication method for connected trucks due to its robust performance and low latency, which are crucial for real-time vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication. This enables instantaneous data exchange for applications that enhance safety, such as collision detection, lane-changing alerts, and emergency response systems. Its proven reliability and regulatory alignment continue to strengthen its adoption in modern trucking operations.

United States Connected Trucks Market held an 85% share, generating USD 12.3 billion in 2024. The U.S. market benefits from early adoption of advanced connectivity systems, extensive telematics infrastructure, and strong participation from global truck manufacturers. OEMs have integrated factory-installed digital connectivity platforms that support real-time monitoring, remote diagnostics, and performance optimization, driving rapid market penetration. Additionally, growing demand for fleet efficiency, stringent safety regulations, and the presence of major telematics providers are accelerating technology deployment across regional fleets.

Key companies operating in the Global Connected Trucks Market include Trimble, Continental, Daimler Truck, BYD Company, Tata Motors, PACCAR, MAN Truck & Bus, Scania, Geotab, and Volvo. Leading players in the Connected Trucks Market are implementing multiple strategies to strengthen their market presence. Many are focusing on developing advanced connectivity ecosystems combining hardware, software, and telematics to deliver integrated fleet intelligence. Strategic collaborations with logistics providers and OEMs are being pursued to expand product portfolios and ensure large-scale deployment. Companies are also investing heavily in AI and data-driven analytics to enhance predictive maintenance, driver safety, and energy optimization.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Technology

- 2.2.4 Range

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.2.7 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for fleet management efficiency

- 3.2.1.2 Integration of 5G and IoT technologies

- 3.2.1.3 Government regulations on safety and emissions

- 3.2.1.4 Increasing adoption of cloud-based telematics platforms

- 3.2.1.5 Growing demand for predictive maintenance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial implementation and maintenance costs

- 3.2.2.2 Concerns over data security and privacy

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of autonomous and semi-autonomous trucks

- 3.2.3.2 Emergence of edge computing for real-time analytics

- 3.2.3.3 Increasing electrification of commercial vehicles

- 3.2.3.4 Rising adoption in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Sustainability and environmental impact analysis

- 3.12.1 Lifecycle assessment and environmental modeling

- 3.12.2 Sustainable design and optimization

- 3.12.3 Environmental compliance and reporting

- 3.12.4 Green technology and innovation

- 3.13 Business Case & ROI Analysis

- 3.13.1 Total cost of ownership framework

- 3.13.2 ROI calculation methodologies

- 3.13.3 Implementation timeline & milestones

- 3.13.4 Risk assessment & mitigation strategies

- 3.14 Performance Benchmarking & KPIs

- 3.14.1 Operational efficiency metrics

- 3.14.2 Safety & compliance indicators

- 3.14.3 Financial performance benchmarks

- 3.14.4 Driver performance scoring systems

- 3.15 Industry Standards & Protocols

- 3.15.1 SAE J1939 communication standards

- 3.15.2 TMC recommended practices

- 3.15.3 Interoperability & data exchange protocols

- 3.15.4 Cybersecurity & functional safety standards

- 3.16 Implementation Best Practices

- 3.16.1 Deployment strategies & methodologies

- 3.16.2 Change management & driver training

- 3.16.3 Data integration & analytics setup

- 3.16.4 Maintenance & support optimization

- 3.17 Vendor Selection & Evaluation Framework

- 3.17.1 Technology evaluation criteria

- 3.17.2 Integration capability assessment

- 3.17.3 Scalability & future-proofing considerations

- 3.17.4 Support & service level requirement

- 3.18 Future outlook & technology roadmap

- 3.18.1 Technology evolution timeline

- 3.18.2 Autonomous trucking integration

- 3.18.3 Electric truck connectivity

- 3.18.4 Data monetization strategies

- 3.18.5 Regulatory evolution impact

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Telematics control units (TCUS)

- 5.2.2 On-board diagnostics (OBD) devices

- 5.2.3 Communication modules (cellular, wi-fi, Bluetooth)

- 5.2.4 Sensors & data collection devices

- 5.2.5 GPS/GNSS positioning systems

- 5.2.6 Others

- 5.3 Software

- 5.3.1 Fleet management software platforms

- 5.3.2 Mobile applications & driver interfaces

- 5.3.3 Analytics & business intelligence tools

- 5.3.4 Integration & API management software

- 5.3.5 Cybersecurity & data protection software

- 5.3.6 Others

- 5.4 Services

- 5.4.1 Installation & integration services

- 5.4.2 Data analytics & consulting services

- 5.4.3 Maintenance & technical support

- 5.4.4 Training & change management services

- 5.4.5 Managed services & outsourcing

- 5.4.6 Others

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Vehicle-to-Infrastructure (V2I) Communication

- 6.2.1 Traffic signal integration

- 6.2.2 Smart highway systems

- 6.2.3 Toll collection & payment systems

- 6.2.4 Weigh station communication

- 6.2.5 Parking & loading zone management

- 6.3 Vehicle-to-Cloud (V2C) Communication

- 6.3.1 Fleet management platforms

- 6.3.2 Remote diagnostics & monitoring

- 6.3.3 Over-the-air updates & configuration

- 6.3.4 Data analytics & business intelligence

- 6.3.5 Regulatory compliance reporting

- 6.4 Vehicle-to-Vehicle (V2V) Communication

- 6.4.1 Platooning & convoy operations

- 6.4.2 Collision avoidance systems

- 6.4.3 Traffic flow optimization

- 6.4.4 Emergency vehicle communication

- 6.4.5 Cooperative adaptive cruise control

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Range, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Dedicated short range communication (DSRC)

- 7.3 Long range

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Light Commercial Vehicles (LCV)

- 8.2.1 Class 1-2 vehicles

- 8.2.2 Pickup trucks & cargo vans

- 8.2.3 Small delivery vehicles

- 8.2.4 Service & utility vehicles

- 8.2.5 Urban last-mile applications

- 8.3 Medium Commercial Vehicles (MCV)

- 8.3.1 Class 3-5 vehicles

- 8.3.2 Box trucks & step vans

- 8.3.3 Food service & beverage trucks

- 8.3.4 Utility & municipal vehicles

- 8.3.5 Regional distribution applications

- 8.3.6 Refrigerated transport (reefer) units

- 8.4 Heavy Commercial Vehicles (HCV)

- 8.4.1 Class 6-8 vehicles

- 8.4.2 Long-haul tractors & semi-trailers

- 8.4.3 Heavy duty trucks & trailers

- 8.4.4 Construction & vocational vehicles

- 8.4.5 Specialized heavy equipment

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Fleet management

- 9.3 Safety & compliance

- 9.4 Remote diagnostics & maintenance

- 9.5 Infotainment & connectivity

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEMs

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 BYD Company

- 12.1.2 Daimler Truck

- 12.1.3 Iveco

- 12.1.4 MAN Truck & Bus

- 12.1.5 Navistar International

- 12.1.6 PACCAR

- 12.1.7 Scania

- 12.1.8 Tata Motors

- 12.1.9 Tesla

- 12.1.10 Volvo

- 12.2 Telematics Providers

- 12.2.1 Fleet Complete

- 12.2.2 Geotab

- 12.2.3 MiX Telematics

- 12.2.4 Omnitracs

- 12.2.5 Platform Science

- 12.2.6 Samsara Networks

- 12.2.7 Teletrac Navman

- 12.2.8 Trimble

- 12.2.9 Verizon Connect

- 12.2.10 Zonar Systems

- 12.3 ADAS & Component Suppliers

- 12.3.1 Aptiv

- 12.3.2 Autoliv

- 12.3.3 Continental

- 12.3.4 DENSO

- 12.3.5 Knorr-Bremse

- 12.3.6 Magna International

- 12.3.7 Mobileye

- 12.3.8 Robert Bosch

- 12.3.9 Valeo

- 12.3.10 ZF Friedrichshafen

- 12.4 Connectivity & Hardware

- 12.4.1 HARMAN International

- 12.4.2 Murata Manufacturing

- 12.4.3 NXP Semiconductors

- 12.4.4 Qualcomm Technologies

- 12.4.5 Sierra Wireless

- 12.4.6 TE Connectivity