|

시장보고서

상품코드

1844368

전자요금징수(ETC) 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Electronic Toll Collection (ETC) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

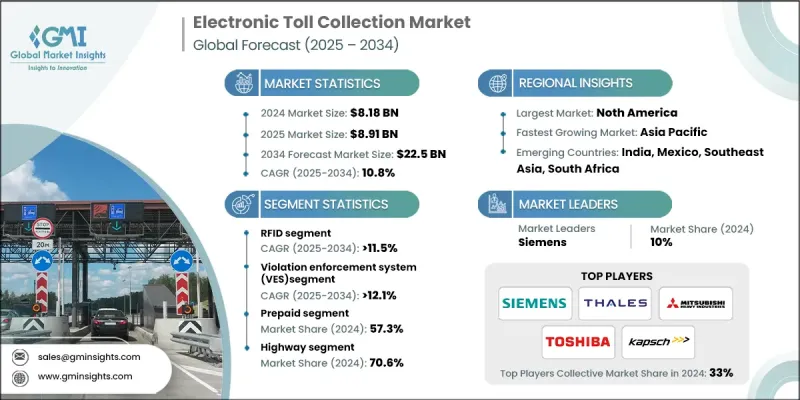

세계의 전자요금징수(ETC) 시장 규모는 2024년에 81억 8,000만 달러에 달했고, CAGR 10.8%를 나타내 2034년에는 225억 달러에 이를 것으로 예측되고 있습니다.

도시 인구의 급증과 자가용차 소유율의 상승에 의해 특히 고속도로나 도시 회랑에서 교통 정체가 발생하고 있습니다. ETC 시스템은 수수료 지불을 자동화하고, 교통 체증을 완화하며, 요금소에서의 처리 능력을 향상시켜 교통 지연을 줄이도록 설계되었습니다. 세계 각국의 정부는 디지털 수수료 징수 프레임워크로의 전환을 선호하고 상호 운용성 표준화를 추진하며 수작업으로 인한 현금 징수를 폐지하고 있습니다. RFID, 인공지능, 클라우드 플랫폼, ANPR 시스템 등의 기술 진보로 최신 ETC 솔루션은 보다 정확하고 효율적이며 안전합니다. 또한 이러한 기술은 운영 비용을 줄이는 데 도움이 되며 광범위한 배포를 가능하게 합니다. 또한 모바일 월렛 및 디지털 결제 솔루션의 보급으로 사용자의 편의성이 더욱 향상되었습니다. ETC 시스템은 공회전 시간과 연료 소비를 줄이고 배출량을 줄여 환경의 지속가능성에 기여합니다. 각국이 지속가능성 이니셔티브와 탈탄소 목표를 다루고 있는 가운데 ETC는 보다 깨끗하고 스마트한 교통 시스템 구축에 필수적인 역할을 하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시장 규모 | 81억 8,000만 달러 |

| 예측 금액 | 225억 달러 |

| CAGR | 10.8% |

2024년 RFID 기술 부문은 46%의 점유율을 차지했으며 2034년까지 연평균 복합 성장률(CAGR) 11.5%를 나타낼 것으로 예측됩니다. RFID는 세계 수수료 네트워크, 특히 아시아 전역의 지역에서 여전히 지배적이고 비용 효율적인 솔루션입니다. 이 시스템은 합리적인 가격, 단순성 및 광범위한 채택으로 매우 뒷받침됩니다. 한편, DSRC(Dedicated Short-Range Communication : 전용 근거리 통신)는 주로 고속의 일반 도로 요금 징수 환경이나 V2X 통신에 있어서 유럽이나 한국 등 일부 지역에서 계속 사용되고 있습니다. RFID가 세계 시장을 선도하는 반면, DSRC는 특정 지역의 생태계에서 존재감을 유지하고 있습니다.

위반 단속 시스템(VES) 부문은 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 12.1%를 나타낼 전망입니다. 오픈 로드, 현금없는 요금으로의 이동이 가속화됨에 따라 자동 단속 도구 수요가 크게 증가하고 있습니다. VES 기술은 카메라, 센서 시스템 및 ANPR을 이용하여 통행 요금 위반자를 식별하고 규정 준수를 수행합니다. 이러한 시스템은 위반 감지를 자동화하여 수익 손실을 방지하고 수수료 관련 법규를 준수하는 데 도움이 됩니다. AI와 애널리틱스에 의해 강화된 최신 VES 솔루션은 감지 정밀도를 향상시키고 차세대 유료 도로 인프라에 필수적입니다.

미국의 전자요금징수(ETC) 시장은 2024년 87.4%의 점유율을 차지했습니다. 전체 전자요금(AET) 시스템의 보급으로 유료도로의 운영방법이 변화하고, 현금 지불이 없어져, 보다 부드러운 교통의 흐름이 가능해지고 있습니다. 이러한 시스템은 운영 비용을 줄일 뿐만 아니라 동적 요금 설정 모델을 통해 정체 관리를 지원합니다. 실시간 교통 데이터를 기반으로 한 변동 요금 제도가 보급되고 있으며, 오프 피크 이동을 촉진하고 교통 효율을 향상시킴으로써 이동 행동에 영향을 미치는 데 도움이 됩니다.

세계의 전자요금징수(ETC) 시장을 선도하는 주요 기업으로는 지멘스, 탈레스, Conduent, 도시바, Kapsch TrafficCom, 미쓰비시중공업, Neology, EFKON, Cubic, TransCore/ST Engineering 등이 있습니다. 전자요금징수(ETC) 시장의 선수들은 교통 당국과 정부와의 전략적 제휴에 주력하고 통합된 수수료 징수 인프라를 개발하고 있습니다. R&D 투자는 정확성 향상, 시스템 비용 절감, AI 주도형 애널리틱스 구현을 선호합니다. 각 회사는 특히 급성장 지역에서 장기 계약을 확보함으로써 세계 사업 전개를 적극적으로 진행하고 있습니다. 또한 많은 기업들이 관할 구역을 넘어 피팅가 없는 이동을 가능하게 하는 상호 운용성 프로토콜을 다루고 있습니다.

목차

제1장 조사 방법

- 시장 범위와 정의

- 연구 설계

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 소스

- 세계

- 지역/국가

- 기본 추정과 계산

- 기준 연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측 모델

- 조사 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 전자요금징수(ETC) 밸류체인

- 정부와 민간 부문의 관계

- 테크놀로지 제공업체와 오퍼레이터의 다이나믹스

- 표준화 단체의 영향요인

- 교통국 통합의 혼란

- 업계에 미치는 영향요인

- 성장 촉진요인

- 교통 정체의 심각화

- 정부의 정책과 규제

- 기술적 진보

- 환경 지속가능성 목표

- 원활한 여행 수요 증가

- 업계의 잠재적 위험 및 과제

- 높은 도입 비용

- 개인정보 보호 및 데이터 보안에 대한 우려

- 시장 기회

- 신흥 시장으로 확대

- 스마트 모빌리티와의 통합과 그 영향

- AI와 분석의 도입

- 환경과 지속가능성에 대한 노력

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- FHWA 전자요금징수(ETC) 기준

- DOT 지능형 교통 시스템 가이드라인

- DSRC의 FCC 주파수 할당

- 국제규격(ISO, CEN, ETSI)

- 지방운송국 규제

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 분석

- 가격 동향 분석

- 운영비용 비교

- 총 소유비용 분석

- 코스트 내역 분석

- 인프라 개발 비용

- 기술 도입 비용

- 시스템 통합 및 커스터마이즈

- 지속가능성과 환경 측면

- 지속가능한 실천

- 폐기물 감축 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적인 노력

- 탄소발자국의 고려

- 시장 전개 통계

- ETC 시스템 설치율

- 트랜스폰더 채용 지표

- 교통량 처리 분석

- 투자 상황 분석

- 정부 인프라 투자

- 민간 유료 도로 투자

- PPP 프로젝트의 자금 조달 분석

- 경쟁 정보

- 기술 리더십 평가

- 솔루션 카테고리별 시장 점유율

- 계약의 승패 분석

- 고객 행동 분석

- 비즈니스 모델의 진화

- 기존 시스템 통합 모델

- 건설·운영·양도(BOT) 모델

- 성능과 품질 기준

- 거래의 정확성 요건

- 시스템 가용성 기준

- 위험 평가 프레임워크

- 구현 타임라인 분석

- 시스템 설계·계획 단계

- 인프라 설치 타임라인

- 상호 운용성과 표준 프레임워크

- 기술적 상호운용성 요건

- 비즈니스 규칙의 조화

- 개인정보 보호 및 데이터 보안

- 트래픽 관리 통합

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 시장 진입 장벽

- 주요 뉴스와 대처

- 합병 및 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추계·예측 : 기술별(2021-2034년)

- 주요 동향

- RFID

- DSRC

- GPS/GNSS

- 영상 분석

- 기타

제6장 시장 추계·예측 : 유형별(2021-2034년)

- 주요 동향

- 자동 차량 분류(AVC)

- 위반 단속 시스템(VES)

- 자동 차량 식별 시스템(AVIS)

- 기타(백오피스 및 서비스)

제7장 시장 추계·예측 : 지불 방법별(2021-2034년)

- 주요 동향

- 선불

- 하이브리드

- 후불

제8장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 도시

- 고속도로

제9장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 네덜란드

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- 세계 최고의 기업

- Kapsch TrafficCom

- TransCore(Roper Technologies)

- Cubic Transportation Systems

- Siemens Mobility

- Thales

- EFKON

- Q-Free

- Conduent

- Neology

- Toshiba

- 지역 유력 기업

- TagMaster

- TOLL COLLECT

- Autostrade Tech

- VINCI Highways

- Mitsubishi Heavy Industries

- DENSO

- Huawei Technologies

- Dahua Technology

- International Road Dynamics

- 신흥기업과 혁신가

- Genetec

- Raytheon Technologies

- Bosch Mobility Solutions

- Continental

- Atos

- NEC

- Hitachi Vantara

- Accenture

- Cognizant Technology Solutions

- Tata Consultancy Services

The Global Electronic Toll Collection (ETC) Market was valued at USD 8.18 billion in 2024 and is estimated to grow at a CAGR of 10.8% to reach USD 22.5 billion by 2034.

The surge in urban populations and rising private vehicle ownership has resulted in traffic congestion, particularly across highways and city corridors. ETC systems are designed to reduce traffic delays by automating toll payments, easing congestion, and increasing throughput at tolling points. Governments worldwide are prioritizing the transition to digital tolling frameworks, pushing for interoperability standards, and eliminating manual cash collection. Technological advancements in RFID, artificial intelligence, cloud platforms, and ANPR systems are making modern ETC solutions more accurate, efficient, and secure. These technologies also help cut operational costs and allow for broader deployment. In addition, the widespread use of mobile wallets and digital payment solutions further increases user convenience. ETC systems contribute to environmental sustainability by reducing idling times and fuel consumption, which leads to lower emissions. As nations commit to sustainability initiatives and decarbonization targets, ETC plays an essential role in building cleaner and smarter transportation systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.18 Billion |

| Forecast Value | $22.5 Billion |

| CAGR | 10.8% |

In 2024, the RFID technology segment held a 46% share and is projected to grow at a CAGR of 11.5% through 2034. RFID remains a dominant and cost-effective solution across global tolling networks, particularly in regions across Asia. These systems are highly favored due to their affordability, simplicity, and widespread adoption. Meanwhile, DSRC (Dedicated Short-Range Communication) continues to be used across select regions like Europe and South Korea, primarily in high-speed open-road tolling environments and V2X communications. While RFID leads the global market, DSRC maintains a presence in specific regional ecosystems.

The violation enforcement system (VES) segment is expected to grow at a CAGR of 12.1% from 2025 to 2034. As the shift toward open-road, cashless tolling accelerates, the demand for automated enforcement tools rises significantly. VES technologies utilize cameras, sensor systems, and ANPR to identify toll violators and enforce compliance. These systems help prevent revenue loss and ensure adherence to toll-related legislation by automating violation detection. Enhanced by AI and analytics, modern VES solutions now offer improved detection accuracy, making them indispensable in next-gen toll infrastructure.

United States Electronic Toll Collection (ETC) Market held 87.4% share in 2024. The widespread rollout of All-Electronic Tolling (AET) systems is transforming how toll roads operate, eliminating cash payments and enabling smoother traffic flow. These systems not only reduce operational costs but also support congestion management through dynamic pricing models. Variable toll rates based on real-time traffic data are gaining traction, helping to influence travel behavior by encouraging off-peak travel and improving traffic efficiency.

Major companies leading the Global Electronic Toll Collection (ETC) Market include Siemens, Thales, Conduent, Toshiba, Kapsch TrafficCom, Mitsubishi Heavy Industries, Neology, EFKON, Cubic, and TransCore / ST Engineering. To strengthen their position, ETC market players are focusing on strategic collaborations with transport authorities and governments to roll out integrated tolling infrastructure. Investment in research and development is a priority to enhance accuracy, reduce system costs, and implement AI-driven analytics. Companies are actively expanding their global footprint by securing long-term contracts, particularly in fast-growing regions. Many are also working on interoperability protocols to enable seamless travel across jurisdictions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Technology

- 2.2.2 Type

- 2.2.3 Payment method

- 2.2.4 Application

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Electronic Toll Collection Value Chain

- 3.1.2 Government-Private Sector Relationships

- 3.1.3 Technology Provider-Operator Dynamics

- 3.1.4 Standards Organization Influence

- 3.1.5 Transportation Authority Integration Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing traffic congestion

- 3.2.1.2 Government policies & regulations

- 3.2.1.3 Technological advancements

- 3.2.1.4 Environmental sustainability goals

- 3.2.1.5 Rising demand for seamless travel

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation costs

- 3.2.2.2 Privacy and data security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Integration with smart mobility & its

- 3.2.3.3 Adoption of ai and analytics

- 3.2.3.4 Environmental & sustainability initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 FHWA electronic toll collection standards

- 3.4.2 DOT intelligent transportation system guidelines

- 3.4.3 FCC spectrum allocation for DSRC

- 3.4.4 International Standards (ISO, CEN, ETSI)

- 3.4.5 Regional transportation authority regulations

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price Trends Analysis

- 3.9.1 Operational Cost Comparison

- 3.9.2 Total Cost of Ownership Analysis

- 3.10 Cost Breakdown Analysis

- 3.10.1 Infrastructure development costs

- 3.10.2 Technology implementation expenses

- 3.10.3 System integration & customization

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable Practices

- 3.11.2 Waste Reduction Strategies

- 3.11.3 Energy Efficiency in Production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon Footprint Considerations

- 3.12 Market Deployment Statistics

- 3.12.1 ETC system installation rates

- 3.12.2 Transponder adoption metrics

- 3.12.3 Traffic volume processing analysis

- 3.13 Investment Landscape Analysis

- 3.13.1 Government infrastructure investment

- 3.13.2 Private sector toll road investment

- 3.13.3 PPP project funding analysis

- 3.14 Competitive Intelligence

- 3.14.1 Technology Leadership Assessment

- 3.14.2 Market Share by Solution Category

- 3.14.3 Contract Win/Loss Analysis

- 3.15 Customer Behavior Analysis

- 3.16 Business Model Evolution

- 3.16.1 Traditional system integration models

- 3.16.2 Build-Operate-Transfer (BOT) Models

- 3.17 Performance & Quality Standards

- 3.17.1 Transaction accuracy requirements

- 3.17.2 System availability standards

- 3.18 Risk Assessment Framework

- 3.19 Implementation Timeline Analysis

- 3.19.1 System design & planning phase

- 3.19.2 Infrastructure installation timeline

- 3.20 Interoperability & Standards Framework

- 3.20.1 Technical interoperability requirements

- 3.20.2 Business rule harmonization

- 3.21 Privacy & Data Security

- 3.22 Traffic Management Integration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Market Entry Barriers

- 4.7 Key news and initiatives

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New Product Launches

- 4.7.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 RFID

- 5.3 DSRC

- 5.4 GPS/GNSS

- 5.5 Video analytics

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Automatic Vehicle Classification (AVC)

- 6.3 Violation Enforcement System (VES)

- 6.4 Automatic Vehicle Identification System (AVIS)

- 6.5 Others (Back office & services)

Chapter 7 Market Estimates & Forecast, By Payment method, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Prepaid

- 7.3 Hybrid

- 7.4 Postpaid

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Urban zones

- 8.3 Highways

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Top Global Players

- 10.1.1 Kapsch TrafficCom

- 10.1.2 TransCore (Roper Technologies)

- 10.1.3 Cubic Transportation Systems

- 10.1.4 Siemens Mobility

- 10.1.5 Thales

- 10.1.6 EFKON

- 10.1.7 Q-Free

- 10.1.8 Conduent

- 10.1.9 Neology

- 10.1.10 Toshiba

- 10.2 Regional Champions

- 10.2.1 TagMaster

- 10.2.2 TOLL COLLECT

- 10.2.3 Autostrade Tech

- 10.2.4 VINCI Highways

- 10.2.5 Mitsubishi Heavy Industries

- 10.2.6 DENSO

- 10.2.7 Huawei Technologies

- 10.2.8 Dahua Technology

- 10.2.9 International Road Dynamics

- 10.3 Emerging Players & Innovators

- 10.3.1 Genetec

- 10.3.2 Raytheon Technologies

- 10.3.3 Bosch Mobility Solutions

- 10.3.4 Continental

- 10.3.5 Atos

- 10.3.6 NEC

- 10.3.7 Hitachi Vantara

- 10.3.8 Accenture

- 10.3.9 Cognizant Technology Solutions

- 10.3.10 Tata Consultancy Services