|

시장보고서

상품코드

1665045

EV용 트랙션 인버터 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)EV Traction Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

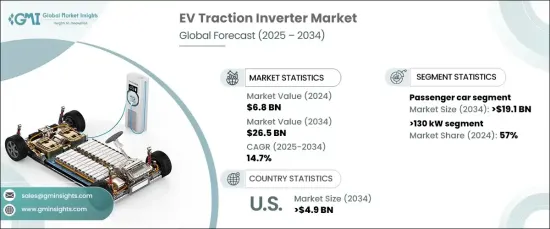

세계의 EV용 트랙션 인버터 시장 규모는 2024년 68억 달러였으며, 2025년부터 2034년까지 14.7%의 연평균 복합 성장률(CAGR)로 견조하게 확대될 것으로 예측되고 있습니다. 각국 정부가 내연기관차(ICE)를 대체하는 보다 깨끗하고 지속 가능한 옵션으로 EV를 추진하고 있기 때문에 세계 전기차(EV) 도입이 급증하고 있는 것이 이 시장 성장의 주요 요인이 되고 있습니다. 이러한 노력은 온실가스 배출을 크게 줄이고 기후 변화라는 임박한 과제를 해결하기 위한 것입니다.

파워 일렉트로닉스의 발전은 트랙션 인버터의 성능과 효율성에 혁명을 일으키고 있습니다. 실리콘 카바이드나 갈륨 질화물과 같은 광대역 갭 반도체와 같은 혁신적인 기술 혁신은 에너지 효율 향상, 열 관리 개선, 보다 컴팩트한 설계를 가능하게 합니다. 이러한 기술은 주행거리의 연장, 충전시간의 단축, 뛰어난 차량 성능에 대한 수요 증가에 대응하는데 필수적이며, 급속히 진화하는 EV 산업에 있어서 필수적입니다.

| 시장 범위 | |

|---|---|

| 시작년 | 2024년 |

| 예측연도 | 2025-2034년 |

| 시작금액 | 68억 달러 |

| 예측 금액 | 265억 달러 |

| CAGR | 14.7% |

차종별로는 승용차와 상용차로 나뉩니다. 2024년에는 승용차 부문이 전체의 73%를 차지해 시장을 선도했으며, 2034년에는 191억 달러 시장 규모에 이를 것으로 예측됩니다. 이 성장을 뒷받침하는 것은 환경 의식 증가, 정부의 인센티브, 불안정한 연료 가격 등이 박차를 가해 개인 이동을 위한 EV 이용이 증가하고 있다는 것입니다. 승용차는 시장 기반이 크고 생산 대수가 많기 때문에 상용차보다 빠른 속도로 전동 이동수단으로 전환하고 있습니다.

EV용 트랙션 인버터 시장은 출력을 기준으로 130kW 이하 및 130kW 이상 부문으로 분류됩니다. 130kW 이상 부문은 고성능 EV에 대한 선호도 증가와 대형 상용차의 전동화에 견인되어 2024년 시장 점유율의 57%를 차지했습니다. 고출력 인버터는 뛰어난 토크, 가속, 항속 거리의 연장을 실현하고, 프리미엄 EV와 까다로운 상업용 용도의 요구에 부응하기 위해 매우 중요합니다. 이러한 고급 인버터는 고성능 조건에서 효율적으로 작동하도록 설계되어 신뢰성과 최적의 에너지 사용을 보장합니다.

미국의 EV용 트랙션 인버터 시장은 2024년에 83%의 점유율을 차지했으며, 2034년에는 49억 달러에 이를 것으로 예측됩니다. 이 나라의 확립된 EV 제조 에코시스템과 소비자 수요 증가가 이 확대를 뒷받침하는 주요 요인이 되고 있습니다. 또한 EV 생산과 트랙션 인버터를 포함한 중요한 부품의 개발에 많은 투자가 이루어지고 있는 것도 시장의 성장 궤도를 뒷받침하고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정과 계산

- 기준연도의 산출

- 시장추계의 주요 동향

- 예측 모델

- 1차 조사와 검증

- 1차 정보

- 데이터 마이닝 소스

- 시장 정의

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 기술 제공업체

- 부품 공급자

- 제조업체

- OEM 제조업체

- 공급자의 상황

- 이익률 분석

- 기술 혁신의 상황

- 주요 뉴스 및 이니셔티브

- 규제 상황

- 영향요인

- 성장 촉진요인

- 전기자동차(EV)의 보급 확대

- 파워 일렉트로닉스 기술의 진보

- 상용차의 전동화

- 충전 인프라 투자 증가

- 업계의 잠재적 위험 및 과제

- EV와 컴포넌트의 높은 초기 비용

- 기술적 복잡성과 열 관리

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계·예측 : 추진력별, 2021-2034년

- 주요 동향

- BEV

- HEV

- PHEV

제6장 시장 추계·예측 : 출력 파워별, 2021-2034년

- 주요 동향

- 130 kW 이하

- 130 kW 이상

제7장 시장 추계·예측 : 기술별, 2021-2034년

- 주요 동향

- IGBT

- MOSFET

제8장 시장 추계·예측 : 반도체 재료별, 2021-2034년

- 주요 동향

- GaN

- Si

- SiC

제9장 시장 추계·예측 : 차량별, 2021-2034년

- 주요 동향

- 승용차

- 상용차

제10장 시장 추계·예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카

- 사우디아라비아

제11장 기업 프로파일

- BorgWarner Inc.

- Continental AG

- DENSO Corporation

- Drive System Design Ltd

- Eaton Corporation

- Hitachi Astemo Ltd

- Hyundai Mobis Co. Ltd.

- Infineon Technologies AG

- John Deere Electronic Solutions

- Lear Corporation

- LG Magna e-Powertrain

- Marelli Corporation

- Meidensha Corporation

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Tesla, Inc.

- Toyota Industries Corporation

- Valeo SA

- Vitesco Technologies

- ZF Friedrichshafen AG

The Global EV Traction Inverter Market was valued at USD 6.8 billion in 2024 and is projected to expand at a robust CAGR of 14.7% from 2025 to 2034. The surging adoption of electric vehicles (EVs) worldwide is a key driver of this market growth, as governments promote EVs as a cleaner and more sustainable alternative to internal combustion engine (ICE) vehicles. These efforts aim to significantly reduce greenhouse gas emissions and tackle the pressing challenges of climate change.

Advancements in power electronics are revolutionizing traction inverter performance and efficiency. Breakthrough innovations, such as wide-bandgap semiconductors like silicon carbide and gallium nitride, are enabling greater energy efficiency, improved thermal management, and more compact designs. These technologies are critical for addressing the growing demand for extended driving ranges, faster charging times, and superior vehicle performance, making them indispensable in the rapidly evolving EV industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $26.5 Billion |

| CAGR | 14.7% |

By vehicle type, the market is divided into passenger cars and commercial vehicles. In 2024, the passenger car segment led the market, accounting for 73% of the total share, and is projected to generate USD 19.1 billion by 2034. This growth is propelled by the increasing use of EVs for personal transportation, spurred by heightened environmental consciousness, government incentives, and volatile fuel prices. Passenger cars are transitioning to electric mobility at a faster pace than commercial vehicles, thanks to their larger market base and higher production volumes.

Based on output power, the EV traction inverter market is categorized into <=130 kW and >130 kW segments. The >130 kW segment held 57% of the market share in 2024, driven by the rising preference for high-performance EVs and the electrification of heavy-duty commercial fleets. High-powered inverters are crucial for delivering exceptional torque, acceleration, and extended range, catering to the needs of premium EVs and demanding commercial applications. These advanced inverters are engineered to operate efficiently under high-performance conditions, ensuring reliability and optimal energy utilization.

The U.S. EV traction inverter market dominated with an 83% share in 2024 and is projected to reach USD 4.9 billion by 2034. The country's well-established EV manufacturing ecosystem and growing consumer demand are key factors fueling this expansion. Additionally, significant investments in EV production and the development of critical components, including traction inverters, are bolstering the market growth trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Technology providers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 OEMs

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing adoption of electric vehicles (EV)

- 3.7.1.2 Advancements in power electronics technology

- 3.7.1.3 Electrification of commercial vehicles

- 3.7.1.4 Increasing investments in charging infrastructure

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs of EV and components

- 3.7.2.2 Technical complexity and thermal management

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 BEV

- 5.3 HEV

- 5.4 PHEV

Chapter 6 Market Estimates & Forecast, By Output Power, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 <=130 kW

- 6.3 >130 kW

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 IGBT

- 7.3 MOSFET

Chapter 8 Market Estimates & Forecast, By Semiconductor Material, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 GaN

- 8.3 Si

- 8.4 SiC

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Passenger car

- 9.3 Commercial vehicle

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 BorgWarner Inc.

- 11.2 Continental AG

- 11.3 DENSO Corporation

- 11.4 Drive System Design Ltd

- 11.5 Eaton Corporation

- 11.6 Hitachi Astemo Ltd

- 11.7 Hyundai Mobis Co. Ltd.

- 11.8 Infineon Technologies AG

- 11.9 John Deere Electronic Solutions

- 11.10 Lear Corporation

- 11.11 LG Magna e-Powertrain

- 11.12 Marelli Corporation

- 11.13 Meidensha Corporation

- 11.14 Mitsubishi Electric Corporation

- 11.15 Robert Bosch GmbH

- 11.16 Tesla, Inc.

- 11.17 Toyota Industries Corporation

- 11.18 Valeo SA

- 11.19 Vitesco Technologies

- 11.20 ZF Friedrichshafen AG