|

시장보고서

상품코드

1665070

자동차 배전 시스템 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Automotive Electrical Distribution Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

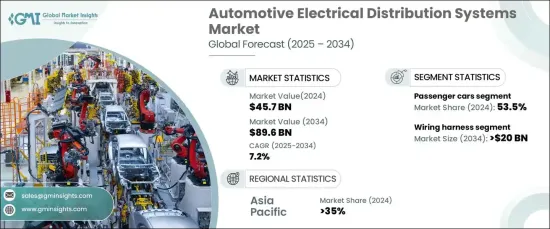

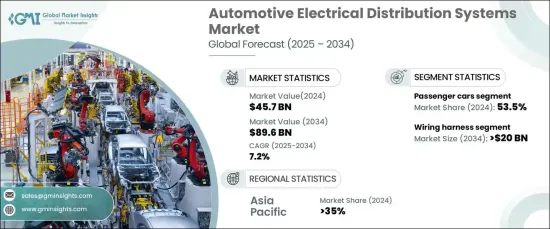

세계의 자동차 배전 시스템 시장은 2024년 457억 달러로 평가되었고 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 7.2%로 견조하게 확대될 것으로 예측됩니다.

이러한 성장은 전력 관리, 에너지 효율, 차량 성능 전체를 최적화하기 위해 고급 전기 부품에 크게 의존하는 전기자동차와 하이브리드 자동차의 채용이 급증하고 있는 것이 배경에 있습니다.

시장 확대의 주요 요인은 ADAS(첨단 운전자 지원 시스템)에 대한 수요 증가입니다. 적응형 크루즈 컨트롤, 레인키핑 어시스턴스, 자동 주차, 충돌 회피, 긴급 브레이크 등의 최첨단 기술은 실시간으로 데이터를 처리하는 센서, 카메라, 레이더 및 전자 장치의 복잡한 네트워크에 의존합니다. 이 복잡성은 ADAS의 기능성을 실현하는 데 있어 고급 배전 시스템이 수행하는 중요한 역할을 부각시켜 시장의 성장을 더욱 뒷받침하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 457억 달러 |

| 예측 금액 | 896억 달러 |

| CAGR | 7.2% |

이 시장은 와이어 하네스, 퓨즈 릴레이 시스템, 스위치 센서, 커넥터 단자, 제어 모듈(ECU) 등을 포함한 부품별로 구분됩니다. 2024년에는 와이어 하네스 분야가 24%의 시장 점유율을 차지했고 2034년까지 200억 달러를 창출할 것으로 예측됩니다. 와이어 하네스는 자동차 배전 시스템에 필수적이며 다양한 차량 구성 요소에 전력 및 신호를 전송하는 핵심 구성 요소로 사용됩니다.

차종에는 승용차, 상용차, 오프 고속도로 차량, 전기자동차, 하이브리드 자동차 등이 있습니다. 승용차는 2024년 시장 점유율 53.5%를 차지해 생산 대수의 증가 보급에 견인되었습니다. 이러한 자동차에는 인포테인먼트, 에어컨 제어, 조명, 안전 기능, 파워트레인 관리, ADAS 등의 고급 시스템에 전력을 공급하기 위한 광범위한 전기 부품이 내장되어 현대 소비자 수요에 부응하고 있습니다.

아시아태평양은 자동차 배전 시스템 시장에서 중요한 선수로 부상하며 2024년에는 35%의 점유율을 차지했습니다. 이 이점은 이 지역이 자동차 제조의 세계 중심지이자 전기자동차의 급속한 보급으로 인한 것입니다. 중국과 같은 국가는 전통적인 자동차 및 전기자동차 생산에 기여하고 있으며 배터리 관리 시스템(BMS), 고전압 와이어 하네스 및 ECU와 같은 중요한 배전 부품에 대한 수요를 촉진하고 있습니다. 이러한 부품은 특히 전기자동차에서 효율적인 배전 및 에너지 관리에 필수적입니다.

보고서 내용

제1장 조사 방법과 조사 범위

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정과 계산

- 기준연도의 산출

- 시장추계의 주요 동향

- 예측 모델

- 1차 조사와 검증

- 1차 정보

- 데이터 마이닝 소스

- 시장 정의

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 자동차 OEM

- 기술 제공업체

- 반도체 제조업체

- 최종 사용자

- 이익률 분석

- 기술과 혁신의 전망

- 비용 내역

- 특허 상황

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 전기자동차와 하이브리드 자동차의 채용 확대

- 엄격한 배기 가스·연비 규제

- ADAS(첨단 운전자 지원 시스템) 수요

- 엄격한 배기 가스·연비 규제

- 업계의 잠재적 위험 및 과제

- 세계의 반도체 부족

- 높은 제조 비용

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계·예측 : 구성 요소별(2021-2034년), 10억 달러

- 주요 동향

- 와이어 하네스

- 퓨즈 및 릴레이

- 스위치 및 센서

- 커넥터 및 단자

- 제어 모듈(ECU)

- 기타

제6장 시장 추계·예측 : 차량별(2021-2034년), 10억 달러

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- LCV

- HCV

- 오프 고속도로 자동차

- EV와 하이브리드

제7장 시장 추계·예측 : 전압별(2021-2034년), 10억 달러

- 주요 동향

- 12V

- 48V

- 400V 이상

제8장 시장 추계·예측 : 기술별(2021-2034년), 10억 달러

- 주요 동향

- 기존

- 고급

제9장 시장 추계·예측 : 최종 용도별(2021-2034년), 10억 달러

- 주요 동향

- OEM

- 애프터마켓

제10장 시장 추계·예측 : 지역별(2021-2034년), 10억 달러

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카

- 사우디아라비아

제11장 기업 프로파일

- Amphenol

- Aptiv

- Draexlmaier

- Eaton

- Furukawa Electric

- Lear

- Leoni

- Littelfuse

- Magna International

- PKC Group

- Prysmian Group

- Rheinmetall

- Samvardhana Motherson

- Spark Minda

- Sumitomo Electric Industries

- TE Connectivity

- Vitesco Technologies

- Yazaki

The Global Automotive Electrical Distribution System Market was valued at USD 45.7 billion in 2024 and is projected to expand at a robust CAGR of 7.2% between 2025 and 2034. This growth is driven by the surging adoption of electric and hybrid vehicles, which rely extensively on advanced electrical components to optimize power management, energy efficiency, and overall vehicle performance.

A key driver of market expansion is the rising demand for Advanced Driver Assistance Systems (ADAS). These cutting-edge technologies, such as adaptive cruise control, lane-keeping assistance, automatic parking, collision avoidance, and emergency braking, rely on an intricate network of sensors, cameras, radars, and electronic devices to process data in real time. This complexity underscores the critical role of sophisticated electrical distribution systems in enabling ADAS functionalities, further propelling market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.7 Billion |

| Forecast Value | $89.6 Billion |

| CAGR | 7.2% |

The market is segmented by components, including wiring harnesses, fuse and relay systems, switches and sensors, connectors and terminals, control modules (ECUs), and others. In 2024, the wiring harness segment held a 24% market share and is anticipated to generate USD 20 billion by 2034. Wiring harnesses are integral to automotive electrical distribution systems, serving as the backbone for transmitting electrical power and signals across various vehicle components.

By vehicle type, the market encompasses passenger cars, commercial vehicles, off-highway vehicles, and electric and hybrid vehicles. Passenger cars dominated the market in 2024, capturing a 53.5% share, driven by high production volumes and widespread adoption. These vehicles incorporate a broad spectrum of electrical components to power advanced systems, including infotainment, climate control, lighting, safety features, powertrain management, and ADAS, catering to modern consumer demands.

The Asia Pacific region emerged as a significant player in the automotive electrical distribution system market, accounting for a 35% share in 2024. This dominance is attributed to the region's position as a global hub for automotive manufacturing and the rapid adoption of electric vehicles. Nations like China are leading contributors to both conventional and electric vehicle production, driving demand for essential electrical distribution components such as battery management systems (BMS), high-voltage wiring harnesses, and ECUs. These components are crucial for efficient power distribution and energy management, particularly in electric vehicles.

Report Content

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automotive OEMs

- 3.2.2 Technology providers

- 3.2.3 Semiconductor manufacturers

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Cost breakdown

- 3.6 Patent landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing adoption of electric and hybrid vehicles

- 3.9.1.2 Stringent emission and fuel efficiency regulations

- 3.9.1.3 Demand for advanced driver assistance systems (ADAS)

- 3.9.1.4 Stringent emission and fuel efficiency regulations

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Global semiconductor shortage

- 3.9.2.2 High manufacturing costs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Wiring harness

- 5.3 Fuse & relay

- 5.4 Switches & sensors

- 5.5 Connectors & terminals

- 5.6 Control modules (ECUs)

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicle

- 6.3.1 LCV

- 6.3.2 HCV

- 6.4 Off highway vehicle

- 6.5 EVs and hybrid

Chapter 7 Market Estimates & Forecast, By Voltage, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 12v

- 7.3 48v

- 7.4 Above 400V

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Conventional

- 8.3 Advanced

Chapter 9 Market Estimates & Forecast, By End use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Amphenol

- 11.2 Aptiv

- 11.3 Draexlmaier

- 11.4 Eaton

- 11.5 Furukawa Electric

- 11.6 Lear

- 11.7 Leoni

- 11.8 Littelfuse

- 11.9 Magna International

- 11.10 PKC Group

- 11.11 Prysmian Group

- 11.12 Rheinmetall

- 11.13 Samvardhana Motherson

- 11.14 Spark Minda

- 11.15 Sumitomo Electric Industries

- 11.16 TE Connectivity

- 11.17 Vitesco Technologies

- 11.18 Yazaki