|

시장보고서

상품코드

1666640

유제품 원료 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Dairy Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

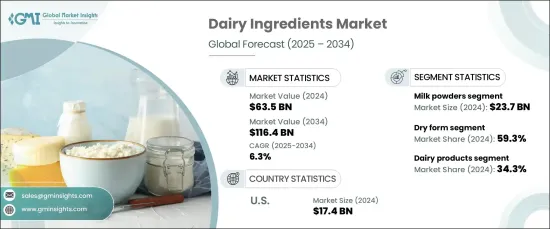

세계의 유제품 원료 시장은 2024년 635억 달러로 평가되었으며, 2025년부터 2034년까지의 CAGR은 6.3%로 예측되어 큰 성장이 예상됩니다.

이 시장에는 분유, 유청 단백질, 유당, 카제인 및 기타 파생 상품과 같은 다양한 유제품 유래 제품이 포함됩니다. 이러한 시장 확대의 주요 촉진요인은 유제품 성분이 제공하는 영양학적 이점에 대한 인식이 높아진 것입니다. 소비자들이 건강한 식단을 유지하는 데 있어 이러한 식재료의 역할에 대한 인식이 높아지면서 식음료 부문 전반에서 유제품의 채택이 증가하고 있습니다. 유제품 원료는 가공식품과 베이커리 제품부터 제과 및 음료에 이르기까지 다양한 용도로 활용되는 것으로 유명합니다. 투명성과 건강을 고려한 선택을 우선시하는 식단 선호도의 변화에 따라 클린 라벨 제품과 강화된 영양에 대한 수요가 증가함에 따라 그 인기는 더욱 높아지고 있습니다.

유제품 시장은 고단백 식단 및 기능성 영양에 대한 선호도 증가 등 여러 소비자 주도 트렌드의 혜택을 받고 있습니다. 사람들은 소화 개선, 체중 관리, 운동 능력 향상과 같은 추가적인 건강상의 이점을 제공하는 제품을 점점 더 많이 찾고 있습니다. 이에 따라 스포츠 영양 및 기능성 식품과 같은 산업에서 유청 단백질과 카세인을 비롯한 유제품 원료에 대한 수요가 꾸준히 증가하고 있습니다. 또한, 최소한의 가공을 거친 천연 식품에 대한 관심이 높아지면서 제조업체들은 건강을 중시하는 소비자층을 충족하는 클린 라벨 유제품 성분 솔루션을 혁신하고 제공해야 하는 과제를 안게 되었습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 635억 달러 |

| 예측 금액 | 1,164억 달러 |

| CAGR | 6.3% |

제품 유형별로는 카제인 및 카제인산염, 유청 성분, 유당 및 유도체, 우유 분말 및 기타 관련 제품이 포함됩니다. 2024년에는 분유가 시장을 장악하며 상당한 점유율을 차지할 것으로 예상됩니다. 긴 유통기한, 운송의 용이성, 다양한 식품에 통합할 수 있는 능력으로 인해 제조업체의 필수 재료가 되었습니다. 전 세계적으로 식품 생산이 계속 확대됨에 따라 분유는 비용 효율성과 장기 보관 기능으로 인해 여전히 최고의 선택입니다.

시장은 또한 형태에 따라 건조 유형과 액체 유형으로 구분되며, 2024년 시장 점유율은 건조 유형이 59.3%를 차지하고 있습니다. 분유, 유청, 카세인을 포함한 건조 유제품 원료는 편의성, 안정성, 유통기한 연장 등의 이유로 선호되고 있습니다. 이러한 특성으로 인해 건조 유제품 원료는 베이커리 제품, 음료 믹스, 제과 제품에 사용하기에 특히 적합합니다. 가공식품의 소비 증가와 빠르고 간편한 식사 솔루션에 대한 수요 증가는 건조 유제품 원료에 대한 수요를 더욱 촉진하고 있습니다.

미국의 유제품 원료 시장은 고단백 기능성 식품과 영양 보충제에 대한 강력한 수요에 힘입어 2024년에 174억 달러의 매출을 기록했습니다. 스포츠 영양, 유아용 조제분유, 클린 라벨 제품에 대한 관심이 높아지면서 시장의 성장이 뒷받침되고 있습니다. 유제품 가공 기술의 발전으로 제조업체는 이제 다양한 소비자 니즈를 충족하는 맞춤형 솔루션을 생산하여 혁신을 주도하고 제품 품질을 향상시킬 수 있게 되었습니다.

목차

제1장 조사 방법과 조사 범위

- 시장 범위와 정의

- 기본 추정과 계산

- 예측 계산

- 데이터 출처

- 1차 데이터

- 2차 데이터

- 유료

- 공적

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 파괴

- 장래의 전망

- 제조업체

- 유통업체

- 공급자의 상황

- 이익률 분석

- 주요 뉴스

- 규제 상황

- 영향요인

- 성장 촉진요인

- 식음료 산업의 확장

- 기능성 식품에 대한 소비자 수요 증가

- 업계의 잠재적 위험 및 과제

- 식물 기반 대안과의 경쟁

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 규모와 예측 : 형태별(2021-2034년)

- 주요 동향

- 건조

- 액체

제6장 시장 규모와 예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 분유

- 유청 성분

- 유당 및 유도체

- 카제인 및 카제인산염

- 기타

제7장 시장 규모와 예측 : 용도별(2021-2034년)

- 주요 동향

- 베이커리 및 제과

- 유제품

- 유아용 조제 분유

- 스포츠 및 임상 영양

- 기타

제8장 시장 규모와 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Amco Proteins

- Arla Foods

- Dairy Farmers of America

- EPI Ingredients

- Fonterra

- FrieslandCampina

- Glanbia

- Ingredia

- Kerry Group

- Lactalis Group

- Saputo

- Sodiaal co-operative group

- Volac International

The Global Dairy Ingredients Market, valued at USD 63.5 billion in 2024, is poised for significant growth with a projected CAGR of 6.3% from 2025 to 2034. The market includes a broad array of milk-derived products such as milk powders, whey proteins, lactose, casein, and other derivatives. A key driver of this expansion is the increasing awareness of the nutritional benefits offered by dairy ingredients. Consumers are becoming more conscious of the role these ingredients play in maintaining a healthy diet, contributing to the rising adoption across the food and beverage sector. Dairy ingredients are celebrated for their versatility, making them a staple in everything from processed foods and bakery items to confectioneries and beverages. Their popularity is further fueled by the growing demand for clean-label products and fortified nutrition, which align with shifting dietary preferences that prioritize transparency and health-conscious choices.

The market is benefiting from several consumer-driven trends, including the rising preference for high-protein diets and functional nutrition. People are increasingly seeking products that provide additional health benefits, such as improved digestion, weight management, and enhanced athletic performance. As a result, the demand for dairy ingredients, particularly whey proteins and casein, is seeing a steady rise in industries like sports nutrition and functional food products. Moreover, the growing interest in natural, minimally processed foods has pushed manufacturers to innovate and offer clean-label dairy ingredient solutions that cater to a health-focused demographic.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $63.5 Billion |

| Forecast Value | $116.4 Billion |

| CAGR | 6.3% |

Segmented by product type, the market includes casein and caseinates, whey ingredients, lactose and derivatives, milk powders, and other related products. In 2024, milk powders dominated the market, capturing a significant share. Their long shelf life, ease of transport, and ability to be incorporated into various food products have made them an essential ingredient for manufacturers. As food production continues to expand globally, milk powders remain a top choice due to their cost-effectiveness and extended storage capabilities.

The market is also segmented by form into dry and liquid variants, with the dry segment accounting for 59.3% of the market share in 2024. Dry dairy ingredients, including powdered milk, whey, and casein, are preferred for their convenience, stability, and extended shelf life. These characteristics make dry dairy ingredients particularly well-suited for use in bakery goods, beverage mixes, and confectionery products. The growing consumption of processed foods, along with the increasing demand for quick and easy meal solutions, is further propelling the demand for dry dairy ingredients.

In the United States, the dairy ingredients market generated USD 17.4 billion in 2024, driven by strong demand for high-protein functional foods and nutritional supplements. The market's growth is supported by the increasing emphasis on sports nutrition, infant formula, and clean-label products. With advances in dairy processing technologies, manufacturers are now able to produce more customized solutions to cater to diverse consumer needs, driving innovation and enhancing product quality.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Expansion of the food and beverage industry

- 3.6.1.2 Increasing consumer demand for functional foods

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Competition from plant-based alternatives

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Form, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Dry

- 5.3 Liquid

Chapter 6 Market Size and Forecast, By Product Type, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Milk powders

- 6.3 Whey ingredients

- 6.4 Lactose and derivatives

- 6.5 Casein and caseinates

- 6.6 Other

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Bakery and confectionery

- 7.3 Dairy products

- 7.4 Infant milk formula

- 7.5 Sports and clinical nutrition

- 7.6 Other

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amco Proteins

- 9.2 Arla Foods

- 9.3 Dairy Farmers of America

- 9.4 EPI Ingredients

- 9.5 Fonterra

- 9.6 FrieslandCampina

- 9.7 Glanbia

- 9.8 Ingredia

- 9.9 Kerry Group

- 9.10 Lactalis Group

- 9.11 Saputo

- 9.12 Sodiaal co-operative group

- 9.13 Volac International