|

시장보고서

상품코드

1844361

전자 주차 브레이크(EPB) 시스템 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Electronic Parking Brake (EPB) System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

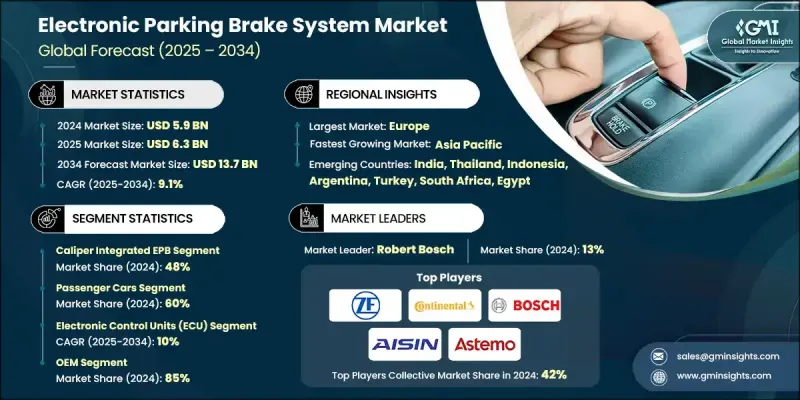

세계의 전자 주차 브레이크(EPB) 시스템 시장 규모는 2024년 59억 달러에 달했고, CAGR 9.1%로 성장해 2034년까지 137억 달러에 이를 것으로 예측됩니다.

자동차 산업이 자동화, 전동화, 첨단 안전 기능을 추진하는 것이 시장 성장을 뒷받침하고 있습니다. EPB 시스템은 향상된 성능, 공간 최적화 및 최신 운전 지원 기술과의 원활한 통합으로 기존의 핸드 브레이크를 대체하는 경향이 커지고 있습니다. 자동차 제조업체는 특히 EV, 하이브리드 자동차, 플러그인 하이브리드 자동차에서 오토 홀드, 경사로 밀림 방지, 스마트 긴급 브레이크 등의 기능을 지원하기 위해 EPB를 통합하고 있습니다. 회생 브레이크 및 차량 에너지 시스템과의 호환성은 차세대 전동 플랫폼에 탑재하는 것을 더욱 뒷받침하고 있습니다. 새로운 모델은 또한 소형 액추에이터와 무선 제어 기능을 특징으로 모듈성과 설계 유연성을 향상시킵니다. 교통 안전과 지능형 브레이크에 대한 세계적인 규제가 증가함에 따라 EPB는 다양한 차량 카테고리에서 필수적인 구성 요소가 되고 있습니다. 또한 소프트웨어 제어 브레이크 기능으로 EPB는 실시간 응답성과 진단을 제공하는 스마트 안전 시스템으로 변모하고 있습니다. 지속가능성의 동향도 EPB의 설계에 영향을 미치고 있으며, 제조업체는 재활용 가능한 재료, 저에너지 부품, 환경부하의 저감에 중점을 두고 세계적인 그린 모빌리티의 움직임과 보조를 맞추고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시장 규모 | 59억 달러 |

| 예측 금액 | 137억 달러 |

| CAGR | 9.1% |

캘리퍼 일체형 EPB 부문은 2024년 48%의 점유율을 차지했으며 2034년까지 연평균 복합 성장률(CAGR) 10%를 보일 것으로 예측됩니다. 이 유형의 EPB는 시스템 전체의 무게를 최소화하고 설치를 단순화하며 기존의 유압식 또는 케이블 풀 메커니즘보다 우수한 성능을 발휘할 수 있으므로 널리 지원됩니다. EPB의 채택이 증가하고 있는 것은 업계가 효율적이고 컴팩트한 브레이크 시스템 아키텍처를 선호하고 있음을 반영합니다.

승용차 부문은 2024년 60%의 점유율을 차지했으며, 2034년까지 연평균 복합 성장률(CAGR) 9.4%를 보일 것으로 예측됩니다. 소형차, 중형차, 세단, SUV에 대한 EPB의 도입이 증가하고 있으며, 특히 자동차 제조업체가 ADAS 플랫폼과 일치하는 고급 브레이크 기술을 요구하고 있는 것이 성장의 원동력이 되고 있습니다. 북미, 아시아태평양 및 유럽의 규제 기준은 강화된 안전 의무와 일상 운전에서 편안함과 자동화를 요구하는 소비자 수요로 인해 이 부문에서 EPB의 보급을 가속화하고 있습니다.

유럽 전자 주차 브레이크(EPB) 시스템 시장은 지능형 브레이크 시스템을 탑재한 프리미엄차와 고급차의 급속한 보급에 힘입어 2024년 35%의 점유율을 차지했습니다. 강력한 정책 프레임워크, 엄격한 자동차 안전 벤치마크 및 자동차 전자부문 전반에 걸쳐 진행 중인 R&D를 통해 유럽은 EPB 기술의 최전선에 있는 지위를 강화하고 있습니다. 커넥티드 자동차, 전기화 플랫폼, 자율주행 솔루션으로의 지속적인 이동은 이 지역의 우위를 더욱 강화하고 있습니다.

세계 전자 주차 브레이크(EPB) 시스템 시장에서 경쟁 구도를 형성하는 주요 기업은 ZF Friedrichshafen, Continental, Hyundai Mobis, Mando, Robert Bosch, Akebono Brake Industry, Hitachi Astemo, Brembo, Knorr-Bremse, Aisin Seiki 등입니다. 전자 주차 브레이크 시스템 시장에서 사업을 전개하는 기업은 시장에서의 존재감을 높이기 위해 기술 혁신, 모듈 설계, 디지털 차량 플랫폼과의 통합에 주력하고 있습니다. 주요 기업은 ADAS 호환성, 자율 주행 기능 및 전자 비상 제어를 지원하는 소프트웨어 중심의 EPB 솔루션에 투자하고 있습니다. 플랫폼 기반 개발을 위한 OEM과의 전략적 제휴를 통해 다양한 차종 간의 원활한 통합이 가능합니다.

목차

제1장 조사 방법

- 시장의 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 소스

- 세계

- 지역/국가

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측 모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률 분석

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 차량 자동화와 ADAS로의 전환

- 차량 플랫폼의 전동화(EV, HEV)

- OEM은 경량으로 모듈식 브레이크 시스템을 추진

- 편리성과 안전성에 대한 소비자 수요

- Brake-by-wire 시스템의 규제 의무

- 업계의 잠재적 위험 및 과제

- 극한 조건 하에서 전자 기기의 신뢰성

- ADAS와 ECU의 통합 복잡성

- 시장 기회

- 시장과 파워트레인의 통합 기회

- 전기 및 하이브리드 파워트레인과의 통합

- 액추에이터와 ECU 기술의 진보

- ADAS 및 Brake-by-wire 플랫폼 확장

- 신흥 시장과 중급차 수요 증가

- 미래의 혁신 기회

- 고급 통합 컨셉

- 스마트 EPB 시스템 개발

- 자율주행차의 준비

- 커넥티드카 통합

- 시장과 파워트레인의 통합 기회

- 성장 가능성 분석

- 규제 상황

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- ESC와 ABS의 통합

- 경사로 밀림 방지 및 오토 홀드 기능

- 긴급 브레이크 어시스트 통합

- ADAS와 자율 시스템의 통합

- EPB 시스템의 비용 구조와 밸류체인 분석

- 컴포넌트 비용의 내역과 분석

- 시스템 유형별 제조 비용 구조

- 통합 비용이 차량 가격에 미치는 영향

- 기존 시스템과 비교한 총소유비용

- 가격 동향

- 지역별

- 제품별

- 생산 통계

- 생산 거점

- 소비 거점

- 수출과 수입

- 특허 분석

- 기술 카테고리와 시스템 유형별 유효한 특허

- EPB 기술에서의 특허 출원 동향

- IP 라이선싱 및 기술 이전 모델

- 특허 소송 리스크 평가

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 감축 전략

- 생산에서의 에너지 효율

- 환경 친화적인 노력

- 탄소발자국의 고려

- 투자 및 자금 조달 분석

- EPB 기술 카테고리별 연구개발 투자

- EPB 시스템 통합에 대한 OEM 투자

- 공급자 투자 및 생산 능력 확대

- 정부의 자금 지원 및 안전성 조사 프로그램

- 공급망의 역학과 구성 요소의 통합

- 액추에이터 모터 및 구동 부품 조달

- 전자제어 유닛 개발 에코시스템

- 센서와 피드백 시스템의 통합

- 소프트웨어 개발 및 검증 프로세스

- 표준화의 정세와 상호 운용성

- ISO 규격 개발 및 구현

- SAE 국제 EPB 규격

- 지역 표준의 조화화의 대처

- OEM 고유의 요건과 변형

- 사례 연구 및 실장 예

- Tesla EPB 통합 분석

- 기존 OEM EV EPB 전략

- 중국의 EV 제조업체가 접근

- 교훈과 모범 사례

- 커넥티드카와 사이버 보안의 통합

- 커넥티드 EPB 시스템 아키텍처

- 사이버 보안 요건과 위협

- 데이터 분석 및 서비스 강화

- EPB 시스템의 신뢰성과 고장 모드 분석

- 일반적인 고장 모드와 근본 원인

- 신뢰성 테스트 및 검증

- 예측 유지보수 및 진단

- 품질 보증 및 관리

- 미래 전망과 혁신의 타임라인

- 단기적인 혼란(2025-2027년)

- 매스마켓에서의 EPB 도입 가속

- 전기자동차 통합의 성숙도

- 기본적인 자율 기능의 통합

- 커넥티드카 서비스 개발

- 중기적인 혼란(2028-2030년)

- 고급 자율주행차 통합

- Brake-by-wire 기술의 실용화

- AI를 활용한 예지보전

- 차량 전체의 시스템 통합

- 장기적인 혼란(2031-2034년)

- 완전 자율 주행차 EPB 시스템

- 첨단 재료 및 제조

- 양자 컴퓨팅 통합

- 차세대 모빌리티 솔루션

- 단기적인 혼란(2025-2027년)

- 시장 발전 시나리오

- 낙관적인 성장 시나리오

- 보수적인 성장 시나리오

- 혼란 시나리오

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추계 및 예측 : 시스템별, 2021-2034년

- 주요 동향

- 케이블 풀 시스템

- 전동 유압 캘리퍼 시스템

- 캘리퍼 일체형 EPB

- 기타

제6장 시장 추계 및 예측 : 차량별, 2021-2034년

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차

- 중형 상용차

- 대형 상용차

제7장 시장 추계 및 예측 : 컴포넌트별, 2021-2034년

- 주요 동향

- 전자제어유닛(ECU)

- 액추에이터

- 센서

- 스위치 및 배선 하네스

- 기타

제8장 시장 추계 및 예측 : 판매 채널별, 2021-2034년

- 주요 동향

- OEM

- 애프터마켓

제9장 시장 추계 및 예측 : 추진력별, 2021-2034년

- 주요 동향

- 내연기관(ICE)

- 하이브리드 전기자동차(HEV/PHEV)

- 배터리 전기자동차(BEV)

제10장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 러시아

- 포르투갈

- 크로아티아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 싱가포르

- 태국

- 인도네시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 이집트

제11장 기업 프로파일

- 세계 기업

- Aisin Seiki

- Akebono Brake Industry

- Brembo

- Continental

- Hitachi Astemo

- Mando

- Robert Bosch

- ZF Friedrichshafen

- 지역 기업

- Advics

- BWI

- Chassis Brakes International

- Haldex

- Hyundai Mobis

- Knorr-Bremse

- Nissin Kogyo

- WABCO

- 신흥 기업

- Aptiv

- Autoliv

- Denso

- Magna International

- Nexteer Automotive

- Schaeffler

- Tenneco

- Valeo

The Global Electronic Parking Brake (EPB) System Market was valued at USD 5.9 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 13.7 billion by 2034.

Market growth is propelled by the automotive industry's push toward automation, electrification, and advanced safety features. EPB systems are increasingly replacing traditional handbrakes due to their enhanced performance, space optimization, and seamless integration with modern driver assistance technologies. Automakers are embedding EPBs to support features like auto-hold, hill-start assist, and smart emergency braking, particularly in EVs, hybrids, and plug-in hybrids. Their compatibility with regenerative braking and vehicle energy systems further drives their inclusion in next-gen electric platforms. Emerging models also feature compact actuators and wireless control, allowing for greater modularity and design flexibility. With rising global regulatory emphasis on road safety and intelligent braking, EPBs are becoming essential components across various vehicle categories. In addition, software-controlled braking capabilities are transforming EPBs into smart safety systems, offering real-time responsiveness and diagnostics. Sustainability trends are also influencing EPB design, with manufacturers focusing on recyclable materials, low-energy components, and reduced environmental impact, aligning with the broader green mobility movement worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.9 Billion |

| Forecast Value | $13.7 Billion |

| CAGR | 9.1% |

The caliper-integrated EPB segment held a 48% share in 2024 and is expected to grow at a CAGR of 10% through 2034. This type of EPB is widely favored for its ability to minimize overall system weight, simplify installation, and deliver superior performance over traditional hydraulic or cable-pull mechanisms. Its rising adoption reflects industry preference for efficient and compact brake system architectures.

The passenger cars segment held a 60% share in 2024 and is projected to grow at a CAGR of 9.4% through 2034. Increasing implementation of EPBs in compact and mid-size vehicles, sedans, and SUVs is driving growth, particularly as automakers seek advanced braking technologies that align with ADAS platforms. Regulatory standards across North America, Asia-Pacific, and Europe continue to accelerate EPB penetration across this segment due to enhanced safety mandates and consumer demand for comfort and automation in everyday driving.

Europe Electronic Parking Brake (EPB) System Market held a 35% share in 2024, supported by the rapid adoption of premium and luxury vehicles equipped with intelligent braking systems. Strong policy frameworks, stringent automotive safety benchmarks, and ongoing R&D across the vehicle electronics sector have cemented Europe's position at the forefront of EPB technology. The continued shift toward connected vehicles, electrified platforms, and autonomous driving solutions further strengthens the region's dominance.

Key players shaping the competitive landscape in the Global Electronic Parking Brake (EPB) System Market include ZF Friedrichshafen, Continental, Hyundai Mobis, Mando, Robert Bosch, Akebono Brake Industry, Hitachi Astemo, Brembo, Knorr-Bremse, and Aisin Seiki. Companies operating in the electronic parking brake system market are focusing on innovation, modular design, and integration with digital vehicle platforms to strengthen their market presence. Key players are investing in software-driven EPB solutions that support ADAS compatibility, autonomous functionality, and electronic emergency control. Strategic collaborations with OEMs for platform-based development allow for seamless integration across various vehicle models.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System

- 2.2.3 Vehicles

- 2.2.4 Component

- 2.2.5 Sales Channel

- 2.2.6 Propulsion

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Shift toward vehicle automation and ADAS

- 3.2.1.3 Electrification of vehicle platforms (EVs, HEVs)

- 3.2.1.4 OEM push for lightweight and modular brake systems

- 3.2.1.5 Consumer demand for convenience and safety

- 3.2.1.6 Regulatory mandates for brake-by-wire systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Electronic reliability under extreme conditions

- 3.2.2.2 Integration complexity with ADAS and ECUs

- 3.2.3 Market opportunities

- 3.2.3.1 Market & powertrain integration opportunities

- 3.2.3.1.1 Integration with electric and hybrid powertrains

- 3.2.3.1.2 Advancements in actuator and ECU technologies

- 3.2.3.1.3 Expansion of ADAS and brake-by-wire platforms

- 3.2.3.1.4 Rising demand in emerging markets and mid-range vehicles

- 3.2.3.2 Future innovation opportunities

- 3.2.3.2.1 Advanced integration concepts

- 3.2.3.2.2 Smart EPB system development

- 3.2.3.2.3 Autonomous vehicle preparation

- 3.2.3.2.4 Connected vehicle integration

- 3.2.3.1 Market & powertrain integration opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 ESC & ABS integration

- 3.7.2 Hill start assist & auto hold functions

- 3.7.3 Emergency brake assist integration

- 3.7.4 ADAS & autonomous system integration

- 3.8 EPB system cost structure & value chain analysis

- 3.8.1 Component cost breakdown & analysis

- 3.8.2 Manufacturing cost structure by system type

- 3.8.3 Integration cost impact on vehicle pricing

- 3.8.4 Total cost of ownership vs traditional systems

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Patent analysis

- 3.11.1 Active patents by technology category & system type

- 3.11.2 Patent filing trends in EPB technology

- 3.11.3 IP licensing & technology transfer models

- 3.11.4 Patent litigation risk assessment

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment & funding analysis

- 3.13.1 R&D investment by EPB technology category

- 3.13.2 OEM investment in EPB system integration

- 3.13.3 Supplier investment & capacity expansion

- 3.13.4 Government funding & safety research programs

- 3.14 Supply chain dynamics & component integration

- 3.14.1 Actuator motor & drive component sourcing

- 3.14.2 Electronic control unit development ecosystem

- 3.14.3 Sensor & feedback system integration

- 3.14.4 Software development & validation processes

- 3.15 Standardization landscape & interoperability

- 3.15.1 ISO standards development & implementation

- 3.15.2 SAE international EPB standards

- 3.15.3 Regional standards harmonization efforts

- 3.15.4 OEM-specific requirements & variations

- 3.16 Case studies & implementation examples

- 3.16.1 Tesla EPB integration analysis

- 3.16.2 Traditional OEM EV EPB strategies

- 3.16.3 Chinese EV manufacturer approaches

- 3.16.4 Lessons learned & best practices

- 3.17 Connected vehicle & cybersecurity integration

- 3.17.1 Connected EPB system architecture

- 3.17.2 Cybersecurity requirements & threats

- 3.17.3 Data analytics & service enhancement

- 3.18 EPB system reliability & failure mode analysis

- 3.18.1 Common failure modes & root causes

- 3.18.2 Reliability testing & validation

- 3.18.3 Predictive maintenance & diagnostics

- 3.18.4 Quality assurance & control

- 3.19 Future outlook & technology disruption timeline

- 3.19.1 Near-term disruptions (2025-2027)

- 3.19.1.1 Mass market EPB adoption acceleration

- 3.19.1.2 Electric vehicle integration Maturity

- 3.19.1.3 Basic autonomous function integration

- 3.19.1.4 Connected vehicle service development

- 3.19.2 Medium-term disruptions (2028-2030)

- 3.19.2.1 Advanced autonomous vehicle integration

- 3.19.2.2 Brake-by-wire technology commercialization

- 3.19.2.3 AI-powered predictive maintenance

- 3.19.2.4 Full vehicle system integration

- 3.19.3 Long-term disruptions (2031-2034)

- 3.19.3.1 Fully autonomous vehicle EPB systems

- 3.19.3.2 Advanced materials & manufacturing

- 3.19.3.3 Quantum computing integration

- 3.19.3.4 Next-generation mobility solutions

- 3.19.1 Near-term disruptions (2025-2027)

- 3.20 Market evolution scenarios

- 3.20.1 Optimistic growth scenario

- 3.20.2 Conservative growth scenario

- 3.20.3 Disruption scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Cable-pull systems

- 5.3 Electric-hydraulic caliper systems

- 5.4 Caliper integrated EPB

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Vehicles, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUVS

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Electronic control unit (ECU)

- 7.3 Actuators

- 7.4 Sensors

- 7.5 Switches & wiring harnesses

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Propulsion, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Internal combustion engine (ICE)

- 9.3 Hybrid electric vehicle (HEV / PHEV)

- 9.4 Battery electric vehicle (BEV)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

- 10.6.5 Egypt

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Aisin Seiki

- 11.1.2 Akebono Brake Industry

- 11.1.3 Brembo

- 11.1.4 Continental

- 11.1.5 Hitachi Astemo

- 11.1.6 Mando

- 11.1.7 Robert Bosch

- 11.1.8 ZF Friedrichshafen

- 11.2 Regional Players

- 11.2.1 Advics

- 11.2.2 BWI

- 11.2.3 Chassis Brakes International

- 11.2.4 Haldex

- 11.2.5 Hyundai Mobis

- 11.2.6 Knorr-Bremse

- 11.2.7 Nissin Kogyo

- 11.2.8 WABCO

- 11.3 Emerging Players

- 11.3.1 Aptiv

- 11.3.2 Autoliv

- 11.3.3 Denso

- 11.3.4 Magna International

- 11.3.5 Nexteer Automotive

- 11.3.6 Schaeffler

- 11.3.7 Tenneco

- 11.3.8 Valeo