|

시장보고서

상품코드

1684582

음료캔 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Beverage Cans Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

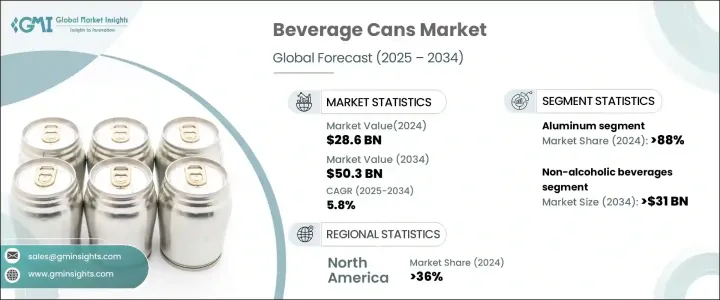

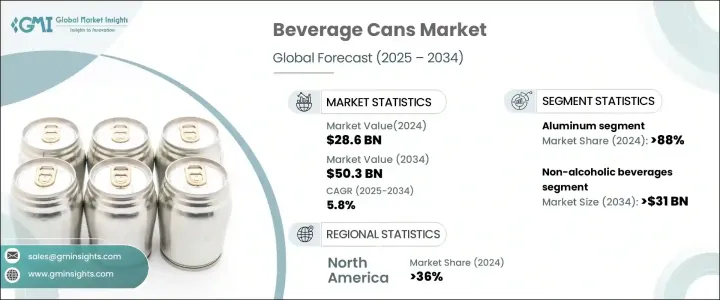

세계의 음료캔 시장은 2024년에 286억 달러로 평가되었고, 2025년부터 2034년까지 CAGR 5.8%로 강력한 성장을 이룰 전망입니다.

이 성장은 소비자 선호가 프리미엄과 건강 지향으로 크게 변화하고 있음을 반영합니다. 라이프 스타일의 속도가 점점 빨라짐에 따라 이동 중에 음료 소비가 증가하는 경향이 있으며 소비자는 편의성과 추가 건강 효과를 제공하는 제품에 매료되고 있습니다. 항산화 물질과 전해질, 기타 건강 증진 성분을 배합한 음료 등 기능적인 수분 보급 옵션은 절대적인 지지를 얻고 있습니다. 환경 의식이 높은 소비자와 브랜드는 재활용 가능하고 친환경적인 패키지를 선호하기 때문에 지속가능성에 대한 관심도 시장 혁신을 촉진하고 있습니다. 뛰어난 재활용성과 경량 특성을 가진 음료캔은 이러한 동향을 뒷받침하는 중요한 존재로서 대두하고 있어 시장의 지속적인 확대가 기대되고 있습니다.

시장은 재료별로 알루미늄과 스틸로 구분되어 2024년의 점유율은 알루미늄이 88%로 압도적이었습니다. 알루미늄의 매력은 비교할 수 없는 지속가능성과 재활용성에 있어, 환경기준의 향상을 목표로 하는 제조업체가 선택하는 재료가 되고 있습니다. 가볍고 내구성이 뛰어나 재활용이 용이한 알루미늄 캔은 음료의 품질과 신선도를 유지하면서 친환경 솔루션을 요구하는 소비자와 업계 수요에 부응하고 있습니다. 이 캔은 풍미를 유지하고, 휴대성을 증가하고, 폐기물을 최소화할 수 있기 때문에 알코올 음료와 비알코올 음료 범주에서 널리 채택됩니다. 캔 제조 기술의 발전으로 캔의 구조적 무결성과 단열성이 더욱 향상되고 음료 산업의 클래식한 알루미늄 역할이 증가하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 286억 달러 |

| 예측 금액 | 503억 달러 |

| CAGR | 5.8% |

시장의 용도는 알코올 음료와 비알코올 음료로 나뉘며, 비알코올 음료의 성장이 현저합니다. 이 카테고리는 CAGR 6%로 성장해 2034년까지 310억 달러를 창출할 것으로 예측됩니다. 저당질 음료, 기능성 음료, 식물성 음료 등 건강 지향적인 음료의 인기가 높아지고 있으며, 혁신적인 패키징 솔루션에 대한 수요가 높아지고 있습니다. 스파클링 워터, 플레이버 워터, 허브 티 등의 제품은 휴대성이 뛰어나고, 보존성이 뛰어나고 재활용성이 높은 알루미늄 캔에 포장되는 경우가 많습니다. 소비자는 웰빙과 지속가능성을 추구하는 광범위한 추세와 일치하는 이러한 옵션에 매료되었습니다.

북미는 2024년 음료캔 시장을 선도해 세계 매출의 36%를 차지했습니다. 미국에서는 소비자가 운반에 편리하고 친환경적인 포장을 선호하기 때문에 음료캔 수요가 급증하고 있습니다. 제조업체 각사는 프리미엄으로 기능적인 음료를 서포트하는 경량으로 완전 재활용 가능한 캔을 개발해, 이러한 기대에 부응하고 있습니다. 이러한 노력은 지속가능하고 건강 지향적인 제품에 대한 이 지역 수요 증가와 일치하며, 시장 성장의 주요 촉진요인으로서 북미의 지위를 확고히 하고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 시장 범위와 정의

- 기본 추정과 계산

- 예측 계산

- 데이터 소스

- 1차

- 2차

- 유료소스

- 공적소스

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 밸류체인에 영향을 주는 요인

- 변혁

- 미래의 전망

- 제조업체

- 유통업체

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 건강 지향 음료에 대한 소비자의 선호 증가

- 알루미늄 캔이 들어간 프리미엄 기능성 음료의 확대

- 캔이 들어간 비알코올 음료의 보급

- 캔들이 와인이나 바로 마실 수 있는 칵테일의 인기 상승

- 크래프트 음료 산업의 확대가 캔의 이용을 촉진

- 업계의 잠재적 리스크 및 과제

- 인공 첨가물을 포함한 캔 음료에 대한 건강상의 인식

- 음료캔 시장의 과포화 가능성

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계 및 예측 : 재료별, 2021-2034년

- 주요 동향

- 알루미늄

- 스틸

제6장 시장 추계 및 예측 : 제품 유형별, 2021-2034년

- 주요 동향

- 1피스 캔

- 2피스 캔

- 3피스 캔

제7장 시장 추계 및 예측 : 용량별, 2021-2034년

- 주요 동향

- 소용량(330ml 미만)

- 중용량(330-500ml)

- 대용량(500ml 이상)

제8장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 알코올 음료

- 무알코올 음료

- 탄산음료

- 과일 및 야채 주스

- 기타

제9장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Ardagh Group

- Ball Corporation

- Baixicans

- Canpack

- Ceylon Beverage Can

- Crown Holdings

- Envases Group

- G3 Enterprises

- GZ Industries

- Nampak

- Novelis

- Orora Packaging

- Scan Holdings

- Showa Aluminum Can

- Speira

- Tata Steel

- Thai Beverage Can

- Toyo Seikan

- Visy

The Global Beverage Cans Market, valued at USD 28.6 billion in 2024, is set to experience robust growth at a CAGR of 5.8% from 2025 to 2034. This growth reflects a significant shift in consumer preferences toward premiumization and health-conscious choices. As lifestyles become increasingly fast-paced, on-the-go consumption of beverages is on the rise, with consumers gravitating toward products that offer convenience and added health benefits. Functional hydration options, such as drinks infused with antioxidants, electrolytes, and other wellness-enhancing ingredients, are gaining immense traction. The focus on sustainability is also driving innovation in the market, as eco-conscious consumers and brands alike prioritize recyclable and environmentally friendly packaging. Beverage cans, with their superior recyclability and lightweight characteristics, have emerged as a key enabler of these trends, positioning the market for sustained expansion.

The market is segmented by material into aluminum and steel, with aluminum commanding a dominant 88% share in 2024. Aluminum's appeal lies in its unparalleled sustainability and recyclability, making it the material of choice for manufacturers aiming to meet growing environmental standards. Lightweight, durable, and easy to recycle, aluminum cans address consumer and industry demands for eco-friendly solutions while maintaining the quality and freshness of beverages. These cans are widely adopted across both alcoholic and non-alcoholic beverage categories due to their ability to preserve flavor, enhance portability, and minimize waste. Advancements in can manufacturing technology have further improved their structural integrity and insulation, elevating aluminum's role as a staple in the beverage industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.6 Billion |

| Forecast Value | $50.3 Billion |

| CAGR | 5.8% |

The application landscape of the market is divided into alcoholic and non-alcoholic beverages, with the non-alcoholic segment witnessing notable growth. This category is projected to grow at a CAGR of 6%, generating USD 31 billion by 2034. The rising popularity of health-conscious choices, such as low-sugar, functional, and plant-based beverages, is fueling demand for innovative packaging solutions. Products like sparkling water, flavored water, and herbal teas are increasingly packaged in aluminum cans, offering superior portability, exceptional preservation, and high recyclability. Consumers are drawn to these options as they align with the broader trend toward wellness and sustainability.

North America led the beverage cans market in 2024, accounting for 36% of the global revenue. In the U.S., the demand for beverage cans is surging as consumers prioritize portable, convenient, and eco-friendly packaging. Manufacturers are meeting these expectations by developing lightweight, fully recyclable cans that support premium and functional beverage offerings. These efforts align with the region's growing appetite for sustainable, health-forward products, cementing North America's position as a key driver of market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Disruptions

- 3.1.3 Future outlook

- 3.1.4 Manufacturers

- 3.1.5 Distributors

- 3.2 Profit margin analysis

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Rising consumer preference for health-conscious beverages

- 3.5.1.2 Expansion of premium functional hydration in aluminum cans

- 3.5.1.3 Proliferation of non-alcoholic beverages in cans

- 3.5.1.4 Increasing popularity of canned wines and ready-to-drink cocktails

- 3.5.1.5 Expansion of craft beverage industry boosting can usage

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Health perceptions of canned beverages containing artificial additives

- 3.5.2.2 Potential over-saturation of the beverage can market

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Aluminum

- 5.3 Steel

Chapter 6 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 1-piece cans

- 6.3 2-piece cans

- 6.4 3-piece cans

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Small (below 330 ml)

- 7.3 Medium (330 ml – 500 ml)

- 7.4 Large (above 500 ml)

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Alcoholic beverages

- 8.3 Non-alcoholic beverages

- 8.3.1 Carbonated soft drinks

- 8.3.2 Fruits & vegetable juices

- 8.3.3 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ardagh Group

- 10.2 Ball Corporation

- 10.3 Baixicans

- 10.4 Canpack

- 10.5 Ceylon Beverage Can

- 10.6 Crown Holdings

- 10.7 Envases Group

- 10.8 G3 Enterprises

- 10.9 GZ Industries

- 10.10 Nampak

- 10.11 Novelis

- 10.12 Orora Packaging

- 10.13 Scan Holdings

- 10.14 Showa Aluminum Can

- 10.15 Speira

- 10.16 Tata Steel

- 10.17 Thai Beverage Can

- 10.18 Toyo Seikan

- 10.19 Visy