|

시장보고서

상품코드

1631600

미국의 알루미늄 음료 캔 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)United States Aluminum Beverage Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

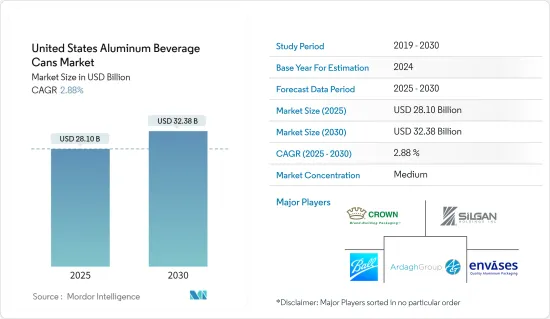

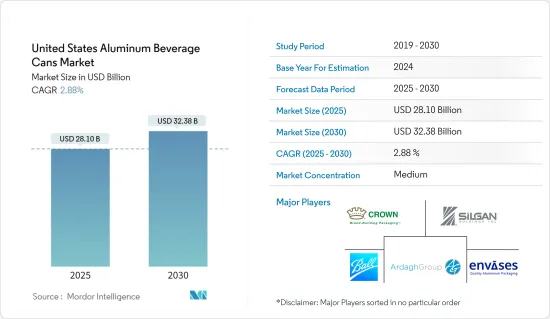

미국의 알루미늄 음료 캔 시장 규모는 2025년에 281억 달러로 추정 및 예측되며, 예측 기간(2025-2030년) 동안 2.88%의 CAGR로 2030년에는 323억 8,000만 달러에 달할 것으로 예상됩니다.

주요 하이라이트

- 알루미늄 캔은 강성, 안정성, 높은 차단성 등 많은 장점을 가지고 있습니다. 이러한 특성으로 인해 보관 기간이 긴 상품이나 장거리 운송이 필요한 상품의 보관에 적합합니다. 제조업체와 산업계가 알루미늄 캔을 선호하는 이유는 부드러움과 가벼움으로 인해 물류 비용을 절감할 수 있기 때문입니다.

주요 하이라이트

- 음료 산업에서는 폐기하기 쉽고 재활용이 가능한 알루미늄 캔이 널리 사용되고 있습니다. 또한 제품의 유통기한을 연장하는 효과도 있습니다. 음료용 알루미늄 캔의 주요 최종사용자 부문에는 탄산음료, 에너지 음료, 알코올 음료 등이 있습니다.

- 소형 사이즈와 멀티팩 포장 형태에 대한 소비자의 선호는 알루미늄 캔의 수량과 디자인 혁신의 성장에 기여하고 있습니다. 알루미늄 캔은 외출이 잦은 라이프스타일을 가진 소비자들에게 특히 적합하며, 편리함을 가장 큰 장점으로 제공합니다. 알루미늄 캔은 축제, 해변, 야외 행사, 스포츠 경기장 등에 쉽게 휴대할 수 있습니다.

주요 하이라이트

- 알루미늄의 재활용은 새로운 금속을 생산하는 데 필요한 에너지의 90% 이상을 절약하고 생산 비용을 절감합니다. 미국에서는 출하되는 알루미늄 캔 3개 중 2개가 재활용되고 있습니다. 이러한 요인들이 향후 시장 성장을 촉진할 것으로 예상됩니다.

- 알루미늄 포장은 플라스틱, 종이, 유리와 같은 대체 포장 솔루션과의 경쟁에 직면해 있습니다. 플라스틱 포장은 여전히 금속 포장의 주요 경쟁자입니다. 알루미늄 캔의 가장 큰 사용자인 음료 산업은 재활용 가능한 플라스틱 포장 솔루션을 채택하기 시작했습니다. 플라스틱 캔은 투명하고 브랜드가 음료의 품질을 홍보할 수 있습니다.

주요 하이라이트

- 2023년 3월, 미국, 캐나다, 멕시코의 PET 포장 산업 산업 단체인 미국 PET 용기 자원 협회(NAPCOR)는 수명주기 평가(LCA)를 발표하였습니다. 이 평가에서 PET병은 유리나 알루미늄 용기보다 환경 부하가 낮은 것으로 나타났습니다.

미국의 알루미늄 음료 캔 시장 동향

3피스 캔이 큰 성장을 이룰 것으로 예상

- 3피스 캔은 원통형 몸체, 하부, 상부 뚜껑의 세 가지 주요 부품으로 구성된 포장입니다. 몸통은 원통형으로 감긴 하나의 금속판에서 형성되며, 아래쪽 끝과 위쪽 뚜껑은 몸통의 양 끝에 단단히 부착된 별도의 원형 조각입니다.

- 내구성이 뛰어나고 안전한 포장 솔루션에 대한 수요가 3피스 금속 캔의 성장을 크게 촉진하고 있습니다. 반려동물 사료는 신선도, 향기, 영양가를 유지할 수 있는 포장이 필요하며, 3피스 금속 캔은 습기, 산소, 빛과 같은 외부 요소로부터 우수한 보호 기능을 제공하여 반려동물 사료의 품질과 안전성을 장기간 보장합니다.

- Organic Trade Association에 따르면, 유기농 포장 식품은 천연 성분을 함유하고 합성 방부제를 포함하지 않는 경우가 많으며, 유기농 포장 식품에 대한 수요가 증가하고 있으며, 2018년에는 174억 5,900만 달러, 2025년에는 250억 6,000만 달러에 달할 것으로 예상됩니다. 백만 달러의 증가가 예상됩니다.

- 이러한 수요 증가는 신뢰할 수 있는 제품 보호, 유통기한 연장, 소비자 선호도, 지속가능성 증명, 제품 제공의 다양성을 제공함으로써 3피스 캔 시장이 번창할 수 있는 기회를 창출합니다.

주목할 만한 성장세를 보이고 있는 에너지 드링크

- 소비자들의 건강에 대한 인식이 높아지면서 설탕, 칼로리, 인공 성분을 줄인 무알콜 음료에 대한 수요가 증가하고 있습니다. 이러한 소비자의 기호 변화로 인해 건강한 음료 시장이 급성장하고 있습니다. 소비자들은 고품질, 천연, 유기농으로 인식되는 음료에 대해서는 기꺼이 프리미엄 가격을 지불할 의향이 있습니다. 무알콜 음료 시장은 신흥국의 중산층 성장과 건강하고 편리한 음료 옵션에 대한 선호도가 높아짐에 따라 새로운 지역과 인구층으로 확대되고 있습니다.

- 미국에서는 최근 몇 년 동안 에너지 음료의 인기가 높아지고 있으며, Beverage Industry Magazine에 따르면 2017년 미국 에너지 음료 매출은 110억 달러에 달하며, 2023년에는 약 185억 달러에 달할 것으로 예상됩니다. 에너지 음료 시장은 치열한 경쟁이 특징이며, 각 브랜드는 정기적으로 새로운 맛, 크기 및 포장 옵션을 발표합니다. 이러한 지속적인 기술 혁신은 특수한 디자인과 대형 포맷을 포함한 다양한 유형의 알루미늄 캔에 대한 수요를 자극합니다. 그 결과, 캔 제조업체들은 이 역동적인 시장 부문의 확장된 포장 요구 사항으로부터 이익을 얻고 있습니다.

- Monster Beverage에 따르면, 미국 내 에너지 드링크 판매량은 2018년 11억 5,000만 병에서 2023년 약 16억 병에 달할 것으로 예상됩니다. 에너지 음료의 판매 증가는 포장 옵션으로서 알루미늄 캔에 대한 수요를 촉진할 것으로 예상됩니다. 알루미늄 캔은 경량성, 재활용성, 편의성 때문에 음료용 포장재로 선호되고 있습니다.

미국 음료용 알루미늄 캔 산업 개요

미국 음료용 알루미늄 캔 시장은 Ardagh Group, Ball Corporation, Crown Holdings Inc. 등 소수의 주요 시장 참여자들에 의해 세분화되어 있습니다. 지속가능한 경쟁 우위는 디자인, 기술, 용도의 혁신을 통해 얻을 수 있을 것으로 예상됩니다. 음료용 알루미늄 캔의 시장 침투율은 지난 10년간 음료 및 식품 수요 증가로 인해 증가했습니다. 또한, 시장 경쟁사들은 파트너십과 같은 경쟁 전략을 채택하고, 연구개발과 혁신적 활동에 중점을 두고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 애널리스트의 3개월간 지원

목차

제1장 소개

- 조사 상정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자의 교섭력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

- 산업 밸류체인 분석

- 금속캔 재활용에 관한 산업 표준과 규제

제5장 시장 역학

- 시장 성장 촉진요인

- 비주류 부문으로부터의 수요 증가

- 금속 포장의 높은 재활용률

- 시장 과제

- 대체품에 대한 수요 상승

제6장 시장 세분화

- 유형별

- 2 피스

- 3 피스

- 용도별

- 탄산음료

- 맥주

- 물

- 에너지 드링크

- 기타 용도(와인, 증류주, 플레이버 음료, 주류, 주스, 유음료)

제7장 경쟁 구도

- 기업 개요

- Ball Corporation

- Ardagh Group

- Crown Holdings Inc.

- Silgan Holdings

- Envases Group

- CANPACK GROUP

- Mauser Packaging Solutions(Bway Holding Corporation)

- Independent Can Company

제8장 투자 분석

제9장 시장 향후 전망

ksm 25.02.04The United States Aluminum Beverage Cans Market size is estimated at USD 28.10 billion in 2025, and is expected to reach USD 32.38 billion by 2030, at a CAGR of 2.88% during the forecast period (2025-2030).

Key Highlights

- Aluminum cans offer numerous advantages, including rigidity, stability, and high barrier properties. These qualities make them suitable for storing goods with extended shelf lives and those requiring long-distance transportation. Manufacturers and industries prefer aluminum cans due to their softness and lightweight nature, which helps reduce logistics costs.

- The beverage industry widely uses aluminum cans because of their easy disposal and recyclability. They also extend product shelf life. Major end-user segments for aluminum beverage cans include carbonated soft drinks, energy drinks, and alcoholic beverages.

- Consumer preferences for small sizes and multi-pack packaging formats contribute to the growth of aluminum can volume and design innovations. Aluminum cans are particularly suitable for consumers with on-the-go lifestyles, offering convenience as a primary benefit. These cans are easily transportable to festivals, beaches, outdoor events, and sports venues.

- Recycling aluminum saves over 90% of the energy required to produce new metal, reducing production costs. Two of every three aluminum cans shipped are recycled in the United States. These factors are expected to drive market growth in the future.

- Aluminum packaging faces competition from alternative packaging solutions such as plastic, paper, and glass. Plastic packaging remains the primary competitor to metal packaging. The beverage industry, the largest user of aluminum cans, has begun adopting recyclable plastic packaging solutions. Plastic cans offer transparency, allowing brands to showcase their beverage quality.

- In March 2023, the National Association for PET Container Resources (NAPCOR), the trade association for the PET packaging industry in the United States, Canada, and Mexico, presented a life cycle assessment (LCA). This assessment indicated that PET bottles have a lower environmental impact than glass and aluminum containers.

Key Highlights

Key Highlights

Key Highlights

United States Aluminum Beverage Cans Market Trends

3-Piece is Anticipated to Witness Significant Growth

- 3-piece metal cans are packaging comprising three main components: the cylindrical body, the bottom end, and the top lid. The body is formed from a single piece of metal sheet rolled into a cylinder, while the bottom end and top lid are separate circular pieces securely attached to the ends of the body.

- The demand for durable and secure packaging solutions has significantly driven the growth of 3-piece metal cans. Pet food requires packaging that can preserve freshness, aroma, and nutritional value. 3-piece metal cans provide excellent protection against external elements such as moisture, oxygen, and light, ensuring the quality and safety of the pet food over an extended period.

- Organic packaged foods often contain natural ingredients and lack synthetic preservatives. 3-piece cans protect against external contaminants and maintain product freshness, which is crucial for organic foods that lack preservatives. According to the Organic Trade Association, the demand for organic packaged food is increasing. It is expected to account for a value increase of USD 17,459 million in 2018 to USD 25,060 million in 2025.

- This growing demand creates opportunities for the 3-piece cans market to thrive by offering reliable product protection, extended shelf life, positive consumer perception, sustainability credentials, and versatility in product offerings.

Energy Drinks is Observing a Notable Growth

- Increasing consumer health awareness has increased demand for non-alcoholic beverages with reduced sugar, calories, and artificial ingredients. This shift in consumer preferences has resulted in a surge in the market for healthier beverage options. Consumers are willing to pay premium prices for beverages perceived as high-quality, natural, and organic. The non-alcoholic beverage market is expanding into new geographical regions and demographic segments, driven by the growth of the middle class in emerging economies and an increasing preference for healthy and convenient drink options.

- Energy drinks have become more popular in the United States in recent years. According to Beverage Industry Magazine, in 2017, sales of energy drinks in the United States accounted for USD 11 billion and reached around USD 18.5 billion by 2023. The energy drink market is characterized by intense competition, with brands regularly introducing new flavors, sizes, and packaging options. This continuous innovation stimulates demand for various types of aluminum cans, including specialty designs and larger formats. As a result, can manufacturers benefit from the expanding range of packaging requirements in this dynamic market segment.

- According to Monster Beverage, energy drink sales in the United States reached approximately 1.6 billion units in 2023, up from 1.15 billion units in 2018. The growth in energy drink sales is expected to drive the demand for aluminum cans as a packaging option. Aluminum cans are favored for their lightweight properties, recyclability, and convenience, making them a preferred choice for beverage packaging.

United States Aluminum Beverage Cans Industry Overview

The aluminum beverage cans market in the United States is fragmented due to the presence of a few major market players, such as Ardagh Group, Ball Corporation, and Crown Holdings Inc. Sustainable competitive advantage is expected to be gained through design, technology, and application innovation. The market penetration for aluminum beverage cans has increased over the past decade due to the increasing demand for food and beverages. Furthermore, the market players are adopting competitive strategies such as partnerships, emphasizing R&D and innovative activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Standards & Regulations on Recycling of Metal Cans

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from the Non-Alcoholic Beverage Sector

- 5.1.2 High Recyclability Rates of Metal Packaging

- 5.2 Market Challenges

- 5.2.1 Growing Demand for Substitutes

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 2-piece

- 6.1.2 3-piece

- 6.2 By Application

- 6.2.1 Carbonated Soft Drinks

- 6.2.2 Beer

- 6.2.3 Water

- 6.2.4 Energy Drinks

- 6.2.5 Other Applications (Wine, Spirits, Flavored, Alcoholic Beverages, Juices, Dairy Based Beverages)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Corporation

- 7.1.2 Ardagh Group

- 7.1.3 Crown Holdings Inc.

- 7.1.4 Silgan Holdings

- 7.1.5 Envases Group

- 7.1.6 CANPACK GROUP

- 7.1.7 Mauser Packaging Solutions (Bway Holding Corporation)

- 7.1.8 Independent Can Company