|

시장보고서

상품코드

1684685

스마트 차량 아키텍처 시장 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Smart Vehicle Architecture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

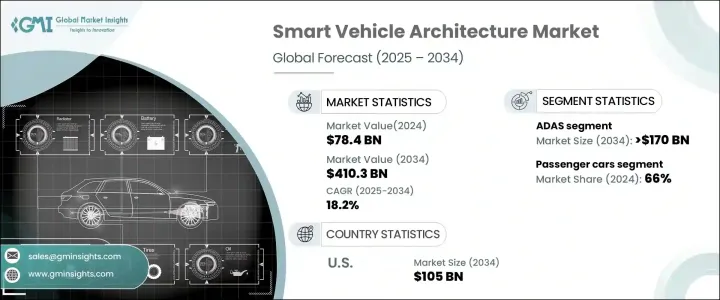

세계의 스마트 차량 아키텍처 시장은 2024년에 784억 달러로 평가되었고, 2025년부터 2034년에 걸쳐 18.2%의 연평균 복합 성장률(CAGR)로 성장할 것으로 예상됩니다.

자동차 기술이 발전함에 따라 제조업체는 원활한 연결성을 선호하며 Vehicle-to-Everything(V2X), 지능형 텔레매틱스 및 고급 진단 도구와 같은 최첨단 통신 시스템을 통합합니다. 5G 네트워크의 보급은 이 시프트를 더욱 가속화하여 보다 빠른 데이터 전송, 서비스 신뢰성 향상, 대기 시간 단축을 가능하게 하고 있습니다.

이러한 진보로 자동차 상황이 바뀌면서 타의 추종을 불허하는 연결성과 사용자 경험을 제공하는 지능적이고 소프트웨어 중심의 자동차로가는 길이 열리고 있습니다. 전기자동차(EV)가 기세를 늘리고 있는 동안 자동차 제조업체는 기존의 파워트레인과 전기 파워트레인을 모두 지원하는 유연한 모듈 설계를 수용하기 위해 차량 아키텍처를 재구성하고 있습니다. 이 시프트는 생산 효율을 최적화할 뿐만 아니라 안전성, 편리성, 자동화를 강화하는 커넥티드, 소프트웨어 정의 차량에 대한 소비자 수요 증가에 대응하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 784억 달러 |

| 예측 금액 | 4,103억 달러 |

| CAGR | 18.2% |

스마트 차량 아키텍처는 V2X 통신, ADAS(첨단 운전 지원 시스템), 인포테인먼트 및 커넥티비티, OTA(Over-the-Air) 업데이트, 사이버 보안 솔루션, 머신러닝(ML)을 갖춘 인공지능(AI) 등 일련의 변화 기술로 추진되고 있습니다. 2024년에는 ADAS가 시장 점유율의 51%를 차지하며 자동차 안전과 자동화 향상에 중요한 역할을 했습니다. 자동차 제조업체가 선진 운전 지원 기능에 주력하는 가운데, 어댑티브 크루즈 컨트롤, 자동 긴급 브레이크, 교통 표지 인식 등의 기능이 업계 표준이 되고 있습니다. 이러한 기술의 급속한 통합은 사용자 경험을 향상시킬 뿐만 아니라 규제 기관이 보다 엄격한 안전 규정 준수를 추진하면서 시장 성장을 가속하고 있습니다.

시장은 승용차, 상용차, EV 등 차량 유형별로 구분됩니다. 2024년에는 생산량이 많고 소비자 수요가 높아지고 선진적인 차재기술의 보급이 몰려 승용차가 66%의 점유율을 차지하며 시장을 석권했습니다. 도시화가 가속화되고 도시 인구가 증가함에 따라 승용차는 여전히 선호되는 교통 수단이며 소비자는 원활한 연결성, 전기화 및 혁신적인 기능을 제공하는 자동차를 점점 더 요구하고 있습니다. 차세대 인포테인먼트 시스템, 자율주행 기능, 통합 AI 솔루션에 대한 수요가 새로운 기술 혁신에 박차를 가하고 있으며, 스마트 차량 아키텍처는 자동차의 미래에 중요한 요소가 되고 있습니다.

미국의 스마트 차량 아키텍처 시장은 2024년에는 85%라는 압도적인 점유율을 차지했으며, 이는 자동차 기술 혁신의 미국 리더십의 증거입니다. 2034년까지 미국 시장은 1,050억 달러를 창출할 것으로 예상되며, 이는 첨단 자동차 기술의 적극적인 채택을 반영합니다. AI 주도의 자율주행차 개발에 중점을 둔 주요 하이테크 기업의 존재로 미국은 스마트 차량 아키텍처의 세계 리더로 자리매김하고 있습니다. 이 지역의 자동차 제조업체들은 EV와 자율주행 차량 모두에서 지능형 차량 시스템의 통합을 주도하고 있으며 시장의 우위를 강화하고 있습니다. AI, 커넥티비티, 전동화의 발전에 따라 스마트 차량 아키텍처의 미래는 전 세계적으로 이동성과 운송을 재정의할 것으로 보입니다.

목차

제1장 조사 방법과 조사 범위

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정과 계산

- 기준연도의 산출

- 시장추계의 주요 동향

- 예측 모델

- 1차 조사와 검증

- 1차 정보

- 데이터 마이닝 소스

- 시장 정의

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 기술 제공업체

- 부품 공급자

- OEM 제조업체

- 최종 사용자

- 공급자의 상황

- 이익률 분석

- 기술 혁신의 상황

- 주요 뉴스 및 이니셔티브

- 규제 상황

- 영향요인

- 성장 촉진요인

- 커넥티드카 수요 증가

- 전기자동차의 성장

- 자율주행차의 채용 증가

- 소프트웨어 정의의 자동차에 대한 주목의 고조

- 업계의 잠재적 위험 및 과제

- 높은 개발 비용

- 데이터 보안 및 개인정보 보호에 대한 우려

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추정 및 예측 : 기술별, 2021년-2034년

- 주요 동향

- ADAS

- 인포테인먼트 & 커넥티비티

- V2x 통신

- 무선(OTA) 업데이트

- 사이버 보안 솔루션

- AI와 ML

제6장 시장 추정 및 예측 : 아키텍처별, 2021년-2034년

- 주요 동향

- 집중형 아키텍처

- 존형 아키텍처

- 모듈형 플랫폼

- 분산형 아키텍처

제7장 시장 추정 및 예측 : 차량별, 2021-2034년

- 주요 동향

- 승용차

- 상용차

- 전기자동차

제8장 시장 추정 및 예측 : 용도별, 2021년-2034년

- 주요 동향

- 자율주행

- 인포테인먼트와 사용자 경험

- 안전 및 보안

- 플릿 관리

- 에너지 관리

제9장 시장 추정 및 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- Aptiv

- Mobileye

- Magna International

- RT-RK

- Huawei Intelligent Automotive Solution(Yinwang)

- Infineon Technologies

- Momenta

- Bosch

- Continental AG

- NVIDIA

- Qualcomm

- Texas Instruments

- Renesas Electronics

- Valeo

- Denso Corporation

- ZF Friedrichshafen

- Panasonic Automotive Systems

- Harman International

- Delphi Technologies

- Lear Corporation

The Global Smart Vehicle Architecture Market generated USD 78.4 billion in 2024 and is expected to expand at a remarkable CAGR of 18.2% between 2025 and 2034. As automotive technology evolves, manufacturers are prioritizing seamless connectivity, integrating cutting-edge communication systems such as Vehicle-to-Everything (V2X), intelligent telematics, and advanced diagnostic tools. The widespread rollout of 5G networks is further accelerating this shift, enabling faster data transmission, enhanced service reliability, and reduced latency.

These advancements are transforming the automotive landscape, paving the way for intelligent, software-driven vehicles that offer unparalleled connectivity and user experience. With electric vehicles (EVs) gaining momentum, automakers are reimagining vehicle architectures to accommodate flexible, modular designs that support both traditional and electric powertrains. This shift is not only optimizing production efficiency but also meeting the rising consumer demand for connected, software-defined vehicles that enhance safety, convenience, and automation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $78.4 Billion |

| Forecast Value | $410.3 Billion |

| CAGR | 18.2% |

Smart vehicle architecture is being driven by a suite of transformative technologies, including V2X communication, Advanced Driver Assistance Systems (ADAS), infotainment and connectivity, Over-the-Air (OTA) updates, cybersecurity solutions, and artificial intelligence (AI) with machine learning (ML). In 2024, ADAS accounted for 51% of the market share, playing a critical role in improving vehicle safety and automation. As automakers focus on advanced driver-assistance capabilities, features such as adaptive cruise control, automatic emergency braking, and traffic sign recognition are becoming industry standards. The rapid integration of these technologies is not only enhancing user experience but also propelling market growth as regulatory bodies push for stricter safety compliance.

The market is segmented by vehicle type, including passenger cars, commercial vehicles, and EVs. In 2024, passenger cars dominated the market with a 66% share, driven by high production volumes, growing consumer demand, and widespread adoption of advanced in-car technologies. As urbanization accelerates and city populations grow, passenger vehicles remain the preferred mode of transport, with consumers increasingly seeking vehicles that offer seamless connectivity, electrification, and innovative features. The demand for next-generation infotainment systems, autonomous driving capabilities, and integrated AI solutions is fueling further innovation, making smart vehicle architectures a key component of the automotive future.

U.S. smart vehicle architecture market held a commanding 85% share in 2024, a testament to the country's leadership in automotive innovation. By 2034, the U.S. market is projected to generate USD 105 billion, reflecting its aggressive adoption of advanced automotive technologies. The presence of major tech companies, along with a strong emphasis on AI-driven autonomous vehicle development, is positioning the U.S. as a global leader in smart vehicle architecture. Automakers in the region are spearheading the integration of intelligent vehicle systems in both EVs and autonomous vehicles, reinforcing the market's dominance. With ongoing advancements in AI, connectivity, and electrification, the future of smart vehicle architecture is set to redefine mobility and transportation on a global scale.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Technology providers

- 3.1.2 Component suppliers

- 3.1.3 OEMs

- 3.1.4 End user

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing demand for connected vehicles

- 3.7.1.2 Growth of electric vehicles

- 3.7.1.3 Rising adoption of autonomous vehicles

- 3.7.1.4 Increasing focus on software-defined vehicles

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High development costs

- 3.7.2.2 Data security & privacy concerns

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 ADAS

- 5.3 Infotainment & connectivity

- 5.4 V2x communication

- 5.5 Over-the-air (OTA) updates

- 5.6 Cybersecurity solutions

- 5.7 AI & ML

Chapter 6 Market Estimates & Forecast, By Architecture, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Centralized architectures

- 6.3 Zonal architectures

- 6.4 Modular platforms

- 6.5 Distributed architectures

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.3 Commercial vehicles

- 7.4 Electric vehicles

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Autonomous driving

- 8.3 Infotainment & user experience

- 8.4 Safety & security

- 8.5 Fleet management

- 8.6 Energy management

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aptiv

- 10.2 Mobileye

- 10.3 Magna International

- 10.4 RT-RK

- 10.5 Huawei Intelligent Automotive Solution (Yinwang)

- 10.6 Infineon Technologies

- 10.7 Momenta

- 10.8 Bosch

- 10.9 Continental AG

- 10.10 NVIDIA

- 10.11 Qualcomm

- 10.12 Texas Instruments

- 10.13 Renesas Electronics

- 10.14 Valeo

- 10.15 Denso Corporation

- 10.16 ZF Friedrichshafen

- 10.17 Panasonic Automotive Systems

- 10.18 Harman International

- 10.19 Delphi Technologies

- 10.20 Lear Corporation