|

시장보고서

상품코드

1684868

관강내 봉합 기기 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Endoluminal Suturing Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

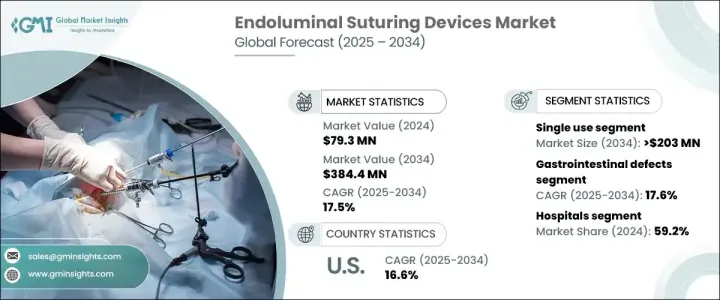

세계의 관강내 봉합 기기 시장은 2024년에 7,930만 달러로 평가되었고, 저침습 수술에 대한 선호도 증가와 소화기계 및 비만 수술 증가로 2025년부터 2034년까지 17.5%의 견조한 CAGR로 확대될 것으로 예측되고 있습니다.

의료 서비스 제공업체는 환자의 안전과 회복 시간 단축을 선호하기 때문에 고급 봉합 솔루션에 대한 수요가 증가하고 있습니다. 세계 비만의 확산은 비만 수술의 급증으로 이어지고 있으며, 관강내 봉합 기기는 위 바이패스 및 외과적 재수술과 같은 수술에서 중요한 역할을 합니다. 또한, 가시화 개선, 조작성 향상, 로봇 시스템과의 통합 등의 기술적 진보에 의해 이러한 기기는 보다 효율적이고 사용하기 쉬워지고 있습니다. 이러한 정밀 주도형의 외과적 개입으로의 전환은 시장 확대에 크게 기여하고 있습니다.

의료 전문가는 수술 위험 감소, 입원 기간 단축, 환자 결과 개선 등의 이유로 관강내 봉합 기기를 채용하는 경향이 강해지고 있습니다. 이러한 장치는 정확하고 복잡한 외과 수술에서도 원활한 조직 근사가 가능합니다. 의료 시설에서는 감염 대책과 비용 효율이 중시되기 때문에 일회용의 단회 사용 봉합 기구 수요가 급증하고 있습니다. 자동 봉합 시스템과 인공지능 구동 수술 기구의 도입으로 수술이 더욱 합리화되고 보다 안전하고 효과적이 되었습니다. 게다가 규제 당국의 승인과 유리한 상환 정책이 시장의 성장을 지원하고 있으며, 이러한 혁신적인 의료기기의 채용을 뒷받침하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 7,930만 달러 |

| 예측 금액 | 3억 8,440만 달러 |

| CAGR | 17.5% |

제품 유형 중에서 일회용 분야가 주요 견인 역할을 하고 CAGR 17.2%로 예측되며, 2034년에는 예상 2억 300만 달러에 달할 전망입니다. 이러한 기구는 교차 오염의 위험을 없애고 감염 관련 합병증을 줄일 수 있으므로 수술 현장에서 선호됩니다. 편의성은 멸균의 필요성을 없애는 것과 함께 엄격한 위생 기준을 준수하면서 운영 비용을 크게 줄입니다. 특히 병원이나 외래수술센터(ASC)에서는 효율성과 환자의 안전성을 높이기 위해 일회용 관강내 봉합 기기를 채용하고 있습니다. 의료 산업이 규제 및 안전 요구 사항을 충족하기 위해 일회용 솔루션으로 전환함에 따라 이러한 고도의 장비에 대한 수요가 급증할 것으로 예상됩니다.

소화관 결핍 용도 분야는 현저한 성장이 예상되며, CAGR 17.6%, 2034년에는 1억 6,960만 달러에 이를 것으로 예측됩니다. 궤양, 천공 및 누공을 포함한 위장관 질환의 발생률이 증가하면 침습 치료 옵션에 대한 수요가 증가하고 있습니다. 이러한 질병의 대부분은 만성 질환 및 라이프 스타일과 관련된 요인으로 인해 효과적인 수술 개입이 필요합니다. 관강내 봉합 기기는 이러한 복잡한 사례에 정밀하고 침습적인 솔루션을 제공하여 환자의 회복률을 높이고 수술 후 합병증을 완화합니다. 첨단 봉합 기술에 의한 소화관 치료 강화에 주목이 모여 있는 것도 시장 확대에 박차를 가하고 있습니다.

미국 관강내 봉합 기기 시장은 상당한 성장이 예상되고 있으며, 2024년 시장 규모는 2,740만 달러였습니다. 비만률 증가 및 위장 장애의 유병률 증가가 수요를 촉진하는 주요 요인입니다. 비만 치료가 보급되고 만성 소화관 질환의 혁신적인 치료에 대한 요구가 증가함에 따라, 관강내 봉합 기기는 전국의 외과 의사에게 선호되는 옵션이 되고 있습니다. 고령화 및 라이프스타일 동향의 변화도 함께, 이들 장비 수요는 더욱 가속화되고 있습니다. 수술 기술의 끊임없는 진보 및 저침습 수술에 대한 강력한 투자로 미국 시장은 관강내 봉합 솔루션의 미래 형성에 매우 중요한 역할을 할 것으로 예상됩니다.

목차

제1장 조사 방법 및 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 세계에서 만성질환 유병률 상승

- 저침습 수술에 대한 수요 증가

- 기술의 진보

- 노인 인구 증가

- 업계의 잠재적 위험 및 과제

- 엄격한 규제 시나리오

- 숙련된 헬스케어 전문가의 부족

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술 상황

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

- 향후 시장 동향

- 밸류체인 분석

제4장 경쟁 구도

- 서문

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 일회용

- 재사용 가능

제6장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 소화관 결손

- 비만 수술

- 위식도 역류증(GERD)

- 기타 용도

제7장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 병원

- 외래수술센터(ASC)

- 기타 최종 사용자

제8장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Apollo Endosurgery

- Boston Scientific

- Braun Melsungen

- Cook Group

- Endo Tools Therapeutics

- ErgoSuture

- Johnson and Johnson

- Karl Storz

- Medtronic

- Olympus Corporation

- Ovesco Endoscopy

- Richard Wolf

- Teleflex Corporation

- Terumo Corporation

- USGI Medical

The Global Endoluminal Suturing Devices Market, valued at USD 79.3 million in 2024, is projected to expand at a robust CAGR of 17.5% from 2025 to 2034., driven by the increasing preference for minimally invasive surgical procedures and the rising number of gastrointestinal and bariatric surgeries. As healthcare providers prioritize patient safety and faster recovery times, the demand for advanced suturing solutions continues to rise. The growing prevalence of obesity worldwide has led to a surge in bariatric procedures, where endoluminal suturing devices play a crucial role in procedures like gastric bypass and surgical revisions. Furthermore, technological advancements, including improved visualization, enhanced maneuverability, and integration with robotic systems, are making these devices more efficient and easier to use. This shift towards precision-driven surgical interventions is significantly contributing to market expansion.

Medical professionals are increasingly embracing endoluminal suturing devices due to their ability to reduce surgical risks, shorten hospital stays, and improve patient outcomes. These devices offer high accuracy, enabling seamless tissue approximation in complex surgical procedures. As healthcare facilities emphasize infection control and cost-efficiency, the demand for disposable, single-use suturing devices is surging. The introduction of automated suturing systems and AI-driven surgical tools is further streamlining operations, making procedures safer and more effective. Additionally, regulatory approvals and favorable reimbursement policies are supporting market growth, encouraging the adoption of these innovative medical devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $79.3 Million |

| Forecast Value | $384.4 Million |

| CAGR | 17.5% |

Among product types, the single-use segment is set to be a key driver, with a projected CAGR of 17.2%, reaching an estimated USD 203 million by 2034. These devices are preferred in surgical settings due to their ability to eliminate cross-contamination risks and reduce infection-related complications. Their convenience, combined with the elimination of sterilization requirements, significantly lowers operational costs while ensuring compliance with stringent hygiene standards. Hospitals and ambulatory surgical centers, in particular, are embracing single-use endoluminal suturing devices to enhance efficiency and patient safety. As the healthcare industry moves towards disposable solutions to meet regulatory and safety requirements, the demand for these advanced devices is expected to surge.

The gastrointestinal defects application segment is anticipated to witness significant growth, with a projected CAGR of 17.6%, reaching USD 169.6 million by 2034. The increasing incidence of gastrointestinal conditions, including ulcers, perforations, and fistulas, is driving demand for minimally invasive treatment options. Many of these conditions stem from chronic diseases and lifestyle-related factors, necessitating effective surgical interventions. Endoluminal suturing devices provide a precise and minimally invasive solution for such complex cases, improving patient recovery rates and reducing post-surgical complications. The growing focus on enhancing gastrointestinal care through advanced suturing technologies is further fueling market expansion.

The United States endoluminal suturing devices market is poised for substantial growth, with an estimated value of USD 27.4 million in 2024. The rising obesity rates and increasing prevalence of gastrointestinal disorders are key factors driving demand. As bariatric procedures gain popularity and the need for innovative treatments for chronic gastrointestinal diseases grows, endoluminal suturing devices are becoming a preferred choice for surgeons across the country. The aging population, coupled with shifting lifestyle trends, is further accelerating the demand for these devices. With continuous advancements in surgical technology and strong investment in minimally invasive procedures, the US market is expected to play a pivotal role in shaping the future of endoluminal suturing solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic disease across the globe

- 3.2.1.2 Increasing demand for minimally invasive procedures

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 Dearth of skilled healthcare professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Single use

- 5.3 Reusable

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Gastrointestinal defects

- 6.3 Bariatric surgery

- 6.4 Gastroesophageal reflux disease (GERD)

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Apollo Endosurgery

- 9.2 Boston Scientific

- 9.3 Braun Melsungen

- 9.4 Cook Group

- 9.5 Endo Tools Therapeutics

- 9.6 ErgoSuture

- 9.7 Johnson and Johnson

- 9.8 Karl Storz

- 9.9 Medtronic

- 9.10 Olympus Corporation

- 9.11 Ovesco Endoscopy

- 9.12 Richard Wolf

- 9.13 Teleflex Corporation

- 9.14 Terumo Corporation

- 9.15 USGI Medical