|

시장보고서

상품코드

1685135

범퍼 센서 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Bumper Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

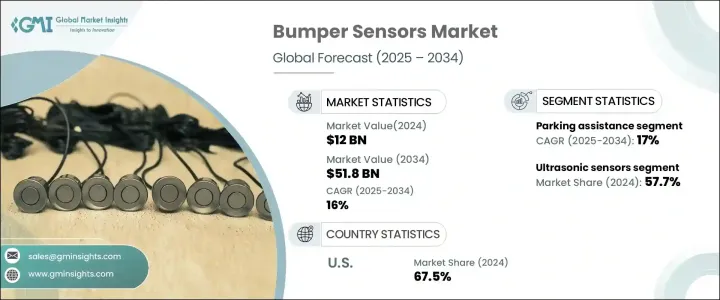

세계의 범퍼 센서 시장은 2024년에 120억 달러로 평가되었으며 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 16%를 나타낼 것으로 예측됩니다.

이러한 성장은 자동 브레이크와 사고 방지를 통해 차량의 안전성을 높이는 ADAS(첨단 운전자 지원 시스템)와 범퍼 센서의 통합이 진행되고 있는 것이 배경에 있습니다. 이러한 센서가 실시간으로 데이터를 수집할 수 있어 운전 경험이 향상되고 사고가 최소화되며 첨단 안전 기능에 대한 수요가 향상됩니다. 최신 자동차에 ADAS가 널리 채용되고 있는 것이 범퍼 센서 수요를 뒷받침해, 기술 혁신과 시장 확대를 가속시키는 시너지 효과를 낳고 있습니다.

범퍼 센서는 장애물을 자동으로 감지하고 경고를 보내거나 브레이크를 작동시켜 충돌을 방지하고 보험금 청구를 줄이는 데 중요한 역할을 합니다. 이러한 센서는 탑승자의 안전을 보장하는 데 도움이 되는 동시에 보험 회사와 제조업체에게도 자동차를 더욱 매력적으로 만듭니다. 자동차 제조업체가 안전을 우선시하는 가운데, 범퍼 센서의 자동차에의 탑재는 증가의 일도를 따르고 있어 시장의 성장을 한층 더 추진하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 120억 달러 |

| 예측 금액 | 518억 달러 |

| CAGR | 16% |

기술별로 볼 때 범퍼 센서 시장에는 초음파 센서, 전자기 센서, 적외선 센서 등이 포함됩니다. 2024년에는 초음파 센서가 57.7%의 점유율로 시장을 선도했습니다. 이 센서는 초음파를 방출하고 초음파가 돌아올 때까지의 시간을 측정하여 가까운 물체를 정확하게 감지합니다. 근접을 판단하는 신뢰성이 높기 때문에 최신의 자동차, 특히 주차 보조나 ADAS 기능에는 빠뜨릴 수 없습니다. 비용 효과, 다용도, 효율성을 통해 초음파 센서는 자동차 제조업체들이 선호하는 옵션이 되어 범퍼 센서 산업의 확대를 더욱 강화하고 있습니다.

용도별로 볼 때 시장은 주차 보조, 사각지대 감지, 충돌 방지 등으로 구분됩니다. 주차 보조 분야는 예측 기간 동안 CAGR 17%를 나타낼 것으로 예측됩니다. 편의성과 안전성에 대한 소비자 수요 증가는 주차 보조 시스템에서 범퍼 센서의 채택을 뒷받침하고 있습니다. 이 시스템은 차량이 장애물을 식별하고 실시간으로 피드백을 제공하고 운전자가 더 정확하고 안전하게 주차할 수 있도록 지원합니다. 이 기능은 주차 공간이 제한되어 조종하기 어려운 도시 지역에서는 특히 가치가 있습니다.

ADAS의 보급에 따라 주차 보조는 현재 고급차와 대중차 모두에서 중요한 기능이 되고 있습니다. 자동차 제조업체는 차량의 안전성을 높이고 진화하는 안전 기준을 준수하기 위해 범퍼 센서를 이용한 주차 보조 시스템을 우선적으로 채용하고 있습니다. 그 결과, 이러한 시스템은 신차 모델에 널리 탑재되어 시장의 급성장을 지원하고 있습니다.

북미에서는 미국이 2024년 범퍼 센서 시장에서 67.5%의 점유율을 차지했습니다. 이 나라는 자동차 기술 혁신에 주력하고 있으며, 하이테크 안전 시스템에 대한 소비자 수요가 시장 확대를 뒷받침하고 있습니다. 충돌 방지 및 주차 보조과 같은 ADAS 기능을 위해 범퍼 센서를 자동차에 통합하는 것은 업계 전반에서 표준이 되고 있습니다. 또한 전기자동차 및 자율주행차의 생산량 증가와 엄격한 안전 규제가 이러한 센서의 채택을 더욱 증가시키고 있습니다. 선도적인 자동차 제조업체와 기술 제공업체가 센서 기술을 발전시키고 있기 때문에 미국은 세계의 범퍼 센서 시장에서 중요한 지위를 유지하고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 시장 범위와 정의

- 기본 추정과 계산

- 예측 계산

- 데이터 소스

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 파괴적 혁신

- 향후 전망

- 제조업체

- 유통업체

- 공급업체 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- ADAS(첨단 운전자 지원 시스템)의 병용

- 사고와 보험금 청구의 감소

- 범퍼 센서 소비를 뒷받침하는 규제 요건

- 범퍼 센서 수요를 끌어올리는 자동차 부문 확대

- 업계의 잠재적 위험 및 과제

- 구형차와의 통합이 한정적

- 복잡한 수리 절차

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계·예측 : 기술별(2021-2034년)

- 주요 동향

- 초음파 센서

- 전자기 센서

- 적외선 센서

- 기타

제6장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 주차 보조

- 충돌 방지

- 사각지대 감지

- 기타

제7장 시장 추계·예측 : 차량 유형별(2021-2034년)

- 주요 동향

- 승용차

- 상용차

제8장 시장 추계·예측 : 판매 채널별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

제9장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Analog Devices, Inc.

- Aptiv(Formerly Delphi Technologies)

- Continental AG

- Denso Corporation

- Gentex Corporation

- HELLA GmbH &Co. KGaA

- Heraeus Sensor Technology

- Hitachi Automotive Systems

- Hyundai Mobis

- Infineon Technologies AG

- Leddartech

- Magna International Inc.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors

- Proxel

- Robert Bosch GmbH

- Steelmate Automotive

- Texas Instruments Incorporated

- Valeo

- ZF Friedrichshafen AG

The Global Bumper Sensor Market was valued at USD 12 billion in 2024 and is projected to grow at a CAGR of 16% from 2025 to 2034. This growth is driven by the increasing integration of bumper sensors with Advanced Driver Assistance Systems (ADAS), which enhance vehicle safety through automated braking and accident prevention. The ability of these sensors to collect real-time data improves driving experiences, minimizes accidents, and strengthens the demand for advanced safety features. The widespread adoption of ADAS in modern vehicles is fueling the demand for bumper sensors, creating a synergy that accelerates technological innovation and market expansion.

Bumper sensors play a crucial role in preventing collisions and reducing insurance claims by automatically detecting obstacles and sending alerts or activating brakes. These sensors help ensure passenger safety while also making vehicles more attractive to insurance companies and manufacturers. As automakers prioritize safety, the integration of bumper sensors in vehicles continues to increase, further supporting market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12 billion |

| Forecast Value | $51.8 billion |

| CAGR | 16% |

By technology, the bumper sensor market includes ultrasonic sensors, electromagnetic sensors, infrared sensors, and others. In 2024, ultrasonic sensors led the market with a 57.7% share. These sensors accurately detect nearby objects by emitting ultrasonic waves and measuring the time it takes for the waves to return. Their reliability in determining proximity makes them essential in modern vehicles, particularly for parking assistance and ADAS features. Due to their cost-effectiveness, versatility, and efficiency, ultrasonic sensors have become the preferred choice for automakers, further driving the expansion of the bumper sensor industry.

Based on application, the market is segmented into parking assistance, blind spot detection, collision avoidance, and others. The parking assistance segment is projected to grow at a CAGR of 17% during the forecast period. Increasing consumer demand for convenience and safety is propelling the adoption of bumper sensors in parking assistance systems. These systems help vehicles identify obstacles and provide real-time feedback, ensuring drivers can park more accurately and safely. This feature is particularly valuable in urban areas with limited parking space, where maneuvering can be challenging.

With ADAS becoming more prevalent, parking assistance is now a key feature in both premium and mass-market vehicles. Automakers are prioritizing parking assistance systems powered by bumper sensors to enhance vehicle safety and comply with evolving safety standards. As a result, these systems are being widely integrated into new vehicle models, supporting the rapid growth of the market.

In North America, the United States dominated the bumper sensor market in 2024, holding a 67.5% share. The country's focus on automotive innovation and consumer demand for high-tech safety systems is driving market expansion. The incorporation of bumper sensors in vehicles for ADAS features, such as collision avoidance and parking assistance, is becoming standard across the industry. Additionally, the rise in electric and autonomous vehicle production, along with stringent safety regulations, is further increasing the adoption of these sensors. With leading automotive manufacturers and technology providers advancing sensor technologies, the United States remains a significant player in the global bumper sensor market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Combination of advanced driver assistance systems (ADAS)

- 3.6.1.2 Reduction in accidents and insurance claims

- 3.6.1.3 Regulatory requirements boosting bumper sensor consumption

- 3.6.1.4 Expanding automotive sector boosting demand for bumper sensors

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Limited integration with older vehicles

- 3.6.2.2 Complex repair procedures

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Volume Units)

- 5.1 Key trends

- 5.2 Ultrasonic sensors

- 5.3 Electromagnetic sensors

- 5.4 Infrared sensors

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Volume Units)

- 6.1 Key trends

- 6.2 Parking assistance

- 6.3 Collision avoidance

- 6.4 Blind spot detection

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle Type, 2021-2034 (USD Billion) (Volume Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.3 Commercial vehicles

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021-2034 (USD Billion) (Volume Units)

- 8.1 Key trends

- 8.2 Original Equipment Manufacturers (OEMs)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Volume Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Analog Devices, Inc.

- 10.2 Aptiv (Formerly Delphi Technologies)

- 10.3 Continental AG

- 10.4 Denso Corporation

- 10.5 Gentex Corporation

- 10.6 HELLA GmbH & Co. KGaA

- 10.7 Heraeus Sensor Technology

- 10.8 Hitachi Automotive Systems

- 10.9 Hyundai Mobis

- 10.10 Infineon Technologies AG

- 10.11 Leddartech

- 10.12 Magna International Inc.

- 10.13 Murata Manufacturing Co., Ltd.

- 10.14 NXP Semiconductors

- 10.15 Proxel

- 10.16 Robert Bosch GmbH

- 10.17 Steelmate Automotive

- 10.18 Texas Instruments Incorporated

- 10.19 Valeo

- 10.20 ZF Friedrichshafen AG