|

시장보고서

상품코드

1698233

자율주행차 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Self-driving Cars Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

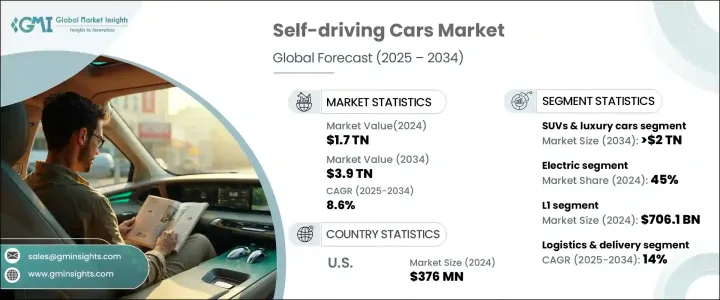

세계의 자율주행차 시장은 2024년 1조 7,000억 달러로 평가되었으며, 2025-2034년 연평균 복합 성장률(CAGR) 8.6%로 확대될 것으로 예상됩니다.

이 성장을 뒷받침하는 주요 요인은 세계보건기구(WHO)가 보고한 대로 세계에서 매년 130만 명 이상의 생명을 빼앗고 있는 교통사고를 대폭 삭감할 수 있는 자율주행차의 가능성입니다. 이러한 사망 사고의 90% 이상은 휴먼 에러에 의한 것으로, 자율 주행 시스템은 AI 주도의 의사 결정과 ADAS(선진 운전 지원 시스템)를 통해 이것을 배제하는 것을 목표로 하고 있습니다. 고도의 센서 통합으로 복잡한 도시 환경에서의 정확한 네비게이션이 가능하게 되는 한편, 5G를 이용한 V2X(Vehicle-to-Everything) 통신은 실시간 교통 정보와 교통 안전을 확보합니다. 2050년까지 도시 인구가 크게 증가할 것으로 예상되는 가운데 자율주행차는 스마트시티 인프라 개발에 있어 매우 중요한 역할을 하며 지속가능하고 효율적인 교통 솔루션을 촉진하고 있습니다.

제품 유형별로 보면 시장에는 컴팩트 SUV, 미드사이즈 SUV, 고급 SUV가 포함되어 있습니다. SUV와 고급 모델은 2024년 시장의 43% 이상을 차지했으며, 2034년에는 2조 달러를 돌파할 것으로 보입니다. 널찍한 디자인은 편안함을 해치지 않으면서 LiDAR, RADAR, AI 기반 소프트웨어 등 최첨단 자율주행 기술을 탑재했습니다. 이러한 자동차는 고도의 안전성과 개인화된 운전 경험에 대한 투자를 마다하지 않는, 기술에 정통한 얼리 어답터에게 어필합니다. 게다가 SUV는 가족용이나 오프로드용으로 높은 기능성을 유지하고 있어 자율주행 분야에서의 채용을 더욱 뒷받침하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 1조 7,000억 달러 |

| 예측 금액 | 3조 9,000억 달러 |

| CAGR | 8.6% |

추진력에 관해서는 자율주행차는 내연기관차(ICE), 하이브리드차, 전기자동차로 분류됩니다. 전기차는 자율주행 시스템과의 매끄러운 통합이 주된 이유로 2024년 45%의 시장 점유율을 차지했습니다. EV는 집중형 전자 아키텍처와 연결 기능을 갖추고 있어 자율주행 기능을 지원하는 데 있어 당연한 우위를 가지고 있습니다. 세계 각국의 정부는, 세제 혜택, 보조금, 충전 인프라의 확충을 통해서 EV의 채용을 계속 지지하고 있어 차세대의 자율 주행 차량을 개발하는 자동차 제조업체에게 EV는 바람직한 선택사항이 되고 있습니다.

자율주행 레벨에는 L1에서 L5까지 있으며, 2024년에는 L1이 7,061억 달러를 차지했습니다. 어댑티브 크루즈 컨트롤과 레인 키핑 어시스턴스 등 L1 기능은 운전자 감시를 유지하면서 운전 안전성을 높입니다. 이러한 기술은 비용 효율이 뛰어나 다양한 차량 부문에서 널리 이용할 수 있습니다. 자동 긴급제동을 포함한 기본적인 운전자 보조 기능을 의무화하는 규제 요건의 증가는 L1 시스템의 수요를 지속적으로 촉진해 시장에서의 존재감을 확고히 하고 있습니다.

자율주행차의 용도는 개인사용, 공유모빌리티, 물류, 공공수송에 이릅니다. 물류 및 배송 분야가 예측 기간 중 CAGR 14%로 가장 빠른 성장이 예상되고 있습니다. 개인이 사용하는 자율주행차는 편의성을 높여 승객이 이동 중에 기타 활동에 종사할 수 있도록 합니다. 공유 모빌리티 서비스는 자율주행 택시를 점차 통합해 도시교통 효율을 높이고 있습니다. 비용 저하 및 경제적 접근성 향상으로 자율주행차의 개인 소유는 더욱 확산되고 있습니다.

자율주행차 시장은 북미가 25%의 점유율을 차지했으며, 미국은 2024년에 3,760억 달러의 수익을 올렸습니다. 이 지역은 자율주행차 기술 혁신으로 선도하고 있으며, 첨단 기술 기업들이 AI, 센서 기술, 커넥티비티의 진보를 개척하고 있습니다. 유리한 정부 규제 및 지속적인 정책 지원이 시장 확대를 더욱 가속화하며 자율주행 기술의 세계적 리더로서의 북미 위상을 확고히 하고 있습니다.

목차

제1장 조사 방법 및 조사 범위

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정 및 계산

- 기준 연도 산출

- 시장 추계 주요 동향

- 예측 모델

- 1차 조사 및 검증

- 시장 범위 및 정의

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 원재료 공급자

- 부품 공급자

- 제조업체

- 기술 제공업체

- 최종 용도

- 이익률 분석

- 공급자의 상황

- 기술 및 혁신의 전망

- 특허 분석

- 규제 상황

- 가격 동향

- 영향요인

- 성장 촉진요인

- 인공지능 및 센서의 기술적 진보

- 안전기능 강화 수요

- 공유 모빌리티 및 라이드 헤일링 서비스 수요 증가

- 전자상거래 및 자율 배송 수요 증가

- 환경 의식의 고조 및 지속가능성에 대한 주목

- 업계의 잠재적 위험 및 과제

- 규제 및 법적 장애물

- 높은 개발 비용

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서문

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계 및 예측 : 자동화 레벨별(2021-2034년)

- 주요 동향

- L1

- L2

- L3

- L4

- L5

제6장 시장 추계 및 예측 : 자동차별(2021-2034년)

- 주요 동향

- 콤팩트카

- 중형차

- SUV 및 고급차

제7장 시장 추계 및 예측 : 추진별(2021-2034년)

- 주요 동향

- ICE

- 전기자동차

- 하이브리드 자동차

제8장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 퍼스널 유스

- 공유 모빌리티

- 물류 및 배송

- 공공 수송

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- Audi(Volkswagen Group)

- BMW

- BYD(Build Your Dreams)

- Cruise(General Motors)

- Ford Motor Company

- Honda

- Hyundai Motor Group

- Lucid Motors

- Mercedes-Benz(Daimler AG)

- Motional Inc

- Navya

- Nissan

- Stellantis

- Tesla

- Toyota

- Volkswagen

- Volvo Cars

- Waymo(Alphabet Inc.)

- Waymo LLC

- Zoox

The Global Self-Driving Cars Market, valued at USD 1.7 trillion in 2024, is expected to expand at a CAGR of 8.6% from 2025 to 2034. The primary factor fueling this growth is the potential of autonomous vehicles to drastically reduce road accidents, which claim over 1.3 million lives worldwide each year, as reported by the World Health Organization. More than 90% of these fatalities result from human error, which autonomous systems aim to eliminate through AI-driven decision-making and advanced driver-assistance technologies. The integration of sophisticated sensors allows precise navigation in complex urban environments, while 5G-powered vehicle-to-everything (V2X) communication ensures real-time traffic updates and road safety. With urban populations projected to rise significantly by 2050, autonomous vehicles are playing a pivotal role in the development of smart city infrastructure, promoting sustainable and efficient transportation solutions.

By product type, the market includes compact, mid-size, and luxury SUVs. SUVs and luxury models captured over 43% of the market in 2024 and are set to surpass USD 2 trillion by 2034. Their spacious design accommodates cutting-edge autonomous technology such as LiDAR, RADAR, and AI-based software without compromising comfort. These vehicles appeal to tech-savvy early adopters willing to invest in advanced safety and personalized driving experiences. Additionally, SUVs remain highly functional for family and off-road use, further boosting their adoption within the autonomous sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Trillion |

| Forecast Value | $3.9 Trillion |

| CAGR | 8.6% |

In terms of propulsion, self-driving vehicles are classified into internal combustion engine (ICE), hybrid, and electric models. Electric vehicles held a 45% market share in 2024, largely due to their seamless integration with autonomous systems. EVs have a natural advantage in supporting autonomous driving features, given their centralized electronic architecture and connectivity capabilities. Governments worldwide continue to push EV adoption through tax benefits, subsidies and expanded charging infrastructure, making them a preferred choice for automakers developing next-generation autonomous fleets.

Autonomy levels range from L1 to L5, with L1 accounting for USD 706.1 billion in 2024. L1 features, such as adaptive cruise control and lane-keeping assistance, enhance driving safety while maintaining driver oversight. These technologies are cost-effective to implement, making them widely available across various vehicle segments. Growing regulatory requirements mandating basic driver-assistance features, including automatic emergency braking, continue to drive demand for L1 systems, ensuring their strong market presence.

Autonomous vehicle applications span personal use, shared mobility, logistics, and public transport. The logistics and delivery sector is expected to witness the fastest growth, with a 14% CAGR during the forecast period. Personal-use autonomous vehicles provide enhanced convenience, enabling passengers to engage in other activities while traveling. Shared mobility services are gradually integrating autonomous taxis, improving urban transportation efficiency. With declining costs and increasing financial accessibility, personal ownership of self-driving cars is becoming more widespread.

North America dominates the self-driving cars market, holding a 25% share, with the United States generating USD 376 billion in revenue in 2024. The region leads in autonomous vehicle innovation, with tech firms pioneering advancements in AI, sensor technology, and connectivity. Favorable government regulations and ongoing policy support further accelerate market expansion, solidifying North America's position as a global leader in self-driving technology.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component suppliers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Price trend

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Technological advancements in artificial intelligence and sensors

- 3.6.1.2 Demand for enhanced safety features

- 3.6.1.3 Increasing demand for shared mobility and ride-hailing services

- 3.6.1.4 Rising e-commerce and demand for autonomous delivery

- 3.6.1.5 Growing environmental awareness and focus on sustainability

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Regulatory and legal hurdles

- 3.6.2.2 High development costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Level of Autonomy, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 L1

- 5.3 L2

- 5.4 L3

- 5.5 L4

- 5.6 L5

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Compact cars

- 6.3 Mid-size cars

- 6.4 SUVs & luxury cars

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

- 7.4 Hybrid Vehicle

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Personal use

- 8.3 Shared mobility

- 8.4 Logistics & delivery

- 8.5 Public transport

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Audi (Volkswagen Group)

- 10.2 BMW

- 10.3 BYD (Build Your Dreams)

- 10.4 Cruise (General Motors)

- 10.5 Ford Motor Company

- 10.6 Honda

- 10.7 Hyundai Motor Group

- 10.8 Lucid Motors

- 10.9 Mercedes-Benz (Daimler AG)

- 10.10 Motional Inc

- 10.11 Navya

- 10.12 Nissan

- 10.13 Stellantis

- 10.14 Tesla

- 10.15 Toyota

- 10.16 Volkswagen

- 10.17 Volvo Cars

- 10.18 Waymo (Alphabet Inc.)

- 10.19 Waymo LLC

- 10.20 Zoox