|

시장보고서

상품코드

1698268

전기 상용차 트랙션 모터 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Electric Commercial Vehicle Traction Motor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

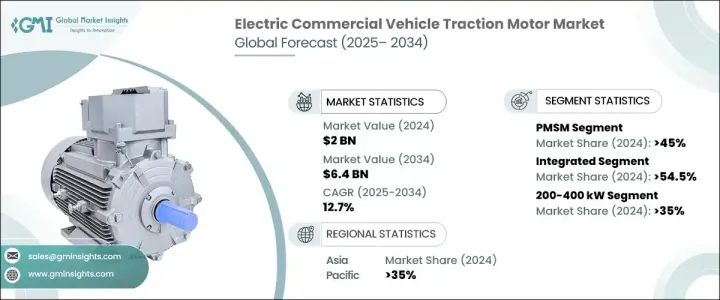

세계의 전기 상용차 트랙션 모터 시장 규모는 2024년에 20억 달러로 평가되었으며, 2025-2034년 CAGR 12.7%로 성장할 것으로 예측됩니다.

이 산업은 효율, 내구성, 성능의 진보에 의해 급속하게 진화하고 있습니다. 영구 자석 동기 모터(PMSM), 스위치드 릴럭턴스 모터(SRM), 래터럴 플럭스 모터등의 신흥 모터 기술은, 낭비를 최소화하면서 에너지 출력을 향상시키고 있습니다. 고도의 냉각 시스템을 갖춘 탄화규소(SiC) 인버터는, 에너지 사용을 한층 더 최적화해, 주행 거리를 늘리고, 전체적인 성능을 향상시키고 있습니다. 경량 소재 및 콤팩트 설계에 의해 토크 밀도가 향상되어 대형 상용차에 이상적인 모터가 되고 있습니다. 한편, 급속 충전 인프라 및 배터리 효율의 개발에 의해, 도시지역에서도 장거리 수송 용도에서도 전기 트럭 및 버스의 실용성이 향상되고 있습니다. 충전 스테이션의 증가로 플리트 오퍼레이터의 대기 시간이 크게 단축되고 있습니다.

전기 상용차 트랙션 모터 시장은 모터 유형, 차축 아키텍처, 차량 범주, 정격 출력에 의해 구분됩니다. PMSM은 높은 에너지 효율, 컴팩트한 구조, 우수한 출력으로 2024년 총 매출의 45% 이상을 차지했습니다. 이러한 모터는 뛰어난 토크 밀도와 회생 브레이크를 제공하기 때문에, 전기 트럭이나 버스에 바람직한 선택사항이 되고 있습니다. 차축 아키텍처별로는 일체형 e-액슬이 2024년 매출 점유율 54.5%로 시장을 선도했습니다. 이러한 시스템은 모터, 인버터, 변속기를 하나의 유닛으로 통합하여 무게를 줄이고 에너지 효율을 높이며 전기 트럭과 밴 내 공간을 최적화합니다. 센트럴 드라이브 유닛은 높은 토크와 내구성이 중요한 헤비 듀티 용도에는 여전히 필수적입니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 20억 달러 |

| 예측 금액 | 64억 달러 |

| CAGR | 12.7% |

차량 카테고리별로는 엄격한 배출가스 규제와 차량 전동화의 진전에 따라 중형 및 대형 트럭이 2024년 시장을 독점했습니다. 이러한 트럭에는, 엄격한 부하 하에서도 효율을 유지할 수 있는 강력하고 고토크의 트랙션 모터가 필요합니다. 고도의 열 관리 및 모듈식 모터 설계로 신뢰성이 더욱 향상되어 총 소유 비용이 절감되고 있습니다. 보급이 진행됨에 따라, 제조업체는 다양한 상용 EV 부문을 원활하게 통합하기 위한 스케일러블한 모터 플랫폼을 개발하고 있습니다.

정격 출력 베이스에서는 200-400kW의 부문이 2024년에 최대의 점유율을 차지하며, 총 매출의 35% 이상을 차지했습니다. 이 레인지의 모터는 장거리 전기 트럭 및 버스에 최적으로, 지속 가능한 물류 및 화물 수송을 서포트합니다. 100kW 미만의 모터는 주로 소형 전기 밴이나 도시 지역의 배송 차량에 사용되고, 100-200kW의 모터는 소형 및 중형 트럭에 널리 사용됩니다. 400kW 이상의 카테고리는, 수소 연료 전지차 및 전동 채굴 트럭 등, 고성능 용도로 확보되어 있습니다.

아시아태평양은 2024년 세계 시장의 35% 이상을 차지했으며, 최대 점유율을 차지했습니다. 중국이 지배적인 기업으로 대두하여 2034년에는 18억 달러에 이를 것으로 예측되며, 정책적 인센티브, 기술의 진보, 배터리 및 희토류 재료의 생산에 있어서 아성이 그 연료가 되고 있습니다.

목차

제1장 조사 방법 및 조사 범위

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정 및 계산

- 기준 연도 산출

- 시장 추계 주요 동향

- 예측 모델

- 1차 조사 및 검증

- 시장 범위 및 정의

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 모터 제조업체

- 배터리 제조업체

- OEM 제조업체

- 파워 일렉트로닉스 제조업체

- 충전 인프라 공급자

- 공급자의 상황

- 이익률 분석

- 기술 및 혁신의 전망

- 특허 분석

- 주요 뉴스 및 이니셔티브

- 신흥기업의 자금조달 분석

- 규제 상황

- 영향요인

- 성장 촉진요인

- 전기상용차(ECVS)의 채용 증가

- 엄격한 배출규제 및 지속가능성 목표

- 모터 효율 및 기술의 진보

- 충전 인프라 확대 및 배터리의 진보

- 업계의 잠재적 위험 및 과제

- 플릿 오퍼레이터에게 높은 초기 비용 및 한정된 ROI

- 공급망 및 원재료의 제약

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서문

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계 및 예측 : 모터별(2021-2034년)

- 주요 동향

- AC 유도 모터

- 영구자석 동기모터(PMSM)

- 스위치 드릴럭턴스 모터(SRM)

- DC 모터

제6장 시장 추계 및 예측 : 자동차별(2021-2034년)

- 주요 동향

- 픽업 트럭

- 중형 및 대형 트럭

- 밴

- 버스

제7장 시장 추계 및 예측 : 정격 출력별(2021-2034년)

- 주요 동향

- 100kW 미만

- 100-200 kW

- 200-400 kW

- 400kW 이상

제8장 시장 추계 및 예측 : 차축 아키텍처별(2021-2034년)

- 주요 동향

- 통합형

- 센트럴 드라이브 유닛

제9장 시장 추계 및 예측 : 트랜스미션별(2021-2034년)

- 주요 동향

- 싱글 스피드 구동

- 멀티 스피드 드라이브

제10장 시장 추계 및 예측 : 설계별(2021-2034년)

- 주요 동향

- 레이디얼 자속

- 축방향 자속

제11장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카

- 사우디아라비아

제12장 기업 프로파일

- ABB

- Allison Transmission

- BorgWarner

- Bosch

- Continental

- Dana

- Danfoss Editron

- General Electric

- Hitachi Automotive

- Magna

- Mitsubishi Electric

- Nidec

- Siemens

- Skoda Transportation

- Toshiba

- Valeo

- Wabtec

- Wolong Electric

- Yaskawa Electric

- ZF

The Global Electric Commercial Vehicle Traction Motor Market was valued at USD 2 billion in 2024 and is projected to grow at a CAGR of 12.7% from 2025 to 2034. The industry is rapidly evolving, driven by advancements in efficiency, durability, and performance. Emerging motor technologies, including permanent magnet synchronous motors (PMSM), switched reluctance motors (SRM), and lateral flux motors, are enhancing energy output while minimizing waste. Silicon carbide (SiC) inverters with advanced cooling systems are further optimizing energy use, extending driving range, and improving overall performance. Lightweight materials and compact designs are increasing torque density, making motors ideal for heavy-duty commercial vehicles. Meanwhile, developments in fast-charging infrastructure and battery efficiency are improving the practicality of electric trucks and buses for both urban and long-haul applications. The increasing number of charging stations is significantly reducing wait times for fleet operators.

The electric commercial vehicle traction motor market is segmented by motor type, axle architecture, vehicle category, and power rating. PMSM accounted for over 45% of total revenue in 2024 due to its high energy efficiency, compact structure, and superior power output. These motors offer excellent torque density and regenerative braking, making them the preferred choice for electric trucks and buses. On the basis of axle architecture, integrated e-axles led the market with a 54.5% revenue share in 2024. These systems integrate motors, inverters, and transmissions into a single unit, reducing weight, increasing energy efficiency, and optimizing space within electric trucks and vans. Central drive units remain essential for heavy-duty applications where high torque and durability are critical.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 12.7% |

By vehicle category, medium and heavy-duty trucks dominated the market in 2024, driven by strict emissions regulations and increasing fleet electrification. These trucks require powerful, high-torque traction motors that maintain efficiency under demanding loads. Advanced thermal management and modular motor designs are further improving reliability and reducing the total cost of ownership. As adoption grows, manufacturers are developing scalable motor platforms for seamless integration across various commercial EV segments.

Based on power rating, the 200-400 kW segment held the largest share in 2024, contributing over 35% of total revenue. Motors in this range are ideal for long-haul electric trucks and buses, supporting sustainable logistics and freight transport. Motors below 100 kW primarily serve compact electric vans and urban delivery vehicles, while 100-200 kW motors are widely used in light and medium-duty trucks. The above 400 kW category is reserved for high-performance applications, including hydrogen fuel cell-powered vehicles and electric mining trucks.

The Asia Pacific region held the largest share of the market in 2024, accounting for over 35% of the global industry. China emerged as the dominant player, projected to reach USD 1.8 billion by 2034, fueled by policy incentives, technological advancements, and its stronghold in battery and rare-earth material production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Motor manufacturers

- 3.1.2 Battery suppliers

- 3.1.3 OEMs

- 3.1.4 Power electronics suppliers

- 3.1.5 Charging infrastructure providers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Startup funding analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of electric commercial vehicles (ECVS)

- 3.9.1.2 Stringent emission regulations & sustainability goals

- 3.9.1.3 Advancements in motor efficiency & technology

- 3.9.1.4 Expansion of charging infrastructure & battery advancements

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial cost & limited ROI for fleet operators

- 3.9.2.2 Supply chain & raw material constraints

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Motor, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 AC induction motors

- 5.3 Permanent magnet synchronous motors (PMSM)

- 5.4 Switched reluctance motors (SRM)

- 5.5 DC motors

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Pickups trucks

- 6.3 Medium and heavy-duty trucks

- 6.4 Vans

- 6.5 Buses

Chapter 7 Market Estimates & Forecast, By Power Rating, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Less than 100 kW

- 7.3 100-200 kW

- 7.4 200-400 kW

- 7.5 Above 400 kW

Chapter 8 Market Estimates & Forecast, By Axle Architecture, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Integrated

- 8.3 Central drive unit

Chapter 9 Market Estimates & Forecast, By Transmission, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Single-speed drive

- 9.3 Multi-speed drive

Chapter 10 Market Estimates & Forecast, By Design, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Radial flux

- 10.3 Axial flux

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 ABB

- 12.2 Allison Transmission

- 12.3 BorgWarner

- 12.4 Bosch

- 12.5 Continental

- 12.6 Dana

- 12.7 Danfoss Editron

- 12.8 General Electric

- 12.9 Hitachi Automotive

- 12.10 Magna

- 12.11 Mitsubishi Electric

- 12.12 Nidec

- 12.13 Siemens

- 12.14 Skoda Transportation

- 12.15 Toshiba

- 12.16 Valeo

- 12.17 Wabtec

- 12.18 Wolong Electric

- 12.19 Yaskawa Electric

- 12.20 ZF