|

시장보고서

상품코드

1698530

자발적 탄소배출권 시장 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Voluntary Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

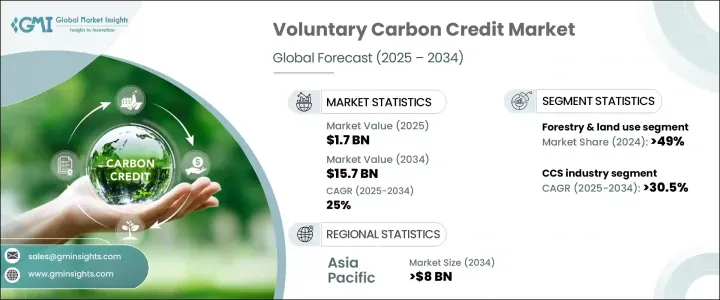

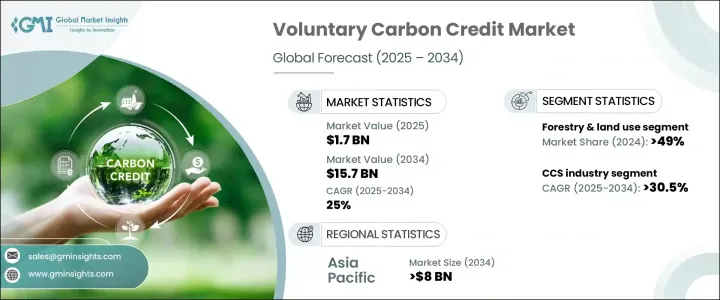

2024년 17억 달러로 평가되었으며, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 25%로 성장할 것으로 예상됩니다.

Net-Zero Emission의 성취와 지속가능성 평가의 향상에 대한 기업의 헌신 증가가 다양한 섹터에 걸친 다양한 크레딧 제도의 개발을 뒷받침하고 있습니다 기업은 사업 활동에 의한 배출을 상쇄하기 위해 탄소배출권을 적극적으로 구입하고 있으며, 시장 성장을 가속하고 있습니다. 컴플라이언스의 틀에 통합된 크레딧은 시장의 유동성, 신뢰성 및 수요를 향상시키고 가격 안정성과 기업 진입에 기여하는 기관 투자자를 모으고 있습니다.

현재 투자자의 신뢰를 높이고 기업의 명성을 높이기 위해 ESG 전략에 탄소 크레딧을 통합하는 기업이 상당히 증가하고 있습니다. 로 감소했지만 업계 예측은 기술 진보와 탄소 오프셋 계산 방법의 개선으로 강력한 회복을 예상하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 17억 달러 |

| 예측 금액 | 157억 달러 |

| CAGR | 25% |

세계에는 기업이 자발적으로 배출량을 오프셋하고 지속가능성의 목표를 따르도록 장려하는 틀이 몇 가지 있습니다.

시장은 임업 및 토지 이용, 농업, 재생 가능 에너지, 탄소 포집 및 저장, 가정 및 지역사회, 화학 프로세스, 공업 및 상업, 수송, 폐기물 관리 등 최종 용도에 근거한 복수의 부문으로 분류됩니다. 2024년에는 산림 및 토지 이용이 시장 점유율의 49% 이상을 차지하고 향후에도 성장이 전망됩니다.

2034년까지 연평균 복합 성장률(CAGR) 30.5% 이상의 성장이 예상되고 있습니다. 국가 포트폴리오에 있어서의 재생 가능 에너지원의 비율 증가에 의해 2034년까지 30억 달러 이상에 달할 것으로 예상됩니다.

미국에서 자발적 탄소배출권 시장은 2022년 2억 달러에서 2024년 4억 달러로 성장했습니다. 블록체인 기술에 의해 지원되는 탄소배출권 거래의 투명성 향상은 시장의 신뢰를 강화하고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 시장 범위와 정의

- 시장 추정 및 예측 파라미터

- 예측 계산

- 데이터 소스

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 전략적 전망

- 혁신과 지속가능성의 전망

제5장 시장 규모와 예측 : 최종 용도별, 2021년-2034년

- 주요 동향

- 농업

- 탄소 포집 및 저장

- 화학 공정

- 가정 및 커뮤니티

- 공업 및 상업

- 임업 및 토지 이용

- 신재생에너지

- 폐기물 관리

- 기타

제6장 시장 규모와 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 불가리아

- 루마니아

- 네덜란드

- 스위스

- 아시아태평양

- 중국

- 인도

- 인도네시아

- 태국

- 중동 및 아프리카

- 튀르키예

- 케냐

- 나이지리아

- 남아프리카

- 라틴아메리카

- 브라질

- 칠레

- 페루

제7장 기업 프로파일

- 3Degrees

- ALLCOT

- Atmosfair

- CarbonClear

- ClimeCo

- Climate Impact Partners

- EcoAct

- Ecosecurities

- Microsoft

- PwC

- Shell

- South Pole

- TerraPass

- The Carbon Collective Company

- The Carbon Trust

- VERRA

The Global Voluntary Carbon Credit Market, valued at USD 1.7 billion in 2024, is projected to expand at a CAGR of 25% from 2025 to 2034. Growing corporate commitments to achieving net-zero emissions and improving sustainability ratings have driven the development of diverse credit systems across different sectors. Companies are actively purchasing carbon credits to offset emissions from business operations, reinforcing market growth. The integration of voluntary carbon credits into compliance frameworks has enhanced market liquidity, credibility, and demand, attracting institutional investors who contribute to price stability and corporate participation. This integration is facilitating increased investment in high-quality projects, boosting global efforts to reduce carbon footprints, and accelerating the industry's expansion.

A significant number of enterprises now incorporate carbon credits into their ESG strategies to strengthen investor confidence and enhance business reputations. While the voluntary carbon credit market saw a decline from USD 1.9 billion in 2022 to USD 1.7 billion in 2024, industry projections indicate a strong rebound driven by technological advancements and improved methods for calculating carbon offsets. Innovations that improve accessibility and traceability are expected to support sustained growth over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $15.7 Billion |

| CAGR | 25% |

Several frameworks worldwide encourage businesses to voluntarily offset emissions and align with sustainability objectives. These guidelines emphasize accountability and transparency, prompting more organizations to engage in carbon credit markets. Additionally, various approaches outside government regulations are promoting voluntary participation in emissions reduction programs, expanding the market's scope.

The market is categorized into multiple segments based on end use, including forestry and land use, agriculture, renewable energy, carbon capture and storage, household and community, chemical processes, industrial and commercial, transportation, and waste management. In 2024, forestry and land use accounted for more than 49% of the market share, with expectations of continued growth. Expanding afforestation and reforestation projects worldwide have increased the demand for carbon offsets, with environmental policies further reinforcing these initiatives.

The carbon capture and storage sector within the voluntary carbon credit market is anticipated to grow at a CAGR exceeding 30.5% through 2034. Rising investments in carbon mitigation and advancements in storage technologies are key factors fueling this expansion. The renewable energy sector is also expected to surpass USD 3 billion by 2034, driven by the growing share of renewable sources in national energy portfolios. As the global energy mix shifts toward sustainable alternatives, the demand for carbon credits is expected to rise significantly.

In the United States, the voluntary carbon credit market grew from USD 200 million in 2022 to USD 400 million in 2024. Increasing net-zero commitments and consumer preference for sustainable products are driving corporate adoption of carbon credit programs. Enhanced transparency in carbon credit trading, supported by blockchain technology, has strengthened trust in the market. Additionally, investments in direct air capture and carbon removal initiatives are fostering innovation, further supporting the voluntary carbon credit industry's growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By End Use, 2021 – 2034 (Million Credits, USD Billion)

- 5.1 Key trends

- 5.2 Agriculture

- 5.3 Carbon capture & storage

- 5.4 Chemical process

- 5.5 Household & community

- 5.6 Industrial & commercial

- 5.7 Forestry & land use

- 5.8 Renewable energy

- 5.9 Waste management

- 5.10 Others

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (Million Credits, USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Bulgaria

- 6.3.2 Romania

- 6.3.3 Netherlands

- 6.3.4 Switzerland

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Indonesia

- 6.4.4 Thailand

- 6.5 Middle East & Africa

- 6.5.1 Turkey

- 6.5.2 Kenya

- 6.5.3 Nigeria

- 6.5.4 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Chile

- 6.6.3 Peru

Chapter 7 Company Profiles

- 7.1 3Degrees

- 7.2 ALLCOT

- 7.3 Atmosfair

- 7.4 CarbonClear

- 7.5 ClimeCo

- 7.6 Climate Impact Partners

- 7.7 EcoAct

- 7.8 Ecosecurities

- 7.9 Microsoft

- 7.10 PwC

- 7.11 Shell

- 7.12 South Pole

- 7.13 TerraPass

- 7.14 The Carbon Collective Company

- 7.15 The Carbon Trust

- 7.16 VERRA