|

시장보고서

상품코드

1698583

C암 시장 - 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)C-arm Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

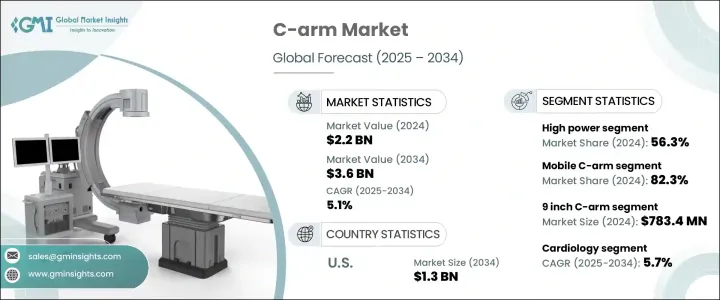

세계의 C암 시장은 2024년 22억 달러로 평가되었으며, 2025년부터 2034년까지 5.1%의 연평균 복합 성장률(CAGR)로 성장할 것으로 예측되고 있습니다.

C암은 이동식과 고정식 모두 있으며 의료 치료를 위해 실시간 X 선 영상을 제공하도록 설계된 고급 이미징 장치입니다. 이러한 장치는 성형외과, 심장병학, 종양학 등 다양한 전문분야에서 수술, 진단, 인터벤셔널 라디올로지에서 중요한 역할을 담당하고 있습니다.

만성 질환이 만연함에 따라 진단, 치료, 외과적 개입에 있어서의 고해상도 화상의 필요성은 계속 확대되고 있습니다. 영상 화질, 사용 편의성, 휴대성 향상은 시장 확대에 더욱 기여하고 있습니다.

| 시장 규모 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 22억 달러 |

| 예측 금액 | 36억 달러 |

| CAGR | 5.1% |

제품 유형별로 모바일 C 암이 2024년 세계 시장에서 82.3%의 점유율을 차지했습니다. 영상 품질 향상, 조작성 개선, 사용자 친화적인 설계가 보급에 기여하고 있습니다. 또한 이러한 시스템은 외상 사례, 정형외과 수술, 투시 처치 등 다양한 용도에 실시간으로 이미지를 제공하기 때문에 수요를 밀어 올리고 시장의 우위성을 확고하게 하고 있습니다.

발전기의 출력을 기반으로 시장은 고출력 부문와 저출력 부문으로 분류됩니다. 이러한 시스템은 고밀도 조직 및 복잡한 해부학적 구조를 영상화할 때 특히 유용하며, 복잡한 의료 처치 시의 정확성을 보장합니다.

이 시장은 이미지 인텐시파이어 유형별로 세분화되어 있어 2024년에는 9인치 C암 카테고리가 7억 8,340만 달러로 최고 부문이었습니다. 이러한 시스템은 휴대성과 영상 해상도의 최적의 균형을 제공하며 수술실과 외래 센터에서의 치료에 매우 적합합니다.

다양한 의료 용도 중에서 심장병학은 2034년까지 5.7%의 연평균 복합 성장률(CAGR)로 가장 빠르게 성장할 것으로 예측되고 있습니다. 실시간 이미징은 혈관 조영이나 스텐트 유치와 같은 절차에 필수적이며, 이 분야에서 C암 수요 증가를 견인하고 있습니다.

최종 용도별로 병원은 2024년 매출액 12억 달러로 시장을 독점하고 있습니다. 많은 예산과 첨단 의료 기술 접근은 이러한 영상 처리 장비의 신속한 도입과 통합을 가능하게 하고 있습니다.

미국의 C암 시장은 정형외과, 심장병학, 신경학 분야에서의 저침습 수술 수요 증가에 견인되어 2034년까지 13억 달러에 이를 것으로 예상됩니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 수술 건수 증가

- 만성 질환 증가

- C암 장치의 기술적 진보

- 낮은 침습 수술에 대한 수요 증가

- 업계의 잠재적 위험 및 과제

- C암 기기와 관련된 고비용

- 숙련된 헬스케어 전문가의 부족

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술 동향

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 유형별, 2021-2034년

- 주요 동향

- 고정식 C암

- 모바일 C암

제6장 시장 추계 및 예측 : 발전기 전력별, 2021-2034년

- 주요 동향

- 고전력

- 저전력

제7장 시장 추계 및 예측 : 이미지 인텐시파이어 유형별, 2021-2034년

- 주요 동향

- 9인치 C암

- 12인치 C암

- 4/6인치 C 암

- 기타 이미지 인텐시파이어 유형

제8장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 정형외과 및 외상

- 순환기

- 신경

- 소화기

- 종양

- 치과

- 기타 용도

제9장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 병원

- 진단센터

- 기타 최종 용도

제10장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제11장 기업 프로파일

- Canon

- Fujifilm

- GE Healthcare

- Genoray

- Hologic

- Philips

- Perlove Medical

- Shimadzu Corporation

- Siemens Healthineers

- StrenMed

- Trivitron Healthcare

- Turner Imaging Systems

- UMG/DEL Medical

- Villa Sistemi Medicali

- Ziehm Imaging

The Global C-Arm Market, valued at USD 2.2 billion in 2024, is set to grow at a CAGR of 5.1% from 2025 to 2034. A C-arm is an advanced imaging device, available in both mobile and fixed configurations, designed to deliver real-time X-ray imaging for medical procedures. These devices play a critical role in surgeries, diagnostics, and interventional radiology across various specialties, including orthopedics, cardiology, and oncology. The rising incidence of chronic diseases, fueled by aging populations, sedentary lifestyles, and poor dietary habits, is driving demand for advanced imaging solutions.

As chronic conditions become more prevalent, the need for high-resolution imaging in diagnosis, treatment, and surgical interventions continues to expand. C-arm systems facilitate complex procedures such as angioplasty, orthopedic surgeries, and tumor removals by providing clear, real-time visuals that enhance surgical precision and patient outcomes. Advances in imaging quality, ease of use, and portability further contribute to market expansion. Hospitals and surgical centers are increasingly integrating these devices to enhance diagnostic accuracy and treatment efficiency, reinforcing the market's steady growth trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 5.1% |

In terms of product type, mobile C-arms dominated the global market with an 82.3% share in 2024. Their portability enables seamless transport across various hospital departments, making them ideal for facilities where space is constrained and multiple procedures occur in different locations. Enhanced imaging quality, improved maneuverability, and user-friendly designs have contributed to their widespread adoption. These systems also provide real-time imaging for a variety of applications, such as trauma cases, orthopedic surgeries, and fluoroscopic procedures, boosting demand and solidifying their market dominance.

Based on generator power, the market is categorized into high-power and low-power segments. High-power C-arms, which captured a 56.3% share in 2024, are preferred in surgical, orthopedic, and trauma applications due to their ability to deliver high-resolution images critical for accurate diagnoses and treatments. These systems are particularly valuable in imaging dense tissues and complex anatomical structures, ensuring precision during intricate medical procedures. Growing cases of chronic diseases, an aging global population, and advancements in minimally invasive surgeries continue to propel demand for high-power C-arm devices. Their ability to deliver real-time imaging while minimizing radiation exposure makes them a preferred choice in modern healthcare settings.

The market is also segmented by image intensifier type, with the 9-inch C-arm category leading at USD 783.4 million in 2024. These systems offer an optimal balance between portability and imaging resolution, making them highly suitable for procedures in operating rooms and outpatient centers. Their versatility in supporting orthopedic surgeries, vascular interventions, and pain management applications further contributes to their widespread adoption.

Among various medical applications, cardiology is projected to grow at the fastest CAGR of 5.7% through 2034. The increasing prevalence of cardiovascular conditions is fueling the need for advanced imaging systems to facilitate complex interventions. Real-time imaging is essential in procedures like angiography and stent placement, driving the growing demand for C-arms in this segment. The global shift toward minimally invasive cardiology treatments is further accelerating market expansion.

By end use, hospitals dominated the market with USD 1.2 billion in revenue in 2024. As the primary healthcare providers for a vast range of diagnostic and surgical procedures, hospitals are major consumers of C-arm systems. Their higher budgets and access to advanced medical technologies enable faster adoption and integration of these imaging devices. Increasing patient volumes, particularly in emergency departments and critical care units, continue to drive demand, positioning hospitals as the leading segment in the market.

The U.S. C-arm market is on track to reach USD 1.3 billion by 2034, driven by the rising demand for minimally invasive procedures across orthopedic, cardiology, and neurology fields. The widespread adoption of real-time imaging technology is playing a crucial role in enhancing surgical precision and improving patient outcomes across healthcare facilities.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing number of surgical procedures

- 3.2.1.2 Rising prevalence of chronic diseases

- 3.2.1.3 Technological advancements of C-arm machines

- 3.2.1.4 Growing demand for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with C-arm machines

- 3.2.2.2 Dearth of skilled healthcare professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Fixed C-arm

- 5.3 Mobile C-arm

Chapter 6 Market Estimates and Forecast, By Generator Power, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 High power

- 6.3 Low power

Chapter 7 Market Estimates and Forecast, By Image Intensifier Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 9 inch C-arm

- 7.3 12 inch C-arm

- 7.4 4/6 inch C-arm

- 7.5 Other image intensifier types

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Orthopedics and trauma

- 8.3 Cardiology

- 8.4 Neurology

- 8.5 Gastroenterology

- 8.6 Oncology

- 8.7 Dental

- 8.8 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Canon

- 11.2 Fujifilm

- 11.3 GE Healthcare

- 11.4 Genoray

- 11.5 Hologic

- 11.6 Philips

- 11.7 Perlove Medical

- 11.8 Shimadzu Corporation

- 11.9 Siemens Healthineers

- 11.10 StrenMed

- 11.11 Trivitron Healthcare

- 11.12 Turner Imaging Systems

- 11.13 UMG/DEL Medical

- 11.14 Villa Sistemi Medicali

- 11.15 Ziehm Imaging