|

시장보고서

상품코드

1698600

토마토 가공 시장 - 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Tomato Processing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

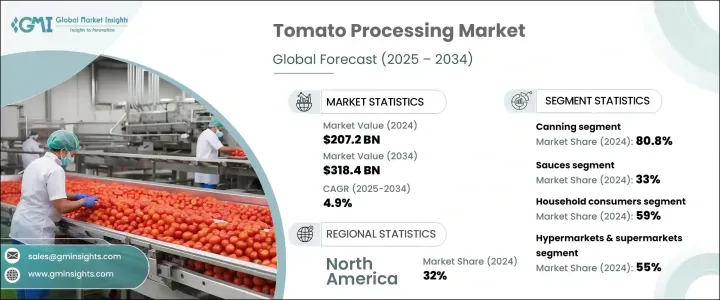

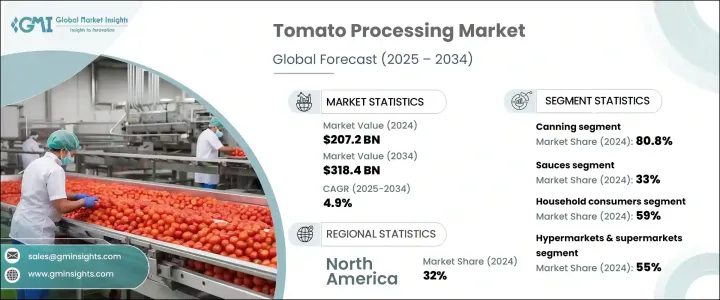

세계의 토마토 가공 시장은 2024년 시장 규모가 2,072억 달러였고, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 4.9%로 성장할 것으로 예측됩니다.

편의성이 높은 식품에 대한 수요 증가와 식품 공급망의 세계화가 이러한 성장을 가속하는 주요 요인입니다. 토마토 가공 식품은 현대의 가정이나 외식 산업에 빠뜨릴 수 없는 것이 되어, 생산과 시장 확대에 박차를 가하고 있습니다. 쉽고 간편한 식사를 요구하는 소비자의 선호도는 페이스트, 소스, 토마토 캔과 같은 제품 수요 급증으로 이어지고 있습니다. 게다가 슈퍼마켓 및 하이퍼마켓, 전자상거래 플랫폼 등 현대적인 소매 확대가 토마토 가공품을 보다 친숙해지게 하고, 시장의 성장을 더욱 뒷받침하고 있습니다. 도시화와 식생활의 진화로 소비자의 행동은 포장식품과 조리된 식품으로 이동하고 시장의 기세는 점점 강해지고 있습니다.

토마토 가공 산업에는 파스타, 토마토캔, 다이스컷 토마토, 소스, 케첩, 주스, 퓌레, 농축 토마토, 파우더 등 폭넓은 제품이 포함되어 있습니다. 그중에서도 소스는 다양한 요리에 폭넓게 사용되어 2024년 시장 점유율의 33%를 차지했습니다. 각 제조업체는 기호의 변화를 이용해, 유기농이나 저염의 선택지를 도입해 건강 지향의 구매층에 어필하고 있습니다. 음식을 준비하기 위해 조리 된 토마토 기반 제품을 사용하기 때문에 여전히 시장 확대에 크게 기여하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 2,072억 달러 |

| 예측 금액 | 3,184억 달러 |

| CAGR | 4.9% |

시장 가공 방법에는 농축, 통조림, 과즙 추출, 건조, 소스 제조, 냉동, 발효가 포함됩니다. 건조와 냉동 같은 방법은 건강 지향의 소비자에게 어필합니다. 농축 공정에서는 토마토 페이스트가 제조되어 다목적 조리 재료로서 도움이 됩니다. 발효 토마토 제품도, 특수한 식품 용도용으로 틈새 시장이 개척됨에 따라 인기를 모으고 있습니다.

시장은 가정용 소비자, 공업용 식품 가공업자, 레스토랑 등의 최종 사용자별로 구분됩니다. 공업 부문과 외식산업은 안정된 고품질 토마토 가공품의 대량 주문이 불가결하므로 확대를 계속하고 있습니다. 음료 부문과 의약품 부문도, 신제품의 혁신에 토마토 추출물을 도입하고 있습니다.

유통 채널에는 하이퍼마켓, 슈퍼마켓, 전문점, 편의점이 포함되어 있으며, 2024년 시장 점유율은 하이퍼마켓 및 슈퍼마켓이 55%로 이 부문을 선도했습니다. 전문 상품은 틈새 시장용으로 유기농과 프리미엄 셀렉션을 제공하고, 편의점은 곧바로 먹을 수 있는 토마토 제품에 중점을 두고 있습니다.

북미는 토마토 가공품의 왕성한 수요에 견인되어 2024년 세계 매출의 32%를 차지해 시장을 선도했습니다. 유럽 시장 확대는 지속가능성에 대한 노력, 유기 제품 수요 및 식품 안전 규제의 엄격화에 의해 추진되고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 시장 범위와 정의

- 기본 추정과 계산

- 예측 계산

- 데이터 소스

- 1차 조사와 검증

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 미래의 전망

- 제조업체

- 유통업체

- 공급자의 상황

- 이익률 분석

- 주요 뉴스

- 규제 상황

- 영향요인

- 성장 촉진요인

- 편의점 음식에 대한 수요 증가

- 식품 공급 체인의 세계화

- 식품 소매 채널 증가

- 업계의 잠재적 위험 및 과제

- 토마토 공급의 계절 변동

- 원재료 가격 변동

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계 및 예측 : 제품별, 2021-2034년

- 주요 동향

- 소스

- 파스타

- 토마토캔

- 케첩

- 주스

- 퓌레

- 다짐

- 농축액

- 소스

- 파우더

- 기타

제6장 시장 추계 및 예측 : 가공 방법별, 2021-2034년

- 주요 동향

- 통조림

- 소스 제조

- 착즙

- 농축

- 건조

- 냉동

- 발효

- 기타

제7장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 가정용 소비자

- 공업용 식품 가공업자

- 음료업계

- 제약업계

- 기타

- 외식 및 푸드서비스

제8장 시장 추계 및 예측 : 유통 채널별, 2021-2034년

- 주요 동향

- 하이퍼마켓 및 슈퍼마켓

- 식품 전문점

- 편의점

- 기타

제9장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제10장 기업 프로파일

- JG Boswell Tomato Company

- Campbell Soup Company

- CFT Group

- ConAgra Brands, Inc

- CONESA Group

- Del Monte Foods, Inc

- Food & Biotech Engineers(India) Pvt. Ltd.

- JBT Corporation

- Kagome Co., Ltd.

- Los Gatos Tomato Products

- Morning Star Company

The Global Tomato Processing Market was valued at USD 207.2 billion in 2024 and is estimated to grow at a CAGR of 4.9% from 2025 to 2034. The increasing demand for convenience foods and the globalization of food supply chains are key factors driving this growth. Processed tomato products have become essential in modern households and the food service industry, fueling production and market expansion. Consumer preference for quick and easy meal solutions has led to a surge in demand for products like pastes, sauces, and canned tomatoes, as these are primary ingredients in ready-to-eat and ready-to-cook meals. Additionally, modern retail expansion, including supermarkets, hypermarkets, and e-commerce platforms, has made processed tomato products more accessible, further driving market growth. Urbanization and evolving dietary habits continue to reinforce the market's momentum, with consumer behavior shifting toward packaged and pre-prepared food options.

The tomato processing industry includes a wide range of products such as pasta, canned tomatoes, diced tomatoes, sauces, ketchup, juice, puree, concentrate, and powder. Among these, sauces held 33% of the market share in 2024 due to their extensive use in various cuisines. As convenience foods gain popularity, ready-to-eat sauces are experiencing heightened demand. Manufacturers are capitalizing on shifting consumer preferences by introducing organic and low-sodium options to appeal to health-conscious buyers. The foodservice industry, including quick-service and casual dining restaurants, remains a significant contributor to market expansion, as these establishments rely on pre-prepared tomato-based products for efficient meal preparation. Innovations in food processing and ingredient formulation further enhance the appeal of this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $207.2 Billion |

| Forecast Value | $318.4 Billion |

| CAGR | 4.9% |

Processing methods in the market include concentration, canning, juice extraction, drying, sauce production, freezing, and fermentation. Canning dominated the market in 2024, accounting for 80.8% of the share, and is expected to grow at a 4.9% CAGR. The convenience and long shelf life of canned tomato products drive their demand among consumers and food service providers. Other methods, such as drying and freezing, attract customers looking for extended product durability, while juice extraction appeals to health-conscious consumers. Concentration processes produce tomato paste, which serves as a versatile cooking ingredient. Fermented tomato products are also gaining traction as niche markets develop for specialized food applications.

The market is segmented by end users, including household consumers, industrial food processors, and restaurants. Household consumers accounted for 59% of the market share in 2024, driven by accessibility and affordability. The industrial sector and food service industry continue to expand, as bulk orders for consistent, high-quality processed tomato products remain essential. The beverage and pharmaceutical sectors are also incorporating tomato extracts into new product innovations. Differentiation through organic and premium offerings plays a crucial role in market competition.

Distribution channels include hypermarkets, supermarkets, specialty stores, and convenience stores, with hypermarkets and supermarkets leading the segment at 55% of the market share in 2024. Competitive pricing and a wide product range contribute to their dominance. Specialty stores cater to niche markets with organic and premium selections, while convenience stores focus on ready-to-eat tomato products. Online sales and direct-to-consumer options continue to rise, offering a broader selection and home delivery convenience.

North America led the market in 2024, accounting for 32% of global revenue, driven by a strong demand for processed tomato products. However, the Asia-Pacific region is expected to witness the highest growth, supported by rising urbanization and increasing disposable incomes. Europe's market expansion is fueled by sustainability initiatives, organic product demand, and stricter food safety regulations. With ongoing advancements in food technology and distribution, the global tomato processing industry is poised for sustained growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for convenience foods

- 3.6.1.2 Globalization of food supply chains

- 3.6.1.3 Increasing food retail channels

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Seasonal variability in tomato supply

- 3.6.2.2 Price volatility of raw materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Sauces

- 5.3 Pasta

- 5.4 Canned tomatoes

- 5.5 Ketchup

- 5.6 Juice

- 5.7 Puree

- 5.8 Diced & chopped

- 5.9 Concentrate

- 5.10 Sauce

- 5.11 Powder

- 5.12 Others

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Canning

- 6.3 Sauce production

- 6.4 Juice extraction

- 6.5 Concentration

- 6.6 Drying

- 6.7 Freezing

- 6.8 Fermentation

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Household consumers

- 7.3 Industrial food processors

- 7.3.1 Beverage industry

- 7.3.2 Pharmaceutical industry

- 7.3.3 Others

- 7.4 Restaurants & foodservice

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Hypermarkets & supermarkets

- 8.3 Food specialty stores

- 8.4 Convenience stores

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 J.G. Boswell Tomato Company

- 10.2 Campbell Soup Company

- 10.3 CFT Group

- 10.4 ConAgra Brands, Inc

- 10.5 CONESA Group

- 10.6 Del Monte Foods, Inc

- 10.7 Food & Biotech Engineers (India) Pvt. Ltd.

- 10.8 JBT Corporation

- 10.9 Kagome Co., Ltd.

- 10.10 Los Gatos Tomato Products

- 10.11 Morning Star Company