|

시장보고서

상품코드

1699401

이식형 의료기기 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Implantable Medical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

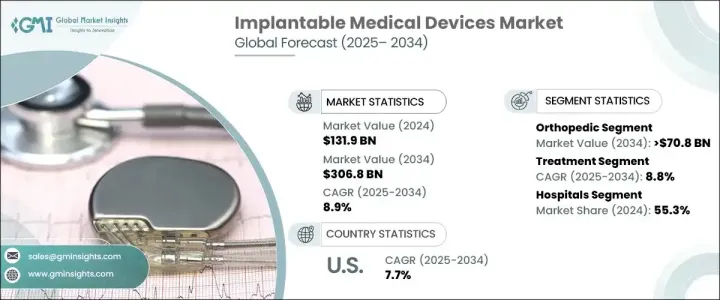

이식형 의료기기 세계 시장은 2024년 1,319억 달러로 평가되었고, 2025-2034년 연평균 8.9% 성장할 것으로 예상됩니다.

이러한 성장에는 심혈관 질환, 신경 질환, 정형외과적 문제와 같은 만성 질환의 유병률 증가가 기여하고 있으며, 이 모든 질환에는 고도의 임플란트 솔루션이 필요합니다. 세계 인구의 고령화에 따라 심박조율기, 신경자극기, 정형외과용 임플란트 및 기타 생명유지장치에 대한 수요가 급증하고 있습니다. 고령층은 노화와 관련된 질병과 만성질환에 걸리기 쉽기 때문에 시장 확대의 큰 원동력이 되고 있습니다.

생체적합성 재료, 무선 기술, 스마트 임플란트 등의 기술 혁신은 이러한 기기의 기능성과 내구성을 향상시키고 있습니다. 최소침습 수술의 부상과 오래 지속되는 솔루션에 대한 환자들의 선호도 또한 이러한 기기들의 채택을 촉진하고 있습니다. 인공지능(AI)과 의료용 사물인터넷(IoMT)의 통합은 새로운 성장의 길을 열어주고 있으며, 더 나은 환자 관리를 위해 실시간 건강 모니터링과 데이터 전송이 가능한 기기들이 등장하고 있습니다. 또한, 3D 프린터를 이용한 임플란트도 급증하고 있으며, 보다 높은 수준의 맞춤화와 수술 결과의 향상을 가능하게 하고 있습니다. 전 세계적으로 의료비 지출이 증가하고 차세대 임플란트에 대한 규제 승인이 완화됨에 따라, 제조업체들은 보다 효율적이고 환자 중심의 기기를 도입하기 위한 연구개발에 집중하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 1,319억 달러 |

| 예상 금액 | 3,068억 달러 |

| CAGR | 8.9% |

시장은 다양한 카테고리로 나뉘는데, 그 중에서도 정형외과용 기기는 큰 폭의 성장이 예상됩니다. 정형외과 분야는 CAGR 5.7%로 성장하여 2034년에는 708억 달러에 달할 것으로 예상됩니다. 골다공증, 골관절염, 골절 증가로 인해 정형외과용 임플란트에 대한 수요가 증가하고 있습니다. 특히 고관절, 무릎관절, 척추 임플란트 등 인공관절 치환술 증가는 시장 확대를 더욱 가속화하고 있습니다. 또한, 교통 사고 및 스포츠 관련 재해로 인한 외상 발생률이 증가함에 따라 전 세계적으로 첨단 정형외과 솔루션의 채택이 증가하고 있습니다.

이식형 의료기기 산업은 다시 치료기기와 진단기기로 나뉩니다. 치료 목적으로 사용되는 기기를 포함한 치료 분야는 CAGR 8.8%로 성장하여 2034년 3,032억 달러에 달할 것으로 예상됩니다. 당뇨병 및 심혈관 질환과 같은 생활습관병 증가로 인해 혁신적이고 내구성이 뛰어난 이식형 솔루션에 대한 수요가 증가하고 있습니다. 이러한 기기들은 환자의 결과와 삶의 질을 크게 향상시키기 때문에 널리 채택되고 있습니다.

미국의 임플란트 의료기기 시장은 2024년 548억 달러로 평가되며 2025-2034년 연평균 7.7%의 성장률을 보일 것으로 예측됩니다. 한국은 무선 충전, 소형화, AI 기반 임플란트 혁신이 업계에 혁명을 일으키고 있는 등 기술 발전의 세계 리더로 자리매김하고 있습니다. 실시간 데이터와 개인화된 치료 옵션을 제공하는 스마트 임플란트는 의료 서비스 제공업체들 사이에서 인기를 끌고 있습니다. 또한, 3D 프린팅 기술은 개인 맞춤형 임플란트 제조에 변화를 가져와 수술의 정확성을 향상시키고 있습니다. 지속적인 R&D 투자와 탄탄한 의료 인프라를 통해 미국은 임플란트 의료기기 혁신의 최전선에서 계속 선두를 유지할 준비가 되어 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 대한 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크&과제

- 성장 가능성 분석

- 규제 상황

- 기술 상황

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

- 향후 시장 동향

- 밸류체인 분석

- 이식형 의료기기 보안 개요

제4장 경쟁 구도

- 서론

- 기업 매트릭스 분석

- 기업 점유율 분석

- 주요 시장 기업 - 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추산 및 예측 : 제품별, 2021년-2034년

- 주요 동향

- 정형외과

- 관절 재건

- 척추 기구

- 외상 고정기구

- 기타 정형외과 제품

- 심장혈관

- 스텐트

- 이식형 심장 제세동기(ICD)

- 페이스메이커

- 심장 재동기화 요법(CRT)

- 심실 보조 장치

- 삽입형 심장 모니터(ICM(이미지 칼라 매칭))

- 기타 심장혈관 관련 제품

- 치과

- 크라운 및 어버트먼트

- 치과 임플란트

- 기타 치과 제품

- 신경

- 뇌심부 자극 기기

- 기타 신경 제품

- 안과

- 안내 렌즈 및 녹내장 임플란트

- 기타 안과 제품

- 성형 외과

- 유방 임플란트

- 둔부 임플란트

- 기타 제품

제6장 시장 추산 및 예측 : 유형별, 2021년-2034년

- 주요 동향

- 치료

- 진단

제7장 시장 예측 : 유형별 시장 추산·예측 : 디바이스별, 2021년-2034년

- 주요 동향

- 스태틱/논아크티브/패시브

- 액티브

제8장 시장 추산 및 예측 : 최종 용도별, 2021년-2034년

- 주요 동향

- 병원

- 외래수술센터(ASC)

- 다중전문센터

- 진료소

- 기타 최종 용도

제9장 시장 추산 및 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카공화국

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 개요

- Abbott

- Advanced Bionics

- Alcon

- Allergan

- BAUSCH+LOMB

- BIOTRONIK

- Boston Scientific

- Cochlear

- Demant

- GORE

- HENRY SCHEIN

- Johnson &Johnson

- MED-EL

- Medtronic

- MicroPort

- mindray

- POLYTECH

- smith &nephew

- stryker

- ZIMMER BIOMET

The Global Implantable Medical Devices Market was valued at USD 131.9 billion in 2024 and is projected to grow at a CAGR of 8.9% between 2025 and 2034. This growth is fueled by the increasing prevalence of chronic conditions such as cardiovascular diseases, neurological disorders, and orthopedic issues, all of which require advanced implantable solutions. As the global population ages, the demand for pacemakers, neurostimulators, orthopedic implants, and other life-enhancing devices continues to surge. The elderly demographic remains a significant driver of market expansion, given their higher susceptibility to age-related ailments and chronic conditions.

Technological advancements are further reshaping the implantable medical devices industry, with innovations in biocompatible materials, wireless technology, and smart implants enhancing the functionality and durability of these devices. The rise of minimally invasive procedures and patient preference for long-lasting solutions are also propelling adoption. The integration of artificial intelligence (AI) and the Internet of Medical Things (IoMT) is creating new growth avenues, with devices now capable of real-time health monitoring and data transmission for better patient management. The market is also seeing a surge in 3D-printed implants, allowing for greater customization and improved surgical outcomes. With healthcare spending increasing globally and regulatory approvals easing for next-generation implants, manufacturers are focusing on research and development to introduce more efficient and patient-centric devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $131.9 Billion |

| Forecast Value | $ 306.8 Billion |

| CAGR | 8.9% |

The market is segmented into various categories, with orthopedic devices expected to witness substantial growth. The orthopedic segment is projected to grow at a CAGR of 5.7%, reaching USD 70.8 billion by 2034. Rising cases of osteoporosis, osteoarthritis, and fractures are contributing to the higher demand for orthopedic implants. The increasing number of joint replacement surgeries, particularly hip, knee, and spinal implants, is further accelerating market expansion. Additionally, the growing incidence of traumatic injuries due to road accidents and sports-related mishaps is driving the adoption of advanced orthopedic solutions worldwide.

The implantable medical devices industry is also divided into treatment and diagnostic devices. The treatment segment, which encompasses devices used for therapeutic purposes, is anticipated to grow at a CAGR of 8.8%, reaching USD 303.2 billion by 2034. The increasing prevalence of lifestyle-related diseases, such as diabetes and cardiovascular disorders, is driving demand for innovative and durable implantable solutions. These devices significantly enhance patient outcomes and quality of life, leading to widespread adoption.

U.S. Implantable Medical Devices Market, valued at USD 54.8 billion in 2024, is expected to expand at a CAGR of 7.7% from 2025 to 2034. The country remains a global leader in technological advancements, with innovations in wireless charging, miniaturization, and AI-driven implants revolutionizing the industry. Smart implants that provide real-time data and personalized treatment options are gaining traction among healthcare providers. Furthermore, 3D printing technology is transforming the production of personalized implants, improving precision in surgical procedures. With continuous R&D investments and a robust healthcare infrastructure, the U.S. is poised to remain at the forefront of implantable medical device innovations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of chronic diseases across the globe

- 3.2.1.2 Scarcity of organ donors

- 3.2.1.3 Technological advancement in developed nations

- 3.2.1.4 Rising government funding for implantable medical devices in developed countries

- 3.2.1.5 Increasing focus on the development of microelectronics and implantable sensors

- 3.2.1.6 Growing adoption of biomaterials for better biocompatibility and outcomes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Stringent regulations for active implantable medical devices

- 3.2.2.3 Considerable rate of post-procedural complications

- 3.2.2.4 High number of recalls of implantable medical devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

- 3.11 Overview on implantable medical device security

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Orthopedic

- 5.2.1 Joint reconstruction

- 5.2.2 Spinal devices

- 5.2.3 Trauma fixation devices

- 5.2.4 Other orthopedic products

- 5.3 Cardiovascular

- 5.3.1 Stents

- 5.3.2 Implantable cardiac defibrillators (ICDs)

- 5.3.3 Pacemaker

- 5.3.4 Cardiac resynchronization therapy (CRT)

- 5.3.5 Ventricular assist devices

- 5.3.6 Implantable cardiac monitors (ICM)

- 5.3.7 Other cardiovascular products

- 5.4 Dental

- 5.4.1 Dental crowns and abutment

- 5.4.2 Dental implants

- 5.4.3 Other dental products

- 5.5 Neurology

- 5.5.1 Deep brain stimulators

- 5.5.2 Other neurology products

- 5.6 Ophthalmology

- 5.6.1 Intraocular lenses and glaucoma implants

- 5.6.2 Other ophthalmology products

- 5.7 Plastic surgery

- 5.7.1 Breast implants

- 5.7.2 Gluteal implants

- 5.8 Other products

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Treatment

- 6.3 Diagnostic

Chapter 7 Market Estimates and Forecast, By Nature of Device, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Static/Non-active/Passive

- 7.3 Active

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Multi-specialty centers

- 8.5 Clinics

- 8.6 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 Advanced Bionics

- 10.3 Alcon

- 10.4 Allergan

- 10.5 BAUSCH + LOMB

- 10.6 BIOTRONIK

- 10.7 Boston Scientific

- 10.8 Cochlear

- 10.9 Demant

- 10.10 GORE

- 10.11 HENRY SCHEIN

- 10.12 Johnson & Johnson

- 10.13 MED-EL

- 10.14 Medtronic

- 10.15 MicroPort

- 10.16 mindray

- 10.17 POLYTECH

- 10.18 smith & nephew

- 10.19 stryker

- 10.20 ZIMMER BIOMET