|

시장보고서

상품코드

1699418

컴플라이언스 탄소배출권 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Compliance Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

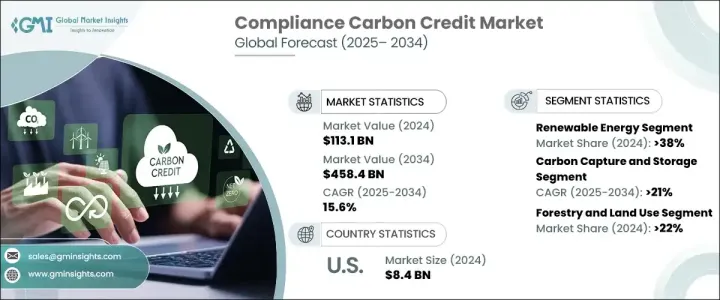

세계 컴플라이언스 탄소배출권 시장은 2024년 1,131억 달러에 달했으며, 2025-2034년 연평균 15.6%의 성장률을 보일 것으로 예측됩니다.

국제 협약과 기업의 지속가능성 약속에 힘입어 기후 변화 대응에 대한 시급성이 높아짐에 따라 탄소배출권은 환경 규제를 충족하고 ESG 프로파일을 강화하고자 하는 조직에 필수적인 도구로 자리매김하고 있습니다. 탄소배출권을 장기 전략에 통합하는 기업이 늘어남에 따라 검증된 고품질 컴플라이언스 크레딧에 대한 수요는 지속적으로 증가하고 있습니다. 각 산업 분야의 기업들은 탄소배출권 프로그램 참여의 재정적, 평판상의 이점을 인식하고 있으며, 이는 배출량 감축 이니셔티브에 대한 투자 증가로 이어지고 있습니다. 전 세계 규제 당국이 탄소 배출 규제를 강화하고 있어, 규제 준수에 기반한 탄소 배출권 거래의 필요성이 더욱 커지고 있습니다. 기업의 넷제로 서약 증가는 배출량 감축 목표와 운영 가능성의 격차를 해소하는 데 필요한 메커니즘으로 탄소배출권 채택을 촉진하고 있습니다.

표준화 및 검증의 진전은 시장 진출기업 증가를 촉진하고, 크레딧 발행 및 거래의 투명성과 신뢰성을 보장했습니다. 블록체인 기술의 통합은 탄소배출권 검증 및 추적을 크게 개선하여 이중계상 및 부정과 관련된 위험을 제거했습니다. 블록체인의 분산형 원장 시스템을 활용하면 기업과 규제 기관은 신용 거래에 대한 안전하고 불변의 기록을 유지할 수 있어 시장 내 신뢰성과 책임성을 높일 수 있습니다. 블록체인의 도입이 진행됨에 따라 거래 플랫폼의 효율성이 향상되고, 기업은 진화하는 규정을 준수하면서 탄소배출권을 원활하게 구매, 판매, 상각할 수 있게 되었습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 1,131억 달러 |

| 예상 금액 | 4,584억 달러 |

| CAGR | 15.6% |

2024년 재생에너지 산업은 유리한 정부 정책과 탄소 배출권 거래제의 시행에 힘입어 탄소배출권 시장에서 큰 비중을 차지할 것으로 예상됩니다. 이 제도는 화석연료를 재생 가능한 대체 에너지로 대체할 때 에너지 회사가 거래 가능한 크레딧을 생성할 수 있도록 함으로써 청정 에너지 발전에 인센티브를 부여하는 제도입니다. 그 결과, 태양광, 풍력, 수력 발전 프로젝트에 대한 투자가 계속 증가하고 있으며, 저탄소 에너지원으로의 전환이 더욱 가속화되고 있습니다. 세계 각국 정부가 더욱 엄격한 탄소 감축 목표를 설정함에 따라, 재생에너지 부문은 앞으로도 컴플라이언스 탄소배출권 시장 성장의 주요 원동력이 될 것으로 예상됩니다.

탄소 회수 및 저장(CCS) 분야는 규제 의무화와 재정적 인센티브 증가에 힘입어 2034년까지 연평균 21%의 성장률을 보일 것으로 예측됩니다. 시멘트, 철강, 발전 등 전통적으로 이산화탄소 배출량이 많은 산업은 배출량을 줄이고 규제 기준을 준수하기 위해 대규모 CCS 솔루션을 적극적으로 도입하고 있습니다. 컴플라이언스 시장은 거래 가능한 탄소배출권으로 이들 산업에 보상을 제공함으로써 최첨단 CCS 기술에 대한 지속적인 투자를 유도하는 경제적 인센티브를 창출하고 있습니다. 각국 정부가 탄소 저장 프로젝트에 대한 자금 지원을 강화함에 따라, 더 많은 기업들이 이러한 솔루션을 채택하여 전반적인 배출량 감축 노력에 기여할 것으로 예상됩니다.

미국의 규제 준수 탄소배출권 시장은 연방 정부의 탄소 가격 정책 및 주정부 주도의 탄소 배출권 거래제 확대에 힘입어 2024년 84억 달러 규모 시장을 창출할 것으로 예상됩니다. 규제된 탄소배출권 거래에 참여하는 주정부가 증가함에 따라, 발전 및 제조업을 중심으로 다양한 산업에서 배출권 거래에 대한 수요가 급증하고 있습니다. 보다 엄격한 배출 규제와 정책 프레임워크는 탄소 저감 기술의 채택을 가속화하고 지속 가능한 목표를 달성하는 데 있어 컴플라이언스 크레딧의 역할을 강화하고 있습니다. 진화하는 규제 상황과 기업의 기후 변화에 대한 헌신으로 미국 시장은 향후 몇 년 동안 크게 성장할 준비가 되어 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 대한 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크&과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 전략적 전망

- 혁신과 지속가능성 전망

제5장 시장 규모와 예측 : 최종 용도별, 2021년-2034년

- 주요 동향

- 농업

- 탄소 포집 및 저장

- 화학 프로세스

- 에너지 효율

- 산업

- 임업 및 토지 이용

- 재생에너지

- 운송

- 폐기물 관리

- 기타

제6장 시장 규모와 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 덴마크

- 노르웨이

- 프랑스

- 스웨덴

- 아시아태평양

- 중국

- 일본

- 뉴질랜드

- 중동 및 아프리카

- 남아프리카공화국

- 라틴아메리카

- 아르헨티나

- 칠레

제7장 기업 개요

- 3Degrees

- ALLCOT

- Atmosfair

- CarbonClear

- ClimeCo

- Climate Impact Partners

- Ecosecurities

- Green Mountain Energy Company

- Shell

- South Pole

- Sterling Planet Inc.

- TerraPass

- The Carbon Collective Company

- The Carbon Trust

- VERRA

- WGL Holdings, Inc

The Global Compliance Carbon Credit Market reached USD 113.1 billion in 2024 and is projected to grow at a CAGR of 15.6% between 2025 and 2034. The growing urgency of climate action, driven by international agreements and corporate sustainability commitments, has positioned carbon credits as an essential tool for organizations looking to meet environmental regulations and enhance their ESG profiles. As more businesses integrate carbon credits into their long-term strategies, the demand for verified and high-quality compliance credits continues to surge. Companies across industries are recognizing the financial and reputational advantages of participating in carbon credit programs, leading to increased investment in emission reduction initiatives. Regulatory bodies worldwide are also tightening carbon emission limits, further driving the need for compliance-based credit trading. The rise of corporate net-zero pledges has propelled the adoption of carbon credits as a necessary mechanism to bridge the gap between emission reduction goals and operational feasibility.

Standardization and verification advancements have fueled greater market participation, ensuring transparency and credibility in credit issuance and trading. The integration of blockchain technology has significantly improved the verification and tracking of carbon credits, eliminating risks associated with double counting and fraud. By leveraging blockchain's distributed ledger system, companies and regulatory bodies can maintain a secure and immutable record of credit transactions, enhancing trust and accountability within the market. As blockchain adoption grows, trading platforms are becoming more efficient, allowing businesses to seamlessly buy, sell, and retire carbon credits while ensuring compliance with evolving regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $113.1 Billion |

| Forecast Value | $458.4 Billion |

| CAGR | 15.6% |

Renewable energy industries accounted for a significant share of the compliance carbon credit market in 2024, driven by favorable government policies and the implementation of cap-and-trade systems. These frameworks incentivize clean energy production by allowing energy companies to generate tradeable credits when replacing fossil fuels with renewable alternatives. As a result, investment in solar, wind, and hydropower projects continues to rise, further accelerating the transition toward low-carbon energy sources. With governments worldwide committing to more stringent carbon reduction targets, the renewable energy sector is expected to remain a key driver of compliance carbon credit market growth.

The carbon capture and storage (CCS) segment is set to expand at a CAGR of 21% through 2034, supported by increasing regulatory mandates and financial incentives. Industries with traditionally high carbon footprints, such as cement, steel, and power generation, are actively deploying large-scale CCS solutions to mitigate emissions and comply with regulatory standards. The compliance market rewards these industries with tradeable carbon credits, creating a financial incentive for continued investment in cutting-edge CCS technologies. As governments ramp up funding for carbon sequestration projects, more companies are expected to adopt these solutions, contributing to overall emission reduction efforts.

The U.S. Compliance Carbon Credit Market generated USD 8.4 billion in 2024, driven by the expansion of federal carbon pricing policies and state-led cap-and-trade programs. As more states participate in regulated carbon credit trading, demand for compliance credits has surged across multiple industries, particularly in power generation and manufacturing. Stricter emission limits and policy frameworks are accelerating the adoption of carbon reduction technologies, reinforcing the role of compliance credits in meeting sustainability goals. With evolving regulatory landscapes and corporate climate commitments, the U.S. market is poised for significant growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By End use, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Agriculture

- 5.3 Carbon Capture & Storage

- 5.4 Chemical process

- 5.5 Energy efficiency

- 5.6 Industrial

- 5.7 Forestry & Land use

- 5.8 Renewable energy

- 5.9 Transportation

- 5.10 Waste management

- 5.11 Others

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Denmark

- 6.3.2 Norway

- 6.3.3 France

- 6.3.4 Sweden

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 New Zealand

- 6.5 Middle East & Africa

- 6.5.1 South Africa

- 6.6 Latin America

- 6.6.1 Argentina

- 6.6.2 Chile

Chapter 7 Company Profiles

- 7.1 3Degrees

- 7.2 ALLCOT

- 7.3 Atmosfair

- 7.4 CarbonClear

- 7.5 ClimeCo

- 7.6 Climate Impact Partners

- 7.7 Ecosecurities

- 7.8 Green Mountain Energy Company

- 7.9 Shell

- 7.10 South Pole

- 7.11 Sterling Planet Inc.

- 7.12 TerraPass

- 7.13 The Carbon Collective Company

- 7.14 The Carbon Trust

- 7.15 VERRA

- 7.16 WGL Holdings, Inc