|

시장보고서

상품코드

1716513

주택용 저전압 개폐 장치 시장 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Low Voltage Residential Switchgear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

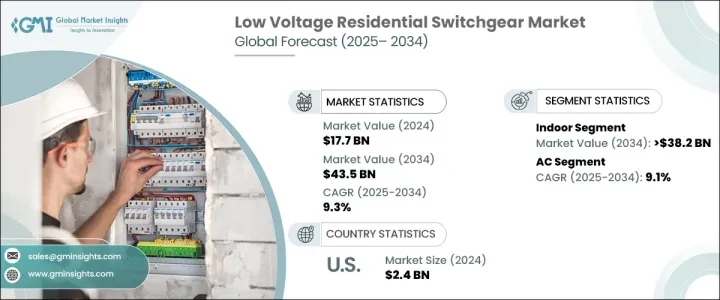

주택용 저전압 개폐장치 세계 시장 규모는 2024년 177억 달러에 달했고, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 9.3%로 성장할 것으로 예측됩니다.

이 시장은 급속한 도시화, 전력 소비 증가, 스마트 홈 기술의 보급으로 꾸준한 성장을 이루고 있습니다. 경제 국가에서는 도시 확대가 현저하고 주택 인프라에서 저압 배전반의 요구가 높아지고 있습니다.

실시간 모니터링, 자동 제어 및 안전성 향상을 제공하는 스마트 스위치기어는 최신 주택용 전기 설비에 필수적인 요소가 되고 있습니다. 신재생에너지 이용과 에너지 절약을 추진하는 정부의 이니셔티브도 시장 성장의 추진에 중요한 역할을 하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 177억 달러 |

| 예측 금액 | 435억 달러 |

| CAGR | 9.3% |

실내 분야는 스마트 홈 기술과 에너지 효율이 높은 전기 시스템의 채택이 증가하고 있기 때문에 2034년까지 382억 달러의 매출이 예상되고 있습니다. IoT 기반 실내 개폐 장치에 대한 수요 증가는 에너지 관리에 대한 소비자 인식과 주거 공간의 안전 및 자동화 강화에 대한 필요성이 높아짐에 따라 촉진되고 있습니다. 에너지 절약을 지원하고 발전에 있어서 재생 가능 에너지원의 이용을 촉진하는 정부의 규제는 이 부문의 성장을 한층 더 가속시키고 있습니다.

교류 부문의 주택용 저전압 개폐장치 시장은 2034년까지 연평균 복합 성장률(CAGR) 9.1%로 성장할 것으로 예측됩니다. 장거리 송전의 효율성으로부터, 배전과 송전에 있어서 교류(AC) 전력이 계속 우위를 차지하고 있는 것이, 이 성장을 뒷받침하고 있습니다. 유럽에서는 전력 전송의 격차를 식별하고 해결하기 위한 지속적인 인프라 평가가 시장에 새로운 기회를 창출하고 있습니다. 주택 환경에서는 신뢰성이 높고 효율적인 전기 시스템에 대한 요구가 높아지고 있어, 원활한 배전을 확보해, 혼란을 최소한으로 억제하는 고도의 개폐 장치 솔루션에 대한 수요가 높아지고 있습니다.

미국의 주택용 저전압 개폐장치 시장은 2024년에 24억 달러 수익을 올렸습니다. 시장의 보급이 진행됨에 따라 회로 보호, 과부하 관리, 전압 제어가 중시되고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 전략 대시보드

- 혁신과 지속가능성의 전망

제5장 시장 규모와 예측 : 설치별, 2021년-2034년

- 주요 동향

- 실내

- 옥외

제6장 시장 규모와 예측 : 전류별, 2021년-2034년

- 주요 동향

- 교류

- 직류

제7장 시장 규모와 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 러시아

- 이탈리아

- 스페인

- 아시아태평양

- 중국

- 호주

- 인도

- 일본

- 한국

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 남아프리카

- 이집트

- 라틴아메리카

- 브라질

- 아르헨티나

제8장 기업 프로파일

- ABB

- Bharat Heavy Electricals

- CG Power and Industrial Solutions

- CHINT Group

- Eaton

- Fuji Electric

- General Electric

- HDHyundai Electric

- Hitachi

- Hyosung Heavy Industries

- Lucy Group

- Mitsubishi Electric

- Ormazabal

- Schneider Electric

- Siemens

- Skema

- Toshiba

The Global Low Voltage Residential Switchgear Market was valued at USD 17.7 billion in 2024 and is projected to grow at a CAGR of 9.3% between 2025 and 2034. The market is witnessing steady growth due to rapid urbanization, increasing electricity consumption, and the widespread integration of smart home technologies. As living standards improve worldwide, residential construction activity is on the rise, driving the demand for efficient, reliable, and safe electrical distribution systems. Developing economies, in particular, are experiencing significant urban expansion, leading to a growing need for low voltage switchgear in residential infrastructures. The growing consumer preference for smart homes equipped with IoT-enabled systems and energy-efficient solutions is further fueling the demand.

Smart switchgear, offering real-time monitoring, automated control, and enhanced safety, is becoming an essential component of modern residential electrical setups. Additionally, the increasing focus on sustainability and energy conservation has led to higher adoption of smart power management systems in households, contributing to the expanding market size. Government initiatives promoting the use of renewable energy and energy-saving practices are also playing a crucial role in driving market growth. As consumers seek safer and more efficient solutions, the demand for advanced low voltage residential switchgear continues to rise, ensuring long-term market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.7 Billion |

| Forecast Value | $43.5 Billion |

| CAGR | 9.3% |

The indoor segment is expected to generate USD 38.2 billion by 2034, driven by the increasing adoption of smart home technologies and energy-efficient electrical systems. The rising demand for IoT-enabled indoor switchgear is being fueled by growing consumer awareness about energy management and the need for enhanced safety and automation in residential spaces. Government regulations supporting energy conservation and promoting the use of renewable energy sources in power generation are further accelerating the growth of this segment. Advanced features such as compact designs, improved communication capabilities, and enhanced safety mechanisms make modern indoor switchgear a preferred choice for utility, commercial, and residential applications.

The low voltage residential switchgear market in the AC segment is projected to grow at a 9.1% CAGR through 2034. The continued dominance of alternating current (AC) power in electricity distribution and transmission, owing to its efficiency in long-distance power transfer, is fueling this growth. In Europe, ongoing infrastructure assessments aimed at identifying and addressing gaps in electricity transmission are creating new opportunities for the market. The rising need for reliable and efficient electrical systems in residential settings is propelling the demand for advanced switchgear solutions that ensure seamless power distribution and minimize disruptions.

The U.S. low voltage residential switchgear market generated USD 2.4 billion in 2024. The increasing use of energy-intensive household appliances, including air conditioners and electric heating units, is driving the need for more sophisticated AC-based switchgear. With the rising prevalence of smart devices and automated systems in homes, there is a growing emphasis on circuit protection, overload management, and voltage control. As residential power consumption continues to increase, the market is shifting towards intelligent and adaptive switchgear systems that enhance operational efficiency and ensure the safety of household electrical systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Installation 2021 – 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 Indoor

- 5.3 Outdoor

Chapter 6 Market Size and Forecast, By Current 2021 – 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 AC

- 6.3 DC

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Russia

- 7.3.5 Italy

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Bharat Heavy Electricals

- 8.3 CG Power and Industrial Solutions

- 8.4 CHINT Group

- 8.5 Eaton

- 8.6 Fuji Electric

- 8.7 General Electric

- 8.8 HD Hyundai Electric

- 8.9 Hitachi

- 8.10 Hyosung Heavy Industries

- 8.11 Lucy Group

- 8.12 Mitsubishi Electric

- 8.13 Ormazabal

- 8.14 Schneider Electric

- 8.15 Siemens

- 8.16 Skema

- 8.17 Toshiba