|

시장보고서

상품코드

1716687

통합 차량 상태 관리(IVHM) 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Integrated Vehicle Health Management (IVHM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

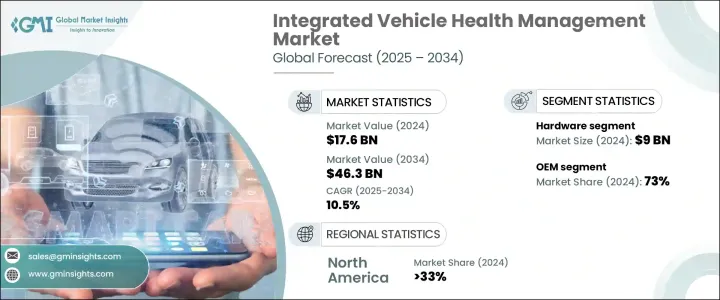

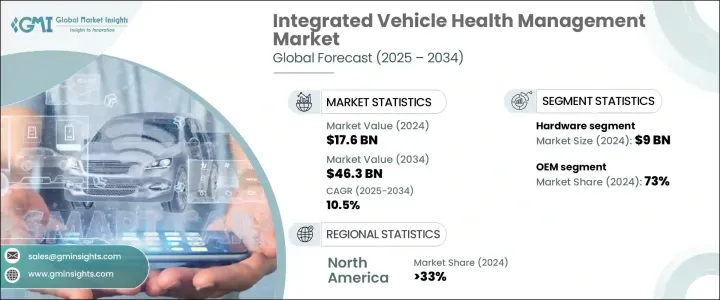

2024년 세계 통합 차량 상태 관리(IVHM) 시장 규모는 176억 달러로 2025년부터 2034년까지 CAGR 10.5%로 성장할 것으로 예상됩니다.

이러한 시장 확대의 배경에는 전기자동차(EV)의 급속한 보급, 커넥티드카의 부상, 최신 자동차의 예지보전에 대한 요구가 증가하고 있습니다. 자동차 기술이 발전함에 따라 제조업체와 차량 운영업체들은 성능 향상, 수명 연장, 다운타임 감소를 위해 실시간 차량 상태 모니터링에 집중하고 있으며, IVHM 시스템은 현재 실시간 진단, 예측 분석, 사전 예방적 유지보수 솔루션을 제공하고 있습니다. 제공하는 자동차 생태계의 중요한 구성요소로 자리 잡고 있습니다.

자동차 제조업체들은 첨단 IVHM 기술을 통합하여 차량의 효율성을 높이고, 고장을 최소화하며, 전반적인 안전성을 향상시키고 있습니다. 자동차 산업이 전동화로 전환함에 따라 배터리 상태 모니터링 솔루션에 대한 수요가 급증하고 있습니다. 전기자동차와 하이브리드 차량은 드라이브 트레인, 배터리 전압, 충전 시스템 등 중요한 구성요소를 지속적으로 추적해야 합니다. 자동차 전자장치의 복잡성 증가와 자율주행 기술의 부상으로 첨단 IVHM 솔루션의 필요성이 더욱 커지고 있습니다. 자동차 제조업체, 차량 관리자 및 서비스 제공업체는 AI 기반 분석 및 클라우드 기반 플랫폼을 활용하여 사전 예방적 유지보수를 보장하고 운영 리스크를 최소화하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 176억 달러 |

| 예상 금액 | 463억 달러 |

| CAGR | 10.5% |

IVHM 시장은 하드웨어, 소프트웨어, 서비스로 나뉘며 하드웨어가 우위를 점하고 2024년 하드웨어가 50%의 시장 점유율을 차지하여 90억 달러의 시장을 창출했습니다. 센서는 엔진 온도, 타이어 공기압, 배터리 상태 등 차량의 주요 매개변수를 모니터링하는 데 매우 중요한 역할을 합니다. 이러한 부품은 실시간 진단을 가능하게 하고, 중요한 시스템이 최적으로 작동할 수 있도록 보장합니다. 자동차 산업이 발전함에 따라 전기자동차 및 자율주행차량을 위해 설계된 특수 하드웨어에 대한 수요는 지속적으로 증가하고 있습니다.

시장 세분화에는 판매 채널도 포함되며, 주문자 상표 부착 제품 제조업체(OEM)가 큰 점유율을 차지하고 있으며, 2024년에는 OEM이 차량 생산 시 IVHM 시스템을 차량에 통합하여 시장의 73%를 점유했습니다. 이러한 완벽한 통합을 통해 차량은 처음부터 고급 진단, 텔레매틱스 및 지속적인 모니터링 기능을 활용할 수 있으며, OEM은 혁신의 최전선에 서서 전기자동차 및 커넥티드카 소유자의 진화하는 요구에 부응하고 있습니다. 및 배터리 건전성 관리가 매우 중요해짐에 따라 제조업체들은 최첨단 IVHM 솔루션에 많은 투자를 하고 있습니다.

미국의 통합 차량 상태 관리(IVHM) 시장은 2024년 32억 달러 규모로 33%의 점유율을 차지했습니다. 미국은 자동차 및 항공우주 분야에서 강력한 존재감을 보이며 IVHM 기술에 대한 수요를 주도하고 있습니다. 자동차 안전, 배기가스 및 유지보수와 관련된 정부 규제가 강화됨에 따라 도입이 더욱 가속화되고 있습니다. 또한, 민간 차량 운영업체와 방위 산업체들은 업무 효율성을 높이기 위해 예지보전을 우선순위에 두고 있습니다. 미국 시장에서는 운송 산업 전반에 걸쳐 최적의 성능, 규정 준수 및 비용 절감을 위해 데이터 기반 차량 상태 관리 시스템으로 빠르게 전환하고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급업체 상황

- 플랫폼 프로바이더

- 소프트웨어 프로바이더

- 서비스 프로바이더

- 유통 채널

- 최종 용도

- 이익률 분석

- 테크놀러지와 혁신 전망

- 특허 분석

- 주요 뉴스와 대처

- 비용 내역 분석

- 규제 상황

- 영향요인

- 성장 촉진요인

- 예지보전에 대한 수요 증가

- EV와 커넥티드카 수요 증가

- 차량 복잡화

- IoT와 AI의 기술적 진보

- 규제 요건과 안전기준

- 업계의 잠재적 리스크와 과제

- 데이터 보안과 프라이버시에 관한 우려

- 레거시 시스템과 통합의 복잡성

- 성장 촉진요인

- 성장 가능성 분석

- Porters 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추정과 예측 : 구성요소별, 2021-2034년

- 주요 동향

- 하드웨어

- 센서

- 전자제어장치(ECU)

- 데이터 수집 시스템

- 통신 모듈

- 텔레매틱스 제어 유닛(TCU)

- 차량내 진단(OBD) 포트

- 소프트웨어

- 진단 소프트웨어

- 예후 소프트웨어

- 데이터 관리 소프트웨어

- 사용자 인터페이스(UI) 소프트웨어

- 서비스

- 설치 및 통합 서비스

- 보수·수리 서비스

- 컨설팅 서비스

제6장 시장 추정과 예측 : 채널별, 2021-2034년

- 주요 동향

- OEM

- 서비스 센터

제7장 시장 추정과 예측 : 용도별, 2021-2034년

- 주요 동향

- 진단

- 예후

제8장 시장 추정과 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 민간·방위 항공

- 자동차

- 선박

- 기타

제9장 시장 추정과 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카공화국

- 사우디아라비아

제10장 기업 개요

- Acellent Technologies

- Aptiv

- Boeing

- Caterpillar

- Cummins

- General Electric

- Honeywell

- IBM

- Intangles Lab

- Iotasmart

- Lockheed Martin

- Michelin

- North Atlantic Industries

- OnStar

- Robert Bosch GmbH

- Rockwell Collins

- Rolls Royce

- Sibros Technologies Inc

- TATA Elxsi

- ZF Friedrichshafen

The Global Integrated Vehicle Health Management Market was valued at USD 17.6 billion in 2024 and is expected to grow at a CAGR of 10.5% between 2025 and 2034. This expansion is fueled by the rapid adoption of electric vehicles (EVs), the rise of connected cars, and the increasing need for predictive maintenance in modern automobiles. As automotive technologies become more sophisticated, manufacturers and fleet operators are focusing on real-time vehicle health monitoring to enhance performance, extend lifespan, and reduce downtime. IVHM systems are now a critical component of the automotive ecosystem, offering real-time diagnostics, predictive analytics, and proactive maintenance solutions.

Automakers are integrating advanced IVHM technologies to enhance vehicle efficiency, minimize breakdowns, and improve overall safety. With the automotive industry shifting toward electrification, the demand for battery health monitoring solutions has surged. Electric and hybrid vehicles require continuous tracking of vital components like drivetrains, battery voltage, and charging systems. The growing complexity of automotive electronics, coupled with the rise of autonomous driving technologies, further amplifies the need for sophisticated IVHM solutions. Automakers, fleet managers, and service providers are leveraging AI-powered analytics and cloud-based platforms to ensure proactive maintenance and minimize operational risks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.6 Billion |

| Forecast Value | $46.3 Billion |

| CAGR | 10.5% |

The IVHM market is categorized into hardware, software, and services, with hardware dominating the landscape. In 2024, hardware accounted for a 50% market share, generating USD 9 billion. Sensors play a pivotal role in monitoring key vehicle parameters, including engine temperature, tire pressure, and battery health. These components enable real-time diagnostics, ensuring that critical systems function optimally. As the automotive industry advances, demand for specialized hardware designed for EVs and autonomous vehicles continues to rise.

Market segmentation also includes distribution channels, with original equipment manufacturers (OEMs) holding a significant share. In 2024, OEMs controlled 73% of the market as they integrated IVHM systems into vehicles during manufacturing. This seamless incorporation allows vehicles to benefit from advanced diagnostics, telematics, and continuous monitoring capabilities from the outset. OEMs remain at the forefront of innovation, addressing the evolving needs of electric and connected vehicle owners. With predictive maintenance and battery health management becoming crucial in the EV segment, manufacturers are investing heavily in cutting-edge IVHM solutions.

The U.S. Integrated Vehicle Health Management (IVHM) Market generated USD 3.2 billion in 2024, accounting for a 33% share. The country's strong presence in the automotive and aerospace sectors drives demand for IVHM technologies. Stricter government regulations related to vehicle safety, emissions, and maintenance further accelerate adoption. Additionally, commercial fleet operators and defense agencies are prioritizing predictive maintenance to enhance operational efficiency. The U.S. market is witnessing a rapid shift toward data-driven vehicle health management systems, ensuring optimal performance, compliance, and cost savings across the transportation industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Platform provider

- 3.2.2 Software provider

- 3.2.3 Service provider

- 3.2.4 Distribution channel

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Cost breakdown analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing demand for predictive maintenance

- 3.9.1.2 Increase in demand for EVs and connected vehicle

- 3.9.1.3 Increasing vehicle complexity

- 3.9.1.4 Technological advancements in IoT and AI

- 3.9.1.5 Regulatory requirements and safety standards

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Data security and privacy concerns

- 3.9.2.2 Complexity of integration with legacy systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 Electronic Control Units (ECUs)

- 5.2.3 Data acquisition systems

- 5.2.4 Communication modules

- 5.2.5 Telematics Control Units (TCUs)

- 5.2.6 On-board diagnostics (OBD) ports

- 5.3 Software

- 5.3.1 Diagnostics software

- 5.3.2 Prognostic software

- 5.3.3 Data management software

- 5.3.4 User Interface (UI) software

- 5.4 Service

- 5.4.1 Installation and integration services

- 5.4.2 Maintenance and repair services

- 5.4.3 Consulting services

Chapter 6 Market Estimates & Forecast, By Channel, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Service center

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Diagnostics

- 7.3 Prognostics

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Commercial & defense aviation

- 8.3 Automotive

- 8.4 Marine

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Acellent Technologies

- 10.2 Aptiv

- 10.3 Boeing

- 10.4 Caterpillar

- 10.5 Cummins

- 10.6 General Electric

- 10.7 Honeywell

- 10.8 IBM

- 10.9 Intangles Lab

- 10.10 Iotasmart

- 10.11 Lockheed Martin

- 10.12 Michelin

- 10.13 North Atlantic Industries

- 10.14 OnStar

- 10.15 Robert Bosch GmbH

- 10.16 Rockwell Collins

- 10.17 Rolls Royce

- 10.18 Sibros Technologies Inc

- 10.19 TATA Elxsi

- 10.20 ZF Friedrichshafen