|

시장보고서

상품코드

1716720

그리드 스케일 고정형 배터리 스토리지 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Grid Scale Stationary Battery Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

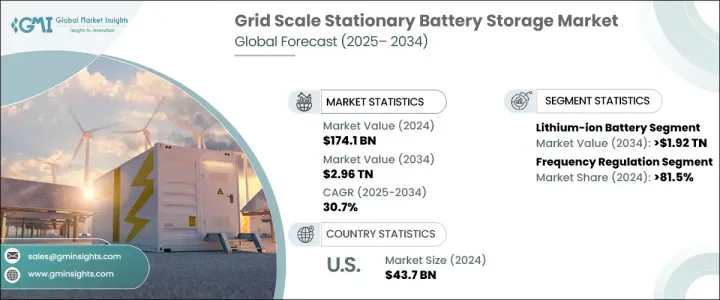

세계의 그리드 스케일 고정형 배터리 스토리지 시장의 2024년 시장 규모는 1,741억 달러로, 2025년부터 2034년까지 CAGR 30.7%를 보일 것으로 예측됩니다.

이 급격한 성장은 태양광과 풍력과 같은 재생 가능 에너지원의 통합이 진행되고 있기 때문에 송전망의 안정성을 유지하고 변동하는 에너지 수요에 대응하기 위해 신뢰성 있고 효율적인 축전 솔루션이 필요합니다. 전력 공급을 확보하는데 있어서 매우 중요한 역할을 하고 있습니다. 재생 가능 에너지 발전은 본질적으로 간헐적이기 때문에 에너지 저장 시스템은 피크 생산시에 잉여 에너지를 저장해, 수요가 많은 시기에 방출하기 위해서 불가결합니다. 세계의 정부나 규제 당국도, 그리드 규모의 축전지 시스템의 도입을 장려하는 정책을 실시해 인센티브를 제공하고 있습니다.

또한 에너지 저장 솔루션의 기술 혁신과 함께 선진적인 배터리 기술 비용이 낮아 다양한 시장에서 대규모 도입이 가능해지고 있습니다. 에너지 집약형의 산업이나 유틸리티에서는 화석 연료에의 의존도를 줄이고, 그리드 운용을 최적화하기 위해서 축전지의 채용이 진행되고 있어, 시장의 눈부신 성장에 공헌하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 1,741억 달러 |

| 예측 금액 | 2조 9,600억 달러 |

| CAGR | 30.7% |

시장은 전지 유형별로 나트륨 유황 전지, 리튬 이온 전지, 플로우 배터리, 납 축전지 등으로 구분됩니다. 고속 충방전이 가능한 이러한 전지는 주파수 조정, 계통 안정화, 재생 가능 에너지의 밸런싱 등의 용도에 최적입니다. 시스템의 개선, 에너지 밀도의 향상으로 리튬 이온 배터리의 수명, 안전성, 효율은 대폭 향상되고 있습니다.

용도별로 그리드 스케일 고정형 배터리 스토리지 시장에는 주파수 조정, 블랙 스타트 서비스, 에너지 시프트, 용량 연장, 기타 서비스가 포함됩니다. 미국에서는 에너지 저장 시스템이 필수적인 그리드 서비스를 제공하고 에너지 배급의 안정성과 효율성을 확보하는 인센티브가 주어지고 있습니다.

미국의 그리드 스케일 고정형 배터리 스토리지 시장의 2024년 시장 규모는 437억 달러로, 투자 세액 공제(ITC)나 생산 세액 공제(PTC) 등 연방 정부의 유리한 정책이 에너지 저장 인프라에 다액의 투자를 자극하고 있습니다. 송전망의 근대화와 재생 가능 에너지의 통합이 우선 과제가 되고 있는 주에서는 배터리 스토리지 시스템의 재정적 실행 가능성이 높아지고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 전략적 전망

- 혁신과 지속가능성의 전망

제5장 시장 규모와 예측 : 배터리별, 2021-2034년

- 주요 동향

- 리튬 이온

- 황나트륨

- 납축전지

- 플로우 배터리

- 기타

제6장 시장 규모와 예측 : 용도별, 2021-2034년

- 주요 동향

- 주파수 조정

- 블랙 스타트 서비스

- 에너지 시프트 및 용량 연기

- 간 수급 조정

- 기타

제7장 시장 규모와 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 프랑스

- 독일

- 이탈리아

- 러시아

- 스페인

- 아시아태평양

- 중국

- 호주

- 인도

- 일본

- 한국

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 라틴아메리카

- 브라질

- 아르헨티나

제8장 기업 프로파일

- BYD Company

- Contemporary Amperex Technology

- Exide Technologies

- GS Yuasa International

- Hitachi Energy

- HOPPECKE Batterien

- Johnson Controls

- LG Energy Solution

- Panasonic Corporation

- SAMSUNG SDI

- Siemens Energy

- SK Innovation

- Tesla

- Toshiba Corporation

The Global Grid Scale Stationary Battery Storage Market was valued at USD 174.1 billion in 2024 and is projected to grow at a CAGR of 30.7% between 2025 and 2034. This exponential growth is driven by the increasing integration of renewable energy sources like solar and wind, which require reliable and efficient storage solutions to maintain grid stability and meet fluctuating energy demands. As the world shifts toward cleaner energy alternatives, grid-scale battery storage plays a pivotal role in ensuring a stable and consistent power supply. Renewable energy generation is inherently intermittent, making energy storage systems essential to store excess energy during peak production and release it during periods of high demand. Governments and regulatory authorities across the globe are also implementing policies and providing incentives to encourage the deployment of grid-scale battery storage systems.

Additionally, the declining costs of advanced battery technologies, coupled with innovations in energy storage solutions, are making large-scale adoption feasible across diverse markets. The growing emphasis on decarbonization and achieving net-zero targets further strengthens the demand for scalable and efficient energy storage solutions. Energy-intensive industries and utilities are increasingly adopting battery storage to reduce dependency on fossil fuels and optimize grid operations, contributing to the market's impressive growth trajectory. The proliferation of smart grid technologies and demand-side management strategies is also accelerating the deployment of grid-scale battery storage systems, offering a robust framework for future growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $174.1 Billion |

| Forecast Value | $2.96 Trillion |

| CAGR | 30.7% |

The market is segmented by battery type into sodium-sulfur, lithium-ion, flow batteries, lead-acid, and others. Lithium-ion batteries lead this space and are expected to generate USD 1.92 trillion by 2034. These batteries, known for their fast charging and discharging capabilities, are ideal for applications such as frequency regulation, grid stabilization, and balancing renewable energy sources. Advances in battery chemistry, improved thermal management systems, and enhanced energy density have significantly increased the lifespan, safety, and efficiency of lithium-ion batteries. Their ability to provide rapid response times and higher energy density makes them a preferred choice for large-scale grid storage projects. As the cost of lithium-ion batteries continues to decline, their adoption in grid-scale applications is expected to rise exponentially.

In terms of application, the grid scale stationary battery storage market includes frequency regulation, black start services, energy shifting, capacity deferral, capacity firming, and other services. The frequency regulation segment held an impressive 81.5% market share in 2024. Several regions are implementing market incentives and frameworks to encourage the use of battery storage systems for frequency regulation. In the U.S., energy storage systems are incentivized to provide essential grid services, ensuring stability and efficiency in energy distribution. These incentives, coupled with increasing investments in grid modernization initiatives, are fueling the rapid expansion of the battery storage market.

The U.S. grid scale stationary battery storage market was valued at USD 43.7 billion in 2024, with favorable federal policies such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC) stimulating substantial investments in energy storage infrastructure. These incentives have made battery storage systems more financially viable, especially in states like California, Texas, and Hawaii, where grid modernization efforts and renewable energy integration are priorities. State-level mandates further enhance the adoption of grid-scale battery storage, supporting grid reliability, renewable energy adoption, and frequency regulation across the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Battery, 2021 - 2034, (MW & USD Million)

- 5.1 Key trends

- 5.2 Lithium-ion

- 5.3 Sodium sulphur

- 5.4 Lead acid

- 5.5 Flow battery

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034, (MW & USD Million)

- 6.1 Key trends

- 6.2 Frequency regulation

- 6.3 Black start services

- 6.4 Energy shifting & capacity deferral

- 6.5 Capacity firming

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034, (MW & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 BYD Company

- 8.2 Contemporary Amperex Technology

- 8.3 Exide Technologies

- 8.4 GS Yuasa International

- 8.5 Hitachi Energy

- 8.6 HOPPECKE Batterien

- 8.7 Johnson Controls

- 8.8 LG Energy Solution

- 8.9 Panasonic Corporation

- 8.10 SAMSUNG SDI

- 8.11 Siemens Energy

- 8.12 SK Innovation

- 8.13 Tesla

- 8.14 Toshiba Corporation