|

시장보고서

상품코드

1721515

배전 자동화 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Distribution Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

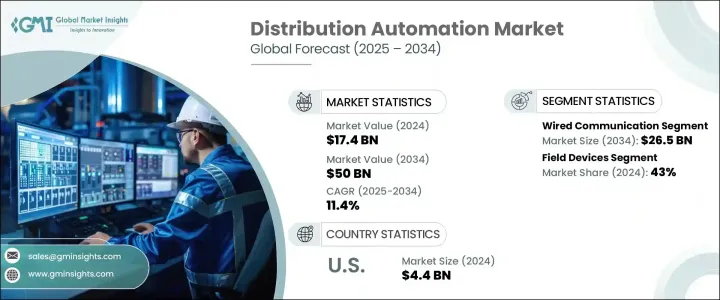

세계의 배전 자동화 시장 규모는 2024년 174억 달러로 평가되었고, CAGR 11.4%를 나타내 2034년에는 500억 달러에 달할 것으로 예측되고 있습니다. 이에 대한 우려가 높아짐에 따라 공공 부문과 민간 부문 모두가 배전 자동화 솔루션을 우선시하고 있습니다.

전기 인프라가 노후화되고 도시에서도 농촌에서도 전기가 급속히 진행되고 있는 가운데, 배전망의 자동화는 보다 스마트한 에너지 시스템으로의 이행에 있어서 중요한 기둥으로서 부상하고 있습니다. 에너지 공급의 균형을 보다 효과적으로 취할 수 있도록 하고 있습니다. 디지털 혁신으로 에너지 인프라가 계속 재편됨에 따라 배전 자동화 시스템은 안정적이고 안전하며 적응력이 뛰어난 에너지 그리드를 구축하려는 전 세계적인 노력에 필수 불가결한 요소가 되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 174억 달러 |

| 예측 금액 | 500억 달러 |

| CAGR | 11.4% |

송전망의 현대화, 스마트 그리드의 도입, 신뢰성이 높은 배전에 대한 요구 증가가 이 시장의 주요 촉진요인이 되고 있습니다. 이를 위해 자동화 솔루션에 점점 주목 받고 있습니다. 배전 자동화는 그리드 성능 향상과 재생 가능 에너지원의 통합을 목표로, 보다 스마트하고 강인한 인프라에 대한 큰 추진의 일환으로 세계적으로 견인력을 늘리고 있습니다.

유선 통신은 여전히 시장의 주류이며 2034년까지 265억 달러의 성장이 예상되고 있습니다. 케이션에서 계속 도움이 되고 있습니다. 유틸리티는 SCADA 시스템이나 송전망의 실시간 감시 등의 기능으로 유선 네트워크에 크게 의존하고 있어 중요한 업무가 원활하게 이루어지도록 하고 있습니다.

스마트 리클로저, 자동 스위치, 고장 표시등을 포함한 현장 장치 분야는 2024년 43%의 점유율을 차지했습니다. 이러한 디바이스는 IoT 및 엣지 컴퓨팅과 통합되어 전력망의 신뢰성과 효율을 향상시키기 때문입니다. 이러한 장치는 전력망의 기능과 신뢰성을 향상시키는 데 필수적입니다. 사물인터넷(IoT) 기술 및 엣지 컴퓨팅과 통합함으로써 이러한 디바이스는 실시간 모니터링, 예지 보전, 고장 감지 기능을 강화합니다. 스마트 리클로저는 고장을 자동으로 감지하고 일시적인 정전 후 전원을 복구하며 정전 시간을 대폭 단축하는 데 특히 중요합니다.

2024년 미국의 배전 자동화 시장 규모는 44억 달러였습니다. 성장의 배경으로는 전력망 시스템의 진보, 신재생에너지원의 채용, 혁신적인 기술 도입 증가가 있습니다. 에너지 효율 개선을 목적으로 하는 연방 및 주정책은 감시와 통제를 강화하기 위한 5G와 에지 네트워크의 통합과 함께 이 시장의 확대를 더욱 촉진하고 있습니다. 인공지능과 IoT 기반 시스템의 채택으로 유틸리티 기업은 운영 최적화, 가동 중지 시간 절감, 그리드 탄력성 강화를 실현하고 있습니다.

세계의 배전 자동화 시장의 주요기업으로는 란디스기어사, ABB사, 시스코사, 이튼사, GE사, G& W 일렉트릭사, S& C 일렉트릭사, 하벨사, 이트론사 엔지니어링 연구소, Siemens, Toshiba Energy Systems & Solutions, Trilliant Holdings, Zailem, Inc. 등이 있습니다. AI 자동화 및 IoT 솔루션에 투자하고 그리드 관리를 개선하고 에너지 배급을 최적화하고 있습니다. 게다가 기업은 제공하는 서비스를 다양화하고 새로운 지역 시장에 진출하기 위해 합병과 인수를 모색하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- PESTEL 분석

제4장 경쟁 구도

- 전략적 대시보드

- 혁신 및 지속가능성 전망

제5장 시장 규모와 예측 : 통신별(2021-2034년)

- 주요 동향

- 유선

- 무선

제6장 시장 규모와 예측 : 구성 요소별(2021-2034년)

- 주요 동향

- 소프트웨어

- 필드 디바이스

- 서비스

제7장 시장 규모와 예측 : 용도별(2021-2034년)

- 주요 동향

- 공공 유틸리티

- 민간 유틸리티

제8장 시장 규모와 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 아시아태평양

- 중국

- 호주

- 일본

- 한국

- 인도

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 라틴아메리카

- 브라질

- 칠레

제9장 기업 프로파일

- ABB

- Cisco

- Eaton

- GE

- G&W Electric

- Hitachi

- Hubbell

- Itron

- Landis Gyr

- NovaTech

- Schneider Electric

- Schweitzer Engineering Laboratories

- S&C Electric Company

- Siemens

- Toshiba Energy Systems & Solutions

- Trilliant Holdings

- Xylem

The Global Distribution Automation Market was valued at USD 17.4 billion in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 50 billion by 2034. The market is witnessing remarkable momentum as utilities worldwide embrace advanced technologies to modernize power grids. Rising energy demands, increasing integration of renewable energy sources, and heightened concerns around grid reliability and resilience are pushing both public and private sector players to prioritize distribution automation solutions. Governments and utility providers are rapidly investing in automation to reduce power outages, enhance energy efficiency, and support a sustainable electricity infrastructure.

With aging electrical infrastructure and surging electrification trends across urban and rural areas alike, automated distribution networks are emerging as a critical pillar in the transition toward smarter energy systems. Automation is also proving essential in handling real-time power consumption data and improving asset management capabilities, enabling utilities to respond faster to faults and balance energy supply more effectively. As digital transformation continues to reshape energy infrastructure, distribution automation systems are becoming indispensable in the global effort to build a reliable, secure, and adaptive energy grid.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.4 Billion |

| Forecast Value | $50 Billion |

| CAGR | 11.4% |

The growing demand for grid modernization, the implementation of smart grids, and the need for reliable power distribution are the primary drivers of this market. Utilities are increasingly turning to automation solutions to enhance efficiency, reduce operational costs, and provide a more stable and reliable power supply to consumers. Distribution automation is gaining traction globally as part of the larger push toward smarter, more resilient infrastructure, aiming to improve grid performance and support the integration of renewable energy sources.

Wired communication remains the dominant segment within the market and is projected to grow by USD 26.5 billion by 2034. Fiber optics and Ethernet networks, known for their stability, low latency, and resistance to interference, continue to help in high-reliability applications. Utility companies rely heavily on wired networks for functions like SCADA systems and real-time monitoring of the grid, ensuring that critical operations run smoothly.

The field devices segment, which includes smart reclosers, automated switches, and fault indicators, accounted for a 43% share in 2024, as these devices integrate with IoT and edge computing to improve the reliability and efficiency of power grids. These devices are essential for improving the functionality and reliability of power grids. By integrating with Internet of Things (IoT) technology and edge computing, these devices enhance real-time monitoring, predictive maintenance, and fault detection capabilities. Smart reclosers are particularly important for automatically detecting faults and restoring power after temporary disruptions, significantly reducing the duration of outages.

U.S. Distribution Automation Market generated USD 4.4 billion in 2024. The growth is attributed to advancements in grid systems, the adoption of renewable energy sources, and the increasing deployment of innovative technologies. Federal and state policies aimed at improving energy efficiency, along with the integration of 5G and edge networks for enhanced monitoring and control, are further driving the expansion of this market. The adoption of artificial intelligence and IoT-based systems is enabling utilities to optimize operations, reduce downtime, and enhance grid resilience.

Key players in the Global Distribution Automation Market include Landis+Gyr, ABB, Cisco, Eaton, GE, G&W Electric, S&C Electric Company, Hubbell, Itron, NovaTech, Schneider Electric, Hitachi, Schweitzer Engineering Laboratories, Siemens, Toshiba Energy Systems & Solutions, Trilliant Holdings, and Xylem. To strengthen their presence, companies in the distribution automation market are focusing on technological innovation and product development. Many are investing in AI-based automation and IoT solutions to improve grid management and optimize energy distribution. Partnerships with utilities and energy providers are also a significant strategy, allowing companies to tailor solutions to specific needs and expand their reach. Additionally, companies are exploring mergers and acquisitions to diversify their offerings and enter new regional markets. Increased investment in cybersecurity solutions is another key strategy to address the growing concerns related to grid security and data privacy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Communication, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Wired

- 5.3 Wireless

Chapter 6 Market Size and Forecast, By Components, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Software

- 6.3 Field devices

- 6.4 Services

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Public utility

- 7.3 Private utility

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 India

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Chile

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Cisco

- 9.3 Eaton

- 9.4 GE

- 9.5 G&W Electric

- 9.6 Hitachi

- 9.7 Hubbell

- 9.8 Itron

- 9.9 Landis+Gyr

- 9.10 NovaTech

- 9.11 Schneider Electric

- 9.12 Schweitzer Engineering Laboratories

- 9.13 S&C Electric Company

- 9.14 Siemens

- 9.15 Toshiba Energy Systems & Solutions

- 9.16 Trilliant Holdings

- 9.17 Xylem