|

시장보고서

상품코드

1721526

반려동물용 백신 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Companion Animal Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

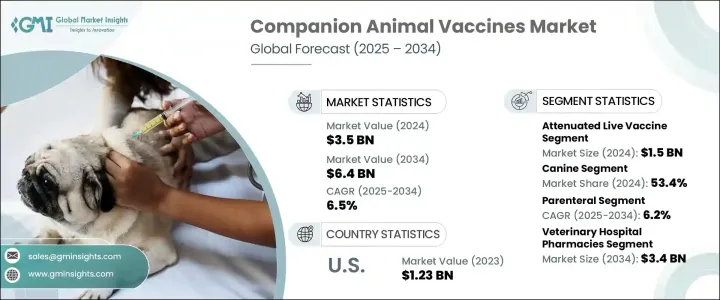

세계의 반려동물용 백신 시장은 2024년 35억 달러로 평가되었고 CAGR 6.5%를 나타내 2034년에는 64억 달러에 이를 것으로 추정되고 있습니다. 세계의 가정이 안정된 페이스로 반려동물을 키우고 있기 때문에 예방 접종과 같은 예방 헬스 케어의 요구가 급속히 높아지고 있습니다. 이러한 의식의 변화는 일상적인 수의료에 대한 투자에 박차를 가해 반려동물을 감염증으로부터 지키는 백신 수요를 급증시키고 있습니다. 또한, 세계의 동물 보건 단체는 조기 백신 접종 프로그램을 추진해, 인수 공통 감염증의 만 연을 줄이고 공중위생의 성과를 향상시키는 데 있어서 예방접종의 중요성을 강화하고 있습니다.

반려동물용 백신 시장은 약독화 백신, 접합형 백신, 불활화 백신, DNA 백신, 재조합 백신 등을 포함한 백신 유형별로 구분됩니다. 부스터 복용량이 장기간에 걸쳐 면역을 제공하는 능력으로 지지되고 있습니다. 약독화된 병원체를 이용하여 면역을 자극하고 다양한 감염증에 대한 효과적인 방어를 제공합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 35억 달러 |

| 예측 금액 | 64억 달러 |

| CAGR | 6.5% |

동물의 유형에서 개는 개, 고양이, 말, 조류로 분류됩니다. 개의 부문은 세계 개 인구 증가와 개 건강에 대한 의식이 높아졌으며 2024년에는 전체 시장의 53.4%를 차지했습니다. 높은 국가에서는 표적 백신 제품에 대한 수요가 높아지고 있습니다.

미국의 반려동물용 백신 시장은 2023년에 12억 3,000만 달러에 이르렀습니다. 따라서 일관된 백신 수요를 견인하고 있습니다. Animal Health, Elanco Animal Health 등 주요 기업들이 혁신을 주도하고 있으며, 미국은 여전히 이 분야에서 매우 중요한 시장입니다.

세계 시장 주요 기업은 연구 개발, 동물 병원과의 제휴, 지역 확대를 통해 백신 제공 강화에 주력하고 있습니다. Pharma, HIPRA 등의 기업들은 세계 반려동물용 소유자의 진화하는 요구를 충족시키기 위해 효과적이고 저렴한 솔루션을 개발하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 반려동물 소유 및 지출 증가

- 반려동물 백신접종에 관한 의식의 고조

- 보험 가입 반려동물용 증가

- 인수 공통 감염증의 만연

- 반려동물 백신접종에 대한 정부의 대처 강화

- 업계의 잠재적 위험 및 과제

- 백신 개발의 고비용

- 백신 개발에 있어서 엄격한 규제 시나리오

- 성장 촉진요인

- 성장 가능성 분석

- 기술의 상황

- 동물 종별 코어백신 및 비코어백신 일람

- 개

- 고양이

- 말

- 조류

- 규제 상황

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 매트릭스 분석

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 백신 유형별(2021-2034년)

- 주요 동향

- 약독화 백신

- 접합 백신

- 불활화 백신

- DNA 백신

- 재조합 백신

- 기타 백신 유형

제6장 시장 추계·예측 : 동물 유형별(2021-2034년)

- 주요 동향

- 개

- 고양이

- 말

- 조류

제7장 시장 추계·예측 : 투여 경로별(2021-2034년)

- 주요 동향

- 비경구

- 경구

- 비강

제8장 시장 추계·예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 동물병원 약국

- 소매 약국

- 전자상거래

제9장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Boehringer Ingelheim International

- Brilliant Bio Pharma

- Bioveta

- Biogenesis Bago

- Ceva Sante Animale

- Durvet

- Elanco Animal Health

- HIPRA

- Indian Immunologicals

- Merck Animal Health

- Sinovac

- Vetoquinol

- Virbac

- Zoetis

The Global Companion Animal Vaccines Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 6.4 billion by 2034. This promising growth trajectory stems from a combination of factors such as increasing pet ownership, rising awareness around animal health, and the expanding trend of pet humanization. As households across the globe continue to adopt pets at a steady pace, the need for preventive healthcare solutions like vaccinations is growing rapidly. Pet owners are prioritizing the overall health and well-being of their companion animals, often equating their care to that of human family members. This shift in attitude is fueling investments in routine veterinary care, creating a surge in demand for vaccines that protect pets from infectious diseases. Moreover, global animal health organizations are promoting early vaccination programs, reinforcing the importance of immunization in reducing the prevalence of zoonotic diseases and improving public health outcomes. The growing emphasis on early-stage disease prevention, supported by rising disposable incomes and advancements in veterinary services, is setting the stage for sustained market expansion through the next decade.

The companion animal vaccines market is segmented by vaccine type, including attenuated live vaccines, conjugate vaccines, inactivated vaccines, DNA vaccines, recombinant vaccines, and others. Among these, the attenuated live vaccine segment was valued at USD 1.5 billion in 2024. These vaccines are favored for their ability to trigger a strong immune response and deliver long-lasting immunity with fewer booster doses. They use weakened forms of pathogens to stimulate immunity, offering effective protection against a variety of infectious conditions. Pet owners and veterinarians continue to choose this vaccine type for its cost-efficiency, reliability, and ability to minimize disease outbreaks in pets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 6.5% |

In terms of animal type, the market is categorized into canines, felines, equines, and avians. The canine segment accounted for 53.4% of the overall market share in 2024, supported by the increasing global dog population and rising awareness of canine health. Countries with high dog ownership rates are witnessing growing demand for targeted vaccine products. Manufacturers are continuously innovating and expanding their vaccine portfolios tailored specifically to dogs, supporting the dominance of the canine segment in the market.

The U.S. Companion Animal Vaccines Market reached USD 1.23 billion in 2023. High pet ownership, coupled with an advanced veterinary healthcare infrastructure, is driving consistent vaccine demand. The pet humanization trend further supports spending on routine checkups and immunizations. With key pharmaceutical companies like Zoetis, Merck Animal Health, Elanco Animal Health, and others leading innovation, the U.S. remains a pivotal market in this space.

Key players in the global market are focused on enhancing their vaccine offerings through R&D, partnerships with veterinary clinics, and regional expansions. Companies such as Vetoquinol, Virbac, Boehringer Ingelheim International, Bioveta, Sinovac, Biogenesis Bago, Brilliant Bio Pharma, HIPRA, and others are developing effective, affordable solutions to meet the evolving needs of global pet owners.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing pet ownership and spending

- 3.2.1.2 Growing awareness about companion animal vaccination

- 3.2.1.3 Growing number of insured pets

- 3.2.1.4 Rising prevalence of zoonotic diseases

- 3.2.1.5 Increasing government initiatives for companion animal vaccination

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of vaccine development

- 3.2.2.2 Stringent regulatory scenario for vaccine development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 List of core and non core vaccines by animal type

- 3.5.1 Canine

- 3.5.2 Feline

- 3.5.3 Equine

- 3.5.4 Avian

- 3.6 Regulatory landscape

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Vaccine Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Attenuated live vaccine

- 5.3 Conjugate vaccine

- 5.4 Inactivated vaccine

- 5.5 DNA vaccine

- 5.6 Recombinant vaccine

- 5.7 Other vaccine types

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Canine

- 6.3 Feline

- 6.4 Equine

- 6.5 Avian

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Parenteral

- 7.3 Oral

- 7.4 Nasal

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Boehringer Ingelheim International

- 10.2 Brilliant Bio Pharma

- 10.3 Bioveta

- 10.4 Biogenesis Bago

- 10.5 Ceva Sante Animale

- 10.6 Durvet

- 10.7 Elanco Animal Health

- 10.8 HIPRA

- 10.9 Indian Immunologicals

- 10.10 Merck Animal Health

- 10.11 Sinovac

- 10.12 Vetoquinol

- 10.13 Virbac

- 10.14 Zoetis