|

시장보고서

상품코드

1721584

황마 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Jute Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

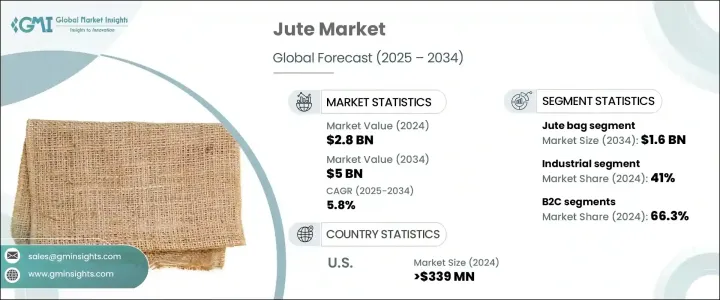

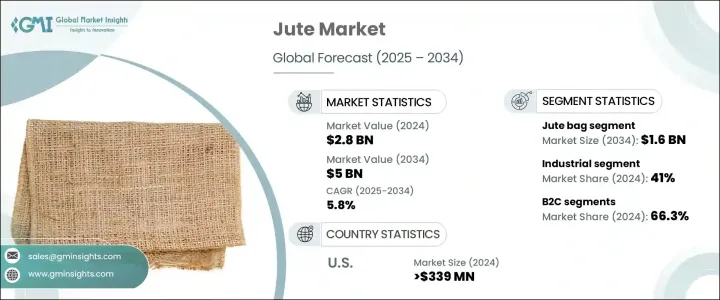

세계의 황마 시장은 2024년 28억 달러에 달했고, CAGR 5.8%로 성장해 2034년까지 50억 달러에 이를 것으로 추정됩니다.

생분해성으로 재생 가능한 소재인 황마는 환경 친화적인 특성과 산업 전반에 걸친 탁월한 범용성으로 급속히 지지를 모으고 있습니다. 지속가능성에 대한 세계의 의식이 높아지며 기업, 정책 입안자, 소비자는 보다 친환경적인 솔루션을 적극적으로 모색하고 있습니다.

이 시장은 산업계가 환경에 대한 배려를 우선한 재료 전략을 재구축하고 있기 때문에 수요가 급증하고 있습니다. ESG 목표가 기업 과제의 중심이 되고 있으며, 소비자는 환경 친화적인 제품을 점점 더 추구하고 있기 때문에 황마는 이 패러다임 전환을 활용하는 데 유리한 입장에 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 28억 달러 |

| 예측 금액 | 50억 달러 |

| CAGR | 5.8% |

소비자의 선호는 기능성과 환경에 대한 책임을 중시하는 선택으로 급속히 진화하고 있습니다. 정부는 지속 가능한 포장 및 섬유의 사용을 장려하기 위해 더 엄격한 규제, 세제 우대, 인센티브를 도입, 이 변화를 강화하고 황마의 관련성이 높아지는 길을 열고 있습니다.

산업계는 합성섬유의 비생분해성 소재를 황마를 기반으로 한 대체 소재로 급속히 대체하고 있습니다. 황마는 소재를 재이용, 재활용, 안전하게 환경으로 되돌리는 등 순환형 경제 모델에 통합할 수 있기 때문에 탄소 중립 목표와 지속가능성의 공약을 달성하려고 노력하고 있는 기업에게 매우 매력적인 선택이 되고 있습니다.

황마 가방 분야에서도 2024년 9억 6,550만 달러를 창출했으며, 2034년에는 16억 달러에 이를 것으로 예측되고 있습니다. 브랜드는 황마 가방을 활용해, 환경에 배려한 브랜딩을 어필해, 현대의 소비자에게 어필하는 유행의 디자인이나 프린트를 도입하고 있습니다. 또, 기업이 플라스틱의 사용량을 줄이는 것과 동시에, 지속가능성의 이야기를 강화하는 것을 목적으로 하고 있기 때문에 판촉 용도도 급속하게 확대하고 있습니다.

최종 사용자 중 토목 공학, 포장 및 자동차 산업에서 황마 기반 재료의 사용에 힘입어 2024년에는 산업 분야가 41%의 점유율을 차지했습니다. 지속가능한 재료에 대한 규제 뒷받침이 황마 복합재료의 혁신과 채용을 촉진하고 있습니다.

미국의 황마 시장은 지속 가능한 패키징에 대한 수요 증가와 황마 기반 제품의 수입 증가를 반영하여 2024년에는 3억 3,900만 달러를 창출하였습니다.

세계의 황마 시장을 형성하는 주요 기업으로는 Cheviot, Bangalore Fort Farms, Budge Budge Company, AI Champdany Industries, Premchand 황마 &Industries 등이 있습니다. 이들 기업은 제품의 혁신, 황마 기반 솔루션의 다양화, 수출 확대, 우수한 혼방 황마 원단을 만들기 위한 연구개발에 많은 투자를 하고 있습니다. 전략적 세계 파트너십과 자동화 기술의 채택은 이러한 기업이 확대하는 시장 수요를 충족시키기 위해 비즈니스 규모를 확대하고 비용을 절감하며 품질 기준을 높이는 데 도움이 됩니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 장래의 전망

- 제조업자

- 리셀러

- 트럼프 정권의 관세 분석

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 합성소재에 대한 환경에 대한 우려

- 정부의 규제

- 합성 소재와의 경쟁

- 업계의 잠재적 리스크 및 과제

- 변동하는 가격

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 규모와 예측 : 제품 유형별, 2021-2034년

- 주요 동향

- 황마 가방

- 황마 수공예품

- 황마 섬유

- 황마 의류

- 황마 가구

- 기타 황마 제품

제6장 시장 규모와 예측 : 용도별, 2021-2034년

- 주요 동향

- 주택용

- 상업용

- 산업용

제7장 시장 규모와 예측 : 유통 채널별, 2021-2034년

- 주요 동향

- B2B

- B2C

- 하이퍼마켓 및 슈퍼마켓

- 전문점

- 온라인

- 기타

제8장 시장 규모와 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Aarbur

- AI Champdany Industries

- Bangalore Fort Farms

- Budge Budge Company

- Cheviot

- Gloster Limited

- Hitaishi-KK

- Howrah Mills Co. Ltd.

- Ludlow Jute & Specialities

- Premchand Jute Industries

- Shree Jee International India

The Global Jute Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 5 billion by 2034, driven by rising environmental concerns and the global push to replace plastic with sustainable alternatives. Jute, a biodegradable and renewable material, is gaining rapid traction for its eco-friendly properties and exceptional versatility across industries. As global awareness around sustainability intensifies, businesses, policymakers, and consumers are actively seeking greener solutions. Jute's low environmental impact, minimal resource consumption, and compatibility with circular economy principles make it a preferred choice across packaging, construction, agriculture, and automotive sectors.

The market is witnessing a strong surge in demand as industries realign their material strategies to prioritize environmental stewardship. Government initiatives worldwide, such as bans on single-use plastics, incentives for sustainable material adoption, and regulations promoting green packaging, are further accelerating jute's adoption. With ESG goals becoming central to corporate agendas and consumers increasingly demanding eco-conscious products, jute is well-positioned to capitalize on this paradigm shift.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $5 Billion |

| CAGR | 5.8% |

Consumer preferences are evolving quickly toward choices that emphasize both functionality and environmental responsibility. Jute, being biodegradable, renewable, and requiring low resource input, continues to capture attention across a wide spectrum of industries. Governments around the world are reinforcing this shift by introducing stricter regulations, tax benefits, and incentives that encourage the use of sustainable packaging and textiles, paving the way for jute's growing relevance.

Industries are swiftly replacing synthetic, non-biodegradable materials with jute-based alternatives. This transition is clearly visible in packaging, agriculture, automotive, and home furnishings. Jute's ability to integrate into circular economy models-where materials are reused, recycled, or safely returned to the environment-makes it a highly attractive choice for companies striving to meet carbon neutrality targets and sustainability commitments.

The jute bag segment alone generated USD 965.5 million in 2024 and is projected to reach USD 1.6 billion by 2034. Known for their biodegradability, durability, and reusability, jute bags are gaining popularity in both fashion and packaging sectors. Brands are leveraging jute bags to showcase eco-conscious branding, incorporating trendy designs and prints that appeal to modern consumers. Promotional use is also expanding rapidly as businesses aim to reduce their plastic footprint while enhancing their sustainability narratives.

Among end-users, the industrial segment commanded a 41% share in 2024, fueled by the use of jute-based materials in civil engineering, packaging, and automotive industries. Regulatory backing for sustainable materials continues to drive innovation and adoption of jute composites. Civil construction projects, in particular, are adopting jute geotextiles for their cost-effectiveness, biodegradability, and practical efficiency.

The United States Jute Market generated USD 339 million in 2024, reflecting rising demand for sustainable packaging and increasing imports of jute-based products. The US stands as a key market for Indian jute exports, driven by a growing eco-conscious consumer base and intensified governmental focus on reducing plastic waste, especially in printed jute bag segments.

Leading players shaping the Global Jute Market include Cheviot, Bangalore Fort Farms, Budge Budge Company, AI Champdany Industries, and Premchand Jute & Industries. These companies are emphasizing product innovation, diversifying jute-based solutions, expanding exports, and investing heavily in R&D to create superior, blended jute fabrics. Strategic global partnerships and the adoption of automation technologies are helping these firms scale operations, cut costs, and elevate quality standards to meet growing market demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariff analysis

- 3.2.1 Trade volume disruptions

- 3.2.2 Retaliatory measures

- 3.3 Impact on the industry

- 3.3.1 Supply-side impact (raw materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.2 Demand-side impact (selling price)

- 3.3.2.1 Price transmission to end markets

- 3.3.2.2 Market share dynamics

- 3.3.2.3 Consumer response patterns

- 3.3.1 Supply-side impact (raw materials)

- 3.4 Key companies impacted

- 3.5 Strategic industry responses

- 3.5.1 Supply chain reconfiguration

- 3.5.2 Pricing and product strategies

- 3.5.3 Policy engagement

- 3.6 Outlook and future considerations

- 3.7 Supplier landscape

- 3.8 Profit margin analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Environmental concern for synthetic material

- 3.11.1.2 Government regulation

- 3.11.1.3 Competition from synthetic material

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Fluctuating prices

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product Type, 2021 - 2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Jute bags

- 5.3 Jute handicrafts

- 5.4 Jute textile

- 5.5 Jute apparel

- 5.6 Jute furnishings

- 5.7 Other jute products

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

Chapter 7 Market Size and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 B2B

- 7.3 B2C

- 7.3.1 Hypermarkets and supermarkets

- 7.3.2 Specialty stores

- 7.3.3 Online

- 7.3.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aarbur

- 9.2 AI Champdany Industries

- 9.3 Bangalore Fort Farms

- 9.4 Budge Budge Company

- 9.5 Cheviot

- 9.6 Gloster Limited

- 9.7 Hitaishi-KK

- 9.8 Howrah Mills Co. Ltd.

- 9.9 Ludlow Jute & Specialities

- 9.10 Premchand Jute Industries

- 9.11 Shree Jee International India