|

시장보고서

상품코드

1740872

대체 단백질 제조 장비 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Alternative Protein Production Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

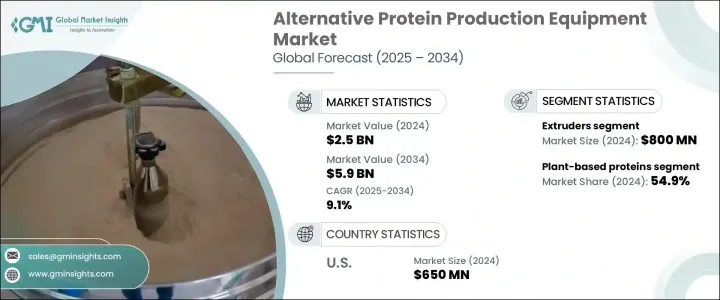

세계의 대체 단백질 제조 장비 시장은 2024년에는 25억 달러로 평가되었으며 CAGR 9.1%를 나타내 2034년에는 59억 달러에 이를 것으로 추정됩니다.

이 성장은 소비자가 건강, 지속가능성, 윤리적 소비를 둘러싼 현대의 가치관에 따른 대체식품을 점점 요구하게 되어, 세계의 식습관이 크게 변화하고 있는 것이 큰 요인이 되고 있습니다. 전통적인 식품 시스템은 압력을 받고 있으며 업계는 대체 단백질을 지원하는 고급 가공 장비에 대한 투자를 촉진하고 있습니다.

건강한 생활에 대한 의식의 고조도 비전통적인 단백질원을 생산할 수 있는 기기에 대한 수요 증가의 원동력이 되고 있습니다. 지방분이 적고, 식이섬유가 풍부하고, 호르몬제나 항생물질 등의 첨가물을 포함하지 않는 대체 단백질을 탐구하게 되어 있습니다.그 결과, 이러한 수요가 높은 단백질 형태를 효율적으로 제조할 수 있는 고도의 기계에 투자하도록, 생산자에게 요구하는 압력이 높아지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 25억 달러 |

| 예측 금액 | 59억 달러 |

| CAGR | 9.1% |

장비유형별로, 압출기가 2024년에 8억 달러의 수익을 올리고 시장을 선도했습니다. 이 분야는 2034년까지 약 9.4%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예측됩니다. 특히 고수분 압출 기술은 동물 조직에서 발견되는 섬유질 구조를 재현하는 데 사용되며 식물성 단백질 소비자의 식습관을 향상시키고 대체 식품의 광범위한 채용을 촉진하는 데 도움이 됩니다.

용도별로는 식물성 단백질이 2024년 시장 점유율 전체의 54.9%를 차지했고 예측 기간 중의 CAGR은 약 9.6%를 나타낼 것으로 예측됩니다. 이 분야는 그 비용 우위성, 시장 준비 상황, 소비자의 수용성에 의해 일찍부터 시장의 주목을 끌어 왔습니다. 다양한 식물원에서 유래한 제품은 식료품 매장과 외식산업의 메뉴에 확고한 발판을 구축하고 있어 건강 지향의 소비자나 지속 가능한 식품 시스템에 관심을 가지는 소비자 증가에 어필하고 있습니다. 가공 능력의 향상을 요구하는 움직임은 분리기, 믹서, 건조기, 압출기 등 식물 유래의 투입물을 취급하여 생산물의 품질을 최적화하도록 조정된 기기에 대한 새로운 투자로 이어졌습니다.

최종 용도별로는 식품산업이 계속 시장을 독점하고 있으며, 2024년에는 최대의 점유율을 차지했고 2034년까지 이 리드를 유지할 것으로 예측됩니다. 기업은 진화하는 소비자의 취향에 대응하기 위해 대체 단백질 제품의 대량 생산을 지원하는 정밀 공학 기기에 많은 투자를 하고 있습니다. 기존 식품 브랜드와 신흥 기업 모두 경쟁력을 유지하기 위해 제조 라인 업그레이드에 자본을 투입하고 있습니다. 발효기, 호퍼, 생물반응기, 대량 압출기 수요는 품질 기준과 생산 확장성을 충족시킬 필요성에 의해 증가하고 있습니다. 건강 지향적이고 환경 친화적인 제품에 대한 소매점의 관심 증가와 소비 지출 증가가 이러한 동향을 더욱 가속화하고 있습니다.

지역별로는 미국이 2024년에 6억 5,000만 달러의 평가액으로 북미 시장을 선도했고, 2034년까지 연평균 복합 성장률(CAGR) 9.5%를 나타낼 것으로 보입니다. 지속 가능한 식습관과 식물 지향의 식생활에 대한 관심이 대체 단백질 생산을 위한 시설의 설립과 확장을 제조업체에 촉진하고 있습니다. 요점을 높여 이 분야에서 첨단 자동화 기계의 중요성을 강화하고 있습니다.

대체 단백질 제조 장비 시장을 적극적으로 형성하는 주요 기업은 ANDRITZ AG, Alfa Laval AB, BAK Food Equipment, Buhler AG, FAM STUMABO, Bepex International LLC, GEA Group Aktiengesellschaft, Middleby Corporation, JBT Marel Corporation, MULTIVAC Sepp Haggenmuller SE . &Co. Inc. Rockwell Automation, Paul Mueller Company, Scansteel Foodtech A/S, SPX FLOW. 등이 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 파괴적 혁신

- 향후 전망

- 제조업체

- 유통업체

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 공급자의 상황

- 무역 분석

- 이익률 분석

- 기술 개요

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 급속히 증가하는 세계 인구

- 건강과 웰니스에 중점 증가

- 지속 가능한 단백질에 대한 소비자 수요 증가

- 식물성 단백질 생산 확대

- 업계의 잠재적 위험 및 과제

- 높은 초기 자본 투자액

- 기존 시스템과의 통합 복잡성

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계·예측 : 장비 유형별(2021-2034년)

- 주요 동향

- 압출기

- 균질화기

- 믹서

- 건조기

- 여과 장치

제6장 시장 추계·예측 : 동작 모드별(2021-2034년)

- 주요 동향

- 반자동

- 자동

제7장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 식물성 단백질

- 배양육

- 곤충 단백질

- 계란 대체품

제8장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 식품업계

- 동물사료

- 영양보조식품

- 기타

제9장 시장 추계·예측 : 가공 기술별(2021-2034년)

- 주요 동향

- 텍스처화

- 발효

- 유화

- 분무 건조

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- Alfa Laval AB

- ANDRITZ AG

- BAK Food Equipment

- Bepex International LLC

- Buhler AG

- FAM STUMABO

- GEA Group Aktiengesellschaft

- JBT Marel Corporation

- Middleby Corporation

- MULTIVAC Sepp Haggenmuller SE &Co. KG

- Paul Mueller Company

- Robert Reiser &Co. Inc.

- Rockwell Automation

- Scansteel Foodtech A/S.

- SPX FLOW

The Global Alternative Protein Production Equipment Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 5.9 billion by 2034. This growth is largely driven by a major shift in global eating habits as consumers increasingly seek food alternatives that align with modern values around health, sustainability, and ethical consumption. With population growth accelerating and income levels rising across key markets, the demand for scalable, reliable, and clean food production technologies is gaining momentum. Traditional food systems are under pressure, prompting the industry to invest in advanced processing equipment that supports alternative proteins. These solutions are becoming critical in transforming how food is produced, offering a viable substitute to conventional meat without compromising on nutrition or taste.

The growing awareness around healthy living is another driving force behind the rise in demand for equipment capable of producing non-traditional protein sources. Consumers today are far more selective about what they eat, actively avoiding foods linked to chronic diseases while embracing options that fuel a more energetic lifestyle. This shift in mindset is encouraging food manufacturers to explore protein alternatives that are leaner, richer in fiber, and free from additives like hormones or antibiotics. As a result, there is increased pressure on producers to invest in advanced machinery capable of efficiently manufacturing these high-demand protein formats. This is reshaping the industry landscape and establishing new standards in food production and equipment design.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 9.1% |

In terms of equipment types, extruders led the market by generating USD 800 million in revenue in 2024. This segment is expected to grow at a CAGR of approximately 9.4% through 2034. These machines are essential for shaping protein ingredients into textures that appeal to consumers seeking substitutes for conventional meat. High-moisture extrusion technology, in particular, is being used to replicate the fibrous structure found in animal tissue, enhancing the eating experience for plant-based protein consumers and helping to drive broader adoption of alternative food products.

Application-wise, plant-based proteins accounted for 54.9% of the total market share in 2024 and are projected to grow at a CAGR of about 9.6% during the forecast period. This segment has captured early market attention thanks to its cost advantages, market readiness, and consumer acceptance. Products derived from various plant sources are finding a strong foothold in grocery aisles and foodservice menus, appealing to a growing group of health-conscious consumers and those interested in more sustainable food systems. The push for improved processing capabilities has led to new investments in equipment such as separators, mixers, dryers, and extruders, tailored to handle plant-derived inputs and optimize output quality.

The food industry continues to dominate the market in terms of end use, holding the largest share in 2024, and is expected to maintain this lead through 2034. As companies race to cater to evolving consumer preferences, they are investing heavily in precision-engineered equipment that supports large-scale production of alternative protein products. Both established food brands and emerging companies are directing capital toward upgrading their manufacturing lines to stay competitive. Demand for fermenters, hoppers, bioreactors, and high-volume extruders is rising, driven by the need to meet quality standards and production scalability. Enhanced retail interest and increased consumer spending on health-driven and environmentally friendly products are further accelerating this trend.

Regionally, the United States led the North American market with a valuation of USD 650 million in 2024 and is set to grow at a CAGR of 9.5% through 2034. Interest in sustainable eating practices and plant-forward diets is encouraging manufacturers to set up or expand facilities geared toward alternative protein production. The shift in consumer preferences is pushing demand for innovative food processing technologies and reinforcing the importance of advanced, automated machinery in this space. This rise in demand has created new opportunities for equipment manufacturers to offer more specialized solutions tailored to the needs of food producers.

Key players actively shaping the alternative protein production equipment market include ANDRITZ AG, Alfa Laval AB, BAK Food Equipment, Buhler AG, FAM STUMABO, Bepex International LLC, GEA Group Aktiengesellschaft, Middleby Corporation, JBT Marel Corporation, MULTIVAC Sepp Haggenmuller SE & Co. KG, Robert Reiser & Co., Inc., Rockwell Automation, Paul Mueller Company, Scansteel Foodtech A/S, and SPX FLOW. These companies are at the forefront of designing and delivering advanced machinery systems that meet the evolving needs of modern protein production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-Side impact (Selling Price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Trade analysis

- 3.5 Profit margin analysis

- 3.6 Technological overview

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rapidly growing global population

- 3.9.1.2 Growing emphasis on health and wellness

- 3.9.1.3 Rising consumer demand for sustainable proteins

- 3.9.1.4 Expansion of plant-based protein production

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial capital investment

- 3.9.2.2 Complexity of integration with existing systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Extruders

- 5.3 Homogenizers

- 5.4 Mixers

- 5.5 Dryers

- 5.6 Filtration units

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Automatic

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Plant-Based proteins

- 7.3 Cultured meat

- 7.4 Insect proteins

- 7.5 Egg replacements

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food industry

- 8.3 Animal feed

- 8.4 Nutraceuticals

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Processing Technology, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Texturization

- 9.3 Fermentation

- 9.4 Emulsification

- 9.5 Spray drying

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alfa Laval AB

- 11.2 ANDRITZ AG

- 11.3 BAK Food Equipment

- 11.4 Bepex International LLC

- 11.5 Buhler AG

- 11.6 FAM STUMABO

- 11.7 GEA Group Aktiengesellschaft

- 11.8 JBT Marel Corporation

- 11.9 Middleby Corporation

- 11.10 MULTIVAC Sepp Haggenmuller SE & Co. KG

- 11.11 Paul Mueller Company

- 11.12 Robert Reiser & Co., Inc.

- 11.13 Rockwell Automation

- 11.14 Scansteel Foodtech A/S.

- 11.15 SPX FLOW