|

시장보고서

상품코드

1740935

자동차용 초음파 기술 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Automotive Ultrasonic Technologies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

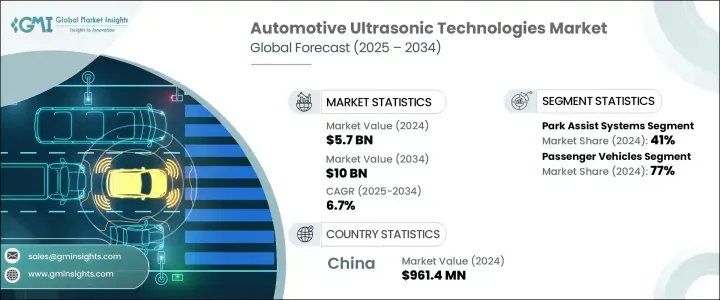

세계의 자동차용 초음파 기술 시장 규모는 2024년에 57억 달러로 평가되었고, ADAS(선진 운전 지원 시스템)와 같은 자동차의 선진 안전 기능에 대한 수요 증가를 배경으로, 2034년에는 100억 달러에 이를 것으로 예측되며, CAGR 6.7%로 성장할 전망입니다.

차량 안전에 대한 관심이 높아지면서 초음파 기술의 통합은 차세대 모빌리티의 핵심 요소로 부상하고 있습니다. 자동차 제조업체들은 더 안전하고 스마트하며 더 연결된 차량에 대한 소비자의 기대치를 충족해야 한다는 압박을 받고 있습니다. 이러한 변화는 프리미엄 브랜드에만 국한된 것이 아니라, 안전에 민감한 소비자들이 점점 더 많은 자동차 시장에서 경쟁력을 유지하기 위해 중급 및 저가형 자동차 부문에서도 초음파 센서 시스템을 빠르게 도입하고 있습니다.

차량 안전 규범의 지속적인 진화, 기술 발전, 자율 주행 기능에 대한 요구로 인해 초음파 기술이 선택이 아닌 필수로 자리 잡는 환경이 조성되고 있습니다. 자동차 제조업체, 공급업체, 기술 혁신가들은 확장 가능하고 비용 효율적인 초음파 솔루션을 시장에 출시하기 위해 집중적으로 협력하여 보급형 차량에도 최첨단 안전 시스템을 장착하고 있습니다. 업계에서는 센서 정확도, 내구성 및 경제성 향상에 초점을 맞춘 R&D 투자가 가속화되고 있으며, 이에 따라 대중 시장 도입 범위가 확대되고 있습니다. 전 세계 정부가 엄격한 차량 안전 프레임워크를 도입하고 스마트 모빌리티 혁신을 장려함에 따라 자동차용 초음파 기술 시장은 선진국과 신흥국 모두에서 지속적인 성장을 이룰 것으로 전망됩니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 57억 달러 |

| 예측 금액 | 100억 달러 |

| CAGR | 6.7% |

안전 기준이 강화됨에 따라 주차 센서, 충돌 방지, 사각지대 감지 등의 기술이 점점 더 대중화되고 있습니다. 여러 지역의 정부는 차량 안전 규정을 적극적으로 업데이트하고 첨단 운전자 보조 기술의 도입을 강조하는 새로운 규정 준수 프레임워크를 도입하고 있습니다. UNECE, NHTSA 및 기타 글로벌 기관과 같은 규제 기관은 장애물 감지, 보행자 경고 시스템, 자동 제동, 향상된 주차 지원 등의 기능을 의무화하여 중심적인 역할을 하고 있으며, 이러한 기능은 모두 초음파 감지 기능에 크게 의존하고 있습니다. 안전 규정이 기본적인 규정 준수에서 사전 사고 예방으로 전환됨에 따라 초음파 기술은 자동차 안전 혁신에서 중추적인 역할을 담당하고 있습니다. 자동차 제조업체들은 이러한 글로벌 안전 규정을 충족하고 안전을 중시하는 소비자들의 충성도를 확보하기 위해 프리미엄 모델뿐만 아니라 중급 및 보급형 차량에도 초음파 센서를 탑재하고 있습니다.

다양한 용도 중에서 주차 보조 시스템은 2024년 41%를 차지하며 가장 큰 비중을 차지할 것으로 예상됩니다. 이러한 시스템은 특히 소형 및 중형 차량의 저속 기동과 주차를 훨씬 쉽고 안전하게 해줍니다. 다른 첨단 안전 시스템에 비해 경제성과 단순성으로 인해 다양한 차량 카테고리의 소비자에게 선택되고 있습니다.

차량 유형별로 세분화되어 있으며, 2024년에는 승용차가 77%의 점유율을 차지할 것으로 예상됩니다. 더 많은 자동차 제조업체가 소형 및 중형차에 초음파 지원 안전 기능을 장착함에 따라 수요가 계속 증가하고 있습니다. 이코노미 클래스 모델에서도 안전성을 강화해야 한다는 규제 압력이 이러한 추세를 더욱 촉진하고 있습니다.

중국은 강력한 자동차 산업과 차량 안전 및 스마트 모빌리티를 장려하는 정부 노력에 힘입어 2024년 세계 시장에서 38%의 압도적인 점유율을 차지할 것으로 예상됩니다. 전기, 하이브리드, 커넥티드 및 자율 주행 차량에 대한 수요가 증가하면서 초음파 도입이 더욱 가속화되고 있습니다.

세계 자동차용 초음파 기술 시장의 주요 기업으로는 현대모비스, 보쉬, 콘티넨탈, 마그나 인터내셔널, NXP 반도체, 로크웰 오토메이션, 미쓰비시 전기, ST마이크로전자, TE 커넥티비티, 텍사스 인스트루먼트 등이 있습니다. 이러한 기업들은 전략적 파트너십, 지속적인 R&D, 제품 혁신에 집중하여 통합을 추진하고 성능을 개선하며 첨단 자동차 안전 기능에 대한 수요 증가에 대응하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 원자재 공급업체

- 부품 제조업체

- 모듈 및 시스템 통합자

- 자동차 OEM 제조업체

- 애프터마켓 공급자 및 설치업자

- 이익률 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원자재)

- 주요 원자재의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원자재)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 기술과 혁신의 상황

- 특허 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 차량 안전 기능 및 ADAS에 대한 수요 증가

- 자율주행 및 반자율주행 차량의 성장

- 정부의 규제 및 안전 기준

- 초음파 센서의 기술 발전

- 스마트 주차 솔루션에 대한 소비자 선호도 증가

- 업계의 잠재적 위험 및 과제

- 불리한 조건에서의 성능 제한

- 제한된 범위 및 시야

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 주차 보조 시스템

- 사각지대 감지

- 충돌 방지

- 자동 주차 시스템

- 기타

제6장 시장 추계 및 예측 : 차량 유형별(2021-2034년)

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제7장 시장 추계 및 예측 : 기술별(2021-2034년)

- 주요 동향

- 근접 감지 센서

- 거리 측정 센서

제8장 시장 추계 및 예측 : 판매 채널별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제10장 기업 프로파일

- Autoliv

- Balluff

- Baumer Holding

- Bosch

- Continental

- Elmos Semiconductor

- Garmin

- Honeywell International

- Hyundai Mobis

- Keyence Corporation

- Magna International

- Mitsubishi Electric

- NXP Semiconductors

- Omron Corporation

- Pepperl Fuchs

- Rockwell Automation

- STMicroelectronics

- TDK Corporation

- TE Connectivity

- Texas Instruments

The Global Automotive Ultrasonic Technologies Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 10 billion by 2034, driven by rising demand for advanced automotive safety features and driver assistance systems like ADAS. As vehicle safety continues to take center stage, the integration of ultrasonic technologies has emerged as a critical enabler of next-generation mobility. Automakers are under growing pressure to meet consumer expectations for safer, smarter, and more connected vehicles. This shift is not limited to premium brands; mid-range and budget-friendly car segments are also rapidly incorporating ultrasonic sensor systems to stay competitive in a market increasingly shaped by safety-conscious consumers.

The continuous evolution of vehicle safety norms, technological advancements, and a push for autonomous capabilities are creating an environment where ultrasonic technologies are not just optional but essential. Automakers, suppliers, and tech innovators are collaborating intensively to bring scalable, cost-effective ultrasonic solutions to the market, ensuring that even entry-level vehicles are equipped with cutting-edge safety systems. The industry is witnessing accelerated R&D investments focused on enhancing sensor accuracy, durability, and affordability, thus widening the scope for mass-market adoption. As governments worldwide introduce stringent vehicle safety frameworks and encourage smart mobility innovations, the automotive ultrasonic technologies market is set to experience sustained growth across both mature and emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $10 Billion |

| CAGR | 6.7% |

Technologies such as parking sensors, collision avoidance, and blind-spot detection are becoming increasingly popular as safety standards tighten. Governments across various regions are actively updating vehicle safety regulations and introducing new compliance frameworks that emphasize the adoption of advanced driver assistance technologies. Regulatory bodies like UNECE, NHTSA, and other global organizations are playing a central role by mandating features such as obstacle detection, pedestrian alert systems, automated braking, and enhanced parking support, all of which rely heavily on ultrasonic sensing capabilities. As safety regulations shift from basic compliance to proactive accident prevention, ultrasonic technologies are securing a pivotal role in automotive safety innovation. Automakers are now embedding ultrasonic sensors not only in premium models but also across mid-range and entry-level vehicles to meet these global safety norms and capture the loyalty of safety-focused consumers.

Among different applications, parking assist systems hold the largest share, accounting for 41% in 2024. These systems make low-speed maneuvering and parking much easier and safer, especially for compact and mid-range vehicles. Their affordability and simplicity compared to other advanced safety systems have made them a go-to choice for consumers across various vehicle categories.

The market is also segmented by vehicle type, with passenger vehicles dominating a 77% share in 2024. Demand continues to climb as more automakers equip compact and mid-sized cars with ultrasonic-enabled safety features. Regulatory pressures requiring enhanced safety even in economy-class models further fuel this trend.

China held a dominant 38% share of the global market in 2024, driven by its robust automotive industry and government initiatives promoting vehicle safety and smart mobility. Growing demand for electric, hybrid, connected, and autonomous vehicles is further accelerating ultrasonic adoption.

Key players in the Global Automotive Ultrasonic Technologies Market include Hyundai Mobis, Bosch, Continental, Magna International, NXP Semiconductors, Rockwell Automation, Mitsubishi Electric, STMicroelectronics, TE Connectivity, and Texas Instruments. These companies are focusing on strategic partnerships, continuous R&D, and product innovation to drive integration, improve performance, and cater to the rising demand for advanced automotive safety features.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Module and system integrators

- 3.2.4 Automotive original equipment manufacturers

- 3.2.5 Aftermarket suppliers and installers

- 3.3 Profit margin analysis

- 3.4 Trump Administration Tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (Raw Materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply Chain Restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (Selling Price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (Raw Materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand for vehicle safety features and ADAS

- 3.9.1.2 Growth of autonomous and semi-autonomous vehicles

- 3.9.1.3 Government regulations and safety standards

- 3.9.1.4 Technological advancements in ultrasonic sensors

- 3.9.1.5 Increasing consumer preference for smart parking solutions

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Performance limitations in adverse conditions

- 3.9.2.2 Limited range and field of view

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Park assist system

- 5.3 Blind spot detection

- 5.4 Collision avoidance

- 5.5 Self-parking system

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Proximity detection sensors

- 7.3 Range measurement sensors

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Autoliv

- 10.2 Balluff

- 10.3 Baumer Holding

- 10.4 Bosch

- 10.5 Continental

- 10.6 Elmos Semiconductor

- 10.7 Garmin

- 10.8 Honeywell International

- 10.9 Hyundai Mobis

- 10.10 Keyence Corporation

- 10.11 Magna International

- 10.12 Mitsubishi Electric

- 10.13 NXP Semiconductors

- 10.14 Omron Corporation

- 10.15 Pepperl+Fuchs

- 10.16 Rockwell Automation

- 10.17 STMicroelectronics

- 10.18 TDK Corporation

- 10.19 TE Connectivity

- 10.20 Texas Instruments