|

시장보고서

상품코드

1833632

헬스케어 컨설팅 서비스 시장 : 시장 기회 및 촉진요인, 업계 동향 분석, 예측(2025-2034년)Healthcare Consulting Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

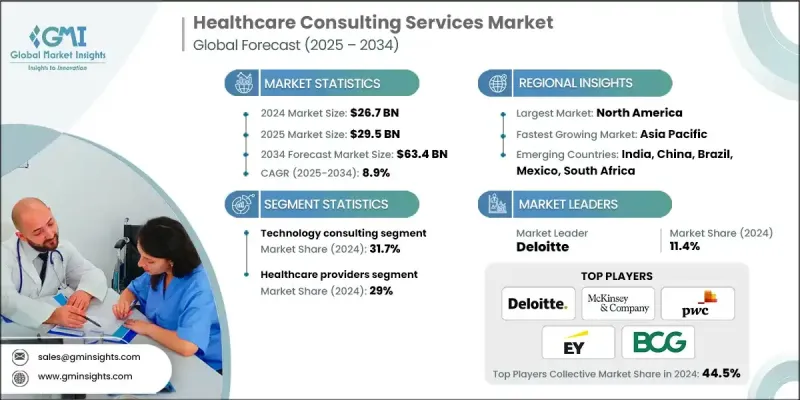

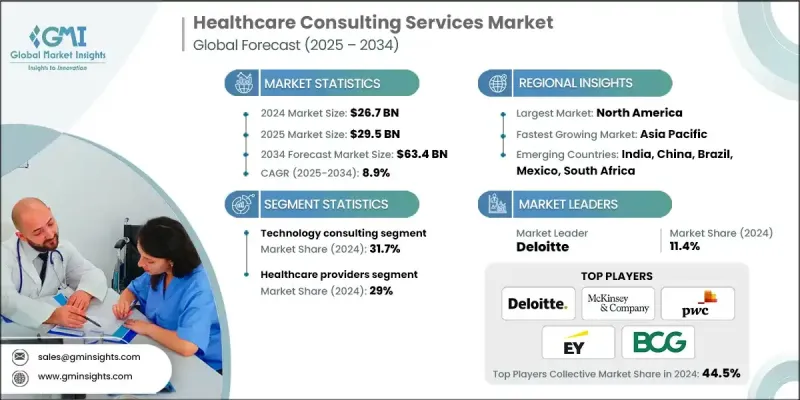

Global Market Insights Inc.가 발행한 최신 보고서에 따르면 세계의 헬스케어 컨설팅 서비스 시장은 2024년에 267억 달러로 평가되었고, CAGR 8.9%로 성장할 전망이며, 2025년 295억 달러에서 2034년에는 634억 달러로 성장할 것으로 예측됩니다.

전자기술(EHR)의 도입, 원격 의료 플랫폼, AI를 활용한 진단 등, 디지털화의 추진에 의해 전문가의 지도에 대한 강한 요구가 생겨나고 있습니다. 헬스케어 컨설턴트는 임상 및 비즈니스 목적에 맞는 디지털 툴의 선택, 도입 및 최적화에 있어 제공업체와 지불자를 지원합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시장 규모 | 267억 달러 |

| 예측 금액 | 634억 달러 |

| CAGR | 8.9% |

기술 컨설팅이 견인 역할

공급자 및 지불자가 업무의 근대화를 위해 디지털 이니셔티브를 가속화하고 있기 때문에 기술 컨설팅 분야가 2024년에 주목해야 할 점유율을 차지했습니다. 전자 의료기기(EHR) 및 원격 의료 플랫폼의 도입부터 AI 중심의 분석 및 사이버 보안 솔루션 구축에 이르기까지 기술 컨설턴트는 의료 기관이 데이터 중심으로 연결된 생태계에 적응하는 데 필수적인 파트너입니다. 디지털 헬스의 도입이 진행됨에 따라 전략적이고 확장성이 뛰어나며, 컴플라이언스를 준수하는 기술 로드맵에 대한 수요는 컨설팅 회사의 주요 추진 요인이 되고 있습니다.

헬스케어 제공업체 채용 증가

의료 제공업체 분야는 업무 최적화, 환자 결과 개선, 관리 간접비 절감에 대한 필요성으로 2024년에 큰 수익을 올렸습니다. 컨설턴트는 의료 제공 기관과 밀접하게 연계하여 케어 제공 모델의 재설계, 밸류 베이스 케어의 틀에 적합, 임상 및 재무 실적을 관리합니다. 워크포스 계획, 디지털 통합, 공급망 최적화 등 공급자는 급변하는 헬스케어 상황에 적응하기 위해 전문가의 고문을 의지하게 되었습니다.

북미가 추진력이 있는 지역으로 상승

북미의 헬스케어 컨설팅 서비스 시장은 선진적인 헬스케어 인프라, 높은 기술 도입 수준, 법규 규제 준수에 대한 강한 관심이 원동력이 되어 2024년 지속적인 점유율을 유지했습니다. 미국은 대규모 병원 네트워크 및 보험 제공업체의 가치 기반 상환 모델, 포퓰레이션 헬스 이니셔티브, 디지털 전환으로의 지속적인 변화가 수요를 이끌고 있습니다. 컨설팅 회사는 도시와 지역 시장 모두에서 고객의 다양한 요구에 대응하기 위해 전문성이 높은 인력, 현지에서의 제공 능력, 기능 횡단적인 서비스 제공에 투자함으로써 존재감을 높이고 있습니다.

헬스케어 컨설팅 서비스 시장의 주요 기업은 IQVIA, Guidehouse, LEK Consulting, Vizient, Capgemini, Ernst & Young, Boston Consulting Group, Cognizant, Bain & Company, Deloitte, Oliver Wyman, Accenture, Chartis, PwC, ClearView Healthcare Partners, Kearney、NTT DATA, HURON, McKinsey &Company, KPMG입니다.

헬스케어 컨설팅 서비스 시장의 리딩 팜은 전문성, 확장성, 고객 중심의 혁신에 중점을 둔 전략을 채택하여 포지션을 강화합니다. 대부분은 지급자 전략, 포퓰레이션 건강, 규제 준수 등의 분야에서 깊은 전문 지식을 가진 수직 전문 팀을 구축하고 있습니다. 기업은 또한 인수 및 헬스 텍 신흥기업과의 제휴를 통해 디지털 능력을 확대하여 엔드 투 엔드 트랜스포메이션 서비스를 제공할 수 있도록 하고 있습니다. 또한 데이터 보안과 상호 운용성에 중점을 둔 각 회사는 HIPAA 및 기타 개인 정보 보호 의무에 따라 프레임 워크를 개발하고 있습니다. 전략적 권장 사항과 실용적인 도입 및 장기적인 변경 관리를 결합하여 컨설팅 제공업체는 헬스케어의 혁신에 필수적인 파트너로서의 지위를 확립하고 있습니다.

목차

제1장 조사 방법 및 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 헬스케어 분야에서 기술의 진보

- 합병 및 인수 활동 증가

- 세계 연구개발비 증가

- 업계의 잠재적 위험 및 과제

- 숨겨진 비용 및 운영의 역학

- 시장 기회

- 디지털 건강 변혁에 대한 수요 증가

- AI와 데이터 분석의 통합 수요

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 기술의 상황

- 현재의 기술 동향

- 신흥기술

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

- 장래 시장 동향

제4장 경쟁 구도

- 서문

- 기업 매트릭스 분석

- 기업의 시장 점유율 분석

- 세계

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 경쟁 포지셔닝 매트릭스

- 주요 시장 기업의 경쟁 분석

- 주요 발전

- 합병 및 인수

- 파트너십 및 협업

- 새로운 서비스 유형의 개시

- 확장 계획

제5장 시장 추계 및 예측 : 서비스종별(2021-2034년)

- 주요 동향

- 기술 컨설팅

- 전략 컨설팅

- 오퍼레이션 컨설팅

- 재무 컨설팅

- 기타 서비스 유형

제6장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 의료 제공자

- 헬스케어 지불자

- 생명과학 및 제약회사

- 헬스케어 기술 및 디지털 헬스 기업

- 정부 및 규제기관

제7장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제8장 기업 프로파일

- Accenture

- Bain & Company

- Boston Consulting Group

- Capgemini

- Chartis

- ClearView Healthcare Partners

- Cognizant

- Deloitte

- Ernst & Young

- Guidehouse

- HURON

- IQVIA

- Kearney

- KPMG

- LEK Consulting

- McKinsey & Company

- NTT DATA

- Oliver Wyman

- PricewaterhouseCoopers(PwC)

- Vizient

The global healthcare consulting services market was estimated at USD 26.7 billion in 2024 and is expected to grow from USD 29.5 billion in 2025 to USD 63.4 billion in 2034, at a CAGR of 8.9%, according to the latest report published by Global Market Insights Inc.

The push toward digitization, such as implementing electronic health records (EHR), telemedicine platforms, and AI-powered diagnostics, is creating a strong need for expert guidance. Healthcare consultants support providers and payers in choosing, deploying, and optimizing digital tools that align with clinical and business objectives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.7 Billion |

| Forecast Value | $63.4 Billion |

| CAGR | 8.9% |

Technology Consulting to Gain Traction

The technology consulting segment held a notable share in 2024, as providers and payers accelerate digital initiatives to modernize their operations. From implementing electronic health records (EHRs) and telehealth platforms to deploying AI-driven analytics and cybersecurity solutions, technology consultants are essential partners in helping healthcare organizations adapt to a more data-centric, connected ecosystem. As digital health adoption grows, the demand for strategic, scalable, and compliant technology roadmaps remains a major growth driver for consulting firms.

Rising Adoption of Healthcare Providers

The healthcare providers segment generated significant revenues in 2024, driven by the need to optimize operations, improve patient outcomes, and reduce administrative overhead. Consultants work closely with provider organizations to redesign care delivery models, align with value-based care frameworks, and manage clinical and financial performance. Whether it's workforce planning, digital integration, or supply chain optimization, providers are increasingly turning to expert advisors to help them adapt to a fast-changing healthcare landscape.

North America to Emerge as a Propelling Region

North America healthcare consulting services market held a sustainable share in 2024, driven by advanced healthcare infrastructure, high levels of technology adoption, and a strong focus on regulatory compliance. The United States leads in demand, fueled by ongoing shifts toward value-based reimbursement models, population health initiatives, and digital transformation across large hospital networks and insurance providers. Consulting firms are expanding their presence by investing in specialized talent, local delivery capabilities, and cross-functional service offerings to meet the diverse needs of clients in both urban and rural markets.

Major players in the healthcare consulting services market are IQVIA, Guidehouse, L.E.K. Consulting, Vizient, Capgemini, Ernst & Young, Boston Consulting Group, Cognizant, Bain & Company, Deloitte, Oliver Wyman, Accenture, Chartis, PricewaterhouseCoopers (PwC), ClearView Healthcare Partners, Kearney, NTT DATA, HURON, McKinsey & Company, and KPMG.

To strengthen their position, leading firms in the healthcare consulting services market are adopting strategies that focus on specialization, scalability, and client-centric innovation. Many are building vertical-specific teams with deep domain expertise in areas like payer strategy, population health, or regulatory compliance. Firms are also expanding their digital capabilities through acquisitions or partnerships with health tech startups, allowing them to offer end-to-end transformation services. Additionally, a strong emphasis is being placed on data security and interoperability, with companies developing frameworks that align with HIPAA and other privacy mandates. By combining strategic advisory with hands-on implementation and long-term change management, consulting providers are positioning themselves as indispensable partners in healthcare transformation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Service type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in the healthcare sector

- 3.2.1.2 Increased merger and acquisitions activity

- 3.2.1.3 Rising global spending on research and development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Hidden costs and operational dynamics

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for digital health transformation

- 3.2.3.2 Demand for AI and data analytics integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Technology consulting

- 5.3 Strategy consulting

- 5.4 Operations consulting

- 5.5 Financial consulting

- 5.6 Other service types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Healthcare providers

- 6.3 Healthcare payers

- 6.4 Life science and pharma companies

- 6.5 Healthcare technology and digital health companies

- 6.6 Government and regulatory agencies

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Accenture

- 8.2 Bain & Company

- 8.3 Boston Consulting Group

- 8.4 Capgemini

- 8.5 Chartis

- 8.6 ClearView Healthcare Partners

- 8.7 Cognizant

- 8.8 Deloitte

- 8.9 Ernst & Young

- 8.10 Guidehouse

- 8.11 HURON

- 8.12 IQVIA

- 8.13 Kearney

- 8.14 KPMG

- 8.15 L.E.K Consulting

- 8.16 McKinsey & Company

- 8.17 NTT DATA

- 8.18 Oliver Wyman

- 8.19 PricewaterhouseCoopers (PwC)

- 8.20 Vizient