|

시장보고서

상품코드

1740978

정형외과 지원 시스템 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Orthopedic Support Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

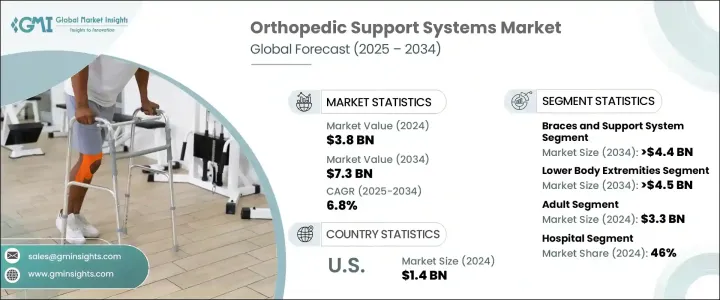

세계의 정형외과 지원 시스템 시장은 2024년에는 38억 달러로 평가되었으며, 2034년에는 73억 달러에 이를 것으로 추정되며, CAGR 6.8%로 성장할 전망입니다.

이러한 증가 추세는 지속적인 정형외과 치료와 이동 지원이 필요한 노인 인구의 증가와 함께 근골격계 및 운동 부상의 증가에 힘입은 바가 큽니다. 또한 사람들은 부상 위험을 사전에 줄이기 위해 지원 장치를 사용하는 등 예방적 건강 관리에 더 많은 관심을 기울이고 있습니다. 보다 사용자 친화적이고 적응력이 뛰어나며 통기성이 좋은 소재를 포함한 보조 시스템 기술의 발전 덕분에 시장은 계속 확대되고 있습니다. 이러한 혁신은 제품을 장시간 착용해도 편안하고 사용자의 순응도를 높여줍니다. 조기 개입과 치료하지 않은 관절 및 근육 부상의 장기적인 영향에 대한 인식이 높아지면서 문화적 변화가 일어나고 있습니다. 많은 사람들, 특히 신체 활동이나 재활에서 회복 중인 사람들은 이제 일상적인 건강 루틴의 일부로 정형외과 지지대를 적극적으로 사용합니다. 이러한 행동 변화는 예방 및 재활 후 의료 관행에 대한 폭넓은 수용을 반영합니다.

제품 유형별로, 정형외과 지원 시스템 시장에는 보조기 및 지지대, 부목, 붕대 및 슬리브, 스트랩이 포함됩니다. 이 중 보조기 및 지지대 카테고리가 성장의 대부분을 주도할 것으로 예상됩니다. 이 부문은 연평균 6.6%의 성장률로 2034년까지 44억 달러 이상에 달할 것으로 예상됩니다. 이러한 기기는 다양한 근골격계 질환을 관리할 수 있는 다용도성 및 광범위한 사용으로 인해 지배적인 위치를 차지하고 있습니다. 특정 신체 부위를 지지하도록 설계된 이 기기는 수술 후 또는 외상 후 단계에서 관절을 안정시키고 불편함을 완화하며 치유를 돕습니다. 모든 연령대에서 부상과 퇴행성 관절 문제가 증가함에 따라 이러한 솔루션에 대한 필요성이 증가하고 있습니다. 또한 최신 제조 기술의 통합으로 제품 디자인이 크게 개선되었습니다. 맞춤형 피팅 옵션부터 조절 가능한 스트랩과 더 가벼운 소재에 이르기까지 이러한 혁신은 전반적인 편안함을 높이고 각 장치의 효율성을 개선하여 시장 수요를 더욱 촉진합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 38억 달러 |

| 예측 금액 | 73억 달러 |

| CAGR | 6.8% |

용도별로 보면 시장에는 상반신 및 하반신 디바이스가 포함됩니다. 하반신 부문은 강력한 성장 동력이 될 것으로 예상되며, 2034년까지 6.7%의 연평균 성장률로 성장할 것으로 전망됩니다. 이러한 수요는 무릎, 엉덩이, 발목과 관련된 부상의 빈도에서 비롯됩니다. 신체 활동과 스포츠 참여가 증가함에 따라 많은 사람들이 이러한 부위에 질환을 앓고 있습니다. 이러한 부상은 통증 완화, 안정성 및 치유를 위해 정형외과적 솔루션을 필요로 하는 경우가 많습니다. 하반신 맞춤형 보조기는 치료뿐만 아니라 특히 최근에 수술을 받았거나 퇴행성 질환을 앓고 있는 환자의 예방을 위해서도 사용됩니다. 예방 의료 및 정형외과 재활이 부상하면서 이러한 제품의 사용 범위가 전통적인 회복 환경을 넘어 훨씬 더 넓어졌습니다.

환자에 따라 시장은 성인과 소아 부문으로 나뉩니다. 2024년에는 성인이 시장의 대부분을 차지하며 33억 달러로 평가되었습니다. 성인은 육체적으로 힘든 직업, 피트니스 루틴, 생활 습관 관련 건강 문제로 인해 근골격계 질환의 발병률이 더 높습니다. 비만이나 당뇨병과 같은 질환은 관절의 긴장과 부상을 더욱 악화시키는 경우가 많습니다. 정형외과 지원 시스템은 만성 통증을 관리하거나, 수술 후 회복하거나, 노화와 관련된 퇴행성 문제를 다루는 성인에게 필수적인 도구가 되었습니다. 웨어러블 정형외과 기기와 같은 비침습적 치료 옵션은 접근성이 개선되고 이점에 대한 인식이 높아짐에 따라 이 그룹에서 인기를 얻고 있습니다.

최종 용도의 관점에서 시장은 병원, 정형외과 센터, 재활 센터 및 기타 시설로 세분화됩니다. 병원은 수술부터 수술 후 재활에 이르기까지 급성 정형외과 치료의 주요 환경이 되고 있습니다. 병원은 전문 인력과 첨단 의료 장비를 갖추고 있어 종합적인 지원 솔루션을 제공하는 데 이상적입니다. 전 세계적으로 정형외과 수술 건수가 계속 증가함에 따라 환자의 회복을 돕는 지원 기기에 대한 수요도 증가하고 있습니다.

미국의 정형외과 지원 시스템 시장은 2024년에 14억 달러에 달하며 향후 몇 년 동안 강력한 확장 조짐을 보이고 있습니다. 이 지역의 성장은 스포츠 관련 부상, 만성 질환의 높은 발생률, 잘 발달된 의료 인프라에 의해 촉진되고 있습니다. 재활 프로토콜과 첨단 의료 기술의 광범위한 채택은 이러한 시스템에 대한 지속적인 수요를 뒷받침합니다. 또한, 주요 제조업체의 강력한 시장 참여는 이 분야의 주요 플레이어로서 미국의 입지를 강화합니다.

전 세계 시장의 약 40%는 상위 5개 기업이 차지하고 있으며, 이들은 연구, 제품 혁신, 전략적 파트너십에 막대한 투자를 하고 있습니다. 이러한 기업들은 웨어러블 센서와 같은 기술을 제품에 통합하여 보다 개인화된 디지털 및 데이터 중심 솔루션으로 나아가고 있습니다. 이러한 방향은 지속적인 발전을 보장하고 진화하는 정형외과 환경에서 경쟁력을 유지할 수 있도록 합니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 정형외과 질환 및 장애의 유병률 증가

- 스포츠 및 사고 관련 부상 사례 증가

- 예방 치료에 대한 대중의 인식 증가

- 기술 발전

- 업계의 잠재적 위험 및 과제

- 장치의 높은 비용

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원자재)

- 주요 원자재의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원자재)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 상환 시나리오

- 기술의 상황

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

- 장래 시장 동향

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 제품별(2021-2034년)

- 주요 동향

- 보조기 및 지지대

- 부목

- 붕대 및 슬리브

- 스트랩

제6장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 하반신

- 무릎 및 허벅지

- 허리, 척추, 등

- 발목

- 다리

- 기타 다리

- 상반신

- 손 및 손목

- 팔꿈치

- 어꺠

- 기타 상반신

제7장 시장 추계 및 예측 : 환자별(2021-2034년)

- 주요 동향

- 성인

- 소아

제8장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 병원

- 정형외과 센터

- 재활 센터

- 기타 용도

제9장 시장추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- 3M

- ALCARE

- aspen medical

- BAUERFEIND

- Bird &Cronin

- BREG

- DeRoyal

- Enovis

- essity

- HELY & WEBER

- MCDAVID

- medi

- OSSUR

- ottobock

- ZIMMER BIOMET

The Global Orthopedic Support Systems Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 7.3 billion by 2034. This rising trend is largely driven by the increasing number of musculoskeletal and athletic injuries, along with a growing elderly population that requires ongoing orthopedic care and mobility assistance. People are also paying more attention to preventive healthcare, which includes the use of support devices to reduce injury risks before they occur. The market continues to expand thanks to advancements in support system technologies, which include more user-friendly, adaptive, and breathable materials. These innovations make the products more comfortable for long-term wear and increase user adherence. Growing awareness around early intervention and the long-term effects of untreated joint and muscular injuries has led to a cultural shift. Many individuals, especially those recovering from physical activity or rehabilitation, now actively use orthopedic supports as part of their daily health routine. This behavioral change reflects a broader acceptance of preventive and post-rehabilitation medical practices.

Segmented by product type, the orthopedic support systems market includes braces and supports, splints, bandages and sleeves, and straps. Among these, the braces and supports category is projected to drive a major portion of the growth. This segment is expected to expand at a CAGR of 6.6%, reaching over USD 4.4 billion by 2034. These devices dominate due to their versatility and extensive use in managing various musculoskeletal conditions. Designed to support specific body areas, they help stabilize joints, alleviate discomfort, and assist in healing during post-surgical or post-trauma phases. A rising number of injuries and degenerative joint issues across all age groups has led to an increased need for such solutions. Moreover, the integration of modern manufacturing techniques has brought significant improvements in product design. From customized fitting options to adjustable straps and lighter materials, these innovations boost overall comfort and improve the effectiveness of each device, thereby driving further market demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 6.8% |

When broken down by application, the market includes devices for upper and lower body extremities. The lower body extremities segment is anticipated to be a strong growth driver, with projections indicating it will reach over USD 4.5 billion by 2034, growing at a CAGR of 6.7%. This demand stems from the frequency of injuries involving the knees, hips, and ankles. Many individuals suffer from conditions in these regions due to increased involvement in physical activities and sports. These injuries often require targeted orthopedic solutions for pain relief, stability, and healing. Support devices tailored for the lower body are used not only for treatment but also for prevention, especially in patients who have recently undergone surgery or who suffer from degenerative diseases. The rise of preventive healthcare and orthopedic rehabilitation has expanded the use of these products far beyond traditional recovery settings.

Based on patient demographics, the market is divided into adult and pediatric segments. Adults made up the majority of the market in 2024, generating USD 3.3 billion in revenue. Adults face a higher incidence of musculoskeletal conditions, partly due to physically demanding jobs, fitness routines, and lifestyle-related health problems. Conditions such as obesity and diabetes often compound the likelihood of joint strain and injuries. Orthopedic support systems have become essential tools for adults managing chronic pain, recovering from surgery, or dealing with age-related degenerative issues. Non-invasive treatment options, such as wearable orthopedic devices, have gained popularity among this group, thanks to improved accessibility and greater awareness of the benefits.

In terms of end use, the market is segmented into hospitals, orthopedic centers, rehabilitation centers, and other facilities. Hospitals held the largest share in 2024, accounting for USD 1.8 billion in revenue and 46% of the total market. This segment is also projected to grow at a CAGR of 6.9% by 2034. Hospitals continue to be the primary setting for acute orthopedic care, from surgeries to post-operative rehabilitation. The availability of specialized staff and advanced medical equipment makes hospitals ideal for providing comprehensive support solutions. As the number of orthopedic surgeries continues to rise globally, so does the demand for support devices that aid in patient recovery.

In the United States, the orthopedic support systems market reached USD 1.4 billion in 2024, showing strong signs of expansion in the years ahead. Growth in this region is fueled by a high occurrence of sports-related injuries, chronic conditions, and a well-developed healthcare infrastructure. The country's extensive adoption of rehabilitation protocols and advanced medical technology supports ongoing demand for these systems. Furthermore, strong market participation from leading manufacturers reinforces the US's position as a major player in this field.

Around 40% of the global market is held by the top five companies, which are heavily investing in research, product innovation, and strategic partnerships. These companies are moving toward more personalized, digital, and data-focused solutions, incorporating technologies such as wearable sensors into their offerings. This direction ensures continuous development and positions them to remain competitive in the evolving orthopedic landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of orthopedic diseases and disorders

- 3.2.1.2 Rise in cases of sports and accident-related injuries

- 3.2.1.3 Growing public awareness of preventive care

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of the devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Reimbursement scenario

- 3.7 Technology landscape

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Braces and support

- 5.3 Splint

- 5.4 Bandage and sleeves

- 5.5 Strap

Chapter 6 Market Estimates and Forecast, By Application 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Lower body extremities

- 6.2.1 Knee/thigh

- 6.2.2 Hip, spine, and back

- 6.2.3 Ankle

- 6.2.4 Foot

- 6.2.5 Other lower body extremities

- 6.3 Upper body extremities

- 6.3.1 Hand and Wrist

- 6.3.2 Elbow

- 6.3.3 Shoulder

- 6.3.4 Other upper body extremities

Chapter 7 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adult

- 7.3 Pediatric

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital

- 8.3 Orthopedic centers

- 8.4 Rehabilitation centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 ALCARE

- 10.3 aspen medical

- 10.4 BAUERFEIND

- 10.5 Bird & Cronin

- 10.6 BREG

- 10.7 DeRoyal

- 10.8 Enovis

- 10.9 essity

- 10.10 HELY & WEBER

- 10.11 MCDAVID

- 10.12 medi

- 10.13 OSSUR

- 10.14 ottobock

- 10.15 ZIMMER BIOMET