|

시장보고서

상품코드

1766174

배양육 바이오리액터 시장 : 기회, 촉진요인, 산업 동향 분석, 예측(2025-2034년)Cultured Meat Bioreactors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

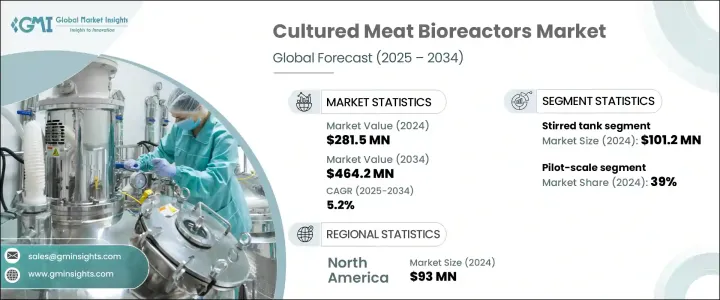

세계 배양육 바이오리액터 시장은 2024년 2억 8,150만 달러로 평가되었고, CAGR 5.2%로 성장하여 2034년에는 4억 6,420만 달러에 이를 것으로 예측되고 있습니다. 이치를 필요로 하지 않는 식육 생산을 가능하게 합니다. 교반 탱크형, 관류형, 에어 리프트형, 중공사형 등, 다양한 유형의 바이오리액터가 있어, 각각, 확대성, 영양 공급, 전단력의 관리 등의 점에서 명확한 이점이 있습니다. 생물 반응기 설계, 세포 배양 배지 및 스케일링 방법의 혁신으로 인해 배양육 생산의 비용 효율성이 향상되었습니다.

기술의 진보에 따라 생산비용은 저하되고, 배양육은 보다 적당하게 입수하기 쉬워질 것으로 예측됩니다. 탑재하고 있습니다. 대체식육에 대한 소비자의 관심이 높아져, 이 기술에 대한 수요를 더욱 뒷받침하고 있지만, 특히 신흥 기업에 있어서는 초기 자본 코스트와 운영 코스트가 여전히 큰 장벽이 되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 2억 8,150만 달러 |

| 예측 금액 | 4억 6,420만 달러 |

| CAGR | 5.2% |

교반 탱크 바이오리액터 부문이 2024년 시장을 선도하여 1억 120만 달러를 낳았습니다. 기술적 위험이 낮습니다. 이 시스템은 1 - 10 리터의 작은 실험실 크기에서 10,000 리터 이상의 산업용 용량까지 확장 가능하며 연구 개발에서 본격적인 제조에 이르기까지 중요한 유연성을 설명합니다.

파일럿 규모의 2024년 점유율은 39%입니다. 배양육 산업은 연구에서 상업 생산으로 이행하고 있기 때문에 파일럿 규모 바이오리액터는 중요한 브리지 역할을 하고 있습니다. 상업화 이전 단계에 있는 많은 회사들은 파일럿 규모의 시스템을 사용하여 세포주를 정제하고, 조직 공학 공정을 최적화하며, 대규모 생산을 시뮬레이션하는 데 있어 대규모 시설과 관련된 높은 비용 없이도 많은 노력을 기울이고 있습니다.

북미의 배양고기 바이오리액터 2024년 시장 규모는 9,300만 달러. 정부가 배양 닭의 판매를 승인한 후, 미국은 상업 배양육 판매의 세계적인 리더가 되어 바이오리액터 기술과 인프라에 대한 투자를 뒷받침하고 있습니다. 이 지역에는 선도적인 연구 기관의 지원을 받아 생물 반응기 개발 및 공정 혁신을 전문으로 하는 최첨단 생명공학 및 식품 기술 회사들이 있습니다. 세대는 윤리적으로 생산된 친환경 식품을 강하게 선호하며, 이는 배양육 수요를 촉진하고 기업에 의한 생물반응기 시스템의 생산 규모 확대와 기술 혁신을 촉진하고 있습니다.

세계 배양육 생물반응기 산업에서 사업을 전개하고 있는 주요 기업으로는 Merck KGaA, ABEC, Alfa Laval, Bioengineering AG, Esco Lifesciences Group, Sartorius AG, GEA, Infos HT, Eppendorf AG, INNOVA Bio-meditech, KBIoTech GmBHHOL BIoTech, Vogtlin Instruments GmbH 등이 있습니다. 시장 리더가 채택하는 주요 전략은 시장에서의 포지셔닝을 높이기 위해 기술 혁신과 협업에 중점을 둡니다.

기업은 바이오리액터의 설계를 개선하고, 세포 배양 배지를 최적화하며, 비용 효율적인 생산을 위한 확장성을 높이기 위해 연구 개발에 폭넓게 투자하고 있습니다. 대응하기 위해 생산 능력 확대와 신흥 시장 진출을 선호하고 있습니다. 마케팅 캠페인에서 지속가능성과 윤리적 식품 생산을 강조하는 것은 환경 의식이 높은 소비자를 끌어들이는데 도움이 됩니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 산업 고찰

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 산업에 미치는 영향요인

- 성장 촉진요인

- 지속 가능한 단백질에 대한 수요 증가

- 바이오리액터 설계에 있어서의 기술적 진보

- 배양육 스타트업에 대한 투자 증가

- 산업의 잠재적 리스크 및 과제

- 높은 자본 비용과 운영 비용

- 생산 규모 확대의 복잡성

- 기회

- 공급망 최적화

- 성장 촉진요인

- 성장 가능성 분석

- 장래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 유형별

- 규제 상황

- 표준 및 컴플라이언스 요건

- 지역 규제 틀

- 인증기준

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확대 계획

제5장 시장 추정 및 예측 : 유형별, 2021-2034년

- 주요 동향

- 중공 섬유

- 에어 리프트 액터

- 교반 탱크

- 기타

제6장 시장 추정 및 예측 : 규모별, 2021-2034년

- 주요 동향

- 실험실 규모

- 파일럿 규모

- 상업규모

제7장 시장 추정 및 예측 : 동작 모드별, 2021-2034년

- 주요 동향

- 배치

- 페드 배치

- 상용

제8장 시장 추정 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 쇠고기

- 가금

- 돼지고기

- 기타

제9장 시장 추정 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 배양육 제조업체

- 계약 제조 조직

- 연구개발기관/실험실

제10장 시장 추정 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- ABEC

- Alfa Laval

- Bioengineering AG

- Eppendorf AG

- Esco Lifesciences Group

- GEA

- Infors HT

- INNOVA Bio-meditech

- KBIoTech GmBH

- Merck KGaA

- OLLITAL Technology

- Pall Corporation

- Sartorius AG

- Solaris BIoTech

- Vogtlin Instruments GmbH

The Global Cultured Meat Bioreactors Market was valued at USD 281.5 million in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 464.2 million by 2034. This market plays a critical role in the cultivated meat sector by enabling large-scale production of lab-grown meat through sophisticated bioreactor systems. These bioreactors create carefully controlled environments for animal cell cultures, allowing meat production without the need for animal slaughter. Various bioreactor types, including stirred-tank, perfusion, airlift, and hollow-fiber systems, each provide distinct advantages in terms of scalability, nutrient delivery, and management of shear forces. Innovations in bioreactor design, cell culture media, and scaling methods have enhanced the cost-efficiency of cultured meat production.

As technology advances, production costs are expected to decline, making cultivated meat more affordable and accessible. Improved texture, flavor, and quality are also key factors that will boost consumer acceptance and drive market growth. Sustainability remains a major motivator, with cultured meat offering an eco-friendly and more ethical alternative to traditional meat production. Rising consumer interest in meat alternatives further fuels demand for this technology, though high initial capital and operating costs remain significant barriers, especially for startups. Establishing production requires specialized bioreactors capable of supporting cell growth at industrial scales.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $281.5 Million |

| Forecast Value | $464.2 Million |

| CAGR | 5.2% |

The stirred-tank bioreactor segment led the market in 2024, generating USD 101.2 million. Stirred-tank bioreactors are highly favored for their reliability and scalability, making them ideal for commercial-scale cell cultivation. With a strong track record in biopharmaceutical and fermentation applications, they present low technical risks to cultivated meat producers. These systems can scale from small laboratory sizes of 1-10 liters to industrial capacities exceeding 10,000 liters, offering vital flexibility for research, development, and full-scale manufacturing. This scalability is essential for companies aiming to commercialize cultured meat at competitive prices.

The pilot-scale segment held a 39% share in 2024. Since the cultured meat industry is transitioning from research to commercial production, pilot-scale bioreactors serve as a critical bridge. Many companies at the pre-commercial stage use pilot-scale systems to refine cell lines, optimize tissue engineering processes, and simulate large-scale production without the high costs associated with full-scale facilities. These bioreactors require lower capital investment, making them accessible to startups and firms working on regulatory approvals or business model development.

North America Cultured Meat Bioreactors Market accounted for USD 93 million in 2024. The United States has fostered a supportive environment for investors and companies involved in cultivated meat through clear regulations. Following government approval for marketing cultured chicken in 2023, the U.S. has become a global leader in commercial cultured meat sales, boosting investments in bioreactor technology and infrastructure. The region hosts some of the most advanced biotech and food tech companies specializing in bioreactor development and process innovation, supported by leading research institutions. Moreover, North American consumers, particularly millennials and Gen Z, show strong preferences for ethically produced, environmentally friendly food products, driving demand for cultured meat and encouraging companies to scale production and innovate bioreactor systems.

Leading companies operating in the Global Cultured Meat Bioreactors Industry include Merck KGaA, ABEC, Alfa Laval, Bioengineering AG, Esco Lifesciences Group, Sartorius AG, GEA, Infors HT, Eppendorf AG, INNOVA Bio-meditech, KBiotech GmBH, OLLITAL Technology, Pall Corporation, Solaris Biotech, and Vogtlin Instruments GmbH. Key strategies adopted by market leaders focus heavily on innovation and collaboration to boost their market positioning.

Companies invest extensively in research and development to improve bioreactor designs, optimize cell culture media, and enhance scalability for cost-effective production. Forming strategic partnerships with cultivated meat producers enables technology integration and process refinement. Firms also prioritize expanding production capacities and entering emerging markets to capitalize on rising demand. Emphasizing sustainability and ethical food production in marketing campaigns helps attract eco-conscious consumers. Additionally, players focus on regulatory compliance and securing intellectual property to safeguard innovations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Scale

- 2.2.4 Mode of Operation

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable protein

- 3.2.1.2 Technological advancements in bioreactor design

- 3.2.1.3 Growing investments in cultured meat startups

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and operating costs

- 3.2.2.2 Complexity in scaling up production

- 3.2.3 Opportunities

- 3.2.4 Supply chain optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Million) (Units)

- 5.1 Key trends

- 5.2 Hollow fiber

- 5.3 Airlift reactor

- 5.4 Stirred tank

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Scale, 2021 – 2034 (USD Million) (Units)

- 6.1 Key trends

- 6.2 Lab-scale

- 6.3 Pilot-scale

- 6.4 Commercial-scale

Chapter 7 Market Estimates and Forecast, By Mode of Operation, 2021 – 2034 (USD Million) (Units)

- 7.1 Key trends

- 7.2 Batch

- 7.3 Fed-batch

- 7.4 Continuous

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million) (Units)

- 8.1 Key trends

- 8.2 Beef

- 8.3 Poultry

- 8.4 Pork

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million) (Units)

- 9.1 Key trends

- 9.2 Cultured meat manufacturers

- 9.3 Contract manufacturing organizations

- 9.4 R&D organizations/Institutes

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million) (Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ABEC

- 11.2 Alfa Laval

- 11.3 Bioengineering AG

- 11.4 Eppendorf AG

- 11.5 Esco Lifesciences Group

- 11.6 GEA

- 11.7 Infors HT

- 11.8 INNOVA Bio-meditech

- 11.9 KBiotech GmBH

- 11.10 Merck KGaA

- 11.11 OLLITAL Technology

- 11.12 Pall Corporation

- 11.13 Sartorius AG

- 11.14 Solaris Biotech

- 11.15 Vogtlin Instruments GmbH