|

시장보고서

상품코드

1766185

전기자동차용 베어링 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Electric Vehicle Bearings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

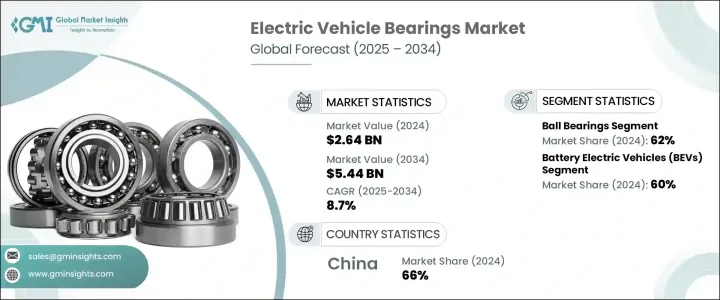

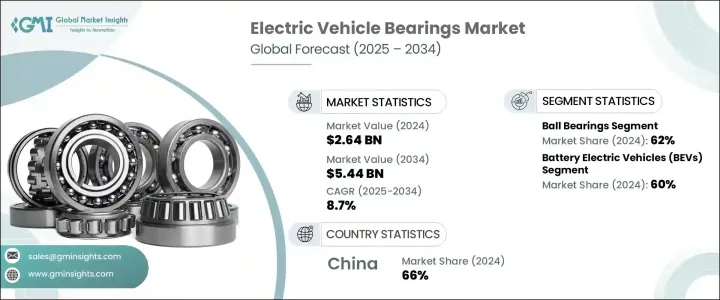

세계의 전기자동차용 베어링 시장 규모는 2024년에 26억 4,000만 달러로 평가되었고, 2034년에는 54억 4,000만 달러에 이르며, CAGR은 8.7%를 나타낼 것으로 전망됩니다.

전동 이동성으로의 이동이 증가함에 따라 전동 드라이브 트레인의 효율, 내구성 및 성능을 향상시키는 고급 베어링 기술의 요구가 가속화되고 있습니다. 비율이 높은 저마찰 부품에 대한 수요 증가가 주요 요인이 되고 있습니다. 주요 자동차 지역에서 EV의 채용이 진행됨에 따라 전기자동차 특유의 기계적·열적 스트레스에 대응하도록 설계된 특수 베어링 수요가 급속히 높아지고 있습니다.

세계 각국의 정부는 재정적인 우대 조치와 환경 규제 강화에 의해 이 전환을 강화하고 있으며, 자동차 제조업체는 경량으로 정밀 설계의 베어링 솔루션을 우선하게 되어 있습니다. 전기자동차의 드라이브 트레인 아키텍처가 진화하여 멀티 스피드 시스템과 통합된 e-액슬이 내장됨에 따라 베어링 공급업체는 까다로운 환경에서도 동작할 수 있는 고성능 솔루션을 제공하는 것이 요구되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 26억 4,000만 달러 |

| 예측 금액 | 54억 4,000만 달러 |

| CAGR | 8.7% |

2024년 볼 베어링은 62%의 점유율로 전기자동차용 베어링 시장을 선도했으며, 예측 기간 중 CAGR은 9.8%를 초과할 것으로 예측됩니다. 전동 드라이브 트레인의 엄격한 운영 요구를 충족시키는 능력으로 그 지위를 유지하고 있습니다. 마찰을 최소화하고 신뢰성을 극대화하는 것으로 알려진 볼 베어링은 전기 모터, 트랜스미션, 휠 허브 등 다양한 전기자동차 부품에 널리 통합되어 있습니다.

배터리 전기자동차(BEV)는 2024년에 60%의 점유율을 차지하며, 부문 점유율로 선두를 확보했습니다. 최적의 성능을 유지하면서 보다 큰 열변동과 장기의 동작 사이클에 대응할 수 있는 베어링이 요구되고 있습니다.

아시아태평양의 전기자동차용 베어링 시장은 66%의 점유율을 차지했으며, 2024년에는 9억 3,970만 달러를 창출하였습니다. 링 제조업체는 연구 개발을 강화하고 고효율 전기 드라이브 트레인에 맞춘 고성능 베어링 솔루션의 생산을 확대함으로써 이 수요에 부응하고 있습니다.

세계의 전기자동차용 베어링 산업에서 혁신과 경쟁을 견인하고 있는 주요 기업에는 Schaeffler, SKF, JTEKT, NTN, Nachi-Fujikoshi, NSK, Timken 등이 있습니다. 시장의 발판을 굳히기 위해, 전기자동차용 베어링 제조업체는 몇개의 중점 전략을 채용하고 있습니다. 이것에는 전기 구동계에 최적화된 고속, 저마찰, 열안정성의 베어링 기술을 개발하기 위한 대규모 R&D 투자를 포함합니다. e-모빌리티 플랫폼으로의 변화에 맞추어 있습니다. 주요 EV 시장, 특히 아시아와 북미에서 제조 거점을 확대하는 것도 중요한 접근법입니다.

목차

제1장 조사 방법

- 시장의 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 소스

- 세계

- 지역/국가

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측 모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 파괴적 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 정부의 지원을 받아 전기차 세계의 보급 진행

- 경량으로 스마트한 베어링 기술의 진보에 의해 효율과 내구성 향상

- 신흥 시장에서의 EV 제조 확대

- 센서 대응 베어링에 의한 예측 유지관리의 통합

- 업계의 잠재적 위험 및 과제

- 초기 비용이 높아

- 복잡한 설치 및 유지보수

- 시장 기회

- 세계 EV 생산의 급증

- OEM과의 연구개발 및 공동개발

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 분석

- 가격 동향

- 지역별

- 구성 요소별

- 생산 통계

- 생산 거점

- 소비 거점

- 수출과 수입

- 코스트 내역 분석

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 삭감 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적인 노력

- 탄소 발자국의 고려

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추정·예측 : 유형별(2021-2034년)

- 주요 동향

- 볼 베어링

- 롤러 베어링

- 기타

제6장 시장 추정·예측 : 차량별(2021-2034년)

- 주요 동향

- 배터리 전기자동차(BEV)

- 플러그인 하이브리드 전기자동차(PHEV)

- 하이브리드 전기자동차(HEV)

- 연료전지 전기자동차(FCEV)

제7장 시장 추정·예측 : 재료별(2021-2034년)

- 주요 동향

- 스틸 베어링

- 세라믹 베어링

- 폴리머 베어링

- 기타

제8장 시장 추정·예측 : 판매 채널별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

제9장 시장 추정·예측 : 베어링 사이즈별(2021-2034년)

- 주요 동향

- 소형 베어링

- 중형 베어링

- 대형 베어링

제10장 시장 추정·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

제11장 기업 프로파일

- ILJIN

- BRK

- C&U Group

- Fersa

- IKO Nippon Thompson

- JTEKT

- Luoyang LYC Bearing

- MinebeaMitsumi

- Nachi-Fujikoshi

- NBC

- NMB Technologies

- NSK

- NSK-Warner

- NTN

- RBC Bearings

- Schaeffler

- SKF

- The Timken

- THK

- ZWZ

The Global Electric Vehicle Bearings Market was valued at USD 2.64 billion in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 5.44 billion by 2034. The rising shift toward electric mobility is accelerating the need for advanced bearing technologies that enhance the efficiency, durability, and performance of electric drivetrains. Market expansion is largely driven by rising demand for energy-efficient, low-friction components that can withstand high loads and contribute to prolonged vehicle and battery life. With the growing adoption of EVs across major automotive regions, demand for specialized bearings designed to address the unique mechanical and thermal stresses of electric vehicles is increasing rapidly.

Governments worldwide are reinforcing this transition with financial incentives and tighter environmental regulations, prompting automakers to prioritize lightweight, precision-engineered bearing solutions. Additionally, the rising production of premium electric vehicles is fueling the demand for ultra-reliable, noise-reducing components that deliver seamless and refined driving experiences. As EV drivetrain architectures evolve-incorporating multi-speed systems and integrated e-axles-bearing suppliers are required to offer high-performance solutions capable of operating in demanding environments. In response, leading manufacturers continue to push design innovation to meet the growing expectations of the automotive sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.64 Billion |

| Forecast Value | $5.44 Billion |

| CAGR | 8.7% |

In 2024, the ball bearings category led the EV bearings market with a dominant 62% share and is expected to expand at a CAGR exceeding 9.8% during the forecast timeline. The segment holds its position due to its ability to support high-volume manufacturing, maintain consistent quality, and meet the demanding operational needs of electric drivetrains. Known for offering minimal friction and maximum reliability, ball bearings are widely integrated into various EV components, including electric motors, transmissions, and wheel hubs. As original equipment manufacturers (OEMs) accelerate the rollout of next-gen vehicle systems-spanning electrification, ADAS, and infotainment technologies-automakers increasingly seek advanced engineering services and components tailored to their unique performance and durability needs.

Battery electric vehicles (BEVs) accounted for a 60% share in 2024, securing the leading segment share. BEVs are fundamentally reshaping the electric vehicle bearings landscape by requiring high-precision components that support enhanced energy efficiency, high-speed operation, and noise minimization. The nature of BEV systems demands bearings that can handle greater thermal fluctuations and extended operating cycles while maintaining optimal performance. As BEVs continue to gain popularity globally, bearing manufacturers are investing in the development of advanced solutions that meet the evolving technical specifications of high-speed electric motors and ensure long-term product reliability.

Asia Pacific Electric Vehicle Bearings Market held a 66% share and generated USD 939.7 million in 2024. As a global leader in EV production and export, China benefits from strong policy support, an expanding supply chain, and a rapidly growing number of domestic automakers. Local bearing manufacturers are responding to this demand by ramping up R&D and scaling production of high-performance bearing solutions tailored for high-efficiency electric drivetrains. The country's active involvement in advancing bearing technologies underscores its position as a central player in the global EV bearings market.

The key companies driving innovation and competition in the Global Electric Vehicle Bearings Industry include Schaeffler, SKF, JTEKT, NTN, Nachi-Fujikoshi, NSK, and Timken. To strengthen their market foothold, electric vehicle-bearing manufacturers are adopting several focused strategies. These include heavy R&D investment to develop high-speed, low-friction, and thermally stable bearing technologies optimized for electric drivetrains. Companies are also forging long-term partnerships with automakers to co-develop custom solutions, aligning with the shift toward integrated e-mobility platforms. Expanding manufacturing footprints in key EV markets, particularly across Asia and North America, is another key approach. In addition, firms are enhancing product portfolios by offering compact, lightweight, and durable designs that meet evolving drivetrain architectures while improving energy efficiency and extending service intervals.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing global adoption of electric vehicles supported by government incentives

- 3.2.1.2 Advancements in lightweight and smart bearing technologies improve efficiency and durability

- 3.2.1.3 Expansion of EV manufacturing in emerging markets

- 3.2.1.4 Integration of predictive maintenance through sensor-enabled bearings.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial costs

- 3.2.2.2 Complex installation and maintenance

- 3.2.3 Market opportunities

- 3.2.3.1 Surging global EV production

- 3.2.3.2 R&D and co-development with OEMs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Ball bearings

- 5.3 Roller bearings

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Battery electric vehicles (BEVs)

- 6.3 Plug-in hybrid electric vehicles (PHEVs)

- 6.4 Hybrid electric vehicles (HEVs)

- 6.5 Fuel cell electric vehicles (FCEVs)

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Steel bearings

- 7.3 Ceramic bearings

- 7.4 Polymer bearings

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Bearing Size, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Small bearings

- 9.3 Medium bearings

- 9.4 Large bearings

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 ILJIN

- 11.2 BRK

- 11.3 C&U Group

- 11.4 Fersa

- 11.5 IKO Nippon Thompson

- 11.6 JTEKT

- 11.7 Luoyang LYC Bearing

- 11.8 MinebeaMitsumi

- 11.9 Nachi-Fujikoshi

- 11.10 NBC

- 11.11 NMB Technologies

- 11.12 NSK

- 11.13 NSK-Warner

- 11.14 NTN

- 11.15 RBC Bearings

- 11.16 Schaeffler

- 11.17 SKF

- 11.18 The Timken

- 11.19 THK

- 11.20 ZWZ