|

시장보고서

상품코드

1807075

자동차용 베어링 시장 : 용도별, 베어링 유형별, EV 유형별, 차량 유형별, 애프터마켓별, 지역별 예측(-2032년)Automotive Bearing Market by Bearing Type, Application, Vehicle Type, EV Type, Aftermarket and Region - Global Forecast to 2032 |

||||||

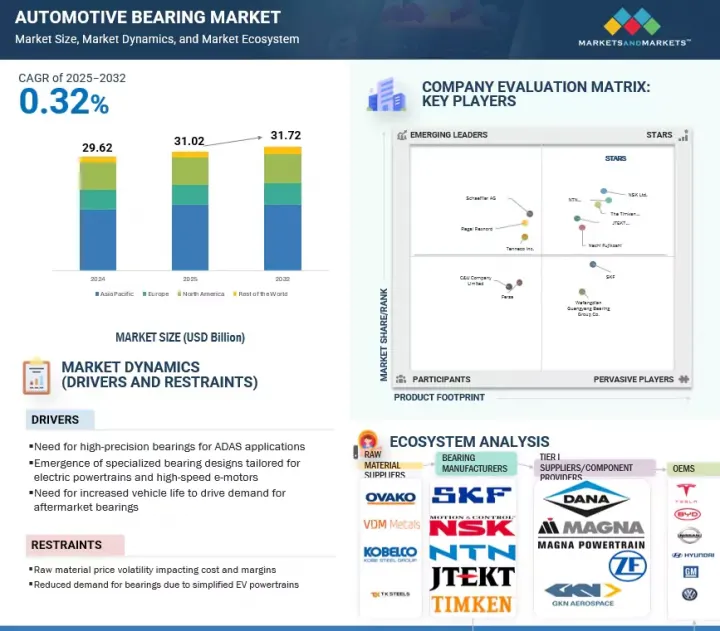

세계의 EV 자동차용 베어링 시장 규모는 2025년 58억 1,000만 달러에서 2032년까지 128억 2,000만 달러로 성장할 것으로 예측되며, CAGR 11.97%가 될 것으로 보입니다.

세계 ICE 자동차용 베어링 시장 규모는 2025년 310억 2,000만 달러에서 2032년까지 317억 2,000만 달러로 성장할 것으로 예측되며, CAGR 0.32%로 완만해질 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 대상 대수 | 금액(100만 달러), 100만대 |

| 부문 | 용도별, 베어링 유형별, EV 유형별, 차량 유형별, 애프터마켓별, 지역별 |

| 대상 지역 | 아시아태평양, 유럽, 북미 및 기타 지역 |

자동차 베어링은 엔진, 변속기, 드라이브 라인과 같은 중요한 차량 시스템의 마찰을 줄이고 효율을 높이고 내구성을 확보하는 데 중요한 역할을 합니다. 특히 아시아태평양에서는 터보차저가 있는 가솔린 직분사 엔진의 채용이 증가하고 있어 고회전, 고압, 고온에 견딜 수 있는 고성능 베어링 수요를 대폭 밀어 올리고 있습니다.

동시에 세계적인 환경규제 강화로 자동차 제조업체는 연비와 배출가스의 저감을 우선할 것을 강요하고 있으며, 세라믹, 고성능 폴리머, 하이브리드 복합재료 등의 고급 베어링 설계와 차세대 재료의 채용이 가속화되고 있습니다. 이러한 동향은 베어링 시장의 진화를 촉진할 뿐만 아니라 자동차 공학과 지속가능한 이동성의 미래를 형성하는데 있어서 베어링의 중요한 역할을 강화하고 있습니다.

자동차 제조업체가 연비 효율, 차량 내 편의성, 드라이브 트레인의 내구성을 우선시하는 동안, 낮은 토크, 노이즈 감소, 고속 설계 등 첨단 베어링 솔루션에 대한 수요가 꾸준히 증가하고 있습니다. EV는 배터리의 항속거리와 성능을 지원하기 때문에 고정밀도로 마찰을 최소화한 베어링이 필요하기 때문에 전기승용차의 채용이 증가하고 있어 이 동향은 더욱 가속화되고 있습니다. 베어링 제조업체는 이 수요에 대응하기 위해, 급속히 기술 혁신을 진행해, OEM과의 제휴를 깊게 하고 있습니다. 예를 들어 SKF와 Schaeffler는 EV 플랫폼용 차세대 허브 베어링을 공동 개발하기 위해 제휴했으며, NSK는 제품 수명을 향상시키기 위해 초음파 피로 베어링 기술을 도입했습니다. NTN과 같은 제조업체는 프리미엄 승용차 모델의 예지 보전을 위해 스마트 센서 내장 베어링을 발표하고 있습니다. 지속가능성을 중시하는 제조업체는 규제 및 환경 목표를 달성하기 위해 세라믹 하이브리드, 자체 윤활재 및 경량 복합재를 모색하고 있습니다. 따라서 승용차 부문은 자동차 베어링에서 가장 크고 가장 역동적 인 분야가되었습니다.

승용차, 특히 고급 세단과 SUV의 왕성한 내수와 수출 증가는 특히 휠 허브, 드라이브 트레인, 변속기 및 엔진 용도이 대부분을 차지하는 내연 기관차의 안정적인 베어링 소비를 지원합니다. EU의 배기가스 규제에 의해 EV의 채용이 점차 늘어나고 있지만, 연간 370만대 이상의 생산 대수의 대부분은 OEM이 효율성, 내구성, 경량 설계에 중점을 두고 있기 때문에 기존의 베어링에 의존하고 있습니다. EU의 기술 기준과 독일 자동차에 대한 미국의 관세 인상과 같은 무역 압력과 같은 규제 요인은 생산 전략과 공급업체와의 협력 관계를 형성하고 있습니다. Schaeffler, SKF, NSK, Stieber, Freudenberg, C&U Europe와 같은 주요 베어링 제조업체는 BMW와 Mercedes-Benz와 같은 선도적인 OEM에 프리미엄 및 특수 솔루션을 제공하며, 그 중 많은 부분이 공동 설계를 통해 이루어졌습니다. 슈바인푸르트와 바이에른과 같은 주요 생산 기지와 혁신 기지는 자동차 클러스터와의 긴밀한 통합을 가능하게 하며, 깊은 홈 볼 베어링, 원형 롤러 베어링, 원통 롤러 베어링 등 고성능 구름 베어링의 저스트 인 타임 공급과 고급 연구 개발을 지원합니다. 독일의 자동차는 노후화가 진행되고 있으며, 예방 보수의 문화가 뿌리 내리고 있기 때문에 애프터마켓은 견조하게 추이하고 있습니다만, 위조품에 의한 안전상의 과제가 있어, 품질 확인 대책의 강화가 요구되고 있습니다. 정밀 엔지니어링, 고급 자동차 생산, 공급업체와의 긴밀한 파트너십에 중점을 두어 독일은 유럽에서 고성능 베어링의 주요 수요국이기도 합니다.

본 보고서에서는 세계 자동차용 베어링 시장에 대해 조사했으며, 용도별, 베어링 유형별, EV 유형별, 차량 유형별, 애프터마켓별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 가격 분석

- 무역 분석

- 생태계 분석

- 공급망 분석

- 기술 분석

- 특허 분석

- 자동차용 베어링의 전략적 개발 : 전동 파워트레인, 디지털 엔지니어링, 협동형 생태계

- 규제 상황

- 사례 연구 분석

- 2025-2026년의 주된 회의와 이벤트

- AI의 영향

- 주요 이해관계자와 구매 기준

- 고객사업에 영향을 주는 동향과 혼란

- 미국의 2025년 관세

제6장 자동차용 베어링 시장(용도별)

- 소개

- 휠 허브

- 변속기

- 드라이브 트레인

- 엔진

- 내장 및 외장

- 주요 인사이트

제7장 자동차용 베어링 시장(베어링 유형별)

- 소개

- 볼 베어링

- 롤러 베어링

- 기타

- 주요 인사이트

제8장 자동차용 베어링 시장(EV 유형별)

- 소개

- 전기자동차

- PHEV

- 주요 인사이트

제9장 자동차용 베어링 시장(차량 유형별)

- 소개

- 승용차

- 소형 상용차

- 대형 상용차

- 주요 인사이트

제10장 자동차용 베어링 시장(애프터마켓별)

- 소개

- 애프터마켓 휠 허브

- 애프터마켓 트랜스미션

- 애프터마켓 드라이브 트레인

- 애프터마켓 엔진

- 애프터마켓 내장 및 외장

- 주요 인사이트

제11장 자동차용 베어링 시장(지역별)

- 소개

- 아시아태평양

- 거시경제 전망

- 중국

- 인도

- 일본

- 한국

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 거시경제 전망

- 프랑스

- 독일

- 이탈리아

- 스페인

- 영국

- 기타

- 기타 지역

- 거시경제 전망

- 브라질

- 러시아

- 남아프리카

제12장 경쟁 구도

- 개요

- 주요 진입기업의 전략 및 강점

- 시장 점유율 분석, 2024년

- 상위 상장기업 및 공개기업의 수익 분석

- 기업 평가 및 재무지표

- 브랜드 및 제품 비교

- 기업 평가 매트릭스: 주요 진입기업, 2024년

- 기업 평가 매트릭스: 중소기업, 2024년

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 진출기업

- NSK LTD.

- NTN CORPORATION

- THE TIMKEN COMPANY

- JTEKT CORPORATION

- NACHI-FUJIKOSHI CORP.

- SCHAEFFLER AG

- SKF

- REGAL REXNORD CORPORATION

- WAFANGDIAN GUANGYANG BEARING GROUP CORPORATION LIMITED

- TENNECO INC.

- FERSA

- C&U COMPANY LIMITED

- 기타 기업

- MINEBEAMITSUMI INC.

- ILJIN ELECTRONICS(I) PVT. LTD.

- NRB INDUSTRIAL BEARINGS LTD.

- RKB BEARING INDUSTRIES

- NAKANISHI MANUFACTURING CORPORATION

- EMERSON BEARING COMPANY

- ORS-ORTADOGU RULMAN SANAYI VE TIC. AS

- TSUBAKI NAKASHIMA CO. LTD.

- CW BEARING

- LYC PRIVATE LIMITED

- HARBIN BEARING MANUFACTURING CO., LTD.

- NEI LTD.(NBC BEARINGS)

- TATA STEEL

제14장 시장에서의 제안

제15장 부록

JHS 25.09.16The global automotive bearing market for EVs is projected to rise from USD 5.81 billion in 2025 to USD 12.82 billion by 2032, at a CAGR of 11.97%. The global automotive bearing market for ICE is projected to grow from USD 31.02 billion in 2025 to USD 31.72 billion by 2032, reflecting a modest CAGR of 0.32%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Segments | Bearing Type, Application, Vehicle Type, EV Type, Aftermarket, and Region |

| Regions covered | Asia Pacific, Europe, North America, and the Rest of the World |

Automotive bearings play a vital role in reducing friction, enhancing efficiency, and ensuring the durability of critical vehicle systems, such as engines, transmissions, and drivelines. The rising adoption of turbocharged gasoline direct injection engines, particularly in Asia Pacific region, is significantly boosting the demand for high-performance bearings capable of withstanding high rotational speeds, extreme pressures, and elevated operating temperatures.

At the same time, increasingly stringent global environmental regulations are compelling automakers to prioritize fuel efficiency and lower emissions, which is accelerating the adoption of advanced bearing designs and next-generation materials, such as ceramics, high-performance polymers, and hybrid composites. Together, these trends are not only driving the evolution of the bearing market but also reinforcing its critical role in shaping the future of automotive engineering and sustainable mobility.

"By vehicle type, the passenger cars segment is projected to account for the largest share during the forecast period."

As automakers prioritize fuel efficiency, cabin comfort, and drivetrain durability, the demand for advanced bearing solutions, such as low-torque, noise-reducing, and high-speed designs, has grown steadily. The increasing adoption of electric passenger vehicles further accelerates this trend, as EVs require high-precision, friction-minimized bearings to support battery range and performance. Bearing manufacturers are innovating rapidly and deepening collaboration with OEMs to cater to this demand. For instance, SKF and Schaeffler have partnered to co-develop next-gen hub bearings for EV platforms, while NSK introduced ultrasonic fatigue-resistant bearing tech to enhance product lifespan. Players like NTN are launching smart sensor-embedded bearings for predictive maintenance in premium passenger models. With sustainability in focus, manufacturers are exploring ceramic hybrids, self-lubricating materials, and lightweight composites to meet regulatory and environmental goals. This makes the passenger cars segment the largest and most dynamic within the automotive bearings space.

"Germany is projected to lead the automotive bearing market in Europe during the forecast period."

Strong domestic demand for and rising export of passenger cars, particularly luxury sedans and SUVs, support a steady bearings consumption, especially for ICE vehicles where wheel hub, drivetrain, transmission, and engine applications dominate. Although EV adoption is gradually increasing under EU emission policies, the bulk of production, over 3.7 million vehicles annually, relies on conventional bearings, with OEMs focusing on efficiency, durability, and lightweight designs. Regulatory factors, including EU technical standards and external trade pressures, such as higher US tariffs on German vehicles, shape production strategies and supplier collaborations. Leading bearing manufacturers such as Schaeffler, SKF, NSK, Stieber, Freudenberg, and C&U Europe provide premium and specialized solutions to major OEMs like BMW and Mercedes-Benz, often through co-engineered designs. Key production and innovation hubs in regions like Schweinfurt and Bavaria enable close integration with automotive clusters, supporting just-in-time supply and advanced R&D in high-performance rolling element bearings, including deep groove ball, tapered roller, and cylindrical roller types. The aftermarket remains robust due to Germany's aging vehicle fleet and preventive maintenance culture, though counterfeit products present safety challenges, driving stronger quality verification measures. A strong focus on precision engineering, premium vehicle production, and close supplier partnerships is helping the country remain a key source of demand for high-performance bearings in Europe.

- By Company Type: OEMs - 35%, Tier I - 25%, Tier 2 - 40%

- By Designation: CXOs - 15%, Managers - 15%, Executives - 70%

- By Region: North America - 20%, Asia Pacific - 50%, Europe - 20 %, Rest of the World - 10%

The global automotive bearing market is dominated by established players such as NSK Ltd. (Japan), NTN Corporation (Germany), The Timken Company (USA), JTEKT Corporation (Japan), and Nachi Fujikoshi (Japan). These companies manufacture and supply automotive bearings for vehicles.

Research Coverage

The study covers the automotive bearing market by bearing type (Ball Bearing, Roller Bearing, and Other Bearings), application (Wheel Hub, Transmission System, Drivetrain, Engine, Interior & Exterior, and Other Applications), vehicle type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), EV type (BEV and PHEV), and Aftermarket (Wheel Hub, Transmission System, Drivetrain, Engine, Interior & Exterior, and Other Applications). It also covers the competitive landscape and company profiles of major automotive bearing market ecosystem players.

Key Benefits of the Report

The study includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall automotive bearing market ecosystem and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Additionally, the report will help stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (High precision bearings for ADAS applications, emergence of specialized bearing designs tailored for electric powertrains and high-speed e-motors, and increasing vehicle life to drive aftermarket bearing demand in automobiles), restraints (Raw material price volatility impacting costs and margins and reduced demand for bearings due to simplified EV powertrains), opportunities (Adoption of sensor-integrated bearings for condition-based monitoring and predictive maintenance and use of alternate materials like ceramics and polymers to boost efficiency and lifespan), and challenges (Persistent supply chain instability and extended lead times and declining replacement cycles due to long-lasting, sealed bearing units) influencing the growth of automotive bearing market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the automotive bearing market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the automotive bearing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like NSK Ltd. (Japan), NTN Corporation (Germany), The Timken Company (USA), JTEKT Corporation (Japan), and Nachi Fujikoshi (Japan)

- MnM Insights: Insights into the use of advanced materials for lightweight and corrosion-resistant design, EV-specific use cases (E-axles, in-wheel motors, thermal management, etc.), and ADAS/semi-autonomous application-related use cases

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.2.2 Primary interviews from demand and supply sides

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Major objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE BEARING MARKET

- 4.2 AUTOMOTIVE BEARING MARKET, BY VEHICLE TYPE

- 4.3 AUTOMOTIVE BEARING MARKET, BY BEARING TYPE

- 4.4 AUTOMOTIVE BEARING MARKET, BY APPLICATION

- 4.5 AUTOMOTIVE BEARING MARKET, BY EV TYPE

- 4.6 AUTOMOTIVE BEARING MARKET, BY AFTERMARKET

- 4.7 AUTOMOTIVE BEARING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Demand for high-precision bearings for ADAS applications

- 5.2.1.2 Emergence of specialized bearing designs tailored for electric powertrains and high-speed e-motors

- 5.2.1.3 Increasing vehicle life to drive demand for aftermarket bearings in automobiles

- 5.2.2 RESTRAINTS

- 5.2.2.1 Reduced demand for bearings due to simplified EV powertrains

- 5.2.2.2 Declining replacement cycles due to long-lasting, sealed bearing units

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of sensor-integrated bearings for condition-based monitoring and predictive maintenance

- 5.2.3.2 Use of alternate materials like ceramics and polymers to boost efficiency and lifespan

- 5.2.4 CHALLENGES

- 5.2.4.1 Persistent supply chain instability and extended lead times

- 5.2.4.2 Raw material price volatility impacting costs and margins

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE BEARINGS, BY APPLICATION

- 5.3.2 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE BEARINGS, BY KEY PLAYER

- 5.3.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.4 TRADE ANALYSIS

- 5.4.1 IMPORT SCENARIO (HS CODE 848210)

- 5.4.2 EXPORT SCENARIO (HS CODE 848210)

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 AUTOMOTIVE BEARING MANUFACTURERS

- 5.5.3 TIER I COMPANIES/COMPONENT PROVIDERS

- 5.5.4 AUTOMOTIVE OEMS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 RAW MATERIAL SUPPLIERS

- 5.6.2 TIER I COMPANIES/COMPONENT PROVIDERS

- 5.6.3 AUTOMOTIVE OEMS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Smart-sensored bearings as enablers of predictive maintenance architecture

- 5.7.1.2 Emerging role of magnetic bearings in electrified vehicle architectures

- 5.7.1.3 Electromagnetic bearings enabling adaptive ride and chassis stabilization

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Self-lubricating bearings with nano-coatings for electrified mobility

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Hybrid ceramic bearings for high-speed electric drivetrains

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 STRATEGIC DEVELOPMENTS IN AUTOMOTIVE BEARINGS: ELECTRIFIED POWERTRAINS, DIGITAL ENGINEERING, AND COLLABORATIVE ECOSYSTEMS

- 5.9.1 INTEGRATION OF BEARINGS WITH ELECTRIFIED POWERTRAIN ARCHITECTURE

- 5.9.1.1 Bearing systems for e-motors and compact EV architectures

- 5.9.1.2 Lubrication under thermal constraints in EV bearings

- 5.9.1.3 Miniaturized power, maximized performance: Bearings for integrated e-drives

- 5.9.2 DIGITAL TWINS AND SIMULATION IN BEARING DESIGN

- 5.9.2.1 Virtual load prediction in automotive bearings

- 5.9.2.2 Predictive failure modeling in bearing design

- 5.9.2.3 Simulation-driven prototyping in development of bearings

- 5.9.3 COLLABORATIVE BEARING ECOSYSTEM

- 5.9.3.1 Co-engineering bearings for electric and autonomous vehicles

- 5.9.3.2 Long-term sourcing contracts for supply of platform-centric bearings

- 5.9.3.3 Risk-sharing frameworks in bearing innovation partnerships

- 5.9.4 SUSTAINABILITY METRICS AND CIRCULAR ECONOMY POTENTIAL

- 5.9.4.1 Material use and reduction of emissions through remanufacturing of bearings

- 5.9.4.2 Re-engineering bearings for greener rulebook

- 5.9.1 INTEGRATION OF BEARINGS WITH ELECTRIFIED POWERTRAIN ARCHITECTURE

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATORY FRAMEWORK, BY COUNTRY

- 5.10.2.1 US

- 5.10.2.2 China

- 5.10.2.3 Japan

- 5.10.2.4 India

- 5.10.2.5 South Korea

- 5.10.2.6 Brazil

- 5.10.2.7 Europe

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SKF INSIGHT DEVELOPED SMART BEARING SYSTEM TO TURN CONVENTIONAL BEARINGS INTO SELF-MONITORING COMPONENTS

- 5.11.2 NTN CORPORATION DEVELOPED PIONEERING SENSOR INTEGRATED BEARING THAT EMBEDS SENSORS

- 5.11.3 SKF GROUP PARTNERED WITH VALEO TO DEVELOP HIGHLY INTEGRATED MAGNETIC SENSOR-BEARING UNIT TO ENABLE EFFICIENT STOP-START FUNCTION IN MICRO-HYBRID VEHICLES

- 5.11.4 TIMKEN COMPANY (US) DEVELOPED SENSOR PAC BEARING PACKAGE FOR INTEGRATED ABS & TRACTION CONTROL

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 IMPACT OF AI

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 US 2025 TARIFF

6 AUTOMOTIVE BEARING MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 WHEEL HUB

- 6.2.1 INTEGRATION OF ABS AND ESC SYSTEMS TO DRIVE MARKET

- 6.3 TRANSMISSION

- 6.3.1 SHIFT TOWARD AUTOMATIC TRANSMISSION TO IMPACT DEMAND

- 6.4 DRIVETRAIN

- 6.4.1 ADOPTION OF ALL-WHEEL-DRIVE (AWD) TO DRIVE DEMAND

- 6.5 ENGINE

- 6.5.1 GROWING ADOPTION OF TGDI OR LARGE ENGINES TO DRIVE DEMAND FOR ENGINE BEARINGS

- 6.6 INTERIOR & EXTERIOR

- 6.6.1 GROWING PREFERENCE FOR SUNROOFS, PREMIUM SEAT ADJUSTERS, AND MOTORIZED COMPONENTS TO BOOST DEMAND

- 6.7 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE BEARING MARKET, BY BEARING TYPE

- 7.1 INTRODUCTION

- 7.2 BALL BEARING

- 7.2.1 NEED FOR LOW-MAINTENANCE COMPACT BEARINGS TO DRIVE MARKET

- 7.3 ROLLER BEARING

- 7.3.1 GROWING PREFERENCE FOR SUVS TO DRIVE DEMAND FOR ROLLER BEARINGS

- 7.4 OTHER BEARINGS

- 7.5 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE BEARING MARKET, BY EV TYPE

- 8.1 INTRODUCTION

- 8.2 BEV

- 8.2.1 POPULARITY OF BEVS TO DRIVE GROWTH IN DEMAND FOR EV-SPECIFIC BEARINGS

- 8.3 PHEV

- 8.3.1 GROWING PHEV SALES DUE TO DUAL POWERTRAINS TO FUEL DEMAND

- 8.4 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE BEARING MARKET, BY VEHICLE TYPE

- 9.1 INTRODUCTION

- 9.2 PASSENGER CARS

- 9.2.1 INCREASING DEMAND FOR PREMIUM CARS TO LEAD MARKET

- 9.3 LIGHT COMMERCIAL VEHICLES

- 9.3.1 DEMAND FOR ENHANCED LOAD CAPACITY AND THERMAL STABILITY TO DRIVE DEMAND FOR BEARINGS IN LCVS

- 9.4 HEAVY COMMERCIAL VEHICLES

- 9.4.1 GROWING DEMAND FOR AIR CONDITIONING IN CARS AND ADOPTION OF PREMIUM SAFETY FEATURES TO DRIVE DEMAND

- 9.5 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE BEARING MARKET, BY AFTERMARKET

- 10.1 INTRODUCTION

- 10.2 AFTERMARKET WHEEL HUB

- 10.2.1 INTEGRATION OF ABS AND ESC SYSTEMS TO DRIVE HIGH WHEEL HUB BEARING REPLACEMENTS

- 10.3 AFTERMARKET TRANSMISSION

- 10.3.1 COMPLEX GEAR SYSTEMS IN MODERN AUTOMATICS TO CREATE HIGH DEMAND

- 10.4 AFTERMARKET DRIVETRAIN

- 10.4.1 NEED FOR CONTINUOUS POWER TRANSFER AND LOAD VARIATIONS TO ACCELERATE MARKET

- 10.5 AFTERMARKET ENGINE

- 10.5.1 RISING VEHICLE AGE AND ENGINE DOWNSIZING TO INCREASE STRAIN ON REPLACEMENT BEARINGS

- 10.6 AFTERMARKET INTERIOR & EXTERIOR

- 10.6.1 RISING DEMAND FOR PREMIUM COMFORT FEATURES IN VEHICLES TO BOOST INTERIOR & EXTERIOR BEARING REPLACEMENTS

- 10.7 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE BEARING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 MACROECONOMIC OUTLOOK

- 11.2.2 CHINA

- 11.2.2.1 Rising adoption of advanced powertrain to fuel demand for high performance bearings

- 11.2.3 INDIA

- 11.2.3.1 Expanding vehicle ownership and production to drive growth in automotive bearings

- 11.2.4 JAPAN

- 11.2.4.1 Focus on precision engineering to drive demand for technologically advanced bearings

- 11.2.5 SOUTH KOREA

- 11.2.5.1 Rising demand for refinement to drive growth in interior automotive bearings

- 11.3 NORTH AMERICA

- 11.3.1 MACROECONOMIC OUTLOOK

- 11.3.2 US

- 11.3.2.1 Innovation and EV adoption to drive steady growth in market

- 11.3.3 CANADA

- 11.3.3.1 Increased vehicle production and demand for aftermarket to accelerate growth

- 11.3.4 MEXICO

- 11.3.4.1 Strategic manufacturing growth to fuel surge in demand for automotive bearings

- 11.4 EUROPE

- 11.4.1 MACROECONOMIC OUTLOOK

- 11.4.2 FRANCE

- 11.4.2.1 Strict urban emission policies to spur fleet renewal and upgrades

- 11.4.3 GERMANY

- 11.4.3.1 Strong OEM-aftermarket collaboration to ensure steady supply and high-quality bearings

- 11.4.4 ITALY

- 11.4.4.1 Demand for luxury and high-performance vehicles to sustain premium bearings market

- 11.4.5 SPAIN

- 11.4.5.1 Regulatory incentives and upcoming EURO 7 standards to drive electrification to impact demand

- 11.4.6 UK

- 11.4.6.1 Premium vehicle production to drive demand for automotive bearings

- 11.4.7 REST OF EUROPE

- 11.5 REST OF THE WORLD

- 11.5.1 MACROECONOMIC OUTLOOK

- 11.5.2 BRAZIL

- 11.5.2.1 Government incentives and strong local manufacturing to drive market

- 11.5.3 RUSSIA

- 11.5.3.1 Rising vehicle production and technological complexity to drive market

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Growing demand for comfort features in vehicles to boost need for interior & exterior bearings

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.5.1 COMPANY VALUATION

- 12.5.2 FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Vehicle type footprint

- 12.7.5.4 Bearing type footprint

- 12.7.5.5 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: SMES, 2024

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 12.9.2 DEALS

- 12.9.3 EXPANSION

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 NSK LTD.

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches/developments

- 13.1.1.3.2 Expansion

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices made

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 NTN CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches/developments

- 13.1.2.3.2 Expansion

- 13.1.2.3.3 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices made

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 THE TIMKEN COMPANY

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices made

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 JTEKT CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches/developments

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansion

- 13.1.4.3.4 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices made

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 NACHI-FUJIKOSHI CORP.

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices made

- 13.1.5.3.3 Weaknesses & competitive threats

- 13.1.6 SCHAEFFLER AG

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Expansion

- 13.1.6.3.3 Other developments

- 13.1.7 SKF

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches/developments

- 13.1.7.3.2 Deals

- 13.1.7.3.3 Expansion

- 13.1.7.3.4 Other developments

- 13.1.8 REGAL REXNORD CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 WAFANGDIAN GUANGYANG BEARING GROUP CORPORATION LIMITED

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 TENNECO INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 FERSA

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Expansion

- 13.1.12 C&U COMPANY LIMITED

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.1 NSK LTD.

- 13.2 OTHER PLAYERS

- 13.2.1 MINEBEAMITSUMI INC.

- 13.2.2 ILJIN ELECTRONICS (I) PVT. LTD.

- 13.2.3 NRB INDUSTRIAL BEARINGS LTD.

- 13.2.4 RKB BEARING INDUSTRIES

- 13.2.5 NAKANISHI MANUFACTURING CORPORATION

- 13.2.6 EMERSON BEARING COMPANY

- 13.2.7 ORS - ORTADOGU RULMAN SANAYI VE TIC. A.S.

- 13.2.8 TSUBAKI NAKASHIMA CO. LTD.

- 13.2.9 CW BEARING

- 13.2.10 LYC PRIVATE LIMITED

- 13.2.11 HARBIN BEARING MANUFACTURING CO., LTD.

- 13.2.12 NEI LTD. (NBC BEARINGS)

- 13.2.13 TATA STEEL

14 RECOMMENDATIONS BY MARKETSANDMARKETS

- 14.1 ASIA PACIFIC: KEY MARKET FOR AUTOMOTIVE BEARINGS

- 14.2 CONSUMER DEMAND AND INNOVATION IN AUTOMOTIVE INTERIOR BEARING MARKET

- 14.3 GROWTH OPPORTUNITIES IN SMART AUTOMOTIVE BEARINGS

- 14.4 GROWTH IN AUTOMOTIVE BEARINGS DUE TO RISING DEMAND FOR PHEVS

- 14.5 CONCLUSION

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS