|

시장보고서

상품코드

1766231

멀티 포맷 포장 라인 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Multi-format Packaging Lines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

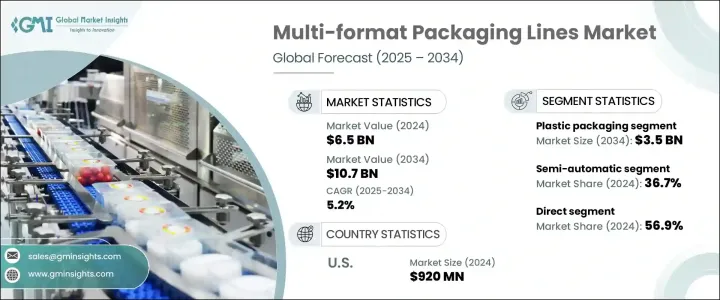

세계의 멀티 포맷 포장 라인 시장은 2024년 65억 달러로 평가되었고 CAGR 5.2%를 나타내며 2034년에는 107억 달러에 이를 것으로 추정됩니다.

이 성장의 원동력은 편의성과 지속가능성에 대한 소비자의 요구 증가이며, 식음료, 퍼스널케어, 의약품 등의 산업에서 연포장이 널리 채용되고 있습니다. 소재에 대응할 수 있도록 진화하고 있어, 제조업체는 최소한의 다운타임으로 다른 포맷간의 전환이 가능합니다.

게다가 경쟁 구도가 치열해지면서 브랜드는 시장 수요와 계절 변화에 신속하게 대응할 수 있는 포장 솔루션을 요구하게 되어 유연한 포장 시스템의 필요성이 더욱 높아지고 있습니다. 기업은 신속한 포맷 전환, 최소한의 다운타임, 멀티 자재관리이 가능한 포장 기술을 우선하게 되어 있습니다. 지역 선호도와 같이 소비자 동향이 급속히 변화하는 가운데 브랜드는 제품의 외관과 형식을 변경해야 할 필요가 없습니다. 이러한 민첩성은 매장에서의 어필을 강화할 뿐만 아니라 포화 상태의 마켓플레이스에서 틈새 부문을 획득하고 브랜드 인지도를 극대화하는 것을 목적으로 한 다양한 제품 포트폴리오를 지원합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 65억 달러 |

| 예측 금액 | 107억 달러 |

| CAGR | 5.2% |

플라스틱 포장 재료 부문은 2024년에 23억 달러의 지배적 점유율을 차지했고 2034년에는 35억 달러에 이를 것으로 예측됩니다. 광범위한 용도는 적응성, 강도 및 경량 특성으로 인해 크고 광범위한 포장 요구 사항에 적합합니다. 이 재료는 고속 포장 라인과의 호환성과 다양한 모양과 크기로 성형 할 수있는 능력을 통해 제품 프레 젠 테이션의 혁신에 대응하고 주도하고 있습니다. 식품, 의약품, 퍼스널케어, 가정용품 등의 업계에서는 보존 기간의 연장, 내 탬퍼성, 생산 비용의 저감 등의 이유로, 포장용 플라스틱에 큰 신뢰를 갖고 있습니다.

반자동 포장 라인 분야는 2024년 36.7% 시장 점유율을 차지했으며 2034년까지 연평균 복합 성장률(CAGR) 6.8%를 나타낼 것으로 예측됩니다. 이러한 시스템은 수동 제어와 자동화된 효율성을 모두 제공하는 능력을 통해 완전 자동화와 관련된 높은 비용 없이 유연한 생산 환경을 만들 수 있기 때문에 점점 더 지지되고 있습니다. 이러한 시스템은 기존의 워크플로우에 쉽게 통합될 수 있어 신뢰성이 높고 포맷 적응성이 높은 장비를 필요로 하는 중소기업 및 수탁 제조업체에 특히 적합합니다.

미국의 멀티 포맷 포장 라인 시장은 2024년 9억 2,000만 달러로 평가되었고 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 5.7%를 나타낼 것으로 예측됩니다. 미국은 첨단 제조 시설, 완전 자동화 시스템, 식음료, 퍼스널케어, 의약품 등 산업의 큰 존재감으로 북미 시장을 선도하고 있습니다. 스마트하고 연포장 기술의 채용은 환경적으로 지속 가능한 제품과 다양한 재고 관리 단위(SKU)를 요구하는 소비자 수요에 의해 추진되고 있습니다.

멀티 포맷 포장 라인 업계 주요 기업은 Fuji Machinery Co. Ltd. Bosch Packaging Technology(Syntegon), Coesia Group, Haver & Boecker, IMA Group, Ishida Co. Ltd. KHS GmbH, Marchesini Group, Multivac Group, ProMach Inc. Serac Group, Sidel Group, SIG Pak 등이 있습니다. 멀티 포맷 포장 라인 시장 기업은 존재감을 높이기 위해 몇 가지 전략에 주력하고 있습니다. 다른 업계 기업과의 파트너십 및 협업은 제품 제공 확대와 새로운 시장 진입을 위해 진행되고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 파괴적 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 기회

- 성장 가능성 분석

- 향후 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 포장 유형별

- 규제 프레임워크

- 규격과 인증

- 환경규제

- 수출입 규제

- 무역 통계(HS코드 8422)

- 주요 수입국

- 주요 수출국

- Porter's Five Forces 분석

- PESTEL 분석

- 소비자 행동 분석

- 구입 패턴

- 선호 분석

- 소비자 행동의 지역차

- 전자상거래가 구매결정에 미치는 영향

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계·예측 : 포장 형태별(2021-2034년)

- 주요 동향

- 1차

- 2차

- 3차

제6장 시장 추계·예측 : 포맷별(2021-2034년)

- 주요 동향

- 파우치

- 병

- 캔

- 판지

- 향 주머니

- 튜브

- 기타

제7장 시장 추계·예측 : 자동화별(2021-2034년)

- 주요 동향

- 수동

- 반자동

- 전자동

제8장 시장 추계·예측 : 포장 재료별(2021-2034년)

- 주요 동향

- 플라스틱

- 유리

- 금속

- 종이 및 판지

- 기타(필름, 호일 등)

제9장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 식음료

- 포장 식품

- 유제품

- 베이커리 및 제과

- 의약품

- 화장품 및 퍼스널케어

- 전자기기 및 소비재

- 기타(담배, 문구류 등)

제10장 시장 추계·예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 직접 판매

- 간접 판매

제11장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

제12장 기업 프로파일

- Barry-Wehmiller Companies

- Bosch Packaging Technology(Syntegon)

- Coesia Group

- Fuji Machinery Co. Ltd.

- Haver &Boecker

- IMA Group

- Ishida Co. Ltd.

- KHS GmbH

- Marchesini Group

- Multivac Group

- ProMach Inc.

- Serac Group

- Sidel Group

- SIG Combibloc Group

- Tetra Pak

The Global Multi-format Packaging Lines Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 10.7 billion by 2034. This growth is driven by the increasing consumer demand for convenience and sustainability, leading to the widespread adoption of flexible packaging across industries such as food and beverage, personal care, and pharmaceuticals. Multi-format packaging lines have evolved to accommodate various package types, shapes, and materials, allowing manufacturers to switch between different formats with minimal downtime. This adaptability enhances operational efficiency and reduces costs associated with maintaining multiple dedicated machines.

Additionally, the competitive retail landscape has led brands to seek packaging solutions that can quickly respond to market demands and seasonal changes, further emphasizing the need for flexible packaging systems. This pressure to remain relevant and adaptive in real time has driven companies to prioritize packaging technologies capable of rapid format changeovers, minimal downtime, and multi-material handling. As consumer trends evolve rapidly-whether due to holidays, promotions, limited editions, or regional preferences-brands are compelled to modify product appearance and format. Multi-format packaging lines enable manufacturers to execute these changes swiftly without compromising efficiency or cost control. This agility enhances shelf appeal but also supports diversified product portfolios aimed at capturing niche segments and maximizing brand visibility in a saturated marketplace.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 5.2% |

The plastic packaging materials segment held a dominant share of USD 2.3 billion in 2024 and is forecasted to reach USD 3.5 billion by 2034. Their widespread application is largely attributed to their adaptability, strength, and lightweight properties, which make them suitable for a broad spectrum of packaging requirements. These materials continue to lead due to their compatibility with high-speed packaging lines and ability to be molded into various shapes and sizes, accommodating innovations in product presentation. Industries such as food and beverage, pharmaceuticals, personal care, and household goods rely heavily on plastics for packaging due to their extended shelf-life protection, tamper resistance, and low production cost.

The semi-automatic packaging lines segment held a market share of 36.7% in 2024 and is projected to grow at a CAGR of 6.8% through 2034. These systems are becoming increasingly favored due to their ability to offer both manual control and automated efficiency, creating a flexible production environment without the high costs associated with full automation. They are especially suitable for SMEs and contract manufacturers who require reliable, format-adaptable equipment that can be easily integrated into existing workflows.

United States Multi-Format Packaging Lines Market was valued at USD 920 million in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2034. The U.S. leads the North American market due to its advanced manufacturing facilities, fully automated systems, and the significant presence of industries like food and beverage, personal care, and pharmaceuticals. The adoption of smart and flexible packaging technologies is driven by consumer demand for environmentally sustainable products and a diverse range of stock-keeping units (SKUs).

Key players in the Multi-Format Packaging Lines Industry include Fuji Machinery Co., Ltd., Bosch Packaging Technology (Syntegon), Coesia Group, Haver & Boecker, IMA Group, Ishida Co., Ltd., KHS GmbH, Marchesini Group, Multivac Group, ProMach Inc., Serac Group, Sidel Group, SIG Combibloc Group, and Tetra Pak. Companies in the multi-format packaging lines market are focusing on several strategies to strengthen their presence. These include investing in research and development to create innovative packaging solutions that meet evolving consumer preferences. Partnerships and collaborations with other industry players are being pursued to expand product offerings and enter new markets. Additionally, companies are adopting sustainable practices by developing eco-friendly packaging materials and processes to align with increasing environmental concerns.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Packaging type

- 2.2.3 Format type

- 2.2.4 Automation

- 2.2.5 Packaging material

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By packaging type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code-8422)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Packaging type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Primary

- 5.3 Secondary

- 5.4 Tertiary

Chapter 6 Market Estimates & Forecast, By Format type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Pouch

- 6.3 Bottle

- 6.4 Can

- 6.5 Carton

- 6.6 Sachet

- 6.7 Tube

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Automation, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automatic

- 7.4 Fully automatic

Chapter 8 Market Estimates & Forecast, By Packaging material, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Plastic

- 8.3 Glass

- 8.4 Metal

- 8.5 Paper and paperboard

- 8.6 Others (films, foils, etc.)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Food and beverages

- 9.3 Packaged food

- 9.4 Dairy products

- 9.5 Bakery and confectionery

- 9.6 Pharmaceuticals

- 9.7 Cosmetics and personal care

- 9.8 Electronics and consumer goods

- 9.9 Others (tobacco, stationery, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 UAE

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Barry-Wehmiller Companies

- 12.2 Bosch Packaging Technology (Syntegon)

- 12.3 Coesia Group

- 12.4 Fuji Machinery Co., Ltd.

- 12.5 Haver & Boecker

- 12.6 IMA Group

- 12.7 Ishida Co., Ltd.

- 12.8 KHS GmbH

- 12.9 Marchesini Group

- 12.10 Multivac Group

- 12.11 ProMach Inc.

- 12.12 Serac Group

- 12.13 Sidel Group

- 12.14 SIG Combibloc Group

- 12.15 Tetra Pak