|

시장보고서

상품코드

1766295

인간 미생물 군집 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Human Microbiome Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

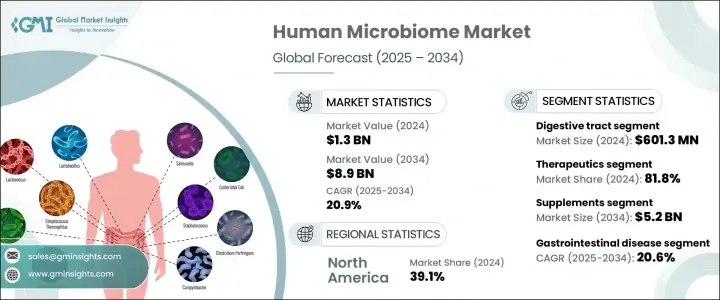

세계의 인간 미생물 군집 시장은 2024년 13억 달러로 평가되었고 2034년에는 89억 달러에 이를 것으로 추정되며, CAGR 20.9%로 성장할 전망입니다. 시장 확장은 인간 건강 유지 및 질병 예방에 미생물 군집이 중요한 역할을 한다는 전 세계의 인식이 높아짐에 따라 크게 촉진되고 있습니다. 인체 내의 미생물 군집은 이제 소화, 면역, 심지어 신경학적 균형 등 다양한 생물학적 과정에 필수적인 요소로 인식되고 있습니다. 이러한 미생물이 전반적인 건강에 미치는 영향을 밝히는 새로운 과학적 돌파구가 등장하면서 미생물 군집 기반 제품에 대한 수요가 가속화되고 있습니다.

인체 미생물 군집에 대한 관심이 높아지면서 의료의 미래가 변화하고 있습니다. 주요 원동력은 환자의 고유한 미생물 프로필에 맞는 치료를 제공하는 정밀 의학으로의 전환입니다. 이러한 개인 맞춤형 접근 방식은 미생물 군집 기반 진단 및 치료의 효과를 높이고, 그 채택을 촉진하고 있습니다. 표적 치료에 대한 수요는 제약 회사, 생명 공학 기업, 연구 기관 간의 협력을 촉진하여 혁신과 상업적 성장을 더욱 가속화하고 있습니다. 시퀀싱 기술과 생물 정보학의 발전도 미생물 군집 매핑 능력을 향상시키고, 새로운 치료 솔루션의 개발을 촉진하며, 의약품 개발 및 질병 예방에 데이터 기반의 접근 방식을 가능하게 하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 13억 달러 |

| 예측 금액 | 89억 달러 |

| CAGR | 20.9% |

미생물 군집 적용을 위해 연구된 다양한 해부학적 부위 중 소화관 부문이 2024년에 6억 130만 달러의 시장 가치를 기록하며 상당한 점유율을 차지했습니다. 이 부문은 장에서 발견되는 미생물의 고밀도와 다양성으로 인해 계속해서 우위를 차지하고 있습니다. 이러한 장내 미생물은 소화를 관리하고, 신진대사를 조절하며, 면역 기능을 지원하고, 유해한 병원균을 방어하는 데 중요한 역할을 합니다. 장내 미생물이 대사 장애, 자가 면역 질환, 신경 퇴행성 질환과 같은 만성 질환에 관여한다는 사실로 인해, 장내 미생물은 지속적인 연구 및 제품 개발의 중심이 되고 있습니다. 장 건강에 대한 관심이 널리 확산되면서 프로바이오틱스, 프리바이오틱스, 포스트바이오틱스, 미생물 군집 기반 치료제 등 표적 솔루션이 출시되고 있습니다.

용도별로는 치료제와 진단으로 부문이 나뉘며, 2024년에는 치료제가 81.8%의 점유율을 차지하며 선두를 달릴 것으로 보입니다. 이러한 우위는 대사 증후군, 위장 질환, 신경 장애 등 미생물 군집의 장애와 관련이 있는 건강 상태가 증가하고 있기 때문으로 보입니다. 생체 치료제, 미생물 군집 기반 이식, 미생물 군집 조절 의약품과 같은 혁신이 이 부문을 강화하고 있습니다. 더 많은 의료 서비스 제공자가 개인의 미생물 군집 프로필에 기반한 맞춤형 치료를 채택함에 따라 미생물 군집 제품의 치료적 가치는 계속 확대되어 다양한 질병에 대해 맞춤형의 보다 효율적인 솔루션을 제공할 것입니다.

질병 유형에 따라 시장은 위장 질환, 내분비 및 대사 질환, 감염성 질환, 암, 중추 신경계 장애 및 기타로 분류됩니다. 위장 질환 부문은 예측 기간 동안 연평균 20.6%의 성장률을 보일 것으로 예상됩니다. 장내 미생물 군집의 장애는 과민성 대장 증후군, 궤양성 대장염, 크론병과 같은 질환과 점점 더 관련이 있는 것으로 알려져 있습니다. 이러한 치료법은 침습성이 적고 더 집중적인 치료 대안을 제공하기 때문에 미생물 군집을 표적으로 하는 중재에 대한 수요가 증가하고 있습니다. 미생물 군집 균형을 회복하는 솔루션에 대한 환자의 선호도가 높아짐에 따라 이 부문의 확장에 크게 기여할 것으로 예상됩니다.

제품 유형별로 평가할 때, 이 시장에는 의약품, 보충제, 진단 테스트 및 기타 제품이 포함됩니다. 프로바이오틱스 및 프리바이오틱스 보충제는 쉽게 구할 수 있고 널리 인정받고 있어 소비가 증가하고 있습니다. 또한, 소비자들이 맞춤형 건강 솔루션을 추구함에 따라 신바이오틱스 및 개인 맞춤형 보충제 혼합물 등 맞춤형 제형이 등장하면서 이 부문의 수요가 더욱 증가하고 있습니다.

지역별로는 북미가 2024년 39.1%의 압도적인 점유율을 기록하며 시장을 주도했습니다. 이 지역적 우위는 높은 의료 지출, 만성 질환 발생률 증가, 강력한 연구 인프라에 의해 뒷받침되고 있습니다. 규제 지원과 선도적인 시장 참여자들의 존재는 임상 및 상업적 응용 분야에서의 채택을 더욱 가속화했습니다.

Archer Daniels Midland Company, Ferring, Seres Therapeutics, Inc.와 같은 주요 참여자들은 전 세계 시장 점유율의 약 40%를 차지합니다. 이 기업들은 전략적 제휴, 합병, 연구 협력 등 다양한 전략을 적극적으로 추진하여 입지를 확대하고, 새로운 시장에 진출하며, 진화하는 미생물 군집 미래에서 경쟁력을 강화하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 산업 고찰

- 생태계 분석

- 공급자의 상황

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 산업에 미치는 영향요인

- 성장 촉진요인

- 생활습관 관련 질환의 부담 증가와 고령 인구 증가

- 자금 지원 정책 및 정부 프로그램의 확대

- 정밀 의학에 대한 수요 증가

- 산업의 잠재적 리스크 및 과제

- 긴 규제 절차와 높은 개발 비용

- 윤리 및 안전 문제

- 시장 기회

- 치료 용도의 확대

- 프로바이오틱스 및 프리바이오틱스 제품 수요 증가

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술

- 현재의 기술 동향

- 신흥기술

- 장래 시장 동향

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확대 계획

제5장 시장 추정 및 예측 : 부위별(2021-2034년)

- 주요 동향

- 소화관

- 폐

- 생식강

- 피부

- 기타

제6장 시장 추정 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 치료

- 진단

제7장 시장 추정 및 예측 : 질환별(2021-2034년)

- 주요 동향

- 감염증

- 소화기 질환

- 내분비 및 대사질환

- 암

- 중추신경질환

- 기타

제8장 시장 추정 및 예측 : 제품별(2021-2034년)

- 주요 동향

- 약

- 보충제

- 프로바이오틱스

- 프리바이오틱스

- 신바이오틱스

- 진단 검사

- 기타

제9장 시장 추정 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- Archer Daniels Midland Company

- Biohm Technologies

- BioGaia

- Biome Diagnostics

- BiomeBank

- Ferring

- Intralytix

- OptiBIoTix

- Pendulum Therapeutics

- Prescient Metabiomics

- Seres Therapeutics

- Seed Health

- The BioArte

- Vedanta Biosciences

- Viome Life Sciences

The Global Human Microbiome Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 20.9% to reach USD 8.9 billion by 2034. Market expansion is largely fueled by the increasing global awareness about the critical role of microbiomes in maintaining human health and preventing disease. Microbial communities in the human body are now recognized as fundamental to various biological processes, including digestion, immunity, and even neurological balance. With new scientific breakthroughs uncovering how these microbes influence overall health, demand for microbiome-based products is accelerating.

Growing interest in the human microbiome is transforming the healthcare landscape. A key driver is the rising shift toward precision medicine, which relies on tailoring treatments to a patient's unique microbial profile. This personalization approach is making microbiome-based diagnostics and therapeutics more effective, driving increased adoption. The demand for targeted therapies is encouraging collaborations between pharmaceutical firms, biotech companies, and research institutes, further fueling innovation and commercial growth. Advancements in sequencing technologies and bioinformatics are also improving microbiome mapping capabilities, encouraging the development of novel treatment solutions, and enabling a data-driven approach to drug development and disease prevention.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $8.9 Billion |

| CAGR | 20.9% |

Among the various anatomical sites studied for microbiome applications, the digestive tract segment held a substantial share, with a market value of USD 601.3 million in 2024. This segment continues to dominate due to the high density and diversity of microbes found in the gut. These gut microorganisms are instrumental in managing digestion, regulating metabolism, supporting immune function, and defending against harmful pathogens. The gut microbiome's involvement in chronic health conditions such as metabolic disorders, autoimmune diseases, and neurodegenerative issues has positioned it as a central focus for ongoing research and product development. The widespread interest in gut health has led to the launch of targeted solutions like probiotics, prebiotics, postbiotics, and microbiome-based therapeutics.

In terms of application, the market is segmented into therapeutics and diagnostics, with therapeutics taking the lead in 2024 by capturing an 81.8% share. This dominance is attributed to the increasing number of health conditions now linked to disruptions in the microbiome, including metabolic syndromes, gastrointestinal diseases, and neurological disorders. Innovations such as live biotherapeutic products, microbiota-based transplants, and microbiome-modulating drugs are strengthening this segment. As more healthcare providers adopt personalized treatments based on individual microbiome profiles, the therapeutic value of microbiome products continues to expand, offering tailored and more efficient solutions across various diseases.

By disease type, the market is categorized into gastrointestinal disease, endocrine and metabolic diseases, infectious disease, cancer, central nervous system disorder, and others. The gastrointestinal disease segment is projected to grow at a CAGR of 20.6% over the forecast period. Disruptions in the gut microbiota are increasingly associated with conditions like irritable bowel syndrome, ulcerative colitis, and Crohn's disease. The demand for microbiome-targeted interventions is rising as these therapies offer less invasive and more focused treatment alternatives. Growing patient preference for solutions that restore microbiota balance is expected to significantly contribute to the expansion of this segment.

When evaluated by product type, the market includes drugs, supplements, diagnostic tests, and other offerings. The supplements category led the market in 2024 and is forecasted to reach USD 5.2 billion by 2034. This dominance stems from rising interest in preventive care and wellness, which is pushing consumers toward non-prescription options that support gut and immune health. Probiotic and prebiotic supplements are readily available and widely accepted, contributing to their growing consumption. Additionally, the emergence of customized formulations, including synbiotics and personalized supplement blends, is further boosting demand in this segment as consumers seek tailored health solutions.

Regionally, North America led the market with a commanding share of 39.1% in 2024. The U.S. market alone grew from USD 400.2 million in 2023 to USD 476.6 million in 2024. This regional dominance is supported by high healthcare spending, rising incidences of chronic illnesses, and strong research infrastructure. Regulatory backing and the presence of leading market players have further accelerated adoption across clinical and commercial applications.

Key participants such as Archer Daniels Midland Company, Ferring, and Seres Therapeutics, Inc. collectively account for around 40% of the global market share. These companies are actively pursuing strategies such as strategic alliances, mergers, and research collaborations to expand their footprint, gain access to new markets, and enhance their competitive positioning in the evolving microbiome landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Site

- 2.2.3 Application

- 2.2.4 Disease

- 2.2.5 Product

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing burden of lifestyle-related diseases and the growing geriatric population

- 3.2.1.2 Increasing funding initiatives and government programs

- 3.2.1.3 Increasing demand for precision medicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Long regulatory pathways and high development costs

- 3.2.2.2 Ethical and safety concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding therapeutic applications

- 3.2.3.2 Growing demand for probiotic and prebiotic products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Site, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Digestive tract

- 5.3 Lung

- 5.4 Reproductive cavity

- 5.5 Skin

- 5.6 Other sites

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Therapeutics

- 6.3 Diagnostics

Chapter 7 Market Estimates and Forecast, By Disease, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Infectious diseases

- 7.3 Gastrointestinal diseases

- 7.4 Endocrine and metabolic diseases

- 7.5 Cancer

- 7.6 Central nervous system (CNS) disorder

- 7.7 Other diseases

Chapter 8 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Drugs

- 8.3 Supplements

- 8.3.1 Probiotics

- 8.3.2 Prebiotics

- 8.3.3 Synbiotics

- 8.4 Diagnostic tests

- 8.5 Other products

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Archer Daniels Midland Company

- 10.2 Biohm Technologies

- 10.3 BioGaia

- 10.4 Biome Diagnostics

- 10.5 BiomeBank

- 10.6 Ferring

- 10.7 Intralytix

- 10.8 OptiBiotix

- 10.9 Pendulum Therapeutics

- 10.10 Prescient Metabiomics

- 10.11 Seres Therapeutics

- 10.12 Seed Health

- 10.13 The BioArte

- 10.14 Vedanta Biosciences

- 10.15 Viome Life Sciences