|

시장보고서

상품코드

1766351

약물 스크리닝 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Drug Screening Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

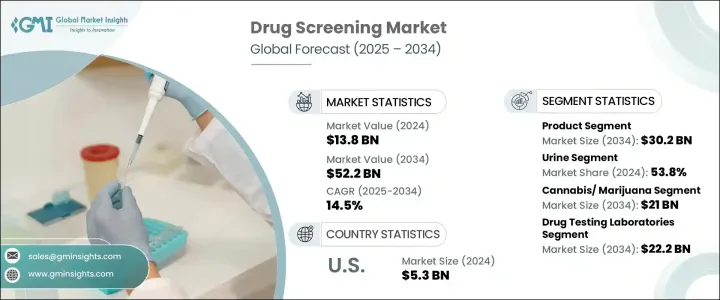

세계의 약물 스크리닝 시장은 2024년에 138억 달러로 평가되었고, CAGR 14.5%로 성장할 전망이며, 2034년에는 522억 달러에 이를 것으로 추정되고 있습니다.

이 성장의 배경에는 약물 남용 문제에 대한 대처에 대한 주목의 고조, 약물 검사 기술의 진보, 고용, 스포츠, 헬스케어 등 여러 분야에 있어서의 정책의 엄격화가 있습니다. 세계 각국의 정부는 약물 남용 박멸에 대한 대처를 강화하고 있으며, 이것이 효과적인 스크리닝 솔루션에 대한 시장의 수요를 한층 더 촉진하고 있습니다.

액체 크로마토그래피 질량분석법(LC-MS)과 면역 분석과 같은 최첨단 기술은 약물 스크리닝 프로세스의 정확성과 효율성을 크게 향상시켰습니다. 게다가 신속 스크리닝 킷이나 온사이트 검사 장치에 대한 액세스가 용이해진 것으로, 프로세스가 보다 편리해져, 결과에 필요로 하는 시간이 단축되고 있습니다. 이에 따라 약물 스크리닝 솔루션은 특히 '약물이 없는 직장법(Drug-Free Workplace Act)'과 같은 규제 하에서 직장의 안전과 컴플라이언스에 필수적인 것이 되어 시장 확대의 원동력이 되고 있습니다.

| 시장 규모 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 138억 달러 |

| 예측 금액 | 522억 달러 |

| CAGR | 14.5% |

약물 스크리닝은 혈액, 소변, 모발, 타액, 땀 등의 생체 시료를 검사하여 약물과 대사 산물을 검출합니다. 시장에는 면역 측정 분석 장치, 크로마토그래피 시스템, 호기 분석 장치, 경구액 검사 키트, 신속 검사 장치 등의 검사 장비를 포함한 약물 검출용으로 설계된 폭넓은 도구 및 서비스가 포함됩니다. 검사실에서의 스크리닝과 현장에서의 스크리닝 모두가 이 업계에서 일반적으로 이용되고 있는 방법입니다.

제품 부문은 시장의 최대 점유율을 차지했으며, 2024년 시장 규모는 81억 달러였습니다. 이 부문에는 면역측정 분석장치, 크로마토그래피장치, 날숨 분석장치 등 정확하고 신뢰성 높은 결과를 내는 데 매우 중요한 툴이 포함됩니다. 신속 검사장치는 휴대성, 사용 편의성, 즉시 결과를 내는 능력에서 특히 수요가 높아 직장이나 긴급 검사 시나리오에서의 사용에 이상적입니다. 샘플 채취 키트, 캘리브레이션 키트, 컨트롤 디바이스 등 소모품도 사용 빈도가 높고 정기적인 보충이 필요하기 때문에 수요가 높습니다.

소변 기반 약물 검사 부문은 2024년에 53.8%의 최대 점유율을 차지했으며, 예측 기간 동안 추가 성장이 예상됩니다. 소변 검사는 그 비용 대비 효과, 신뢰성, 폭넓은 물질의 검출 능력으로 인해 여전히 가장 널리 사용되는 방법입니다. 대사물은 소변으로 배설되기 때문에 최근 약물 사용을 특정하기 위한 이상적인 샘플이 됩니다. 소변 검사는 직장 약물 검사, 고용 전 스크리닝, 재활 프로그램에 일반적으로 사용됩니다. 비침습적인 채취 방법 및 칸나비노이드, 오피오이드, 암페타민, 벤조디아제핀 등의 물질을 검출하는 능력으로 약물 남용 관리 프로그램에 필수적인 것이 되고 있습니다.

북미 약물 스크리닝 2024년 시장 규모는 59억 달러로 평가되었고, 2034년에는 212억 달러에 이를 전망이며, CAGR 14%로 성장할 것으로 예측됩니다. 북미는 엄격한 규제 요건, 기술 혁신, 직장 안전에 대한 높은 의식이 시장을 견인하고 있습니다. 미국에서는, 운수성(DOT)이나 약물 남용 및 정신 위생 관리국(SAMHSA)등에 의한 규제의 골조가 있어, 운수, 헬스 케어, 정부 등 다양한 업계에서 약물 검사가 의무화되고 있습니다.

세계 약물 스크리닝 시장의 주요 기업은 Abbott, Agilent, Dragerwerk, Laboratory Corporation of America (LabCorp), Quest Diagnostics, Thermo Fisher Scientific, F. Hoffmann-La Roche, and Lifeloc Technologies 등이 있습니다. 이러한 기업은 합계로 시장 점유율의 상당 부분을 차지하고 있으며, 기술 혁신의 추진, 규제 준수, 효율적인 약물 검사 기술의 개발에 공헌하고 있습니다. 시장에서의 지위를 높이기 위해 약물 스크리닝 시장의 기업은 몇 가지 전략에 주력하고 있습니다. 대기업은 연구 개발에 고액의 투자를 실시해, 검사 기술의 혁신과 정밀도 및 스피드의 향상을 도모하고 있습니다. 또, 헬스케어, 고용, 법집행 기관 등 폭넓은 업계에 대응하기 위해, 제품 포트폴리오를 확대하고 있습니다. 연구기관이나 다른 기업과의 전략적 제휴 및 협력 관계도 시장 확대를 위해 형성되고 있습니다.

목차

제1장 조사 방법 및 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 약물 및 알코올 소비량 증가

- 약물 스크리닝을 지원하는 엄격한 법률의 존재

- 약물 남용 검사를 위한 제품 및 서비스의 가용성 증가

- 업계의 잠재적 위험 및 과제

- 직장에서의 약물 검사 금지

- 훈련을 받은 연구실 전문가의 부족

- 시장 기회

- 직장에서 약물 검사 정책 도입 증가

- 신흥 국가에서 의식 증가 및 정책 시행

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술 및 혁신의 상황

- 갭 분석

- 약물 스크리닝 제품 및 서비스별 볼륨 분석(2024년)

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서문

- 기업 매트릭스 분석

- 제품 및 서비스별 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병 및 인수

- 파트너십 및 협업

- 확장 계획

제5장 시장 추계 및 예측 : 컴포넌트별(2021-2034년)

- 주요 동향

- 제품

- 분석 장치

- 면역 측정 분석 장치

- 크로마토그래피 분석 장치

- 호기 분석 장치

- 구강액 검사 분석 장치

- 신속 검사 장치

- 소모품

- 분석 장치

- 약물 스크리닝 서비스

제6장 시장 추계 및 예측 : 샘플 유형별(2021-2034년)

- 주요 동향

- 소변

- 호흡

- 경구 보수액

- 머리

- 기타 샘플 유형

제7장 시장 추계 및 예측 : 약물 유형별(2021-2034년)

- 주요 동향

- 대마 및 마리화나

- 오피오이드

- 알코올

- 암페타민

- 기타 약물 유형

제8장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 약물 검사 기관

- 직장

- 병원

- 법 집행 기관

- 기타 용도

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Abbott

- Agilent

- Alcohol Countermeasure Systems

- Alfa Scientific Designs

- Dragerwerk

- Eurofins Scientific

- F. Hoffmann-La Roche

- Laboratory Corporation of America(LabCorp)

- Lifeloc Technologies

- Omega Laboratories

- OraSure Technologies

- PerkinElmer

- Premier Biotech

- Psychemedics

- Quest Diagnostics

- Shimadzu

- Siemens Healthineers

- Thermo Fisher Scientific

The Global Drug Screening Market was valued at USD 13.8 billion in 2024 and is estimated to grow at a CAGR of 14.5% to reach USD 52.2 billion by 2034. This growth can be attributed to an increasing focus on addressing substance abuse issues, advancements in drug testing technologies, and the rise of stricter policies in various sectors, including employment, sports, and healthcare. Governments worldwide are intensifying efforts to combat drug abuse, which is further spurring market demand for effective screening solutions.

Cutting-edge technologies like liquid chromatography-mass spectrometry (LC-MS) and immunoassays have significantly improved the accuracy and efficiency of drug screening processes. Moreover, the rise in accessibility to rapid screening kits and on-site testing devices is making the process more convenient and reducing the time required for results. This has made drug screening solutions indispensable for workplace safety and compliance, especially under regulations like the Drug-Free Workplace Act, which has become a driving force behind the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.8 Billion |

| Forecast Value | $52.2 Billion |

| CAGR | 14.5% |

Drug screening involves testing biological samples such as blood, urine, hair, saliva, or sweat to detect drugs or their metabolites. The market encompasses a wide range of tools and services designed for drug detection, including testing devices such as immunoassay analyzers, chromatography systems, breath analyzers, oral fluid testing kits, and rapid test devices. Both laboratory and on-site screenings are common methods used in the industry.

The product segment accounted for the largest share of the market, valued at USD 8.1 billion in 2024. This segment includes essential tools such as immunoassay analyzers, chromatographic instruments, and breath analyzers, which are pivotal in delivering accurate and reliable results. Rapid testing devices are particularly in demand due to their portability, ease of use, and ability to provide immediate results, which makes them ideal for use in workplace and emergency testing scenarios. Consumables like sample collection kits, calibration kits, and control devices are also in high demand, as they are used frequently and require regular replenishment.

The urine-based drug testing segment held the largest share of 53.8% in 2024, with further growth anticipated during the forecast period. Urine testing remains the most widely used method due to its cost-effectiveness, reliability, and ability to detect a broad range of substances. Since metabolites are excreted in urine, it serves as an ideal sample for identifying recent drug use. Urine tests are commonly used for workplace drug testing, pre-employment screenings, and rehabilitation programs. Their non-invasive collection method and ability to detect substances like cannabinoids, opioids, amphetamines, and benzodiazepines make them indispensable in substance abuse management programs.

North America Drug Screening Market generated USD 5.9 billion in 2024 and is projected to reach USD 21.2 billion by 2034, growing at a CAGR of 14%. North America leads the market, driven by stringent regulatory requirements, technological innovations, and high awareness of workplace safety. The regulatory framework in the U.S., including mandates by the Department of Transportation (DOT) and the Substance Abuse and Mental Health Services Administration (SAMHSA), requires drug testing in various industries, including transportation, healthcare, and government.

Key players in the Global Drug Screening Market include companies such as Abbott, Agilent, Dragerwerk, Laboratory Corporation of America (LabCorp), Quest Diagnostics, Thermo Fisher Scientific, F. Hoffmann-La Roche, and Lifeloc Technologies. These companies collectively hold a substantial portion of the market share and are instrumental in driving innovation, regulatory compliance, and developing efficient drug testing technologies. To enhance their market position, companies in the drug screening market focus on several strategies. Leading players are heavily investing in research and development to innovate and improve the accuracy and speed of testing technologies. They are also expanding their product portfolios to cater to a wide range of industries, including healthcare, employment, and law enforcement. Strategic partnerships and collaborations with research institutions and other businesses are also being formed to expand their market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Sample type

- 2.2.4 Drug type

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing drug and alcohol consumption

- 3.2.1.2 Presence of stringent laws to support drug screening

- 3.2.1.3 Growing availability of products and services for drug-of abuse testing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Prohibition on workplace drug testing

- 3.2.2.2 Dearth of trained laboratory professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption of drug testing policies in workplaces

- 3.2.3.2 Rising awareness and policy enforcement in developing countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.6 Gap analysis

- 3.7 Drug screening volume analysis, by product and service, 2024

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 MEA

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company share analysis, by product and service

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Product

- 5.2.1 Analytical instruments

- 5.2.1.1 Immunoassay analyzers

- 5.2.1.2 Chromatographic analyzers

- 5.2.1.3 Breath analyzers

- 5.2.1.4 Oral fluid testing analyzers

- 5.2.2 Rapid testing devices

- 5.2.3 Consumables

- 5.2.1 Analytical instruments

- 5.3 Drug screening services

Chapter 6 Market Estimates and Forecast, By Sample Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Urine

- 6.3 Breath

- 6.4 Oral fluids

- 6.5 Hair

- 6.6 Other sample types

Chapter 7 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Cannabis/ marijuana

- 7.3 Opiods

- 7.4 Alcohol

- 7.5 Amphetamines

- 7.6 Other drug types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Drug testing laboratories

- 8.3 Workplace

- 8.4 Hospitals

- 8.5 Law enforcement agencies

- 8.6 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 Agilent

- 10.3 Alcohol Countermeasure Systems

- 10.4 Alfa Scientific Designs

- 10.5 Dragerwerk

- 10.6 Eurofins Scientific

- 10.7 F. Hoffmann-La Roche

- 10.8 Laboratory Corporation of America (LabCorp)

- 10.9 Lifeloc Technologies

- 10.10 Omega Laboratories

- 10.11 OraSure Technologies

- 10.12 PerkinElmer

- 10.13 Premier Biotech

- 10.14 Psychemedics

- 10.15 Quest Diagnostics

- 10.16 Shimadzu

- 10.17 Siemens Healthineers

- 10.18 Thermo Fisher Scientific