|

시장보고서

상품코드

1773259

전동 모빌리티 디바이스 시장 기회, 성장 촉진요인, 업계 동향 분석 및 예측(2025-2034년)Powered Mobility Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

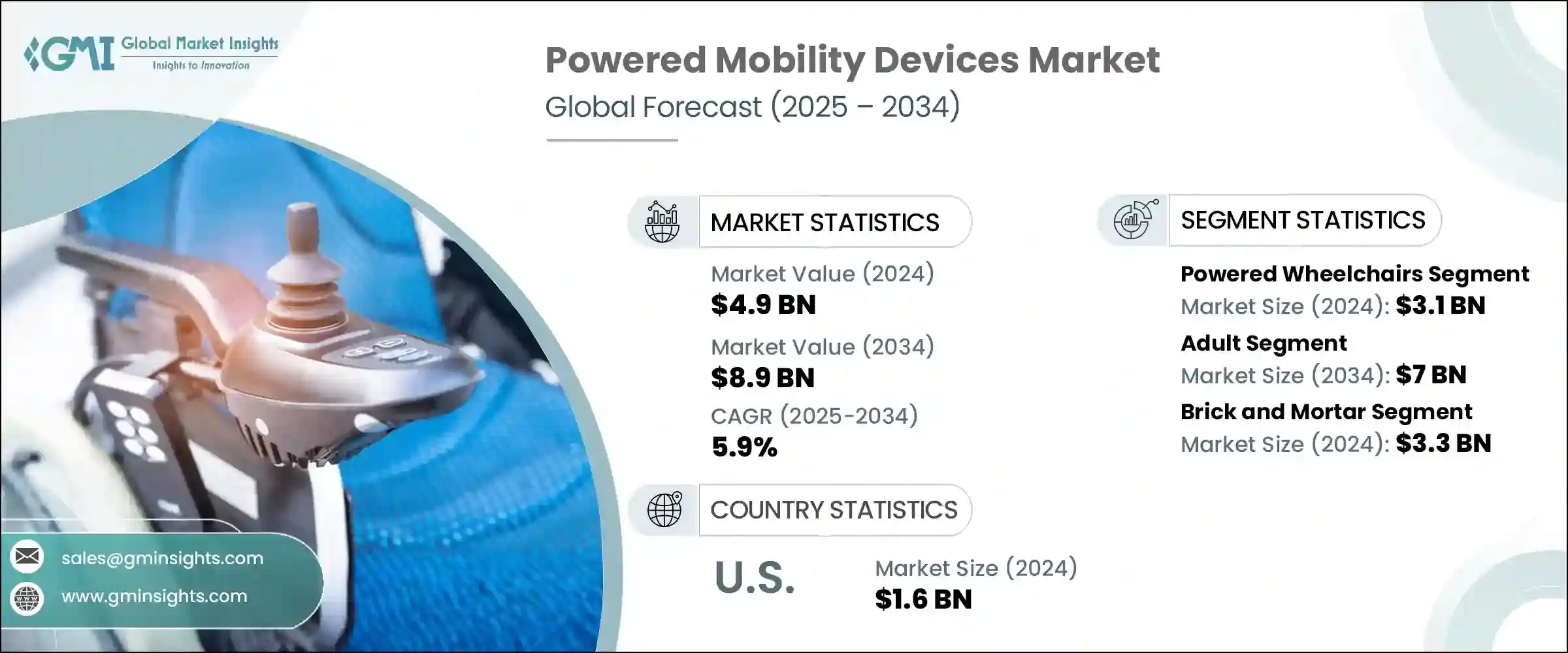

세계의 전동 모빌리티 디바이스 시장은 2024년에는 49억 달러로 평가되었고, CAGR 5.9%로 성장하여 2034년에는 89억 달러에 이를 것으로 추정되고 있습니다.

이러한 급격한 증가는 전 세계적으로 장애율 증가, 신경 질환의 유병률 증가, 이동 보조기구의 급속한 기술 발전으로 인한 것입니다. 배터리로 구동되는 모빌리티 솔루션은 수작업으로 이동이 어렵거나 불가능한 경우 독립성을 제공하여 삶의 질을 크게 향상시킬 수 있습니다. 센서와 카메라가 장착된 스마트 휠체어의 도입은 매우 중요한 발전으로, 사용자, 특히 신경학적 문제가 있는 사용자들이 실시간 피드백을 통해 안전하게 이동할 수 있도록 도와줍니다. 이러한 지능형 장치는 이동성을 향상시킬 뿐만 아니라 의료 서비스 제공업체에게 귀중한 행동 통찰력을 제공할 수 있습니다. 미충족 의료 수요, 급속한 기술 발전, 진화하는 인구통계학적 패턴의 융합은 전동 모빌리티 디바이스가 헬스케어와 개인 자립에 필수적인 이유를 명확하게 설명합니다.

전동 모빌리티 디바이스는 사용자의 안전과 자립을 최우선으로 하는 최첨단 기술을 통합하여 이동의 장벽을 극복할 수 있는 길을 열어줍니다. 첨단 센서, 직관적인 컨트롤, AI 기반 내비게이션으로 개인별 맞춤화된 보다 스마트하고 반응성이 높은 조작을 제공합니다. 자율적인 기능은 보조자에 대한 의존도를 낮추고, 사용자가 다양한 환경에서 자신감 있게 이동할 수 있는 자유도를 높입니다. 혁신과 인체공학적 디자인이 결합된 이 모빌리티 보조기구는 신체적 접근성을 향상시킬 뿐만 아니라, 사회적 포용과 정서적 행복을 증진시켜 전반적인 삶의 질을 향상시킵니다. 기술이 발전함에 따라 전동 모빌리티 기기는 더욱 적응력이 뛰어나고, 신뢰성이 높으며, 사용자 친화적이 되어 개인 맞춤형 모빌리티 지원의 새로운 기준을 제시하고 있습니다.

| 시장 범위 | |

|---|---|

| 개시 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 개시 금액 | 49억 달러 |

| 예측 금액 | 89억 달러 |

| CAGR | 5.9% |

전동 휠체어 부문은 실내외를 막론하고 원활하고 편리한 이동을 제공함으로써 2024년 31억 달러에 달하는 시장을 주도했습니다. 독립 구동, 스탠딩 휠체어, 휴대용 유닛 등 다양한 옵션을 통해 사용자는 조절 가능한 쿠션, 인체공학적 등받이, 고급 틸트 인 스페이스 메커니즘과 같은 고도의 맞춤형 기능을 통해 편안함을 향상시킬 뿐만 아니라, 재활을 지원하고 2차적 재활을 재활을 지원하고 2차적인 건강 문제를 줄여줍니다.

성인 인구 부문은 2034년까지 70억 달러에 달할 것으로 예상되며, 특히 노년층이 가장 큰 사용자층을 형성할 것으로 예측됩니다. 이 인구층의 장애 유병률 증가는 큰 성장 촉진요인입니다. 전동 모빌리티 기기는 일상 업무를 간소화하고, 사용자의 자율성을 강화하며, 피로를 최소화하는 데 중요한 역할을 하고 있으며, 노인의 약 40%가 이동 제한에 직면해 있습니다.

미국의 전동 모빌리티 기기 시장은 2024년 16억 달러로 평가되었고, 신경 질환, 척수 손상, 고령화 인구 증가에 힘입어 성장세를 보이고 있습니다. 유리한 상환 정책과 가처분 소득 증가가 결합하여 고급 전동 휠체어와 이동용 스쿠터의 도입이 가속화되어 시장 성장의 모멘텀이 더욱 강화되고 있습니다.

세계 전동 모빌리티 디바이스 시장의 주요 기업으로는 PRIDE MOBILITY, GOLDEN, Drive DeVilbiss Healthcare, KARMAN, INVACARE, Hoveround Mobility Solutions, Airwheel, Decon, Meyra, Permobil, OttoBock, Ottobock, Merits, Levo, Frido 등이 있습니다. Mobility, MEYRA, Permobil, Ottobock, OSTRICH, Merits, LEVO, Frido 등이 있습니다. 이들 기업은 사용자 수요를 충족시키기 위해 기술 혁신, 자금 조달, 디자인을 교체하고 있습니다. 주요 제조업체들은 센서, IoT 연결성, AI 기반 내비게이션 등을 통합한 지능형 기능의 연구개발을 통해 차별화를 꾀하고 있으며, 보다 안전하고 데이터가 풍부한 모빌리티 솔루션을 제공합니다.

또한, 다양한 사용자 및 상태에 대응할 수 있도록 교체 가능한 구동 장치, 조절 가능한 좌석, 스탠딩 메커니즘과 같은 모듈식 설계로 포트폴리오를 확장하고 있습니다. 기업들은 의료 서비스 제공업체 및 지불자와의 파트너십을 통해 비용 장벽을 낮추고 상환 경로를 개선하는 한편, 노인과 신경 장애를 가진 사람들을 대상으로 한 마케팅을 진행하고 있습니다. 틈새 혁신기업을 전략적으로 인수하거나 합작투자를 통해 새로운 기술과 지역 시장을 개척하는 데 도움을 주고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급업체 상황

- 각 단계에서의 부가가치

- 밸류체인에 영향을 미치는 요인

- 업계에 대한 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크와 과제

- 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 기술 및 혁신 상황

- 현재 기술 동향

- 신기술

- 제품 유형별 가격 동향

- 향후 시장 동향

- 상환 시나리오

- 소비자 행동 분석

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 세계

- 북미

- 유럽

- 기타 지역

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 인수합병(M&A)

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추산·예측 : 제품 유형별, 2021-2034년

- 주요 동향

- 전동 휠체어

- 후륜식

- 중륜식

- 전륜식

- 기타

- 전동 차량

- 3륜

- 사륜

- 5륜

- 파워 애드온 또는 추진 보조 유닛

제6장 시장 추산·예측 : 환자별, 2021-2034년

- 주요 동향

- 성인

- 소아

제7장 시장 추산·예측 : 유통 채널별, 2021-2034년

- 주요 동향

- 오프라인 매장 판매

- 온라인 채널

제8장 시장 추산·예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 홈케어

- 재활치료센터

- 병원

- 기타

제9장 시장 추산·예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카공화국

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 개요

- Airwheel

- decon

- drive DeVilbiss Healthcare

- Frido

- GOLDEN

- Hoveround Mobility Solutions

- INVACARE

- KARMAN

- LEVO

- merits

- MEYRA

- OSTRICH

- ottobock

- permobil

- PRIDE MOBILITY

The Global Powered Mobility Devices Market was valued at USD 4.9 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 8.9 billion by 2034. This surge is due to rising global disability rates, increased prevalence of neurological conditions, and rapid technological progress in mobility aids. Battery-powered mobility solutions offer independence where manual movement is challenging or impossible, significantly enhancing quality of life. The introduction of smart wheelchairs with sensors and cameras marks a pivotal advancement, enabling users-especially those with neurological challenges-to navigate environments safely with real-time feedback. These intelligent devices not only boost mobility but also support healthcare providers with valuable behavior insights. The convergence of unmet medical needs, rapid technological advancements, and evolving demographic patterns clearly explains why powered mobility devices are becoming indispensable in healthcare and personal independence.

These devices lead the way in overcoming mobility barriers by integrating cutting-edge technology that prioritizes user safety and independence. Equipped with advanced sensors, intuitive controls, and AI-powered navigation, they offer smarter, more responsive operations tailored to individual needs. Autonomous features reduce the reliance on caregivers, allowing users greater freedom to move confidently in various environments. By combining innovation with ergonomic design, these mobility aids not only enhance physical accessibility but also improve overall quality of life, fostering social inclusion and emotional well-being. As technology continues to evolve, powered mobility devices are becoming more adaptive, reliable, and user-friendly, setting new standards in personalized mobility support.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $8.9 Billion |

| CAGR | 5.9% |

The powered wheelchair segment led the market in 2024, reaching USD 3.1 billion, by providing seamless, effortless movement both indoors and outdoors. With diverse options such as independent drive, standing wheelchairs, and portable units, users benefit from highly customizable features like adjustable cushions, ergonomic backrests, and advanced tilt-in-space mechanisms-enhancements that not only improve comfort but also support rehabilitation and reduce secondary health issues.

The adult population segment is expected to reach USD 7 billion by 2034, especially seniors form the largest base of users. The increasing prevalence of disabilities within this demographic is a significant growth driver. Powered mobility devices play a vital role in simplifying everyday tasks, enhancing user autonomy, and minimizing fatigue-benefits that are crucial for older adults, nearly 40% of whom face mobility limitations.

United States Powered Mobility Devices Market was valued at USD 1.6 billion in 2024, supported by a rise in neurological conditions, spinal cord injuries, and an aging population. Favorable reimbursement policies combined with higher disposable incomes have accelerated the adoption of premium electric wheelchairs and mobility scooters, further strengthening the market's growth momentum.

Leading brands in the Global Powered Mobility Devices Market include PRIDE MOBILITY, GOLDEN, Drive DeVilbiss Healthcare, KARMAN, INVACARE, Hoveround Mobility Solutions, Airwheel, Decon Mobility, MEYRA, Permobil, Ottobock, OSTRICH, Merits, LEVO, and Frido. These companies are reshuffling innovation, funding, and design to meet user demands. Leading manufacturers are differentiating through R&D of intelligent features-integrating sensors, IoT connectivity, and AI-driven navigation-to offer safer, data-enriched mobility solutions..

They are expanding portfolios with modular designs-swappable drive units, adjustable seating, and standing mechanisms-to accommodate a wider range of users and conditions. Firms are forging partnerships with healthcare providers and payers to reduce cost barriers and improve reimbursement pathways, while targeted marketing addresses seniors and individuals with neurological disabilities. Strategic acquisitions of niche innovators, along with joint ventures, help companies tap new technologies and geographic markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Patient

- 2.2.4 Distribution channel

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of neurological diseases

- 3.2.1.2 Technological advancements in powered mobility products

- 3.2.1.3 Rising percentage of geriatric population

- 3.2.1.4 Increasing prevalence of disabilities worldwide

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of powered wheelchairs

- 3.2.2.2 Stringent regulatory framework

- 3.2.3 Opportunities

- 3.2.3.1 Focus on lightweight and foldable electric wheelchairs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends, by product type

- 3.7 Future market trends

- 3.8 Reimbursement scenario

- 3.9 Consumer behaviour analysis

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Rest of the world

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Powered wheelchairs

- 5.2.1 Rear wheel

- 5.2.2 Mid-wheel

- 5.2.3 Front wheel

- 5.2.4 Other types

- 5.3 Power operated vehicles

- 5.3.1 3-wheel devices

- 5.3.2 4-wheel devices

- 5.3.3 5-wheel devices

- 5.4 Power add-on or propulsion-assist units

Chapter 6 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adult

- 6.3 Pediatric

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 Online channel

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Home care

- 8.3 Rehabilitation centers

- 8.4 Hospitals

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airwheel

- 10.2 decon

- 10.3 drive DeVilbiss Healthcare

- 10.4 Frido

- 10.5 GOLDEN

- 10.6 Hoveround Mobility Solutions

- 10.7 INVACARE

- 10.8 KARMAN

- 10.9 LEVO

- 10.10 merits

- 10.11 MEYRA

- 10.12 OSTRICH

- 10.13 ottobock

- 10.14 permobil

- 10.15 PRIDE MOBILITY