|

시장보고서

상품코드

1773328

피복 작물 종자 품종 시장 기회와 촉진요인, 업계 동향 분석 및 예측(2025-2034년)Cover Crop Seed Varieties Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

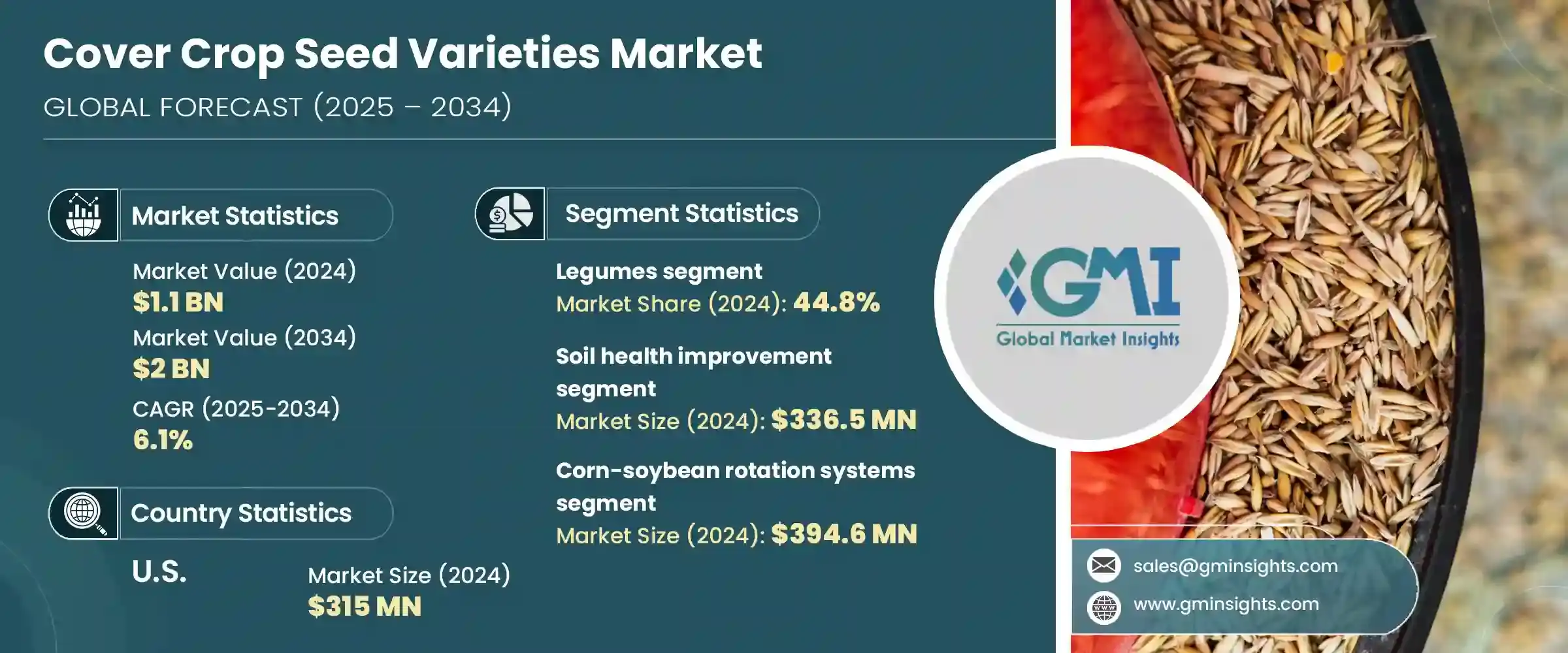

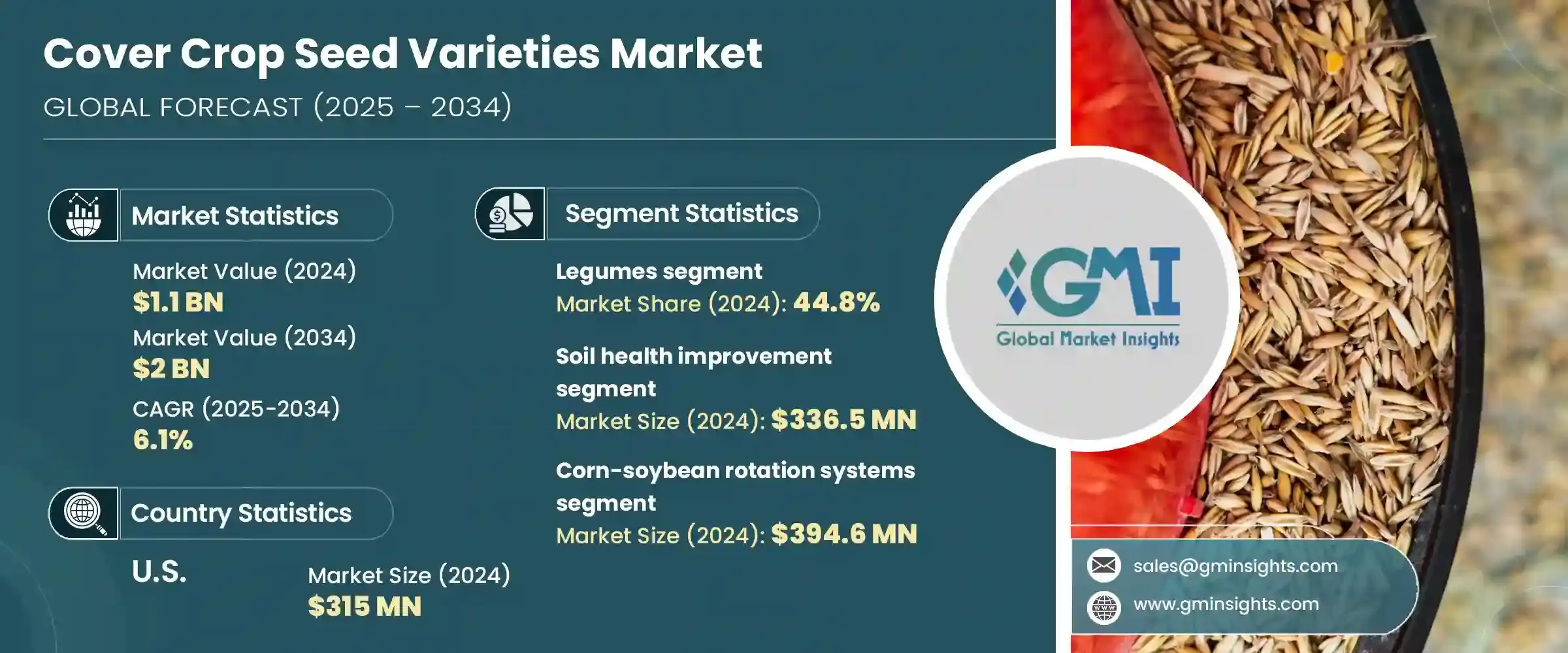

세계의 피복 작물 종자 품종 시장은 2024년 11억 달러로 평가되었으며 CAGR 6.1%를 나타내 2034년에는 20억 달러에 이를 것으로 추정되고 있습니다. 전통적인 농법에 의한 환경 파괴를 최소한으로 억제하는데 있어서 필수적인 툴이 되고 있습니다. 이 종자은 토양의 비옥도를 높이고, 침식을 방지해, 잡초의 생육을 자연스럽게 관리하는 데 있어 매우 중요한 역할을 담당하고 있어, 농가가 생산성과 환경에의 책임을 양립시키려 그 노력합니다.

농부는 윤작 시스템과 보전 경작의 효과적인 부분으로 피복 작물에 주목하고 있습니다. 하지만 지속적인 과제가 되고 있는 가운데, 새로운 종자 기술은 특히 건조한 조건의 지역용으로, 가뭄이나 병에 강한 품종을 개발하는 것으로, 이러한 우려에 대처하고 있습니다. 보다 전략적인 피복 작물의 도입이 가능해져 농업의 효율과 성과가 향상되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 11억 달러 |

| 예측 금액 | 20억 달러 |

| CAGR | 6.1% |

2024년 펄스는 작물 유형별로 시장을 독점하고 세계 매출 점유율의 44.8%를 차지했으며 2034년까지 연평균 복합 성장률(CAGR) 6%를 나타낼 것으로 예측됩니다. 이 종자은 미생물의 활동을 통해 대기 중의 질소를 자연적으로 고정하는 능력이 있어 합성 비료에 대한 의존을 크게 줄일 수 있기 때문에 선호되고 있습니다. 개선할 수 있는 능력을 가지고 있기 때문에 저부하 농업시스템의 도입을 목표로 하는 농가에게 실용적인 선택이 되고 있습니다.

호밀, 귀리, 보리 등의 목초도 지상 피복, 토양 안정화, 잡초 억제 등의 성능으로 시장의 상당 부분을 차지하고 있습니다. 콩과 식물과 병용하여 양분 풍부화와 침식 억제를 모두 실현합니다.

용도별로는 토양의 건전성 향상이 2024년 시장 규모 3억 3,650만 달러로 주요 부문으로 두드러졌으며, 2034년까지 연평균 복합 성장률(CAGR) 6.2%를 나타낼 전망입니다. 농가는 유기물을 늘리고, 미생물의 활동을 촉진하고, 토양의 구조적 무결성을 높일 수 있는 피복 작물 종자 품종에 대한 투자를 늘리고 있습니다. 또한 질소 고정 및 탄소 격리에서 옥수수의 자연적인 역할은 화학 물질 투입의 필요성을 줄이는 동시에 생물 다양성 향상과 물 침투 개선 등 생태 학적 이익을 가져옵니다.

최종 용도별로는 옥수수와 대두의 윤작 시스템이 2024년에는 3억 9,460만 달러를 차지했고, 2034년까지 연평균 복합 성장률(CAGR) 6.4%를 나타내 고성장이 예측됩니다. 이 시스템은 대규모 농업 지역에서 널리 실시되고 있으며, 해충과 질병의 사이클을 차단하면서 토양 비옥도를 유지하는 능력으로 지지를 얻고 있습니다. 잡초의 개체수를 억제하기 위해, 이러한 윤작에 짜넣어지는 것이 늘고 있습니다. 피복 작물은 보전 활동과의 궁합이 좋기 때문에 장기적인 지속가능성과 수량의 신뢰성을 중시하는 생산자에게 있어서 바람직한 선택지가 되고 있습니다.

지역별로는 미국이 북미 시장을 선도하고 2024년의 평가액은 3억 1,500만 달러였고, 2034년까지의 CAGR은 6.3%를 나타낼 것으로 예측되고 있습니다. 스튜어드십을 촉진하는 인센티브와 규제 프레임워크를 통한 정책 지원에 기인하고 있습니다.

세계의 피복 작물 종자 품종 시장 주요 기업으로는 Bayer Crop Science, Corteva Inc. Syngenta Group, KWS Cereals, Green Cover Seed 등이 있습니다.

목차

제1장 조사 방법

- 시장의 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 소스

- 세계

- 지역/국가

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측 모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 파괴적 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 지속 가능한 농업에 대한 주목 고조

- 정부의 우대조치와 환경규제

- 유기농업과 환경친화적인 농업에 대한 수요 증가

- 업계의 잠재적 위험 및 과제

- 높은 종자 조달의 초기 비용

- 소규모 농가의 낮은 인지도

- 시장 기회

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 작물 유형별

- 향후 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계(HS코드)(참고 : 무역 통계는 주요 국가에서만 제공됨)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 감축 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적인 노력

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계·예측 : 작물 유형별(2021-2034년)

- 주요 경향

- 콩 및 식물

- 크림슨 클로버

- 레드 클로버

- 털이 많은 베치

- 오스트리아 겨울 완두콩

- 기타 콩 및 식물

- 잔디

- 호밀

- 귀리

- 겨울 밀

- 보리

- 트리티 칼레

- 연간 호밀

- 기타 잔디 품종

- 브라 시카

- 무

- 겨자 품종

- 순무

- 기타 브라 시카 품종

- 기타 피복 작물

- 메밀

- 해바라기

- 파셀리아

- 혼합종 혼합

제6장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 경향

- 토양 건강 개선

- 침식 제어 및 토양 보존

- 영양소 관리 및 질소 고정

- 잡초 억제 및 관리

- 탄소 격리 및 기후 혜택

- 가축 사료 및 방목

- 생물다양성 증진 및 서식지 조성

제7장 시장 추계·예측 : 최종 용도 시스템별(2021-2034년)

- 주요 동향

- 옥수수-대두 순환 시스템

- 면화 생산 시스템

- 야채 및 특용 작물 시스템

- 유기농업경영

- 가축 통합 시스템

- 보존 예비 프로그램 신청

- 기타 재배 시스템

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제9장 기업 프로파일

- Bayer Crop Science

- Corteva Inc.

- Syngenta Group

- KWS Cereals

- Green Cover Seed

- Kings AgriSeeds

- GO Seed

- Troy Cover Seed

- GS3 Quality Seed

- Walnut Creek Seeds

- Stokes Seeds

- CoverCress Inc

- Benson Hill

- Cibus

The Global Cover Crop Seed Varieties Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 2 billion by 2034. This steady upward trend is largely fueled by the increasing shift toward sustainable agriculture and the growing importance of soil management practices. As modern farming continues to evolve, cover crop seeds are becoming vital tools in improving overall soil structure, supporting nutrient cycling, and minimizing environmental damage caused by traditional farming methods. These seeds play a pivotal role in enhancing soil fertility, preventing erosion, and naturally managing weed growth-factors that are gaining relevance as farmers strive to balance productivity with environmental responsibility.

Farmers are turning to cover crops as an effective part of crop rotation systems and conservation tillage. These seeds help retain moisture in the soil, improve organic content, and foster biodiversity on farmlands. With climate variability becoming a persistent challenge, newer seed technologies are addressing these concerns by developing drought- and disease-resistant varieties, particularly for regions with arid conditions. Additionally, advancements in precision agriculture are enabling more strategic deployment of cover crops to improve farming efficiency and outcomes. The push toward sustainable productivity is encouraging the adoption of cover crop seeds as a reliable solution to meet environmental targets while maintaining output. As a result, the market is seeing growing interest from both small-scale and commercial farmers who want to integrate eco-friendly methods into their operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $2 Billion |

| CAGR | 6.1% |

In 2024, legumes dominated the market by crop type, securing 44.8% of the global revenue share, and are anticipated to grow at a CAGR of 6% through 2034. These seeds are favored for their ability to naturally fix atmospheric nitrogen through microbial activity, significantly reducing the reliance on synthetic fertilizers. Their fast germination, adaptability across diverse climates, and ability to improve soil structure make them a practical choice for farmers aiming to adopt low-impact agricultural systems. These benefits collectively contribute to improved yields and enhanced soil quality, further strengthening the segment's stronghold in the market.

Grasses, such as rye, oats, and barley, also hold a significant portion of the market due to their performance in ground coverage, soil stabilization, and weed suppression. Although these varieties are not major nitrogen contributors on their own, they play a key role in producing biomass and protecting the soil surface. These crops are commonly used in tandem with legumes to achieve both nutrient enrichment and erosion control. Brassicas, which include species with deep-rooting systems, are used for soil decompaction and pest management. However, their share remains lower than legumes and grasses, mainly because their benefits are more specialized and dependent on specific soil conditions and pest dynamics.

By application, soil health improvement stood out as the leading segment with a market size of USD 336.5 million in 2024 and is poised to grow at a CAGR of 6.2% by 2034. The rising focus on regenerative agriculture has led farmers to increasingly invest in cover crop seed varieties that can boost organic matter, promote microbial activity, and enhance the structural integrity of soil. As these crops hold the soil in place and reduce runoff, they contribute directly to preventing nutrient loss and enhancing the long-term viability of farmland. Moreover, their natural role in nitrogen fixation and carbon sequestration helps reduce the need for chemical inputs while offering ecological benefits such as biodiversity enhancement and improved water infiltration.

In terms of end use, corn-soybean rotation systems accounted for USD 394.6 million in 2024 and are forecasted to grow at the highest rate of 6.4% CAGR through 2034. These systems are widely practiced in large-scale agricultural regions and have gained traction for their ability to maintain soil fertility while breaking pest and disease cycles. Cover crops are increasingly being integrated into these rotations to reduce nitrogen loss, prevent erosion, and suppress weed populations. The compatibility of cover crops with conservation efforts makes this segment a preferred choice for producers focusing on long-term sustainability and yield reliability.

Regionally, the United States led the North American market, with a valuation of USD 315 million in 2024, expected to grow at a CAGR of 6.3% through 2034. The country's dominance can be attributed to its large-scale farming operations, early adoption of sustainable agricultural practices, and policy support through incentives and regulatory frameworks that promote environmental stewardship. Increasing awareness among producers and growing consumer demand for sustainably sourced food has also contributed to the rapid growth of cover crop adoption across the country.

Leading companies in the global cover crop seed varieties market include Bayer Crop Science, Corteva Inc., Syngenta Group, KWS Cereals, and Green Cover Seed. These players continue to expand their product portfolios and leverage strong distribution networks to meet the evolving needs of farmers worldwide, further shaping the trajectory of this growing market.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Crop type

- 2.2.3 Application

- 2.2.4 End use system

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing focus on sustainable agriculture

- 3.2.1.2 Government incentives and environmental regulations

- 3.2.1.3 Rising demand for organic and eco-friendly farming

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial costs for seed procurement

- 3.2.2.2 Limited awareness among smallholder farmers

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By crop type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only )

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Crop Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trend

- 5.2 Legumes

- 5.2.1 Crimson clover

- 5.2.2 Red clover

- 5.2.3 Hairy vetch

- 5.2.4 Austrian winter pea

- 5.2.5 Other legume varieties

- 5.3 Grasses

- 5.3.1 Cereal rye

- 5.3.2 Oats

- 5.3.3 Winter wheat

- 5.3.4 Barley

- 5.3.5 Triticale

- 5.3.6 Annual ryegrass

- 5.3.7 Other grass varieties

- 5.4 Brassicas

- 5.4.1 Daikon radish

- 5.4.2 Mustard varieties

- 5.4.3 Turnips

- 5.4.4 Other brassica varieties

- 5.5 Other cover crops

- 5.5.1 Buckwheat

- 5.5.2 Sunflower

- 5.5.3 Phacelia

- 5.5.4 Mixed species blends

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Litres)

- 6.1 Key trend

- 6.2 Soil health improvement

- 6.3 Erosion control and soil conservation

- 6.4 Nutrient management and nitrogen fixation

- 6.5 Weed suppression and management

- 6.6 Carbon sequestration and climate benefits

- 6.7 Livestock forage and grazing

- 6.8 Biodiversity enhancement and habitat creation

Chapter 7 Market Estimates & Forecast, By End Use System, 2021-2034 (USD Billion) (Thousand Litres)

- 7.1 Key trends

- 7.2 Corn-soybean rotation systems

- 7.3 Cotton production systems

- 7.4 Vegetable and specialty crop systems

- 7.5 Organic farming operations

- 7.6 Livestock integration systems

- 7.7 Conservation reserve program applications

- 7.8 Other cropping systems

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Litres)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Bayer Crop Science

- 9.2 Corteva Inc.

- 9.3 Syngenta Group

- 9.4 KWS Cereals

- 9.5 Green Cover Seed

- 9.6 Kings AgriSeeds

- 9.7 GO Seed

- 9.8 Troy Cover Seed

- 9.9 GS3 Quality Seed

- 9.10 Walnut Creek Seeds

- 9.11 Stokes Seeds

- 9.12 CoverCress Inc

- 9.13 Benson Hill

- 9.14 Cibus