|

시장보고서

상품코드

1773344

코딩, 라벨링 및 검사용 포장 기기 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Coding, Labelling and Inspection Packaging Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

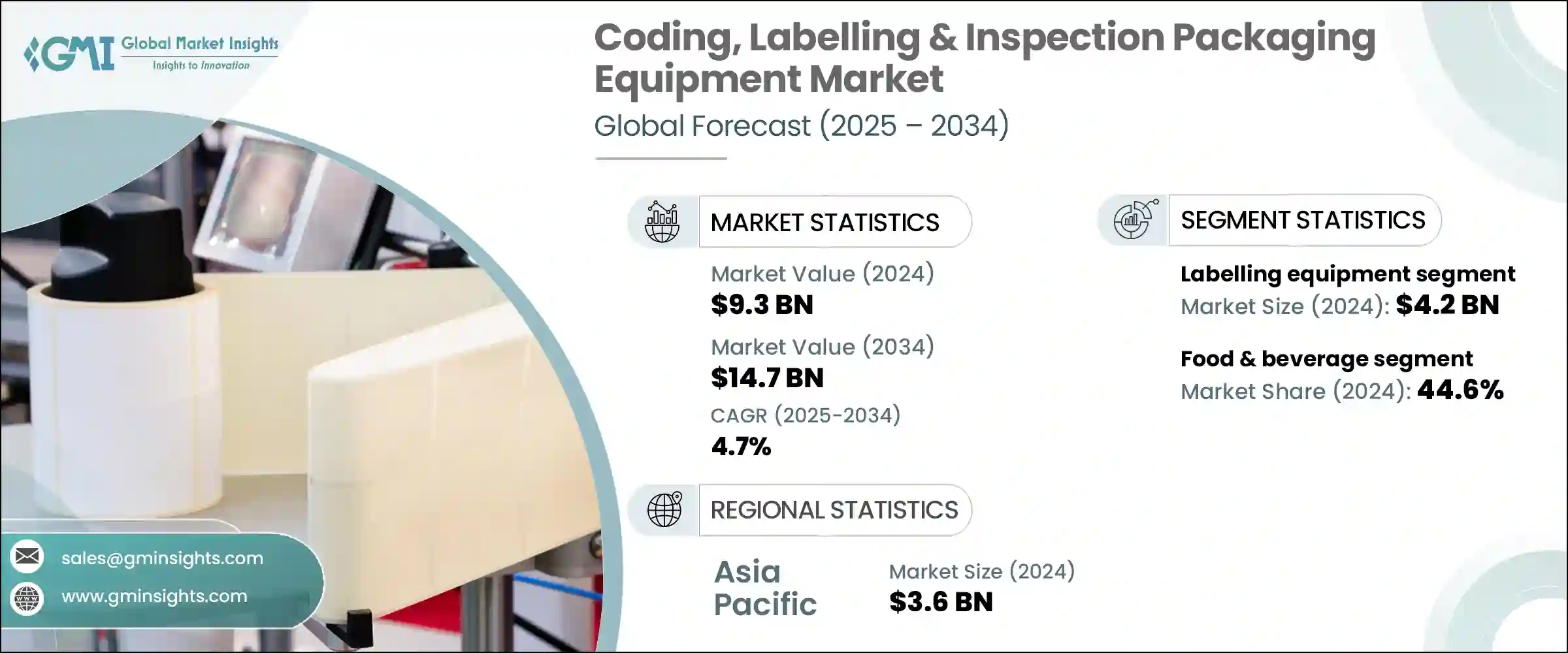

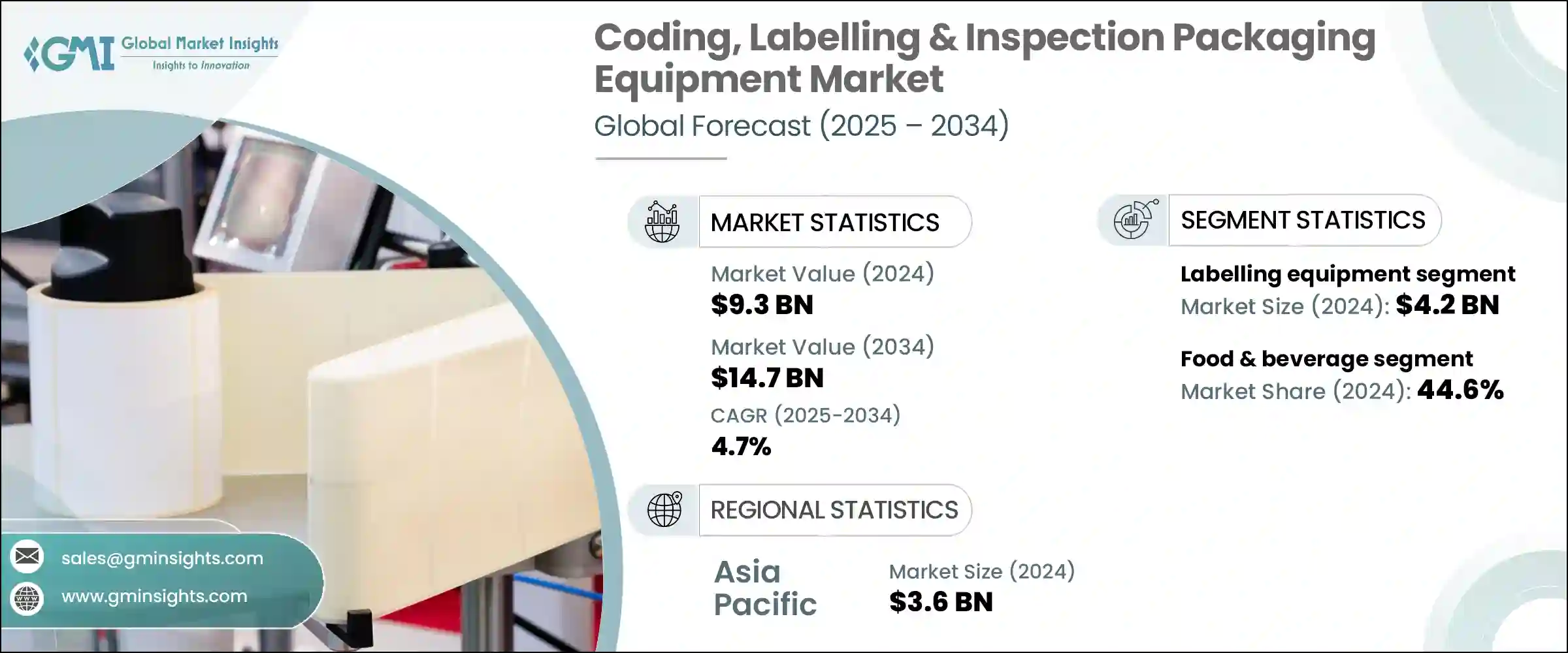

세계의 코딩, 라벨링 및 검사용 포장 기기 시장 규모는 2024년에는 93억 달러로 평가되었고, CAGR 4.7%를 나타내 2034년에는 147억 달러에 이를 것으로 예측되고 있습니다.

이러한 시스템은 의약품, 소비재, 화장품 및 식품과 같은 산업에서 포장 및 공급 체인 프로세스를 지원하는 중요한 구성 요소입니다. 제조 업체가 제품의 리콜을 효율적으로 관리하고 배치 정보를 모니터링하는 데 도움이 됩니다. 한편, 고급 카메라를 탑재한 검사 장비는 제품의 무결성을 유지하기 위해 포장, 씰, 인쇄 코드의 결함을 확인합니다.

이 시장에는 특정 업계 수요에 맞게 맞춤화 가능하고 확장 가능한 장비를 제공하는 수많은 세계 기업이 있습니다. 이 회사들은 다양한 제품 크기, 생산 속도 및 규제 요구 사항에 적응할 수 있는 모듈식 플랫폼으로 적극적으로 포트폴리오를 확장하고 있습니다. 각 제조업체는 기존의 자동화 인프라와 원활하게 통합할 수 있는 솔루션에 중점을 두어 장비 업그레이드 및 포맷 변경 시 보다 높은 유연성과 다운타임을 줄일 수 있습니다. 또한 많은 기업들은 AI 주도 검사, 클라우드 기반 데이터 분석, 실시간 모니터링 시스템 등의 스마트 기술을 활용하여 전체 공급망의 정확성, 효율성 및 추적성을 강화하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 93억 달러 |

| 예측 금액 | 147억 달러 |

| CAGR | 4.7% |

2024년 라벨링 장비 부문 매출은 42억 달러였습니다. 라벨링은 가격, 수량, 품질 등 중요한 세부사항을 전달함으로써 제품의 가시성과 소비자의 의사결정에 중요한 역할을 합니다. 산업계가 재고 관리를 강화하고 제품의 진정성을 확인하며 고객 참여도를 높이기 위해 자동화된 스마트 라벨링 솔루션에 대한 수요가 증가하고 있습니다. 의약품, 퍼스널케어, 식품 등의 섹터가 라벨링 기기의 주요 견인역이며 혁신적인 기술의 채용을 뒷받침하고 있습니다.

식음료 부문은 44.6%의 점유율을 차지했으며, 2024년에는 41억 달러를 창출했습니다. 투명성, 추적성, 엄격한 안전 규제 준수를 요구하는 소비자 요구 증가는 랩 어라운드 라벨링 기계 및 스티커 라벨링 기계와 같은 고정밀 라벨링 시스템에 대한 대규모 투자를 식품 제조업체에 촉구하고 있습니다. 북미 및 유럽과 같은 지역의 규제 요건은 규정 준수를 손상시키지 않고 대량 생산에 대응할 수 있는 고급 솔루션의 도입을 기업에 촉구하고 있습니다.

미국의 코딩, 라벨링 및 검사용 포장 기기 시장은 2024년에 64%의 점유율을 차지했습니다. 미국 시장 성장의 원동력은 엄격한 라벨링 규제와 대규모 제조 업무입니다. 식품, 의약품, 물류 등 주요 산업에서는 생산 및 유통 워크플로우를 간소화하기 위해 고급 라벨링 및 검사 시스템에 대한 의존도가 높아지고 있습니다.

코딩, 라벨링 및 검사용 포장 기기 시장 주요 기업은 Domino, Leibinger, Markem-Imaje, Videojet, Accutek Packaging Equipment, SATO, HERMA, Hitachi IESA, Korber AG, Romaco Group, Uhlmann Group, CVC Technologies, Marchesini 그룹, GEA, Paxiom 등이 있습니다. 시장에서의 지위를 강화하기 위해 각 회사는 몇 가지 전략적 접근에 주력하고 있습니다.

기업은 보다 밀접한 고객관계를 구축하고 장기적인 로열티를 확보하기 위해 전략적 파트너십, 인수, 애프터서비스 강화를 통해 세계의 발자취를 확대하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 식품 및 음료 업계에 있어서의 라벨 부착 기기 수요 증가

- 전자상거래와 물류 성장

- 제품 인증 및 위조 방지 수요 증가

- 업계의 잠재적 위험 및 과제

- 통합의 복잡성

- 원재료 가격 변동

- 기회

- 성장 촉진요인

- 성장 가능성 분석

- 향후 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 규제 상황

- 표준 및 규정 준수 요건

- 지역 규제 틀

- 인증기준

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계·예측 : 기기 유형별(2021-2034년)

- 주요 동향

- 코딩 장비

- 잉크젯 코더

- 레이저 코더

- 기타

- 라벨링 기기

- 감압식

- 수축 슬리브

- 인쇄 및 적용

- 기타

- 검사기기

- 머신 비전 시스템

- 누출 감지

- 중량 선별기

- 금속 감지기

- 기타

제6장 시장 추계·예측 : 포장 형태별(2021-2034년)

- 주요 동향

- 1차 포장

- 2차 포장

- 3차 포장

제7장 시장 추계·예측 : 동작 모드별(2021-2034년)

- 주요 동향

- 수동

- 반자동

- 자동

제8장 시장 추계·예측 : 최종 이용 산업별(2021-2034년)

- 주요 동향

- 식음료

- 의약품

- 화장품 및 퍼스널케어

- 일렉트로닉스

- 화학

- 공업제품

- 기타

제9장 시장 추계·예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 직접 판매

- 간접 판매

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- Accutek Packaging Equipment

- CVC Technologies

- Domino

- GEA

- HERMA

- Hitachi IESA

- Korber AG

- Leibinger

- Marchesini Group

- Markem-Imaje

- Paxiom

- Romaco Group

- SATO

- Uhlmann Group

- Videojet

The Global Coding, Labelling and Inspection Packaging Equipment Market was valued at USD 9.3 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 14.7 billion by 2034. These systems are vital components across industries such as pharmaceuticals, consumer goods, cosmetics, and food and beverages, supporting packaging and supply chain processes. Coding and labeling systems produce durable, high-quality labels that not only ensure compliance with diverse regulatory standards worldwide but also enhance brand identity and customer trust. Traceability remains a key factor, helping manufacturers efficiently manage product recalls and monitor batch information. Meanwhile, inspection equipment equipped with advanced cameras checks for defects in packaging, seals, and printed codes to maintain product integrity. Innovations like IoT integration, Industry 4.0 capabilities, and machine learning are significantly enhancing inspection precision and operational efficiency.

The market features numerous global players providing customizable and scalable equipment tailored to specific industry demands. These companies are actively expanding their portfolios with modular platforms that can be adapted to different product sizes, production speeds, and regulatory requirements. Manufacturers are focusing on solutions that can integrate seamlessly with existing automation infrastructures, allowing for greater flexibility and reduced downtime during equipment upgrades or format changes. Many players are also leveraging smart technologies-such as AI-driven inspection, cloud-based data analytics, and real-time monitoring systems-to enhance accuracy, efficiency, and traceability across supply chains.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $14.7 Billion |

| CAGR | 4.7% |

In 2024, the labeling equipment segment generated USD 4.2 billion. Labeling plays a crucial role in product visibility and consumer decision-making by conveying essential details such as price, quantity, and quality. As industries aim to boost inventory management, verify product authenticity, and improve customer engagement, demand for automated and smart labeling solutions is on the rise. Sectors like pharmaceuticals, personal care, and food are major drivers for labeling equipment, pushing the adoption of innovative technologies.

The food & beverage segment accounted for 44.6% share and generated USD 4.1 billion in 2024. Growing consumer demand for transparency, traceability, and compliance with stringent safety regulations is pushing food manufacturers to invest heavily in high-precision labeling systems like wrap-around and sticker labeling machines. Regulatory requirements in regions such as North America and Europe are motivating companies to adopt advanced solutions capable of handling high-volume production without compromising compliance.

United States Coding, Labelling & Inspection Packaging Equipment Market held a 64% share in 2024. The U.S. market's growth is driven by strict labeling regulations and large-scale manufacturing operations. Key industries, including food, pharmaceuticals, and logistics, increasingly depend on sophisticated labeling and inspection systems to streamline their production and distribution workflows.

Leading companies in the Coding, Labelling & Inspection Packaging Equipment Market include Domino, Leibinger, Markem-Imaje, Videojet, Accutek Packaging Equipment, SATO, HERMA, Hitachi IESA, Korber AG, Romaco Group, Uhlmann Group, CVC Technologies, Marchesini Group, GEA, and Paxiom. To strengthen their market position, companies focus on several strategic approaches. Innovation remains a priority, with investments in R&D to develop smarter, faster, and more flexible equipment that integrates seamlessly with digital supply chains and Industry 4.0 technologies.

Firms are expanding their global footprint through strategic partnerships, acquisitions, and enhanced after-sales services to build closer customer relationships and ensure long-term loyalty. Customization and modular design are emphasized to meet the specific needs of diverse industries. Additionally, manufacturers prioritize sustainability by creating energy-efficient systems and reducing waste.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Packaging type

- 2.2.4 Operation mode

- 2.2.5 End use industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for labelling equipment from food & beverages industry

- 3.2.1.2 Growth of e-commerce and logistics

- 3.2.1.3 Rising demand for product authentication & anti-counterfeiting

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Integration complexity

- 3.2.2.2 Fluctuating raw material prices

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 – 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Coding equipment

- 5.2.1 Inkjet coders

- 5.2.2 Laser coders

- 5.2.3 Others

- 5.3 Labeling equipment

- 5.3.1 Pressure-sensitive

- 5.3.2 Shrink sleeve

- 5.3.3 Print and apply

- 5.3.4 Others

- 5.4 Inspection equipment

- 5.4.1 Machine vision systems

- 5.4.2 Leak detection

- 5.4.3 Checkweighers

- 5.4.4 Metal detectors

- 5.4.5 Others

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 – 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Primary

- 6.3 Secondary

- 6.4 Tertiary

Chapter 7 Market Estimates and Forecast, By Operation Mode, 2021 – 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automatic

- 7.4 Automatic

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Pharmaceuticals

- 8.4 Cosmetics & personal care

- 8.5 Electronics

- 8.6 Chemicals

- 8.7 Industrial products

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.1.1 Direct sales

- 9.1.2 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Accutek Packaging Equipment

- 11.2 CVC Technologies

- 11.3 Domino

- 11.4 GEA

- 11.5 HERMA

- 11.6 Hitachi IESA

- 11.7 Korber AG

- 11.8 Leibinger

- 11.9 Marchesini Group

- 11.10 Markem-Imaje

- 11.11 Paxiom

- 11.12 Romaco Group

- 11.13 SATO

- 11.14 Uhlmann Group

- 11.15 Videojet