|

시장보고서

상품코드

1773369

항공우주용 패스너 시장 기회와 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Aerospace Fasteners Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

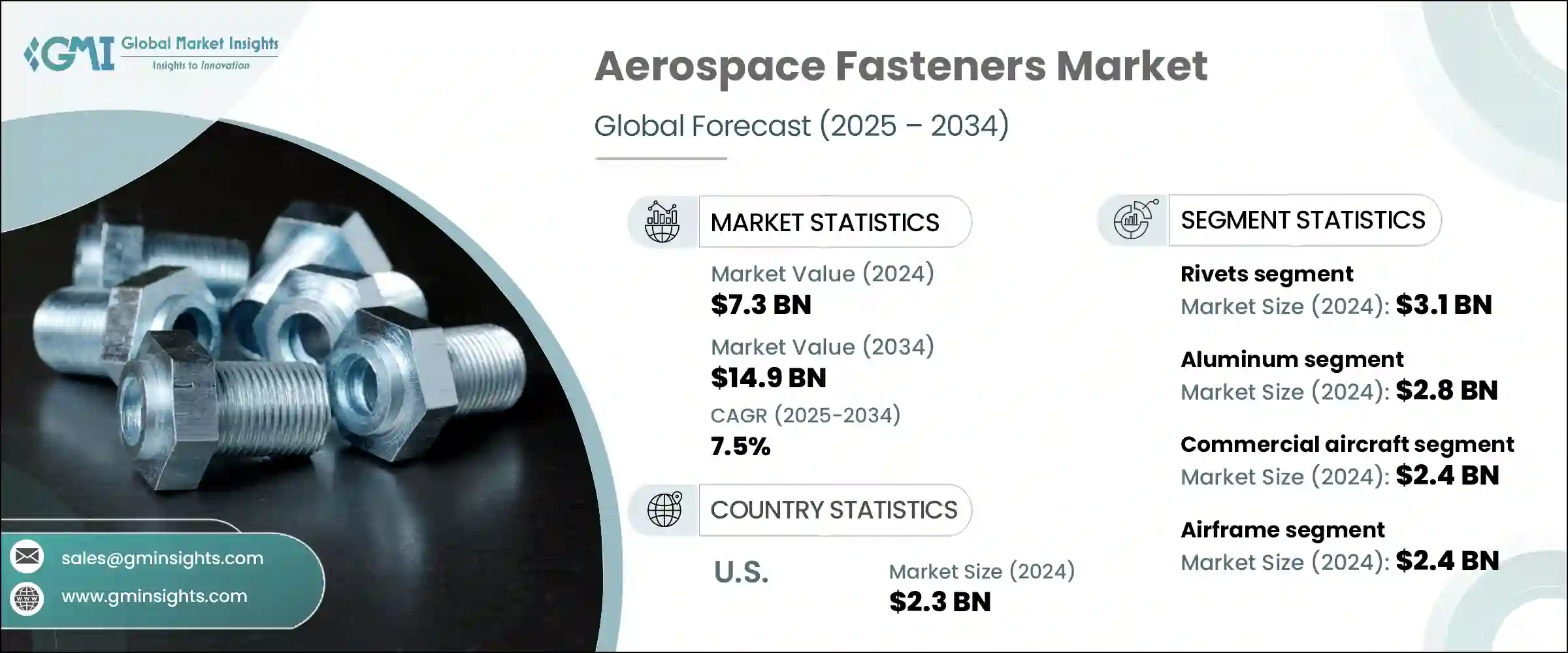

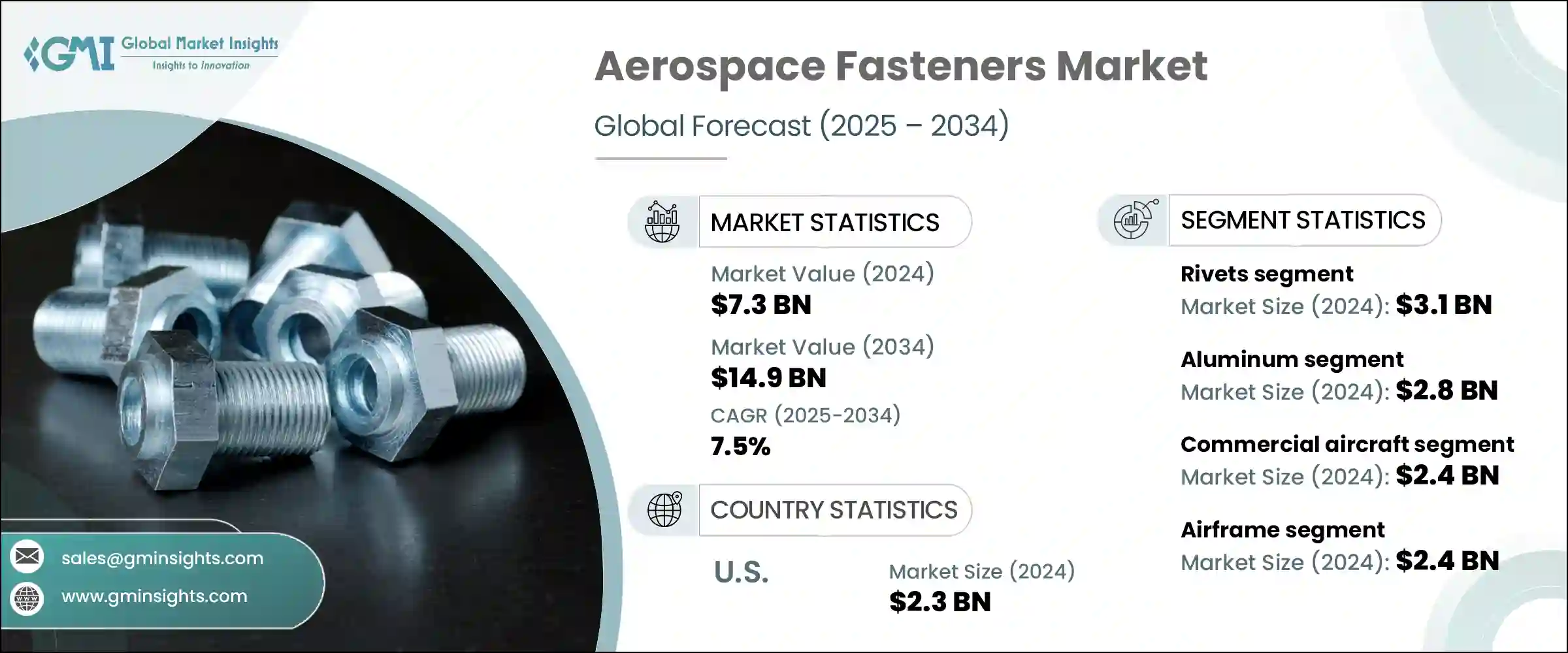

세계의 항공우주용 패스너 시장은 2024년 73억 달러로 평가되었으며 CAGR 7.5%를 나타내 2034년에는 149억 달러에 이를 것으로 추정되고 있습니다. 항공기 부품을 보다 새롭고 가볍고 고성능의 대체품으로 대체하는 움직임을 가속화하고 있습니다.연비 효율과 내구성의 중요성이 높아짐에 따라, 항공우주용 패스너는 구조 부품 제조에 있어서의 기술 혁신의 중심에 자리잡게 되어, OEM 조립과 애프터마켓 정비 모두에 있어서 필수적이 되고 있습니다.

세계의 무역정세는 이 시장에 큰 영향을 주고 있습니다. 특히 중국으로부터의 수입항공우주등급의 알루미늄과 철강을 대상으로 한 이전의 관세는 원재료비용의 상승과 필수부품에 대한 액세스의 제약으로 이어졌습니다. 공급업체 포트폴리오의 다양화를 실시해, 리스크의 최소화를 도모했습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 73억 달러 |

| 예측 금액 | 149억 달러 |

| CAGR | 7.5% |

리벳 부문은 2024년에 31억 달러를 만들어 냈습니다. 민간 항공기 제조, 특히 주요 날개와 동체와 같은 고진동, 고하중 부분에 널리 사용되고 있습니다.

2024년 항공우주용 패스너 부문의 알루미늄 부문은 28억 달러로 평가되었습니다. 알루미늄 패스너 수요는 특히 중요하지 않은 구조 용도나 내장 부품으로 증가의 일도를 추적하고 있습니다. 알루미늄 합금의 배합이 강화된 것으로, 최신의 복합재 구조와의 재료 적합성도 향상해, 제조 부문과 서비스 부문 양쪽에서 채용이 진행되고 있습니다.

2024년 미국의 항공우주용 패스너 시장 규모는 23억 달러였습니다. 이 나라의 우위성은 민간항공 및 방위항공 분야의 선도적인 제조업체의 본거지인 세계의 항공우주 허브로서의 지위로 거슬러 올라갈 수 있습니다. 이 분야의 대기업은 지속적인 기체 정비와 차세대 시스템의 통합 모두에서 국내 수요를 자극하고 있습니다. 미국은 또한 세계에서 가장 종합적인 MRO 네트워크 중 하나를 보유하고 있으며 대규모 민간 및 군용기의 정기적인 서비스 사이클 및 시스템 업그레이드를 지원합니다. 차세대 폭격기와 극초음속 항공기 등 전략적 항공 능력에 초점을 맞춘 국방비 증가는 티타늄 합금, 고온 인코넬, 탄소 기반 복합재료로 만들어진 특수 패스너에 대한 수요를 강화하고 있습니다.

항공우주용 패스너 시장을 적극적으로 형성하는 주요 기업으로는 TriMas Corporation, Boeing, LISI Aerospace, Wurth Group, B&B Specialties Inc. Cherry Aerospace, Precision Castparts Corp. National 항공우주용 패스너 Corporation, Preci-Manufacturing, Stanley Group, Howmet Aerospace Inc. 등이 있습니다. 경쟁력을 높이기 위해 항공우주 패스너 업계의 기업은 몇 가지 중요한 전략을 채택하고 있습니다. 가혹한 조건 하에서도 확실하게 기능하는 보다 경량으로 내식성이 뛰어난 패스너를 개발하기 위해, 연구 개발에 다액의 투자를 실시했습니다. 항공기 OEM과의 전략적 제휴는 새로운 플랫폼 설계에 조기 통합을 보장하는 데 도움이 됩니다. 또한 기업은 현지 생산 및 디지털 조달 시스템을 통해 공급망 최적화에 주력하고 혼란을 최소화하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 파괴적 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 세계의 항공교통량 증가와 항공기 확대

- 군용기의 근대화의 급증

- MRO(유지보수, 수리, 오버홀) 서비스 성장

- 첨단 제조 기술 도입

- 우주 탐사와 위성 발사 증가

- 업계의 잠재적 위험 및 과제

- 고급 패스너 재료의 고비용

- 엄격한 규제 및 인증 요건

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 향후 시장 동향

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 제품별

- 가격 전략

- 새로운 비즈니스 모델

- 규정 준수 요건

- 국방예산 분석

- 세계의 방위비의 동향

- 지역 방위 예산 배분

- 북미

- 유럽

- 아시아태평양

- 중동 및 아프리카

- 라틴아메리카

- 주요 방위 근대화 프로그램

- 예산 예측(2025-2034년)

- 업계의 성장에 미치는 영향

- 국가별 방위 예산

- 공급 체인의 탄력

- 지정학적 분석

- 인재 분석

- 디지털 변혁

- 합병, 인수, 전략적 제휴의 상황

- 위험 평가 및 관리

- 주요 계약 체결(2021-2024년)

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 시장 집중 분석

- 지역별

- 주요 기업의 경쟁 벤치마킹

- 재무실적의 비교

- 수익

- 이익률

- 연구개발

- 제품 포트폴리오 비교

- 제품 라인업의 넓이

- 기술

- 파괴적 혁신

- 지리적 존재의 비교

- 세계의 실적 분석

- 서비스 네트워크의 범위

- 지역별 시장 침투율

- 경쟁 포지셔닝 매트릭스

- 리더

- 챌린저

- 팔로워

- 틈새 기업

- 전략적 전망 매트릭스

- 재무실적의 비교

- 주요 발전(2021-2034년)

- 합병과 인수

- 파트너십 및 협업

- 기술적 진보

- 확대 및 투자 전략

- 지속가능성에 대한 노력

- 디지털 변혁의 대처

- 신흥기업/스타트업기업경쟁 구도

제5장 시장 추계·예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 리벳

- 나사

- 너트 및 볼트

- 기타

제6장 시장 추계·예측 : 재료별(2021-2034년)

- 주요 동향

- 알루미늄

- 강철

- 초합금

- 티타늄

제7장 시장 추계·예측 : 플랫폼별(2021-2034년)

- 주요 동향

- 상업용 항공기

- 협폭동체

- 광폭동체

- 지역 제트기

- 군용기

- 비즈니스 제트기

- 헬리콥터

- 무인 항공기(UAV)

제8장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 기체

- 인테리어

- 엔진

- 제어 표면

- 랜딩 기어

- 기타

제9장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- OEM

- MRO(유지보수, 수리, 오버홀)

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제11장 기업 프로파일

- B&B Specialties Inc.

- Boeing

- Bollhoff Group

- Cherry Aerospace

- Howmet Aerospace Inc.

- LISI Aerospace

- MS Aerospace

- National Aerospace Fasteners Corporation

- Preci-Manufacturing

- Precision Castparts Corp.

- Stanley Black &Decker, Inc.

- TriMas Corporation

- Wurth Group

The Global Aerospace Fasteners Market was valued at USD 7.3 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 14.9 billion by 2034. This robust growth trajectory is closely tied to the rapid expansion of commercial airline fleets and the continuous upgrades in military aviation infrastructure. Rising air travel demand across emerging economies, coupled with increasing investments in national defense, is fueling the replacement of outdated aircraft components with newer, lightweight, and high-performance alternatives. The growing importance of fuel efficiency and durability has placed aerospace fasteners at the center of innovation in structural component manufacturing, making them essential in both OEM assembly and aftermarket servicing.

The global trade landscape has had a significant influence on this market. Previous tariffs targeting imported aerospace-grade aluminum and steel-especially those from China-led to elevated raw material costs and constrained access to essential components. These disruptions forced US-based manufacturers to rethink sourcing strategies, with many turning to domestic suppliers or diversifying vendor portfolios to minimize risk. These actions aimed to offset cost pressures while maintaining delivery timelines in a tightly scheduled manufacturing ecosystem. With an ongoing shift toward lightweight design and enhanced structural reliability, manufacturers are focusing on fasteners that can work seamlessly with composite materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $14.9 Billion |

| CAGR | 7.5% |

The rivets segment generated USD 3.1 billion in 2024. Rivets maintain dominance due to their essential role in delivering lightweight yet durable joints that are critical in maintaining airframe integrity. These fasteners are widely used in commercial aircraft production, particularly for high-vibration, load-bearing areas such as wings and fuselages. Advances in rivet installation-particularly blind rivet technology-have further increased efficiency and reliability, making them indispensable across both OEM manufacturing and ongoing maintenance operations.

Aluminum segment in the aerospace fasteners segment in 2024, valued at USD 2.8 billion. Its popularity stems from a superior strength-to-weight ratio, corrosion resistance, and cost-effectiveness, making it the material of choice for reducing aircraft mass and improving fuel economy. As aircraft designs increasingly focus on weight reduction, demand for aluminum fasteners continues to climb, particularly in non-critical structural applications and interior components. Enhanced aluminum alloy formulations are also boosting material compatibility with modern composite structures, driving adoption across both manufacturing and servicing divisions.

United States Aerospace Fasteners Market generated USD 2.3 billion in 2024. The country's dominance can be traced to its position as a global aerospace hub, home to leading manufacturers across commercial and defense aviation. Major players in this space continue to fuel domestic demand with both ongoing fleet maintenance and the integration of next-generation systems. The U.S. also hosts one of the world's most comprehensive MRO networks, supporting regular service cycles and system upgrades for large civilian and military fleets. Rising defense expenditures, focused on strategic air capabilities such as next-gen bombers and hypersonic aircraft, have intensified demand for specialized fasteners made from titanium alloys, high-temperature Inconel, and carbon-based composites.

Key players actively shaping the Aerospace Fasteners Market include TriMas Corporation, Boeing, LISI Aerospace, Wurth Group, B&B Specialties Inc., Cherry Aerospace, Precision Castparts Corp., National Aerospace Fasteners Corporation, Preci-Manufacturing, Stanley Black & Decker Inc., M.S Aerospace, Bollhoff Group, and Howmet Aerospace Inc. To enhance their competitive edge, companies in the aerospace fasteners industry are adopting several key strategies. They're investing heavily in R&D to develop lighter, corrosion-resistant fasteners that perform reliably under extreme conditions. Strategic collaborations with aircraft OEMs help ensure early integration into new platform designs. Additionally, firms are focusing on supply chain optimization through localized manufacturing and digital procurement systems to minimize disruptions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Material trends

- 2.2.3 Platform trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO Perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing global air traffic & fleet expansion

- 3.2.1.2 Surge in military aircraft modernization

- 3.2.1.3 Growth in MRO (maintenance, repair, and overhaul) services

- 3.2.1.4 Adoption of advanced manufacturing technologies

- 3.2.1.5 Rising space exploration & satellite launches

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced fastener materials

- 3.2.2.2 Stringent regulatory and certification requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Pricing strategies

- 3.11 Emerging business models

- 3.12 Compliance requirements

- 3.13 Defense budget analysis

- 3.14 Global defense spending trends

- 3.15 Regional defense budget allocation

- 3.15.1 North America

- 3.15.2 Europe

- 3.15.3 Asia Pacific

- 3.15.4 Middle East and Africa

- 3.15.5 Latin America

- 3.16 Key defense modernization programs

- 3.17 Budget forecast (2025-2034)

- 3.17.1 Impact on industry growth

- 3.17.2 Defense budgets by country

- 3.18 Supply chain resilience

- 3.19 Geopolitical analysis

- 3.20 Workforce analysis

- 3.21 Digital transformation

- 3.22 Mergers, acquisitions, and strategic partnerships landscape

- 3.23 Risk assessment and management

- 3.24 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Rivets

- 5.3 Screws

- 5.4 Nuts & bolts

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Aluminum

- 6.3 Steel

- 6.4 Superalloys

- 6.5 Titanium

Chapter 7 Market Estimates and Forecast, By Platform, 2021 – 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Commercial aircraft

- 7.2.1 Narrow-body

- 7.2.2 Wide-body

- 7.2.3 Regional jets

- 7.3 Military aircraft

- 7.4 Business jets

- 7.5 Helicopters

- 7.6 Unmanned aerial vehicles (UAVs)

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 Airframe

- 8.3 Interiors

- 8.4 Engine

- 8.5 Control surfaces

- 8.6 Landing gear

- 8.7 Other

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 OEM (Original Equipment Manufacturers)

- 9.3 MRO (Maintenance, Repair, and Overhaul)

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 B&B Specialties Inc.

- 11.2 Boeing

- 11.3 Bollhoff Group

- 11.4 Cherry Aerospace

- 11.5 Howmet Aerospace Inc.

- 11.6 LISI Aerospace

- 11.7 M.S Aerospace

- 11.8 National Aerospace Fasteners Corporation

- 11.9 Preci-Manufacturing

- 11.10 Precision Castparts Corp.

- 11.11 Stanley Black & Decker, Inc.

- 11.12 TriMas Corporation

- 11.13 Wurth Group