|

시장보고서

상품코드

1773383

식품 알레르기 치료 시장(2025-2034년) : 기회, 성장 촉진요인, 산업 동향 분석, 예측Food Allergy Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

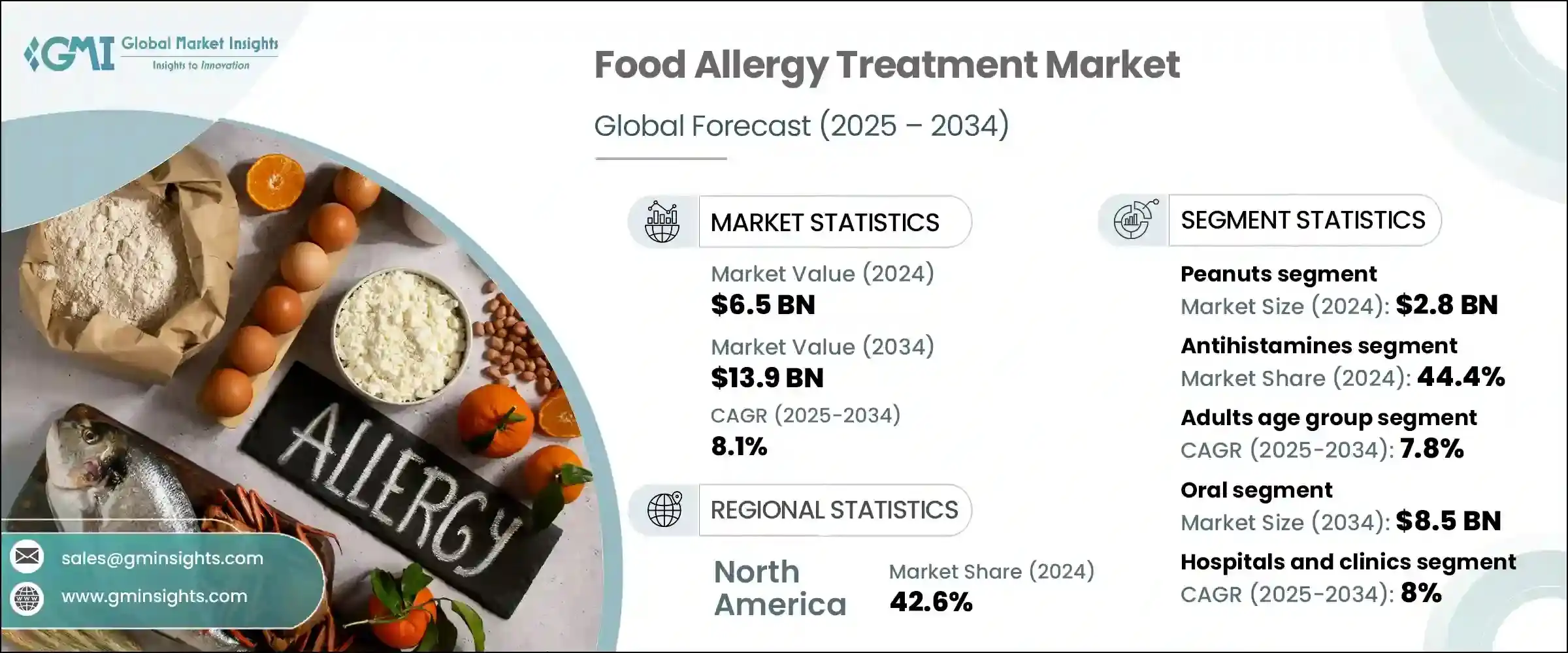

세계의 식품 알레르기 치료 시장은 2024년에는 65억 달러로 평가되었으며 CAGR 8.1%로 성장하여 2034년에는 139억 달러에 이를 것으로 추정됩니다.

이 견조한 성장은 소아 및 성인 집단에서 식품 알레르기의 발생률이 증가함에 따라 특히 발생합니다. 개발도상국에서는 변화하는 식습관으로 인해 알레르기원에 점점 더 노출되고 있으며 따라서 진단과 효율적인 치료 솔루션에 대한 수요를 촉진하고 있습니다.

예방 헬스케어와 개인화된 치료 플랜의 인기가 높아지면서 치료의 전망을 한층 더 넓혀가고 있습니다. 식품 알레르기 치료 시장은 탐지 도구의 이용 가능성이나 외래 진료의 중시 고조와 함께 급속히 진화하고 있습니다. 식품 알레르기가 정신적, 신체적, 사회적인 행복에 계속 영향을 주고 있는 가운데, 보다 많은 학교, 직장, 여행단체가 지원 정책을 채용하여 알레르기 관련 리스크에 대한 전체적인 대응 능력을 강화하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024 |

| 예측연도 | 2025-2034 |

| 시작금액 | 65억 달러 |

| 예측금액 | 139억 달러 |

| CAGR | 8.1% |

치료 접근법의 혁신은 이 시장 성장 촉진요인 중 하나이며 면역요법 패치, 경구 점막 치료제 및 미생물에 중점을 둔 치료제와 같은 새로운 제제에 대한 수요가 급증하고 있습니다. 또한 소아 이외의 광범위한 치료 접근의 필요성이 강조되고 있습니다. 식품 알레르기와 공존하는 것에 의한 심리적 부담이 높아지는 가운데, 환자나 간병인은 보다 뛰어난 안전성 프로파일과 치료 결과 개선을 제공하는 표적 요법을 점점 받아들이고 있습니다.

알레르기원 유형별로 시장은 유제품, 땅콩, 견과류 및 기타 알레르기원으로 구분됩니다. 땅콩 알레르기는 반응의 심각성과 즉각적인 개입의 필요성으로 인해 의약품 연구개발의 초점이 되었습니다.

치료제의 유형에 따라 시장은 항히스타민제, 에피네프린, 면역요법 등으로 분류됩니다. 이러한 유형들은 사용하기 쉽고 쉽게 구할 수 있으며 시판되고 있기 때문에 많은 환자에게 이용하기 쉬운 옵션이 되고 있습니다.

연령층별로는 시장은 소아와 성인으로 나뉘어져 있습니다. 성인은 2024년에 최고 점유율을 차지하였으며, 예측기간 중의 CAGR은 7.8%로 현저한 성장이 예측되고 있습니다. 가공 식품의 소비 증가, 장내 세균총 교란, 보다 강한 알레르기 반응 등의 요인이 이 부문의 성장에 기여하고 있습니다.

투약 경로별로는 경구약이 2024년 시장을 선도하였고 2034년에는 85억 달러에 이를 것으로 예측되고 있습니다. 경구약은 임상 모니터링의 필요가 적고 환자의 순응도를 향상시키며 치료비도 줄일 수 있습니다.

시장을 최종 용도별로 분류하면, 병원 및 진료소, 재택치료, 기타 유형이 있습니다. 병원에서 사용할 수 있는 임상 프로그램과 후속 치료는 케어의 지속성을 지원하고 장기적인 알레르기 증상을 더 잘 관리할 수 있도록 지원합니다.

지역별로는 북미가 2024년에 42.6%의 압도적인 점유율로 세계 시장을 차지했습니다. 미국의 시장 규모는 맞춤형 치료에 대한 수요 증가와 강력한 공중보건 이니셔티브를 반영하여 2023년의 23억 달러에서 2024년에는 25억 달러로 증가했습니다.

유럽은 2024년 시장 규모가 17억 달러였으며 이후 강력한 성장이 예상되고 있습니다. 정부의 지원 프로그램, 치료 기술의 진보, 생물제제나 정밀 치료에 대한 접근성 향상이 이 지역의 시장 상황을 강화하고 있습니다.

경쟁구도는 Sanofi, Teva Pharmaceutical, Kenvue, Genentech, Hal Allergy와 같은 대기업이 주도하며, 2024년에는 시장의 60% 가까이를 차지하였습니다. 각사는 연구개발 이니셔티브를 통해 포트폴리오의 확대에 주력하고 있습니다. 한편, 지역 기업과 현지 기업은 지역 수요에 맞는 비용 대비 효과적인 솔루션을 제공함으로써 계속 경쟁압력을 높이고 있습니다.

목차

제1장 조사방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 세계적으로 식품 알레르기의 유병률이 상승하고 있으며 특히 어린이들 사이에서 증가

- 혁신적이고 표적화된 치료 옵션에 대한 투자 증가

- 국민 의식의 고조와 적극적인 알레르기 관리

- 업계의 잠재적 위험 및 과제

- 표준화된 진단 도구의 부족

- 신흥 치료법에 대한 부작용 위험

- 시장 기회

- 경구 면역요법과 생물학적 제제의 확대

- 제약기업과 연구기관의 제휴

- 성장 촉진요인

- 성장 가능성 분석

- 파이프라인 분석

- 장래 시장 동향

- 기술과 혁신의 상황

- 규제 상황

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁구도

- 소개

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

제5장 시장 추계 및 예측 : 알레르기원 유형별(2021-2034년)

- 주요 동향

- 유제품

- 땅콩

- 견과류

- 기타 알레르기원 유형

제6장 시장 추계 및 예측 : 치료 유형별(2021-2034년)

- 주요 동향

- 항히스타민제

- 에피네프린

- 면역요법

- 기타 치료 유형

제7장 시장 추계 및 예측 : 연령별(2021-2034년)

- 주요 동향

- 어린이

- 성인

제8장 시장 추계 및 예측 : 투여 경로별(2021-2034년)

- 주요 동향

- 경구

- 비경구

- 경비

제9장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 병원 및 진료소

- 재택치료

- 기타 용도

제10장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- AdvaCare

- Aimmune Therapeutics

- Alerje

- ARS Pharma

- Camallergy

- Celltrion

- DBV Technologies

- Genentech

- Hal Allergy

- Kenvue

- Sanofi

- Stallergenes Greer

- Teva Pharmaceutical

The Global Food Allergy Treatment Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 13.9 billion by 2034. This robust growth is largely attributed to the rising incidence of food allergies across both pediatric and adult populations. Evolving dietary patterns and increased exposure to allergens, especially in developing regions, are driving the demand for timely diagnosis and efficient treatment solutions. Environmental factors and urban lifestyles also play a crucial role in aggravating allergic reactions, prompting individuals to seek early intervention.

Preventive healthcare and the growing popularity of personalized treatment plans are further broadening the treatment landscape. With improved awareness, people are opting for early-stage management, which not only reduces complications but also enhances the long-term quality of life for patients. The healthcare ecosystem is rapidly evolving with the availability of detection tools and a growing emphasis on outpatient care. As food allergies continue to impact mental, physical, and social well-being, more schools, workplaces, and travel organizations are adopting supportive policies, strengthening the overall response to allergy-related risks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $13.9 Billion |

| CAGR | 8.1% |

Innovation in treatment approaches is another driver of this market, with demand surging for newer formulations such as immunotherapy patches, oral mucosal treatments, and microbiome-focused therapeutics. The industry is experiencing a paradigm shift toward inclusive and gender-neutral healthcare protocols, highlighting the need for broader treatment access beyond children. With rising concerns over the psychological toll of living with food allergies, patients and caregivers are increasingly embracing targeted therapies that offer better safety profiles and improved outcomes.

By allergen type, the market is segmented into dairy products, peanuts, tree nuts, and other allergens. Among these, the peanuts segment emerged as the largest contributor, generating USD 2.8 billion in revenue in 2024. Increasing sensitivity to peanuts, particularly in urban populations, has led to heightened demand for advanced therapies. The severity of reactions and the immediate need for intervention have made peanut allergies a focal point for pharmaceutical R&D. This trend has resulted in increased investments from biotech firms and strong support from regulatory bodies, paving the way for cutting-edge therapies with improved safety and efficacy.

Based on treatment type, the market is categorized into antihistamines, epinephrine, immunotherapy, and others. Antihistamines maintained dominance in 2024 with a market share of 44.4%. These are the go-to medications for managing mild to moderate symptoms like itching, swelling, or congestion. Their ease of use, wide availability, and over-the-counter status make them an accessible choice for many patients. Antihistamines are often the first line of defense in both emergency and preventive care, supporting their strong position in the treatment landscape.

In terms of age group, the market is divided between children and adults. Adults held the leading share in 2024 and are projected to grow at a notable CAGR of 7.8% over the forecast period. With growing adult-onset food allergies and rising awareness about late diagnoses, this segment is rapidly expanding. Factors such as increased consumption of processed foods disrupted gut microbiota, and stronger allergic reactions are contributing to the segment's growth. Additionally, severe allergic reactions like anaphylaxis are more common among adults, intensifying the demand for comprehensive treatment options.

On the basis of the route of administration, the oral segment led the market in 2024 and is expected to reach USD 8.5 billion by 2034. Oral medications are favored for their convenience and affordability. Compared to injectables, they require less clinical oversight, resulting in higher patient compliance and lower treatment costs. These advantages have contributed to their wide adoption across both home care and clinical settings.

When segmented by end use, the market includes hospitals and clinics, home care settings, and others. Hospitals and clinics accounted for the highest revenue share in 2024 and are estimated to grow at a CAGR of 8% during the forecast timeline. These facilities offer specialized diagnostic tools and emergency response capabilities, making them essential for managing severe allergic reactions. Moreover, clinical programs and follow-up treatments available in hospitals support continuity of care, ensuring better management of long-term allergic conditions. Increased investment in healthcare infrastructure, particularly in emerging economies, is also fueling the growth of hospital-based allergy treatment services.

Regionally, North America dominated the global market with a commanding share of 42.6% in 2024. The region benefits from early diagnosis, strong healthcare infrastructure, and rising healthcare expenditure on allergy management. The market in the United States alone rose from USD 2.3 billion in 2023 to USD 2.5 billion in 2024, reflecting the heightened demand for personalized therapies and robust public health initiatives.

Europe followed with a market value of USD 1.7 billion in 2024 and is expected to show strong growth. Government-backed programs, advancements in treatment technology, and improved accessibility to biologics and precision therapies are enhancing the regional landscape. Strategic collaborations between pharmaceutical companies and public institutions are also playing a key role in driving innovation and ensuring better access to novel treatments.

The competitive landscape remains highly dynamic, led by major players such as Sanofi, Teva Pharmaceutical, Kenvue, Genentech, and Hal Allergy, who together accounted for nearly 60% of the market in 2024. These companies are focused on expanding their portfolios through acquisitions, product launches, and R&D initiatives. Meanwhile, regional and local firms continue to create competitive pressure by offering cost-effective solutions tailored to local demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Allergen type

- 2.2.3 Treatment type

- 2.2.4 Age group

- 2.2.5 Route of administration

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global prevalence of food allergies, especially among children

- 3.2.1.2 Increasing investment in innovative and targeted treatment options

- 3.2.1.3 Growing public awareness and proactive allergy management

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of standardized diagnostic tools

- 3.2.2.2 Risk of adverse reactions to emerging therapies

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of oral immunotherapy and biologics

- 3.2.3.2 Collaborations between pharmaceutical firms and research institutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Future market trends

- 3.6 Technology and innovation landscape

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 Middle East and Africa

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Allergen Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dairy products

- 5.3 Peanuts

- 5.4 Tree nuts

- 5.5 Other allergen types

Chapter 6 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Antihistamines

- 6.3 Epinephrine

- 6.4 Immunotherapy

- 6.5 Other treatment types

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Children

- 7.3 Adults

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Parenteral

- 8.4 Intranasal

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital and clinics

- 9.3 Homecare settings

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AdvaCare

- 11.2 Aimmune Therapeutics

- 11.3 Alerje

- 11.4 ARS Pharma

- 11.5 Camallergy

- 11.6 Celltrion

- 11.7 DBV Technologies

- 11.8 Genentech

- 11.9 Hal Allergy

- 11.10 Kenvue

- 11.11 Sanofi

- 11.12 Stallergenes Greer

- 11.13 Teva Pharmaceutical