|

시장보고서

상품코드

1773434

기어박스 및 기어 모터 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Gearbox and Gear Motors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

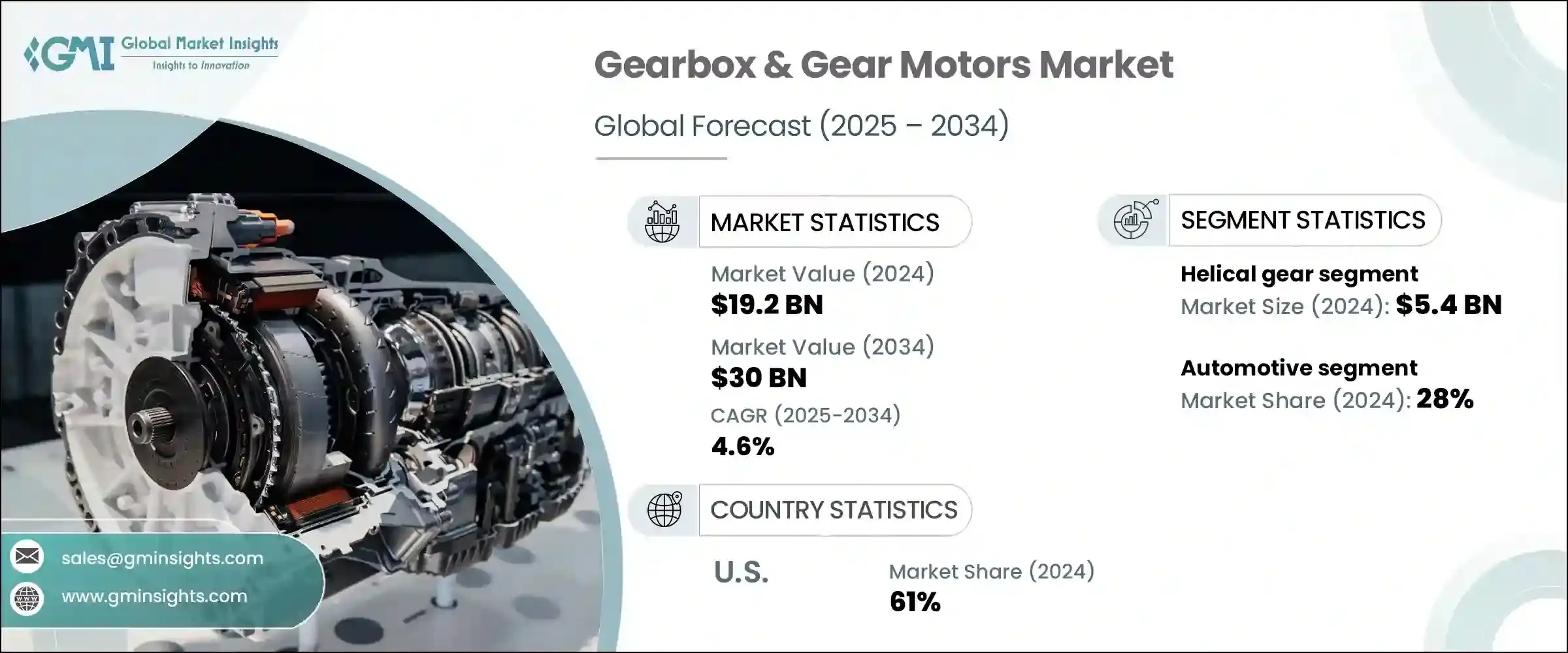

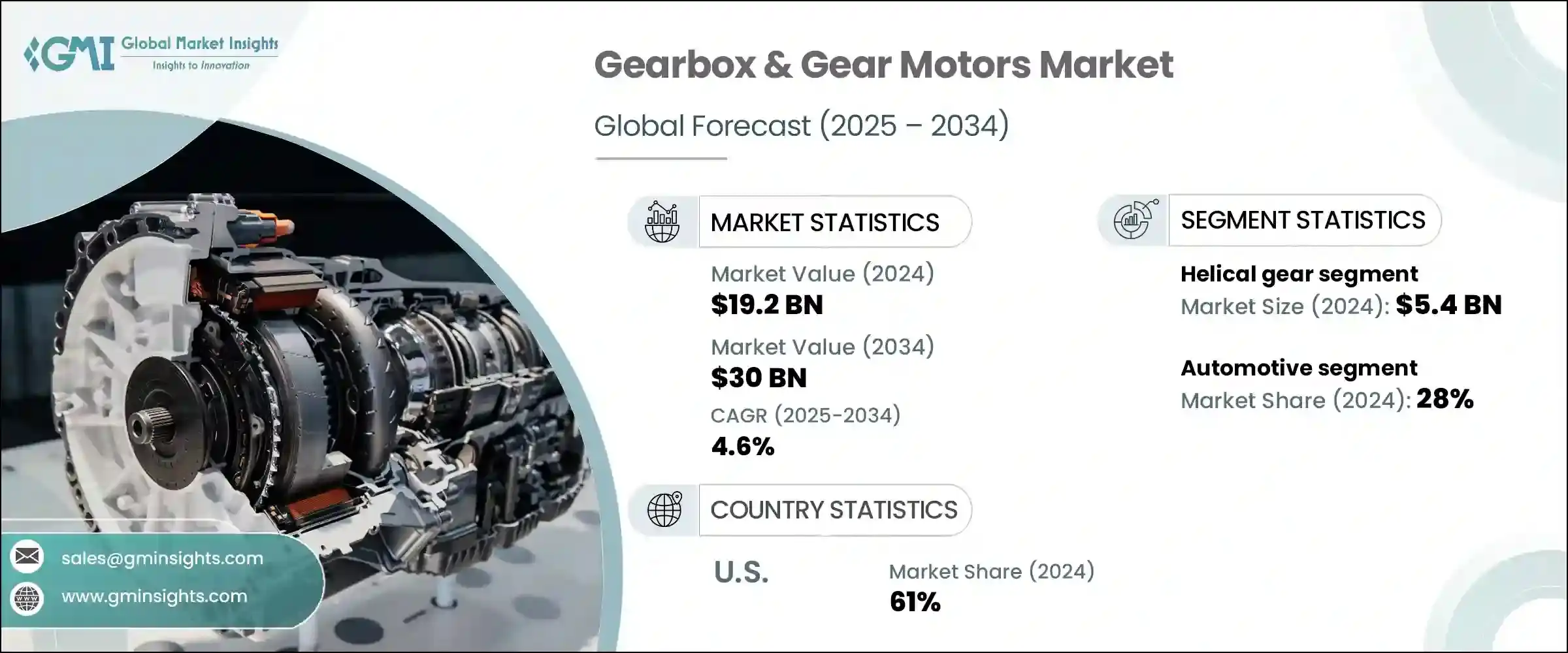

기어박스 및 기어 모터 세계 시장은 2024년에 192억 달러로 평가되었고, CAGR 4.6%로 성장하여 2034년에는 300억 달러에 이를 것으로 추정되고 있습니다.

전기자동차의 인기 증가와 더불어 산업 자동화의 확대와 로봇 공학의 발전이 시장 수요를 지속적으로 견인하고 있습니다. 청정 에너지원, 특히 풍력에너지에 대한 투자가 증가함에 따라 다양한 동력 응용 분야에서 신뢰할 수 있는 고성능 기어 모터의 필요성이 더욱 커지고 있습니다. 전 세계 산업계가 인프라 현대화 및 에너지 효율 개선에 중점을 두면서 혁신적인 기어박스 기술에 대한 수요가 급증하고 있습니다.

특히 에너지 분야에서 에너지 포획을 강화하고 회전 효율을 최적화하는 기어 모터의 중요성이 커지고 있습니다. 그 결과, 시장은 자동차, 제조, 발전 등 여러 최종 사용 수직 분야에서 강력한 성장을 목격하고 있습니다. 그러나 이러한 성장에도 불구하고, 높은 유지보수 비용은 여전히 큰 걸림돌로 작용하고 있습니다. 기어 어셈블리, 모터, 제어 시스템이 통합되어 있어 복잡성이 증가하고 전문적인 서비스가 필요한 경우가 많습니다. 또한, 부품 가격의 변동과 전문적인 유지보수의 필요성은 운영 비용 상승의 원인이 되어 비용에 민감한 시장에서 폭넓은 채택을 방해하는 요인으로 작용하고 있습니다. 그럼에도 불구하고, 현재 진행 중인 연구개발과 제품 개선은 장기적인 유지보수에 대한 우려를 줄이는 데 도움이 되고 있습니다.

| 시장 범위 | |

|---|---|

| 개시 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 개시 금액 | 192억 달러 |

| 예측 금액 | 300억 달러 |

| CAGR | 4.6% |

헬리컬 기어 분야는 2024년 54억 달러 규모 시장을 창출했습니다. 이 모터는 각진 톱니로 설계되어 진동과 작동 소음을 최소화하고 효율성을 높입니다. 헬리컬 기어는 크레인, 호이스트 시스템, 컨베이어 기계, 중공업 공구 등 부드러운 움직임과 부하 용량을 필요로 하는 산업에서 흔히 볼 수 있습니다. 이러한 기어 솔루션은 제조업, 자동화 시스템, 의료 장비와 같은 고정밀 용도를 포함하여 조용한 작동과 토크 성능이 중요한 환경에 적합합니다. 또한, 큰 부하를 관리하고 높은 토크를 제공하는 능력으로 인해 자재관리, 광업, 인프라 등의 분야에도 적합합니다.

2024년에는 자동차 분야가 28%의 점유율을 차지했습니다. 다양한 카테고리에서 매년 수백만 대의 자동차가 생산되기 때문에 이 분야는 기어 구동 시스템에 대한 대규모의 안정적인 수요를 지속적으로 창출하고 있습니다. 전기, 하이브리드 또는 기존 내연기관 엔진의 구성에 관계없이 기어박스는 최적의 동력 전달을 위해 필수적인 요소로 자리매김하고 있습니다. 자동차 산업의 급속한 기술 혁신은 연비 향상, 첨단 안전 기술, 원활한 주행 경험을 지원하는 기어 구성품에 대한 수요를 더욱 증가시키고 있습니다. 현대 자동차는 진화하는 배기가스 규제와 성능 요건에 맞추어 다단 변속 시스템과 스마트 기어 메커니즘을 탑재하고 있습니다.

미국의 기어박스 및 기어 모터 시장은 2024년 61%의 점유율을 차지했습니다. 이 시장의 성장을 뒷받침하는 것은 산업 자동화 및 스마트 제조 개념의 광범위한 도입입니다. 건설, 포장, 식품 제조, 제약 등 여러 분야에서 효율적인 동력 전달 기술의 채택이 증가하고 있습니다. 또한, 산업용 로봇과 에너지 인프라에 대한 투자 증가는 새로운 기회를 창출하고 있습니다. 효율성, 신뢰성, 컴팩트한 디자인을 중시하는 미국 제조업체들은 맞춤형 제품 라인, 유지보수 감소 설계, 상태 모니터링 및 예지보전이 가능한 지능형 시스템을 제공함으로써 기술 혁신을 주도하고 있습니다.

기어박스 및 기어 모터 세계 시장을 형성하는 주요 기업으로는 Bonfiglioli S.p.A.,Elecon Engineering Co.Ltd.,Portescap,NORD Drivesystems Group,Shanthi Gears Limited, Nidec Corporation, Top Gear Transmissions, Dunkermotoren, Regal Rexnord Corporation, Siemens AG, Flender International Inc. Nidec Corporation,Top Gear Transmissions,Dunkermotoren,SEW-EURODRIVE GmbH &Co. GmbH,ABB 등이 있습니다. 시장에서의 입지를 강화하기 위해 주요 기어 박스, 기어 모터 제조업체는 다양한 공격적인 전략을 채택하고 있습니다.

많은 기업들이 제품 개발에 많은 투자를 통해 수명이 길고 유지보수가 필요 없는 고효율, 저소음의 솔루션을 개발하고 있습니다. 또한, 세계 공급망을 강화하고 각 지역 수요에 대한 대응력을 높이기 위해 현지 생산 시설을 설립하고 있습니다. 전략적 파트너십과 인수는 기업들이 새로운 시장을 개척하고 제품 포트폴리오를 확장하는 데 도움이 되고 있습니다. 또한, 일부 제조업체들은 인더스트리 4.0으로의 전환에 맞추어 실시간 진단 및 예지보전을 위한 스마트 모니터링 시스템을 통합하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급업체 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 미치는 요인

- 업계에 대한 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크&과제

- 기회

- 성장 가능성 분석

- 향후 시장 동향

- 기술 및 혁신 상황

- 현재 기술 동향

- 신기술

- 가격 동향

- 지역별

- 규제 상황

- 표준과 컴플라이언스 요건

- 지역 규제 구조

- 인증 기준

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 인수합병(M&A)

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추산·예측 : 유형별, 2021년-2034년

- 주요 동향

- 헤리컬 기어

- 유성 기어

- 베벨 기어

- 웜 기어

- 기타

제6장 시장 추산·예측 : 제품 유형별, 2021년-2034년

- 주요 동향

- 기어박스

- 기어 모터 유닛

제7장 시장 추산·예측 : 정격 출력별, 2021년-2034년

- 주요 동향

- 7.5kW 미만

- 7.5kW-75kW

- 75kW 이상

제8장 시장 추산·예측 : 최종 이용 산업별, 2021년-2034년

- 주요 동향

- 자재관리

- 자동차

- 식품 및 음료

- 의료

- 풍력

- 금속 및 광업

- 기타

제9장 시장 추산·예측 : 유통 채널별, 2021년-2034년

- 주요 동향

- 직접

- 간접

제10장 시장 추산·예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카공화국

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 개요

- ABB

- Bonfiglioli S.p.A.

- Dunkermotoren

- Elecon Engineering Co. Ltd.

- Flender International GmbH

- NGL

- Nidec Corporation

- NORD Drivesystems Group

- Portescap

- Regal Rexnord Corporation

- SEW-EURODRIVE GmbH &Co. KG

- Shanthi Gears Limited

- Siemens AG

- Sumitomo Heavy Industries Ltd.

- Top Gear Transmissions

The Global Gearbox & Gear Motors Market was valued at USD 19.2 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 30 billion by 2034. The rising popularity of electric vehicles, along with expanding industrial automation and advancements in robotics, continues to drive market demand. Growing investments in clean energy sources, particularly wind energy, are further boosting the need for dependable and high-performing gear motors across various power applications. As industries worldwide focus on modernizing infrastructure and improving energy efficiency, the demand for innovative gearbox technologies is surging.

Gear motors, especially in energy sectors, are becoming increasingly critical due to their ability to enhance energy capture and optimize rotational efficiency. As a result, the market is witnessing strong growth in several end-use verticals, including automotive, manufacturing, and power generation. However, despite this expansion, high upkeep expenses remain a notable barrier. The integrated nature of gear assemblies, motors, and control systems increases complexity, often requiring specialized servicing. Variability in component prices and the need for expert maintenance also contribute to elevated operational costs, which can deter broader adoption in cost-sensitive markets. Nevertheless, ongoing R&D and product enhancements are helping reduce long-term maintenance concerns.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.2 Billion |

| Forecast Value | $30 Billion |

| CAGR | 4.6% |

The helical gear segment generated USD 5.4 billion in 2024. These motors are designed with angled teeth, minimizing vibration and operating noise and boosting efficiency. They're commonly found in industries requiring smooth motion and load capacity, such as cranes, hoisting systems, conveyor machinery, and heavy industrial tools. These gear solutions are well-suited for environments where quiet operation and torque performance are vital, including high-precision applications in manufacturing, automation systems, and medical devices. Their capacity to manage significant loads and deliver high torque also makes them favorable for sectors such as material handling, mining, and infrastructure.

In 2024, the automotive segment accounted for a 28% share. With millions of vehicles produced each year across various categories, the sector continues to generate a massive and consistent demand for gear-driven systems. Whether in electric, hybrid, or traditional internal combustion engine configurations, gearboxes remain essential for optimal power delivery. Rapid innovation within the automotive industry is further increasing the need for gear components that support enhanced fuel efficiency, advanced safety technologies, and seamless driving experiences. Modern vehicles are being equipped with multi-speed systems and smart gear mechanisms tailored for evolving emission regulations and performance requirements.

United States Gearbox & Gear Motors Market held a 61% share in 2024. Growth in this market is supported by the widespread implementation of industrial automation and smart manufacturing concepts. Multiple sectors-including construction, packaging, food production, and pharmaceuticals-are increasingly adopting efficient power transmission technologies. Additionally, rising investments in industrial robotics and energy infrastructure are creating new opportunities. With an emphasis on efficiency, reliability, and compact design, US manufacturers push innovation by offering customizable product lines, reduced-maintenance designs, and intelligent systems capable of condition monitoring and predictive maintenance.

Key companies shaping the Global Gearbox & Gear Motors Market include Bonfiglioli S.p.A., Elecon Engineering Co. Ltd., Portescap, NORD Drivesystems Group, Shanthi Gears Limited, Nidec Corporation, Top Gear Transmissions, Dunkermotoren, SEW-EURODRIVE GmbH & Co. KG, Regal Rexnord Corporation, Siemens AG, Flender International GmbH, ABB, Sumitomo Heavy Industries Ltd., and NGL. To strengthen their market standing, leading gearbox, and gear motor manufacturers are adopting a range of proactive strategies.

Many are investing significantly in product development to create high-efficiency and low-noise solutions with longer lifespans and reduced maintenance needs. Companies are also enhancing their global supply chains and establishing local production facilities to ensure better responsiveness to regional demands. Strategic partnerships and acquisitions are helping firms tap into new markets and extend product portfolios. Additionally, several manufacturers are incorporating smart monitoring systems for real-time diagnostics and predictive maintenance, aligning with the shift toward Industry 4.0.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Product Type

- 2.2.4 Rated Power

- 2.2.5 End use Industry

- 2.2.6 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for electrical vehicles

- 3.2.1.2 Growth in renewable energy sector

- 3.2.1.3 Advancements in industrial automation and robotics

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High maintenance costs

- 3.2.2.2 Fluctuations in raw material costs

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Helical gear

- 5.3 Planetary gear

- 5.4 Bevel gear

- 5.5 Worm gear

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Gearbox

- 6.3 Gear motor unit

Chapter 7 Market Estimates and Forecast, By Rated Power, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 7.5 kW

- 7.3 7.5 kW to 75 kW

- 7.4 Above 75 kW

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Material handling

- 8.3 Automotive

- 8.4 Food and beverages

- 8.5 Medical

- 8.6 Wind power

- 8.7 Metals and mining

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Bonfiglioli S.p.A.

- 11.3 Dunkermotoren

- 11.4 Elecon Engineering Co. Ltd.

- 11.5 Flender International GmbH

- 11.6 NGL

- 11.7 Nidec Corporation

- 11.8 NORD Drivesystems Group

- 11.9 Portescap

- 11.10 Regal Rexnord Corporation

- 11.11 SEW-EURODRIVE GmbH & Co. KG

- 11.12 Shanthi Gears Limited

- 11.13 Siemens AG

- 11.14 Sumitomo Heavy Industries Ltd.

- 11.15 Top Gear Transmissions