|

시장보고서

상품코드

1773444

보관 및 핸들링 장비 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Storage and Handling Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

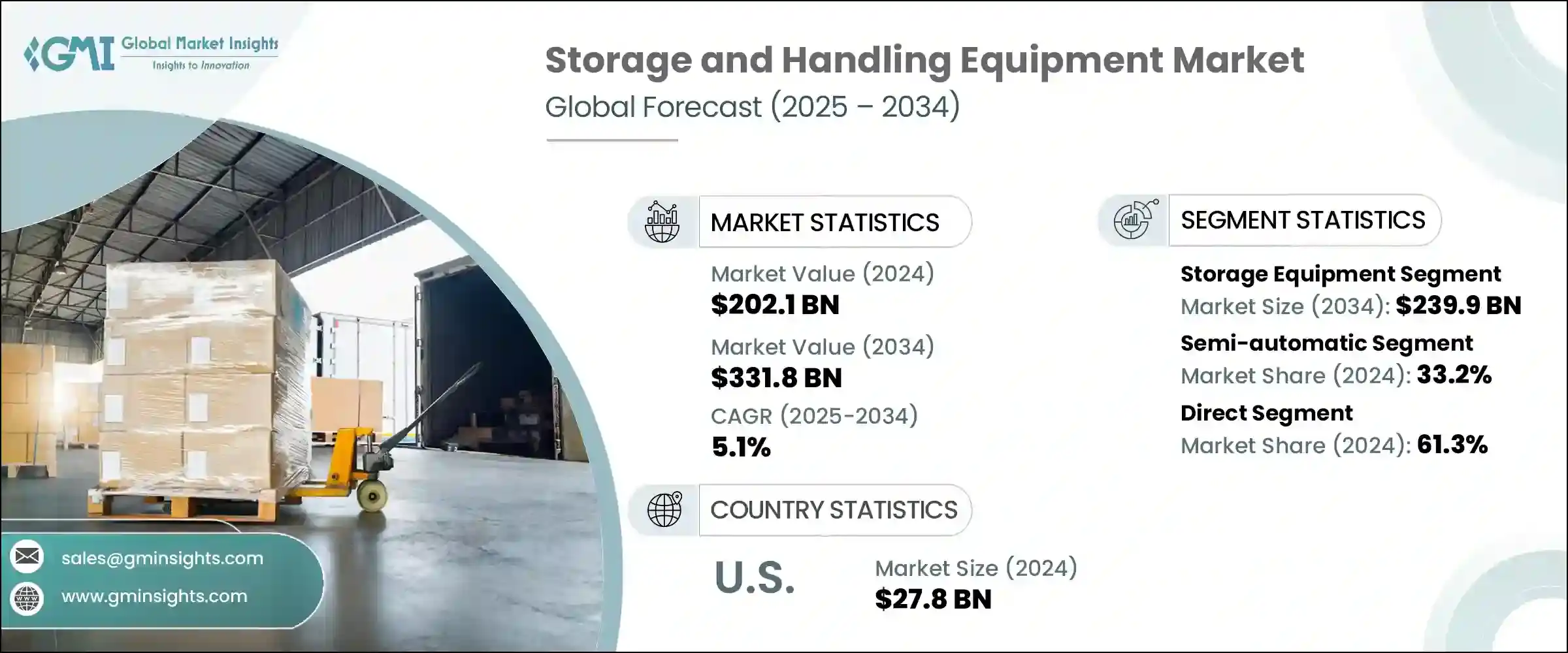

보관 및 핸들링 장비 세계 시장 규모는 2024년에 2,021억 달러로 평가되었고, CAGR 5.1%로 성장하여 2034년에는 3,318억 달러에 이를 것으로 추정됩니다.

특히 북미, 서유럽 및 신흥 동남아시아에서 전자상거래의 폭발적인 성장으로 인해 풀필먼트 센터는 고밀도 랙, 로봇 컨베이어, 모듈형 메자닌과 같은 첨단 솔루션에 대한 투자가 필요하며, IoT, RFID, 텔레메트리 시스템은 이제 거의 표준이 되어 실시간 재고 추적 및 물류 동기화를 가능하게 합니다. 실시간 재고 추적과 물류 동기화를 가능하게 하는 IoT, RFID, 원격 측정 시스템은 이제 거의 표준이 되었습니다. 특히 소매, 전자상거래, 자동차 부문에서는 24시간 운영되는 창고 운영이 예상에 따라 최신 보관 및 취급 시스템과 자동화의 조합이 창고 모델을 변화시키고 있습니다.

로봇 공학, 자동 보관 및 검색 시스템(AS/RS), 컨베이어 시스템, 가이드 지게차, 자율 이동 로봇(AMR)의 통합은 창고 업무에 혁명을 일으키고 있습니다. 이러한 기술을 통해 기업은 인건비를 비례적으로 증가시키지 않고도 증가하는 주문 수요에 효율적으로 대응할 수 있습니다. 반복적인 작업을 자동화하고 자재 흐름을 최적화함으로써 기업은 정확성, 속도 및 처리량을 향상시킬 수 있습니다. 또한, 이러한 기술 혁신은 인적 오류를 줄이고, 안전성을 높이며, 시설 내 공간 활용을 극대화하는 데 도움이 됩니다. 그 결과, 기업은 운영 비용을 낮추면서 피크 시간대에도 높은 서비스 수준과 확장성을 유지할 수 있습니다. 이러한 자동화로의 전환으로 창고 관리는 공급망에서 보다 스마트하고 신속한 구성 요소로 변모하고 있습니다.

| 시장 범위 | |

|---|---|

| 개시 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 개시 금액 | 2,021억 달러 |

| 예측 금액 | 3,318억 달러 |

| CAGR | 5.1% |

2024년에는 보관 장비만 1,402억 달러, 2034년에는 2,399억 달러에 달할 것으로 예측됩니다. 팔레트 랙, 메자닌 플랫폼, 모듈형 선반과 같은 유닛은 공간을 최대한 활용하는 데 필수적입니다. 팔레트 랙은 이 부문의 절반 이상을 차지하며, 맞춤형 솔루션에 대한 요구로 인해 전자상거래에서 의약품, 식품 유통에 이르기까지 산업 전반에 걸쳐 수요가 급증하고 있습니다.

반자동 부문은 2024년 33.2%의 점유율을 차지했으며, 2034년까지 6.5% 성장할 것으로 예측됩니다. 가이드 지게차, 벨트 컨베이어, 조정 가능한 랙과 같은 반자동화 솔루션은 완전 자동화를 위한 전체 투자를 하지 않고도 효율성을 개선할 수 있는 스위트 스팟에 해당합니다. 업계 데이터에 따르면, 이러한 시스템은 전 세계 중형 창고의 약 40%에 도입되어 있습니다.

2024년 미국 보관 및 취급 장비 시장 규모는 278억 달러로 평가되었고, 2034년까지 6.2%의 연평균 복합 성장률(CAGR)을 보일 것으로 예측됩니다. 대규모 전자상거래 인프라, 촘촘한 물류 네트워크, 물류 대기업 및 소매업체의 활발한 산업 기반은 반자동 컨베이어, 고밀도 랙, 차세대 로봇에 대한 투자를 지속적으로 촉진하고 있습니다. 창고 현대화 및 식음료 물류 분야에서 꾸준한 성장세를 보이고 있습니다.

보관 및 취급 장비 시장의 주요 기업은 Interroll Group,Dematic,Toyota Material Handling,Honeywell Intelligrated,Bastian Solutions,Hyster-Yale Materials Handling,Daifuku Corporation,SSI Schafer,Jungheinrich AG,Swisslog,Flexcon Container,Mecalux,BEUMER Group,Raymond Corporation,Godrej Storage Solutions 등입니다. 주요 기업들은 전자상거래 및 소매 분야의 성장을 목표로 재고 변동과 계절적 피크에 신속하게 대응할 수 있는 모듈식 확장형 시스템에 집중하고 있습니다. 이들 기업은 IoT, AI 기반 분석, 로봇, 특히 AS/RS 및 AMR과 같은 첨단 기술을 통합하여 업무 효율성을 높이고 노동 의존도를 낮추고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급업체 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 미치는 요인

- 파괴적 변화

- 업계에 대한 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크&과제

- 기회

- 성장 가능성 분석

- 향후 시장 동향

- 기술 및 혁신 상황

- 현재 기술 동향

- 신기술

- 가격 동향

- 지역별

- 유형별

- 규제 프레임워크

- 규격과 인증

- 환경 규제

- 수출입 규제

- 무역 통계(HS코드 8428)

- 주요 수입국

- 주요 수출국

- Porter의 Five Forces 분석

- PESTEL 분석

- 소비자 행동 분석

- 구입 패턴

- 선호도 분석

- 소비자 행동의 지역 차이

- E-Commerce가 구매 결정에 미치는 영향

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 인수합병(M&A)

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추산·예측 : 기기 유형별, 2021년-2034년

- 주요 동향

- 보관 기기

- 팰릿 락 시스템

- Selective racking (most common)

- Double deep racking

- Drive-in/drive-through racking

- Push back racking

- 기타

- 선반 시스템

- 정적 선반

- 이동식 선반

- 기타

- 특수 보관

- Cantilever racks (for long items)

- Multi-tier racking

- Mezzanine flooring

- Modular storage systems

- 기타

- 팰릿 락 시스템

- 핸들링 장비

- 운송

- 지게차(전기, 가스, 디젤)

- 팰릿 잭

- 핸드 트럭

- 컨베이어 시스템

- 기타

- 리프팅 기기

- Cranes

- Hoists

- Lift tables

- Scissor lifts

- 기타

- 연속 핸들링 장비

- 벨트 컨베이어

- 롤러 콘베이어

- 체인 컨베이어

- 공기압 시스템

- 운송

제6장 시장 추산·예측 : 자동화별, 2021년-2034년

- 주요 동향

- 수동

- 반자동

- 완전자동화

제7장 시장 추산·예측 : 용도별, 2021년-2034년

- 주요 동향

- 제조업

- 자동차

- 일렉트로닉스

- 식품 및 음료

- 의약품

- 화학제품

- 섬유

- 유통 및 물류

- 소매

- E-Commerce

- 기타

제8장 시장 추산·예측 : 유통 채널별, 2021년-2034년

- 주요 동향

- 직접

- 간접

제9장 시장 추산·예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카공화국

- 아랍에미리트(UAE)

- 사우디아라비아

제10장 기업 개요

- Bastian Solutions

- BEUMER Group

- Daifuku Co., Ltd.

- Dematic

- Flexcon Container

- Godrej Storage Solutions

- Honeywell Intelligrated

- Hyster-Yale Materials Handling, Inc.

- Interroll Group

- Jungheinrich AG

- Mecalux

- Raymond Corporation

- SSI Schafer

- Swisslog

- Toyota Material Handling

The Global Storage and Handling Equipment Market was valued at USD 202.1 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 331.8 billion by 2034. This momentum is driven by explosive growth in e-commerce-especially in North America, Western Europe, and emerging Southeast Asia-requiring fulfillment centers to invest in advanced solutions like high-density racks, robotic conveyors, and modular mezzanines. IoT, RFID, and telemetry systems are now nearly standard, enabling real-time inventory tracking and synchronized logistics. With warehouse operations expected to run around the clock, especially in retail, e-commerce, and automotive sectors, modern storage and handling systems-combined with automation-are transforming the warehouse model.

The integration of robotics, automated storage and retrieval systems (AS/RS), conveyor systems, guided forklifts, and autonomous mobile robots (AMRs) is revolutionizing warehouse operations. These technologies enable businesses to efficiently handle increasing order demands without proportionally increasing labor expenses. By automating repetitive tasks and optimizing material flow, companies improve accuracy, speed, and throughput. Additionally, these innovations help reduce human error, enhance safety, and maximize space utilization within facilities. As a result, businesses can maintain high service levels and scalability, even during peak periods, while keeping operational costs in check. This shift toward automation is transforming warehousing into a smarter, more responsive component of the supply chain.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $202.1 Billion |

| Forecast Value | $331.8 Billion |

| CAGR | 5.1% |

Storage equipment alone accounted for USD 140.2 billion in 2024 and is projected to reach USD 239.9 billion by 2034. Units like pallet racks, mezzanine platforms, and modular shelving are crucial for maximizing space utilization. With pallet racking holding more than half of this segment, demand is surging across industries from e-commerce to pharmaceuticals and food distribution, driven by the need for customizable solutions.

The semi-automatic segment captured a 33.2% share in 2024 and is expected to grow at 6.5% through 2034. Semi-automated solutions-such as guided forklifts, belt conveyors, and adjustable racks-hit the sweet spot by improving efficiency without the full investment of complete automation. Industry data indicates these systems are implemented in approximately 40% of mid-sized warehouses globally.

U.S. Storage and Handling Equipment Market was valued at USD 27.8 billion in 2024 and is anticipated to grow at a CAGR of 6.2% through 2034. The country's extensive e-commerce infrastructure, dense distribution networks, and thriving industrial base-driven by logistics giants and retailers-continue to fuel investment in semi-automated conveyors, high-density racks, and next-gen robotics. Growth remains steady in both warehouse modernization and food-and-beverage logistics.

Key players in the Storage and Handling Equipment Market include Interroll Group, Dematic, Toyota Material Handling, Honeywell Intelligrated, Bastian Solutions, Hyster-Yale Materials Handling, Daifuku Co., Ltd., SSI Schafer, Jungheinrich AG, Swisslog, Flexcon Container, Mecalux, BEUMER Group, Raymond Corporation, and Godrej Storage Solutions. Leading firms are focusing on modular and scalable systems that allow fast adaptation to varying inventory and seasonal peaks, targeting growth in e-commerce and retail sectors. They are integrating advanced technologies like IoT, AI-driven analytics, and robotics-especially AS/RS and AMRs-to enhance operational efficiency and reduce labor dependency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Automation

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code- 8428)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Equipment type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Storage equipment

- 5.2.1 Pallet racking systems

- 5.2.1.1 Selective racking (most common)

- 5.2.1.2 Double deep racking

- 5.2.1.3 Drive-in/drive-through racking

- 5.2.1.4 Push back racking

- 5.2.1.5 Others

- 5.2.2 Shelving systems

- 5.2.2.1 Static shelving

- 5.2.2.2 Mobile shelving

- 5.2.2.3 Others

- 5.2.3 Specialty storage

- 5.2.3.1 Cantilever racks (for long items)

- 5.2.3.2 Multi-tier racking

- 5.2.3.3 Mezzanine flooring

- 5.2.3.4 Modular storage systems

- 5.2.3.5 Others

- 5.2.1 Pallet racking systems

- 5.3 Handling equipment

- 5.3.1 Transport equipment

- 5.3.1.1 Forklifts (electric, gas, diesel)

- 5.3.1.2 Pallet jacks

- 5.3.1.3 Hand trucks

- 5.3.1.4 Conveyor systems

- 5.3.1.5 Others

- 5.3.2 Lifting equipment

- 5.3.2.1 Cranes

- 5.3.2.2 Hoists

- 5.3.2.3 Lift tables

- 5.3.2.4 Scissor lifts

- 5.3.2.5 Others

- 5.3.3 Continuous handling equipment

- 5.3.3.1 Belt conveyors

- 5.3.3.2 Roller conveyors

- 5.3.3.3 Chain conveyors

- 5.3.3.4 Pneumatic systems

- 5.3.1 Transport equipment

Chapter 6 Market Estimates & Forecast, By Automation, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automated

- 6.4 Fully automated

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manufacturing

- 7.3 Automotive

- 7.4 Electronics

- 7.5 Food and beverage

- 7.6 Pharmaceuticals

- 7.7 Chemicals

- 7.8 Textiles

- 7.9 Distribution and logistics

- 7.10 Retail

- 7.11 E-commerce

- 7.12 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 UAE

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bastian Solutions

- 10.2 BEUMER Group

- 10.3 Daifuku Co., Ltd.

- 10.4 Dematic

- 10.5 Flexcon Container

- 10.6 Godrej Storage Solutions

- 10.7 Honeywell Intelligrated

- 10.8 Hyster-Yale Materials Handling, Inc.

- 10.9 Interroll Group

- 10.10 Jungheinrich AG

- 10.11 Mecalux

- 10.12 Raymond Corporation

- 10.13 SSI Schafer

- 10.14 Swisslog

- 10.15 Toyota Material Handling