|

시장보고서

상품코드

1801818

오토바이 및 스쿠터 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Motorcycle and Scooter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

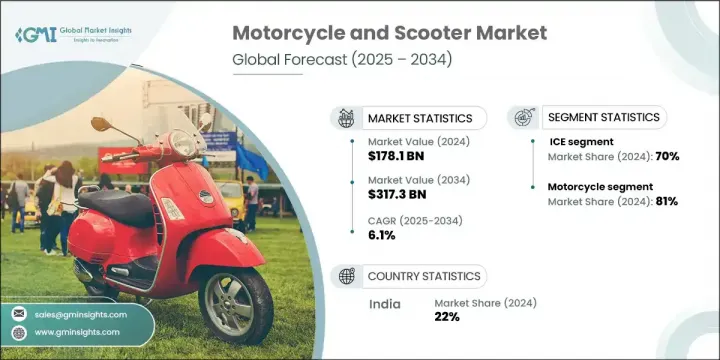

세계의 오토바이 및 스쿠터 시장 규모는 2024년에 1,781억 달러에 달하고, CAGR 6.1%로 성장할 전망이며 2034년에는 3,173억 달러에 이를 것으로 예측됩니다.

이 시장은 진화하는 도시 교통 수요, 지속가능성에 대한 인식 제고, 젊은 층의 선호도 변화로 인해 큰 변화를 겪고 있습니다. 소비자들이 환경 의식을 우선시하고 친환경 교통 수단을 지원하는 정부 인센티브의 혜택을 받으면서 전기 모델의 인기가 꾸준히 증가하고 있습니다. 도시 교통 체증과 비용 효율적이며 소형화된 이동 수단에 대한 수요가 이륜차 수요를 촉진하고 있습니다.

제조사들은 GPS, 모바일 연결성, 진단 기능 등 최근 기능을 도입하여 오토바이와 스쿠터의 매력을 높이고 있습니다. 또한 경량 구조, 세련된 미학, 인체공학적 디자인 동향이 젊은 고객층을 끌어들이고 있습니다. 차량 구독 서비스 및 라이드셰어링 옵션과 같은 새로운 비즈니스 모델이 대도시 지역에서 개인 이동 수단 접근 방식을 서서히 변화시키고 있습니다. 애프터마켓도 라이더 맞춤형 커스터마이징, 성능 업그레이드, 안전성 강화 부품에 대한 수요 증가와 함께 진화하며 이륜차 부문에 대한 소비자 참여를 더욱 촉진하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 1,781억 달러 |

| 예측 금액 | 3,173억 달러 |

| CAGR | 6.1% |

2024년 내연기관(ICE) 모델은 약 70%의 시장 점유율을 차지했으며, 2025년부터 2034년까지 연평균 5% 이상의 성장률을 보이면서 확대될 것으로 전망됩니다. 전기 이륜차의 인기가 꾸준히 상승하고 있지만, 많은 라이더들은 여전히 전통적인 가솔린 차량을 선호합니다. 광범위한 연료 공급 인프라, 확립된 기계적 신뢰성, 장거리 주행에 적합한 우수한 주행 거리는 ICE 차량이 전 세계 판매량을 계속 주도하는 주요 이유입니다. 기존 엔진의 성장세는 현재로서는 전 세계 많은 소비자의 기대를 계속 충족시키고 있음을 보여줍니다.

2024년 오토바이는 81%의 점유율로 주요 제품 부문을 유지했습니다. 이 부문은 2034년까지 연평균 6%의 성장률을 보일 것으로 예상됩니다. 특히 신흥 경제국을 비롯한 수많은 전 세계 지역에서 오토바이는 일상 교통수단으로서 가장 실용적이고 경제적인 수단입니다. 100cc에서 250cc 사이의 표준 엔진 용량을 가진 이 바이크들은 수백만 통근자들에게 필수적인 이동 수단 역할을 합니다. 전 세계 생산량의 상당 부분은 아시아태평양 지역에서 발생하며, 여기서 경제성과 기능적 실용성이 주요 구매 요인으로 작용합니다.

인도의 오토바이 및 스쿠터 시장은 22%의 점유율을 차지했으며 2024년에는 296억 달러 규모를 기록했습니다. 전 세계 최대 오토바이 생산국인 인도는 전 세계 이륜차 생산량의 약 15-20%를 차지하며, 2024 회계연도 기준 약 2,800만 대를 생산했습니다. 오토바이가 레저나 고급 수단으로 활용되는 성숙 시장과 달리, 인도 소비자들은 일상적인 이동 수단으로 의존합니다. 여기서 구매 결정은 비용 효율성, 연비, 유지보수 용이성, 일상적 신뢰성 등의 고려사항에 의해 좌우됩니다.

세계의 오토바이 및 스쿠터 시장을 형성하는 주요 기업으로는 Classic Legends, Hero, TVS, Piaggio, Yamaha, Suzuki, Honda, Bajaj Motorcycles, OLA, ATHER 등이 있습니다. 오토바이 및 스쿠터 업계의 주요 제조사들은 혁신, 현지화, 제품 다각화에 집중함으로써 시장 입지를 강화하고 있습니다. 지속가능성 목표와 청정 이동 수단에 대한 소비자 관심 증가에 부응하기 위해 전기차 포트폴리오를 확대되고 있습니다. 스마트 연결 기능과 안전 기술에 대한 투자는 사용자 경험 향상과 브랜드 차별화에 기여하고 있습니다. 많은 기업들이 물류 비용 절감과 현지 수요 효율적 충족을 위해 지역별 생산 거점을 구축하며 내수 및 수출 시장 점유율을 강화하고 있습니다. 기술 기업 및 모빌리티 플랫폼과의 파트너십은 구독 모델과 공유 모빌리티 솔루션을 통해 새로운 수익원을 창출하고 있습니다.

목차

제1장 조사 방법

- 시장의 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 소스

- 세계

- 지역/국가

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측 모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률 분석

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 도시화와 교통 정체

- 전자상거래와 라스트 마일 배송 확대

- 연료 가격 상승

- 전동 이륜차의 급속한 보급

- 아시아 중산층 인구 증가

- 업계의 잠재적 위험 및 과제

- 안전 문제 및 사고율 증가

- 부족한 충전 인프라

- 공급망 혼란

- 원자재 비용 상승

- 시장 기회

- 전기화 및 전기차 보급률

- 커넥티드 및 스마트 모빌리티 솔루션

- 구독 및 리스 모델

- 아프리카와 동남아시아 시장 확대

- 배송 플랫폼과 전략적 파트너십

- 오토바이 및 스쿠터 시장 발전

- 시장 개척과 성숙도 분석

- 기존 모빌리티 솔루션에서 최신 모빌리티 솔루션으로 전환

- 이륜차 부문의 기술 채택 라이프사이클

- 시장 통합 및 산업 재편 동향

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- Porter's Five Forces 분석

- PESTEL 분석

- 기술 혁신과 고급 기능

- 오토바이 ADAS 및 안전 기술 통합

- 커넥티드 오토바이 솔루션과 IoT 통합

- 고급 파워트레인 기술

- 자율 및 반자율 기능의 개발

- 오토바이 및 스쿠터 시장 변환

- 전동 이륜차 기술 진화

- 배터리 기술과 항속 거리 최적화

- 충전 인프라 개발 및 접근성

- 정부 인센티브와 정책지원 분석

- 소비자 행동과 시장의 기호

- 인구 통계 프로필 및 타겟 고객 분석

- 구매 결정 요인과 구매 프로세스

- 사용 패턴과 이동 행동

- 브랜드 충성도 및 전환 패턴

- 가격 민감도 및 가치 인식 분석

- 특허 상황

- 가격 동향

- 국가별

- 제품별

- 코스트 내역 분석

- 생산 통계

- 수입과 수출

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 감축 전략

- 생산 에너지 효율

- 환경 친화적 노력

- 탄소발자국의 고려

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추정 및 예측 : 제품별(2021-2034년)

- 주요 동향

- 오토바이

- 크루저 오토바이

- 스포츠 오토바이

- 투어링 오토바이

- 표준/네이키드 오토바이

- 어드벤처/듀얼 스포츠 오토바이

- 오프로드/다트 오토바이

- 스쿠터

- 기존 가솔린 스쿠터

- 전기 스쿠터

- 맥시 스쿠터

- 모펫형 스쿠터

제6장 시장 추정 및 예측 : 추진별(2021-2034년)

- 주요 동향

- 내연기관(ICE)

- 전기자동차(EV)

제7장 시장 추정 및 예측 : 배기량별(2021-2034년)

- 주요 동향

- 250cc 미만

- 250-500cc

- 500cc-1000cc

- 1000cc 초과

제8장 시장 추정 및 예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 오프라인

- 온라인

제9장 시장 추정 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 개인

- 상업

제10장 시장 추정 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- Global Two-Wheeler OEMs

- Bajaj

- Hero

- Honda

- Piaggio

- Suzuki

- TVS

- Yamaha

- Premium Motorcycle Brands

- BMW Motorrad

- Ducati

- Harley-Davidson

- KTM

- Royal Enfield

- Kawasaki

- Electric Two-Wheeler Manufacturers

- Ather

- Ola Electric

- Revolt

- Ultraviolette

- Yadea

- Zero Motorcycles

- Niu Technologies

- Component and System Suppliers

- Bosch

- Brembo

- Continental

- Nissin

- ZF

- Connected Mobility and Software Providers

- MapmyIndia

- Ride Vision

- Sibros

- TomTom

- Vahan

The Global Motorcycle and Scooter Market was valued at USD 178.1 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 317.3 billion by 2034. This market is undergoing major changes due to evolving urban transportation needs, rising awareness around sustainability, and shifting preferences among younger demographics. Electric variants are gaining steady traction as consumers prioritize environmental consciousness and benefit from government incentives supporting green transportation. Urban congestion and the need for cost-efficient, compact mobility options are fueling demand for two-wheelers.

Manufacturers are enhancing the appeal of motorcycles and scooters by incorporating modern features such as GPS, mobile connectivity, and diagnostic capabilities. Additionally, trends in lightweight construction, sleek aesthetics, and ergonomic design are drawing in a younger customer base. New business models like vehicle subscription services and ridesharing options are slowly reshaping how people access personal mobility in metropolitan areas. The aftermarket is also evolving, with increasing demand for rider-specific customization, performance upgrades, and enhanced safety components, and further driving consumer engagement with the two-wheeler segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $178.1 Billion |

| Forecast Value | $317.3 Billion |

| CAGR | 6.1% |

In 2024, internal combustion engine (ICE) models held approximately 70% market share and are forecast to expand at a CAGR of over 5% from 2025 to 2034. While electric two-wheelers are steadily rising in popularity, traditional petrol-powered vehicles remain the preferred choice among many riders. The widespread availability of fueling infrastructure, well-established mechanical reliability, and superior range for longer rides are key reasons ICE vehicles continue to dominate global sales volumes. The momentum behind conventional engines demonstrates that, for now, they continue to meet the expectations of many consumers worldwide.

Motorcycles remained the leading product category in 2024, accounting for 81% share. This segment is expected to grow at a CAGR of 6% through 2034. In numerous global regions, particularly in emerging economies, motorcycles represent the most practical and economical means of daily transportation. With standard engine capacities ranging between 100cc and 250cc, these bikes serve as essential mobility tools for millions of commuters. A large share of global production originates from the Asia Pacific, where affordability and functional utility are major purchasing factors.

India Motorcycle and Scooter Market held 22% share and generated USD 29.6 billion in 2024. As the top global manufacturer of motorcycles, India contributes roughly 15-20% of worldwide two-wheeler production, with approximately 28 million units built in FY 2024. Unlike in mature markets, where motorcycles often serve recreational or luxury roles, Indian consumers rely on them for everyday use. Here, critical buying decisions are shaped by considerations like cost-efficiency, mileage, ease of maintenance, and day-to-day reliability.

Leading players shaping the Global Motorcycle and Scooter Market include Classic Legends, Hero, TVS, Piaggio, Yamaha, Suzuki, Honda, Bajaj Motorcycles, OLA, and ATHER. Top manufacturers in the motorcycle and scooter industry are reinforcing their market position by focusing on innovation, localization, and product diversification. They are expanding their electric vehicle portfolios to align with sustainability goals and growing consumer interest in cleaner mobility. Investment in smart connectivity features and safety technology is helping brands enhance user experience and brand differentiation. Many are strengthening their domestic and export footprints by establishing regional manufacturing hubs to reduce logistics costs and meet local demand efficiently. Partnerships with tech firms and mobility platforms are creating new revenue streams through subscription models and shared mobility solutions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Propulsion

- 2.2.4 Engine Displacement

- 2.2.5 Distribution Channel

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising urbanization and traffic congestion

- 3.2.1.2 Expansion of e-commerce and last-mile delivery

- 3.2.1.3 Increasing fuel prices

- 3.2.1.4 Rapid adoption of electric two-wheelers

- 3.2.1.5 Growing middle-class population in Asia

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Safety concerns and rising accident rates

- 3.2.2.2 Inadequate charging infrastructure

- 3.2.2.3 Supply chain disruptions

- 3.2.2.4 Rising raw material costs

- 3.2.3 Market opportunities

- 3.2.3.1 Electrification and EV penetration

- 3.2.3.2 Connected and smart mobility solutions

- 3.2.3.3 Subscription and leasing models

- 3.2.3.4 Market expansion in Africa and Southeast Asia

- 3.2.3.5 Strategic partnerships with delivery platforms

- 3.2.4 Motorcycle and scooter market evolution

- 3.2.4.1 Historical market development and maturity analysis

- 3.2.4.2 Transition from traditional to modern mobility solutions

- 3.2.4.3 Technology adoption lifecycle in two-wheeler segment

- 3.2.4.4 Market consolidation and industry restructuring trends

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology innovation and advanced features

- 3.7.1 Motorcycle ADAS and safety technology integration

- 3.7.2 Connected motorcycle solutions and iot integration

- 3.7.3 Advanced powertrain technologies

- 3.7.4 Autonomous and semi-autonomous features development

- 3.8 Electric motorcycle and scooter market transformation

- 3.8.1 Electric two-wheeler technology evolution

- 3.8.2 Battery technology and range optimization

- 3.8.3 Charging infrastructure development and accessibility

- 3.8.4 Government incentives and policy support analysis

- 3.9 Consumer behavior and market preferences

- 3.9.1 Demographic profile and target customer analysis

- 3.9.2 Purchase decision factors and buying journey

- 3.9.3 Usage patterns and mobility behavior

- 3.9.4 Brand loyalty and switching patterns

- 3.9.5 Price sensitivity and value perception analysis

- 3.10 Patent landscape

- 3.11 Price trend

- 3.11.1 By country

- 3.11.2 By product

- 3.12 Cost breakdown analysis

- 3.13 Production statistics

- 3.13.1 Import and export

- 3.13.2 Major import countries

- 3.13.3 Major export countries

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly Initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Motorcycles

- 5.2.1 Cruiser motorcycles

- 5.2.2 Sport motorcycles

- 5.2.3 Touring motorcycles

- 5.2.4 Standard/naked motorcycles

- 5.2.5 Adventure/dual-sport motorcycles

- 5.2.6 Off-road/dirt motorcycles

- 5.3 Scooters

- 5.3.1 Traditional gasoline scooters

- 5.3.2 Electric scooters

- 5.3.3 Maxi scooters

- 5.3.4 Moped-style scooters

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Internal combustion engine (ICE)

- 6.3 Electric vehicles (EVs)

Chapter 7 Market Estimates & Forecast, By Engine Displacement, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Under 250cc

- 7.3 250cc-500cc

- 7.4 500cc-1000cc

- 7.5 Above 1000cc

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Offline

- 8.3 Online

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Personal

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Two-Wheeler OEMs

- 11.1.1 Bajaj

- 11.1.2 Hero

- 11.1.3 Honda

- 11.1.4 Piaggio

- 11.1.5 Suzuki

- 11.1.6 TVS

- 11.1.7 Yamaha

- 11.2 Premium Motorcycle Brands

- 11.2.1 BMW Motorrad

- 11.2.2 Ducati

- 11.2.3 Harley-Davidson

- 11.2.4 KTM

- 11.2.5 Royal Enfield

- 11.2.6 Kawasaki

- 11.3 Electric Two-Wheeler Manufacturers

- 11.3.1 Ather

- 11.3.2 Ola Electric

- 11.3.3 Revolt

- 11.3.4 Ultraviolette

- 11.3.5 Yadea

- 11.3.6 Zero Motorcycles

- 11.3.7 Niu Technologies

- 11.4 Component and System Suppliers

- 11.4.1 Bosch

- 11.4.2 Brembo

- 11.4.3 Continental

- 11.4.4 Nissin

- 11.4.5 ZF

- 11.5 Connected Mobility and Software Providers

- 11.5.1 MapmyIndia

- 11.5.2 Ride Vision

- 11.5.3 Sibros

- 11.5.4 TomTom

- 11.5.5 Vahan