|

시장보고서

상품코드

1822651

비디오 텔레매틱스 시장 : 기회, 촉진요인, 업계 동향 분석 및 예측(2025-2034년)Video Telematics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

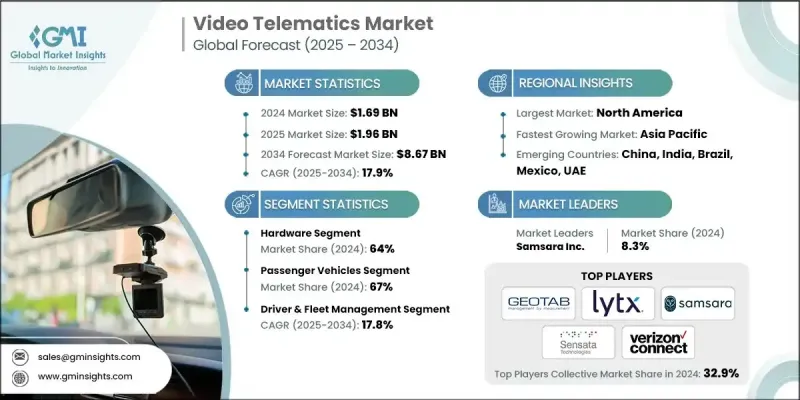

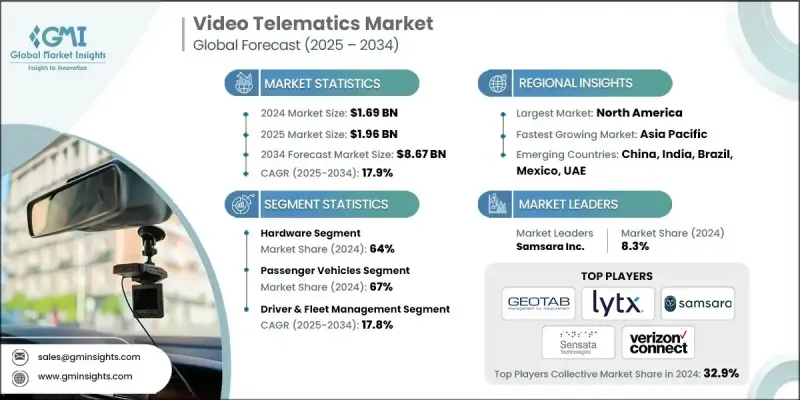

Global Market Insights Inc.가 발행한 최신 보고서에 따르면 세계의 비디오 텔레매틱스 시장은 2024년에 16억 9,000만 달러로 평가되었고, CAGR은 17.9%를 나타낼 것으로 예측되며 2025년 19억 6,000만 달러에서 2034년에 86억 7,000만 달러로 성장할 전망입니다.

미국의 ELD(전자 기록 장치) 의무화 및 기타 전 세계 안전 기준과 같은 규제로 인해 차량 관리자들은 법적 규정 준수 및 보고 정확성을 보장하기 위해 통합 비디오 및 텔레매틱스 솔루션을 채택하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시장 규모 | 16억 9,000만 달러 |

| 예측 금액 | 86억 7,000만 달러 |

| CAGR | 17.9% |

하드웨어 채택 증가

하드웨어 부문은 대시캠, 실내 카메라, DVR, 센서 지원 액세서리 등의 장치에 의해 2024년에 상당한 점유율을 기록했습니다. 차량 운영사들이 안전 및 규정 준수를 위해 실시간 시각적 인사이트를 점점 더 우선시함에 따라, 견고하고 고해상도이며 AI가 통합된 하드웨어에 대한 수요가 계속 증가하고 있습니다. 제조업체들은 승용차부터 장거리 트럭에 이르기까지 다양한 차량 유형을 뒷받침하기 위해 장치 내구성, 연결성 및 설치 용이성 개선에 주력하고 있습니다.

승용차 수요 증가

승용차 부문은 개인 안전, 보험 할인, 도난 방지에 대한 수요 증가에 의해 촉진되어, 2025-2034년 동안 강력한 성장을 보일 것입니다. 차량 호출 서비스, 회사 차량 플릿, 심지어 개인 소비자들까지 실시간 경고, 운전자 행동 추적, 사고 기록 기능을 제공하는 지능형 블랙박스를 차량에 장착할 것입니다. 기술에 익숙한 이 고객층을 사로잡기 위해 기업들은 눈에 띄지 않고 사용자 친화적이며 모바일 앱과 호환되는 맞춤형 솔루션을 개발하고 있습니다.

운전자 및 차량 관리 시장 확대

운전자 및 차량 관리 부문은 2024년 상당한 시장 점유율을 기록했으며, 이는 운전자의 행동 모니터링, 연비 개선, 운영 위험 감축에 대한 기업의 필요성에 촉진된 결과입니다. GPS, 가속도계, AI 기반 분석과 결합된 실시간 영상은 차량 관리자가 피로, 주의 산만 운전, 급제동, 경로 이탈을 감지할 수 있게 합니다. 이 데이터 중심 접근법은 관리자가 운전자 코칭을 효과적으로 수행하는 동시에 경로 및 정비 스케줄링을 최적화할 수 있도록 지원합니다. 클라우드 통합 및 실시간 의사 결정 분야의 지속적인 혁신으로 산업 전반에 걸쳐 도입이 확대되며, 해당 부문은 30억 달러를 넘어설 전망입니다.

지역별 인사이트

북미가 추진력이 있는 지역으로 상승

북미의 비디오 텔레매틱스 시장은 엄격한 차량 안전 규정, 상용차 도입 증가, 운전자 책임 의식 고조로 2024년 강력한 점유율을 기록했습니다. 미국 단독으로도 시장 매출의 상당한 부분을 기록하며 물류, 현장 서비스, 여객 운송, 공공 부문 차량에 걸쳐 도입이 확산되고 있습니다. 견고한 인프라와 높은 기술 보급률은 북미를 비디오 텔레매틱스 용도의 지속적인 혁신과 확장에 유리한 환경으로 만듭니다.

비디오 텔레매틱스 시장의 주요 기업은 Trimble Transportation(Trimble Inc.), Nauto, Verizon Connect(Verizon Communications Inc.), VisionTrack, Lytx, Geotab, SmartWitness(Sensata Technologies), MiX Telematics, Samsara, Netradyne입니다.

비디오 텔레매틱스 시장 기업들은 입지를 공고히 하기 위해 인공지능 기반 혁신, 전략적 파트너십, 수직 산업별 맞춤형 솔루션에 주력하고 있습니다. 시장 선도 기업들은 인공지능을 적용해 실시간 운전자 코칭, 자동화된 사고 감지, 예측 유지보수 인사이트를 구현하고 있습니다. 보험사, 차량 리스 업체, 물류 제공업체와의 협력을 통해 고객 기반을 확대되고 서비스 통합성이 개선되고 있습니다.

목차

제1장 조사 방법

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- GMI 독자적인 AI 시스템

- AI를 활용한 조사 강화

- 출처 일관성 프로토콜

- AI의 정밀도 지표

- 예측 모델

- 1차 조사와 검증

- 시장 예측의 주요 동향

- 정량화된 시장 영향 분석

- 성장 파라미터 예측에 대한 수학적 영향

- 시나리오 분석 프레임워크

- 1차 정보의 일부(단, 이에 국한되지 않음)

- 데이터 마이닝 출처

- 2차

- 유료 출처

- 공개 출처

- 지역별 출처

- 2차

- 조사의 궤적과 신뢰도 점수

- 연구 추적 컴포넌트

- 스코어링 컴포넌트

- 조사의 투명성에 관한 보충

- 출처 기여 프레임워크

- 품질 보증 지표

- 신뢰에 대한 헌신

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률 분석

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 증가하는 사고율이 모니터링 솔루션 도입을 촉진

- 정부는 전자 기록 및 안전 조치를 의무화

- 보험과 사기 방지

- 차량 운영사는 경로 및 연료 최적화를 통해 비용 절감을 목표

- AI, IoT 및 클라우드가 비디오 텔레매틱스 기능을 향상

- 업계의 잠재적 위험 및 과제

- 높은 도입 비용

- 데이터 프라이버시 및 보안에 대한 우려

- 시장 기회

- 확대하는 전자상거래와 물류 수요

- AI와 고급 분석 통합

- 신흥 시장 진출

- 보험 텔레매틱스 프로그램

- 성장 촉진요인

- 기술과 혁신 상황

- 하드웨어 컴포넌트와 카메라 시스템

- 다중 카메라 구성 및 배치

- 이미지 센서 기술과 해상도

- 저장 및 데이터 관리 시스템

- 접속 및 통신 모듈

- 소프트웨어 플랫폼 및 분석 엔진

- 실시간 비디오 처리 알고리즘

- AI와 머신러닝의 통합

- 이벤트 검출 및 분류

- 운전자 행동 분석 및 점수화

- 클라우드 인프라 및 데이터 관리

- 동영상 저장 및 검색 시스템

- 엣지 컴퓨팅 및 로컬 처리

- 데이터 압축 및 대역폭 최적화

- API 통합 및 타사 연결

- 사용자 인터페이스 및 대시보드 시스템

- 플릿 매니저 대시보드 및 보고서

- 드라이버용 모바일 애플리케이션

- 실시간 경고 및 알림 시스템

- 하드웨어 컴포넌트와 카메라 시스템

- 성장 가능성 분석

- 규제 상황

- 전 세계 개인정보 보호 및 데이터 보호 프레임워크

- 운송 및 차량 안전 규정

- 보험 및 리스크 관리 규제

- 사이버 보안 및 데이터 보안 기준

- Porter's Five Forces 분석

- PESTEL 분석

- 기술 동향과 혁신

- 인공지능 및 머신 러닝 발전

- 컴퓨터 비전 및 객체 인식

- 음성 분석을 위한 자연어 처리

- 예측 모델링 및 위험 평가

- 엣지 컴퓨팅과 실시간 처리

- 기기 내 AI 처리 능력

- 지연 시간 및 대역폭 요구 사항을 감축

- 오프라인 조작과 데이터 동기화

- 고급 카메라와 센서 기술

- 4K 및 초고화질 비디오

- 야간 투시 및 저조도 성능

- 360도 및 다각도 커버

- IoT 및 커넥티드카 에코시스템과의 통합

- 차량 간 통신(V2X)

- 스마트 인프라 통합

- 커넥티드 차량 생태계 개발

- 인공지능 및 머신 러닝 발전

- 특허 분석

- 이용 사례

- 최상의 시나리오

- 소비자 행동 분석

- 비용 편익 분석과 ROI 프레임워크

- 총소유비용(TCO) 분석

- 투자수익률(ROI) 모델

- 구현 및 전개 비용 분석

- 업계별 재무 영향 평가

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 감축 전략

- 생산 과정의 에너지 효율성

- 환경 친화적인 노력

- 탄소발자국의 고려

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 새로운 경쟁 위협

- 신규 시장 참가자

- 기술 혁신 업체

- 대체 비즈니스 모델

- 경쟁 정보 프레임워크

- 주요 뉴스와 대처

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

- 시장 진입 장벽과 경쟁상의 해자

- 기술과 지적재산 보호

- 고객 전환 비용과 록인

- 규모와 네트워크 효과

제5장 시장 추계 및 예측 : 컴포넌트별(2021-2034년)

- 주요 동향

- 하드웨어

- 대시캠

- GPS 추적 장치

- 센서

- 온보드 진단(OBD) 디바이스

- 소프트웨어

- 비디오 분석 및 AI 처리 소프트웨어

- 플릿 관리 및 대시보드 플랫폼

- 통합 및 API 소프트웨어

- 서비스

- 설치 서비스

- 유지보수 및 지원 서비스

- 관리형 서비스

- 컨설팅 서비스

제6장 시장 추계 및 예측 : 기술별(2021-2034년)

- 주요 동향

- 임베디드 시스템

- 연결된 시스템

- 독립형 시스템

제7장 시장 추계 및 예측 : 차량별(2021-2034년)

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(HCV)

- 대형 상용차(HCV)

- 특수 차량 및 긴급 차량

제8장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 운전자와 차량 관리

- 예측 유지보수

- 보험 텔레매틱스

- 자산 추적

- 법 집행 기관

제9장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 운송 및 물류

- 건설 및 인프라

- 헬스케어

- 소매 및 소비자 서비스

- 정부 및 공공 안전

- 에너지 및 유틸리티

제10장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- 세계 리더

- Geotab

- Lytx

- Samsara

- Trimble

- Verizon Communications

- Motive Technologies(formerly KeepTruckin)

- Azuga

- Webfleet Solutions

- Teletrac Navman

- 지역 기업

- Fleet Complete

- MiX Telematics

- Sensata Technologies

- Quartix Technologies

- SureCam Limited

- VisionTrack

- 신흥 기업, 혁신 기업

- AT&T

- FleetCam

- LightMetrics

- Nauto

- Netradyne

- One Step GPS

The global video telematics market was estimated at USD 1.69 billion in 2024 and is expected to grow from USD 1.96 billion in 2025 to USD 8.67 billion by 2034, at a CAGR of 17.9%, according to the latest report published by Global Market Insights Inc.

Regulations such as the ELD (Electronic Logging Device) mandate in the U.S. and other global safety standards are pushing fleet managers to adopt integrated video and telematics solutions to ensure legal compliance and reporting accuracy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.69 Billion |

| Forecast Value | $8.67 Billion |

| CAGR | 17.9% |

Rising Adoption in Hardware

The hardware segment held a notable share in 2024, driven by devices such as dashcams, in-cabin cameras, DVRs, and sensor-enabled accessories. As fleet operators increasingly prioritize real-time visual insights for safety and compliance, the demand for rugged, high-resolution, and AI-integrated hardware continues to rise. Manufacturers are focusing on improving device durability, connectivity, and ease of installation to support diverse vehicle types, from passenger cars to long-haul trucks.

Growing Demand in Passenger Vehicles

The passenger vehicles segment will witness strong growth during 2025-2034, driven by the rising demand for personal safety, insurance discounts, and theft prevention. Ride-hailing services, company car fleets, and even private consumers are equipping vehicles with intelligent dashcams that offer real-time alerts, driver behavior tracking, and accident recording capabilities. Companies tailoring solutions to be discreet, user-friendly, and compatible with mobile apps to appeal to this tech-savvy demographic.

Driver & Fleet Management to Gain Traction

The driver & fleet management segment generated a notable share in 2024, driven by the organizations ' need to monitor driver behavior, improve fuel efficiency, and reduce operational risk. Real-time video combined with GPS, accelerometers, and AI-powered analytics allows fleet managers to detect fatigue, distracted driving, harsh braking, and route deviations. This data-rich approach empowers managers to coach drivers effectively while optimizing routes and maintenance schedules. The segment is on track to exceed USD 3 billion, with continuous innovations in cloud integration and real-time decision-making driving adoption across industries.

Regional Insights

North America to Emerge as a Propelling Region

North America video telematics market held a robust share in 2024, driven by stringent fleet safety regulations, rising commercial vehicle adoption, and increasing awareness around driver accountability. The U.S. alone is responsible for a significant portion of market revenue, with adoption spanning logistics, field services, passenger transport, and public sector fleets. Robust infrastructure and high technology penetration make North America a favorable environment for continuous innovation and expansion in video telematics applications.

Major players in the video telematics market are Trimble Transportation (Trimble Inc.), Nauto, Verizon Connect (Verizon Communications Inc.), VisionTrack, Lytx, Geotab, SmartWitness (Sensata Technologies), MiX Telematics, Samsara, and Netradyne.

To solidify their presence, companies in the video telematics market are focusing on AI-driven innovation, strategic partnerships, and vertical-specific solutions. Market leaders are embedding artificial intelligence to enable real-time driver coaching, automated incident detection, and predictive maintenance insights. Collaborations with insurance firms, fleet leasing companies, and logistics providers help expand customer bases and improve service integration.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.1.6 GMI proprietary AI system

- 1.1.6.1 AI-Powered research enhancement

- 1.1.6.2 Source consistency protocol

- 1.1.6.3 AI accuracy metrics

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components:

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Technology

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing accident rates drive adoption of monitoring solutions.

- 3.2.1.2 Governments mandate electronic logging and safety measures.

- 3.2.1.3 Insurance & Fraud Prevention

- 3.2.1.4 Fleets aim to cut costs through route and fuel optimization.

- 3.2.1.5 AI, IoT, and cloud enhance video telematics capabilities.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Implementation Costs

- 3.2.2.2 Data Privacy & Security Concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Growing E-commerce & Logistics Demand

- 3.2.3.2 AI & Advanced Analytics Integration

- 3.2.3.3 Expansion in Emerging Markets

- 3.2.3.4 Insurance Telematics Programs

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.3.1 Hardware components and camera systems

- 3.3.1.1 Multi-camera configuration and placement

- 3.3.1.2 Image sensor technology and resolution

- 3.3.1.3 Storage and data management systems

- 3.3.1.4 Connectivity and communication modules

- 3.3.2 Software platform and analytics engine

- 3.3.2.1 Real-time video processing algorithms

- 3.3.2.2 AI and machine learning integration

- 3.3.2.3 Event detection and classification

- 3.3.2.4 Driver behavior analysis and scoring

- 3.3.3 Cloud infrastructure and data management

- 3.3.3.1 Video storage and retrieval systems

- 3.3.3.2 Edge computing and local processing

- 3.3.3.3 Data compression and bandwidth optimization

- 3.3.3.4 API integration and third-party connectivity

- 3.3.4 User interface and dashboard systems

- 3.3.4.1 Fleet manager dashboard and reporting

- 3.3.4.2 Driver mobile applications

- 3.3.4.3 Real-time alert and notification systems

- 3.3.1 Hardware components and camera systems

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Global privacy and data protection framework

- 3.5.2 Transportation and fleet safety regulations

- 3.5.3 Insurance and risk management regulations

- 3.5.4 Cybersecurity and data security standards

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology trends and innovations

- 3.8.1 Artificial intelligence and machine learning advancement

- 3.8.1.1 Computer vision and object recognition

- 3.8.1.2 Natural language processing for voice analysis

- 3.8.1.3 Predictive modeling and risk assessment

- 3.8.2 Edge computing and real-time processing

- 3.8.2.1 On-device AI processing capabilities

- 3.8.2.2 Reduced latency and bandwidth requirements

- 3.8.2.3 Offline operation and data synchronization

- 3.8.3 Advanced camera and sensor technology

- 3.8.3.1 4K and ultra-high definition video

- 3.8.3.2 Night vision and low-light performance

- 3.8.3.3 360-degree and multi-angle coverage

- 3.8.4 Integration with IoT and connected vehicle ecosystem

- 3.8.4.1 Vehicle-to-everything (V2X) communication

- 3.8.4.2 Smart infrastructure integration

- 3.8.4.3 Connected fleet ecosystem development

- 3.8.1 Artificial intelligence and machine learning advancement

- 3.9 Patent analysis

- 3.10 Use cases

- 3.11 Best-case scenario

- 3.12 Consumer behaviour analysis

- 3.13 Cost-benefit analysis and ROI framework

- 3.13.1 Total cost of ownership (TCO) analysis

- 3.13.2 Return on investment (ROI) models

- 3.13.3 Implementation and deployment cost analysis

- 3.13.4 Financial impact assessment by industry vertical

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Emerging competitive threats

- 4.6.1 New market entrants

- 4.6.2 Technology disruptors

- 4.6.3 Alternative business models

- 4.6.4 Competitive intelligence framework

- 4.7 Key news and initiatives

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans and funding

- 4.8 Market entry barriers and competitive moats

- 4.8.1 Technology and IP protection

- 4.8.2 Customer switching costs and lock-in

- 4.8.3 Scale and network effects

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Dash cams

- 5.2.2 GPS tracking devices

- 5.2.3 Sensors

- 5.2.4 Onboard diagnostics (OBD) devices

- 5.3 Software

- 5.3.1 Video analytics and AI processing software

- 5.3.2 Fleet management and dashboard platforms

- 5.3.3 Integration and API software

- 5.4 Services

- 5.4.1 Installation services

- 5.4.2 Maintenance & support services

- 5.4.3 Managed services

- 5.4.4 Consulting services

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Embedded systems

- 6.3 Connected systems

- 6.4 Standalone systems

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCVs)

- 7.3.2 Medium commercial vehicles (HCVs)

- 7.3.3 Heavy commercial vehicles (HCVs)

- 7.4 Specialty and emergency vehicles

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Driver & fleet management

- 8.3 Predictive maintenance

- 8.4 Insurance telematics

- 8.5 Asset tracking

- 8.6 Law enforcement

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Transportation & logistics

- 9.3 Construction and infrastructure

- 9.4 Healthcare

- 9.5 Retail and consumer services

- 9.6 Government & public safety

- 9.7 Energy and utilities

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1.1 Global Leaders

- 11.1.1.1 Geotab

- 11.1.1.2 Lytx

- 11.1.1.3 Samsara

- 11.1.1.4 Trimble

- 11.1.1.5 Verizon Communications

- 11.1.1.6 Motive Technologies (formerly KeepTruckin)

- 11.1.1.7 Azuga

- 11.1.1.8 Webfleet Solutions (Bridgestone)

- 11.1.1.9 Teletrac Navman

- 11.1.2 Regional Players / Champions

- 11.1.2.1 Fleet Complete

- 11.1.2.2 MiX Telematics

- 11.1.2.3 Sensata Technologies

- 11.1.2.4 Quartix Technologies

- 11.1.2.5 SureCam Limited

- 11.1.2.6 VisionTrack

- 11.1.3 Emerging Players / Disruptors

- 11.1.3.1 AT&T

- 11.1.3.2 FleetCam

- 11.1.3.3 LightMetrics

- 11.1.3.4 Nauto

- 11.1.3.5 Netradyne

- 11.1.3.6 One Step GPS