|

시장보고서

상품코드

1911377

비디오 텔레매틱스 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2026-2031년)Video Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

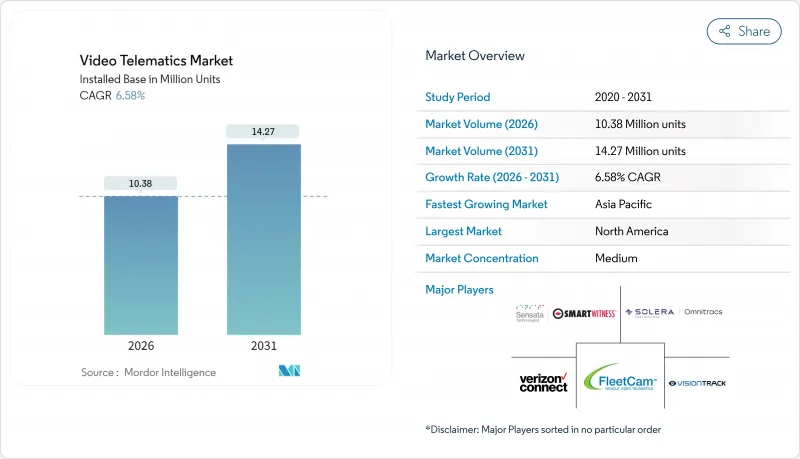

비디오 텔레매틱스 시장은 2025년 974만 달러에서 2026년 1,038만 달러로 성장할 것으로 보입니다. 2026-2031년의 연평균 복합 성장률(CAGR) 6.58%로 성장할 것으로 전망되며, 2031년까지 1,427만 달러에 이를 것으로 예측됩니다.

유럽의 의무화된 ADAS 및 운전자 모니터링 규정, 하락하는 에지 AI 하드웨어 비용, 증가하는 보험 인센티브가 상업용 차량 군 전체에 걸친 채택을 가속화하고 있습니다. 북미의 성장은 보험사가 비디오로 검증된 운전 행동에 보험료 할인을 연계함에 따라 여전히 보험 중심인 반면, 아시아의 수요는 급속한 전기화 및 스마트 시티 프로그램에 힘입고 있습니다. GPS, 진단, AI 영상을 통합한 플랫폼이 차량 관리 업체들이 분산된 시스템을 교체함에 따라 전면에 부상하고 있으며, 이러한 융합은 일회성 하드웨어 판매에서 클라우드 분석과 연계된 구독 수익으로의 전환을 촉진하고 있습니다. Powerfleet의 Fleet Complete 인수와 같은 전략적 인수합병은 영상, 데이터, 차량 관리를 단일 플랫폼에 통합하려는 경쟁적 경쟁을 강조합니다.

세계의 비디오 텔레매틱스 시장 동향 및 인사이트

운전자 모니터링 및 ADAS 데이터 기록에 대한 규제 요건

유럽연합(EU)은 2024년 7월 GSR2를 시행하여 신차 인증 시 지능형 속도 보조, 자율 긴급 제동, 운전자 졸음 감지 기능을 의무화했습니다. 유엔 유럽경제위원회(UNECE)가 발표한 유사 규제는 아시아와 미주 지역에서도 조화를 촉구하고 있습니다. 보험사들은 이제 책임 확인을 위해 영상으로 검증된 ADAS 데이터를 요구하며, 대시캠을 선택적 도구에서 규정 준수 필수품으로 전환시키고 있습니다. 지속적인 운전자 주의력 분산 경고 요구사항은 차량 관리 업체들이 텔레매틱스 대시보드와 연동되는 다중 카메라 설치로 전환하도록 촉진합니다. 지역별 전개이 확대됨에 따라 즉시 사용 가능한 규정 준수 패키지를 제공하는 업체들이 선점 효과를 얻고 있습니다. 이 연쇄 효과는 애프터마켓 개조 시장까지 확대됩니다. 혼합 연령 차량을 보유한 업체들은 화주 및 물류 중개업체와의 계약 조건을 충족하기 위해 기존 차량을 개조해야 하기 때문입니다.

차량 텔레매틱스 통합 영상 솔루션의 확산

차량 관리자들은 과거 위치 추적, 정비 일정 관리, 영상 안전 기능을 별도 계약으로 운영했습니다. 통합 영상 텔레매틱스 플랫폼은 이제 단일 구독으로 이러한 기능을 묶어 업무 흐름을 간소화하고 속도, 위치, 영상 증거를 연계해 허위 경보를 줄입니다. GPS 데이터가 급제동 사건을 검증하고 카메라가 주의 산만을 확인하면 운전자 수용률이 향상되며 안전 코칭이 실시간으로 이루어집니다. 예측 정비도 혜택을 보는데, AI 영상이 차량 마모를 가속화하는 운전자 행동을 감지하고 센서 진단과 결합하기 때문입니다. 2023년 판매된 신차의 75%에 기본 탑재된 OEM 내장형 텔레매틱스는 카메라 설치용 배선 하네스가 설치를 단순화하여 시스템 통합을 더욱 촉진합니다. 클라우드 배포가 주류를 이루며, 혼합 차량도 사내 서버 없이 분석 기능을 확장할 수 있습니다.

개인 정보 보호 및 데이터 보호 규정 준수 장벽

GDPR 규정은 생체 인식 데이터에 대한 명시적 동의, 삭제 권리 워크플로우, 안전한 익명화를 요구하여 차량 운영사가 복잡한 데이터 거버넌스 아키텍처를 구축하도록 강제합니다. 특정 관할권이 클라우드 위치를 제한함에 따라 국경을 넘는 운영은 저장 문제를 더욱 복잡하게 만들어 인프라 비용을 증가시킵니다. 개인정보 보호 의무는 항상 켜진 녹화를 선호하는 안전 규정과 충돌할 수 있어, 지오펜싱 기반 마스킹 및 실시간 얼굴 흐림 처리로 이어져 처리 오버헤드를 증가시킵니다. 완벽한 규정 준수 툴킷을 제공할 수 있는 벤더는 가격 프리미엄을 얻는 반면, 소규모 공급업체는 필요한 개발 자금을 조달하는 데 어려움을 겪습니다. 여러 지역에서 진행 중인 지속적인 입법 검토로 인해 규정 준수 목표가 계속 변경되면서 지속적인 소프트웨어 업데이트와 법률 자문이 필요해집니다.

부문 분석

통합 시스템은 2025년 비디오 텔레매틱스 시장의 57.10%를 차지했으며, 차량 관리 업체들이 안전, 유지보수, 경로 설정을 위한 플랫폼을 통합함에 따라 연평균 7.89%의 성장률을 보이고 있습니다. 텔레매틱스 데이터와 영상 증거의 결합은 감지 정확도를 높여 코칭을 개선하는 동시에 경보 피로를 줄입니다. OEM 파트너십은 카메라 장착용 하네스를 공장 출고 시 설치하여 개조 작업을 줄여 채택을 가속화합니다. 반면, 기본적인 녹화는 필요하지만 완전한 텔레매틱스 통합을 위한 자원이 부족한 비용 제약 운영사들 사이에서는 독립형 카메라가 여전히 사용되고 있습니다.

전개의 기세는 하드웨어 마진보다 소프트웨어 부가 기능에 연계된 구독 경제를 선호합니다. 내장형 연결성은 기기 교체 없이 새로운 분석 기능을 활성화하는 무선 업데이트를 지원합니다. 결과적으로 통합 구독자의 평생 가치는 일회성 카메라 판매를 능가하여 공급업체가 서비스를 번들로 묶도록 유도합니다. M&A 동향은 텔레매틱스 기업들이 역량 격차를 해소하고 반복 수익을 확보하기 위해 영상 전문 기업을 인수하는 모습을 보여줍니다.

대형 트럭은 소송 방어 및 보험료 할인으로 확립된 ROI를 바탕으로 2025년 비디오 텔레매틱스 시장 점유율 35.92%를 차지했습니다. 규제 기관은 운행 시간 규정 준수를 위해 ELD 통합 카메라를 의무화하여 장거리 차량군 내 보급률을 공고히 하고 있습니다. 지방자치단체가 승객 안전을 최우선으로 하는 ‘비전 제로(Vision Zero)’ 목표를 채택함에 따라 버스 시장도 꾸준한 성장세를 유지하고 있습니다. 경상용차 시장은 전자상거래 택배사들이 밀집된 도시 노선에서 경미한 접촉사고를 줄이기 위해 영상 코칭을 전개하며 완만한 성장을 보입니다.

승용차는 렌탈 및 리스 업체들이 실시간 운전자 행동 모니터링과 연계해 손해 면책 수수료를 부과함에 따라 7.29%의 연평균 성장률(CAGR)로 가장 가파른 상승세를 기록합니다. 사용량 기반 보험 시범 사업은 카메라를 장착해 원격 측정 데이터를 검증하고 사기를 방지함으로써 소비자 노출을 확대합니다. 가격 민감성에도 불구하고 스마트폰 연결형 카메라 도널이 진입 장벽을 낮춰, 개인 보험 가입자들이 영구 설치 없이 영상을 시험해 볼 수 있게 함으로써 혜택이 명확해질 때 통합 하드웨어로의 향후 업셀 경로를 마련합니다.

지역별 분석

북미는 성숙한 텔레매틱스 생태계와 보험사의 적극적인 참여로 2025년 38.30%의 점유율을 유지했습니다. 보험사는 안전 운전 기록에 따라 보험료 할인을 제공하여 소규모 운송업체까지 카메라 설치를 유도하고 있습니다. 데이터 사용에 대한 규제 명확화로 전개가 간소화되었으며, 교통량이 많은 구간의 5G 커버리지는 실시간 영상 전송을 가능케 하여 거의 즉각적인 보험금 청구 처리가 이루어집니다. 경쟁 압력은 이제 설치 대수에서 고급 분석으로 전환되고 있으며, 머신 러닝을 통해 사고 발생 전에 예측 가능한 위험 패턴을 식별합니다.

유럽은 GSR2(일반 보안 규정 2) 시행 후 급속한 확산세를 보입니다. 규정 준수 마감 시한으로 인해 운송사들은 운전자 모니터링 하드웨어 설치를 선택할 수밖에 없었기 때문입니다. 동시에 엄격한 GDPR(일반 데이터 보호 규정) 체제는 강력한 개인정보 보호 조치의 중요성을 부각시켜, 플랫폼 내 익명화 및 안전한 데이터 파이프라인을 제공하는 업체들에게 유리하게 작용합니다. 통합 솔루션이 번창하는 이유는 운영사들이 안전 규정과 비즈니스 최적화 요구를 동시에 충족하는 단일 대시보드를 선호하기 때문입니다. 친환경 운송 회랑에 대한 투자 증가로 인해, 친환경 화물 인증을 위한 에코 드라이빙 자격을 검증하는 기술에 대한 강조가 더욱 커지고 있습니다.

아시아태평양은 2031년까지 연평균 복합 성장률(CAGR) 7.38%로 가장 빠른 성장을 기록할 것으로 보이고, 대규모 전기화 인센티브와 야심찬 스마트 시티 계획이 이를 주도합니다. 중국의 전기 물류 차량은 배터리 상태, 충전 패턴, 운전자 행동을 종합적으로 모니터링해야 하므로 전기차 특성에 맞춘 영상 분석 수요가 증가하고 있습니다. 인도에서 학교 버스 및 대중교통에 차량 위치 추적 장치를 의무화함에 따라 시장 규모가 확대될 전망입니다. 지역 공급망에서 생산되는 비용 효율적인 하드웨어는 진입 장벽을 더욱 낮춰, 기존 장비 제약 없이 소규모 운영사들도 클라우드 분석으로 도약할 수 있게 합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트의 3개월간 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 차량용 텔레매틱스 통합 영상 솔루션 채택 증가

- 운전자 모니터링 및 ADAS 데이터 기록에 관한 규제 요건

- 카메라/엣지 AI 비용 저하

- 상업용 차량의 안전 규정 준수 강화

- 사용량 기반 보험의 영상 검증 청구 전환

- 도로 이미지 데이터의 수익화와 스마트 시티 연계

- 시장 성장 억제요인

- 개인정보 보호 및 데이터 보호 규정 준수 장벽

- 중소기업 차량을 위한 높은 하드웨어 및 설치 비용

- HD 및 4K 스트리밍을 위한 대역폭/저장 용량 부담

- 비디오 분석의 상호 운용성에 대한 개방형 표준 부족

- 업계 밸류체인 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업 협상력

- 구매자 협상력

- 신규 참가업체 위협

- 대체품 위협

- 경쟁도

- 투자분석

제5장 시장 규모와 성장 예측(단위)

- 유형별

- 통합 시스템

- 독립 시스템

- 차량 유형별

- 대형 트럭

- 버스 및 장거리 버스

- 소형 상용차(LCV)

- 승용차

- 전개 모델별

- 클라우드 기반

- 온프레미스/하이브리드

- 컴포넌트별

- 하드웨어(카메라, DVR/NVR, 센서)

- 소프트웨어 및 분석

- 서비스(설치, 구독, 지원)

- 지역별

- 북미

- 남미

- 유럽

- 아시아태평양

- 중동 및 아프리카

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 벤더의 시장 점유율과 포지셔닝

- Global Vendor Share

- North America Vendor Ranking

- Europe Vendor Ranking

- 기업 프로파일

- SmartWitness(Sensata Technologies)

- Verizon Connect(Verizon Communications Inc.)

- Omnitracs(Solera Holdings Inc.)

- FleetCam(Pty) Ltd

- VisionTrack Ltd

- Lytx Inc.

- Nauto Inc.

- SureCam(Europe)Limited

- LightMetrics Inc.

- NetraDyne Inc.

- Geotab Inc.

- ATandT Inc.

- Fleet Complete Inc.

- Samsara Inc.

- Octo Group SpA

- Motive Technologies Inc.

- One Step GPS LLC

- MiX Telematics Ltd

- Trimble Transportation(Trimble Inc.)

- Streamax Technology Co. Ltd

- Howen Technologies Co. Ltd

- Micronet Ltd

- PFK Electronics(Pty) Ltd

- Blackvue(Pittasoft Co. Ltd)

- Garmin Ltd

- Zonar Systems Inc.

- Azuga Holdings Inc.

제7장 시장 기회와 장래의 전망

HBR 26.01.29The video telematics market is expected to grow from USD 9.74 million in 2025 to USD 10.38 million in 2026 and is forecast to reach USD 14.27 million by 2031 at 6.58% CAGR over 2026-2031.

Mandated ADAS and driver-monitoring regulations in Europe, falling edge-AI hardware costs, and rising insurance incentives are accelerating adoption across commercial fleets. North American growth remains insurance-driven as carriers link premium discounts to video-verified driving behavior, while Asian demand rides on rapid electrification and smart-city programs. Integrated platforms that merge GPS, diagnostics, and AI video move to the forefront as fleets replace disparate systems, and the same convergence fuels a shift from one-time hardware sales toward subscription revenues tied to cloud analytics. Strategic acquisitions such as Powerfleet's purchase of Fleet Complete underscore the competitive race to bundle video, data, and fleet management within a single stack.

Global Video Telematics Market Trends and Insights

Regulatory mandates for driver-monitoring and ADAS data logging

The European Union enforced GSR2 in July 2024, requiring intelligent speed assist, autonomous emergency braking, and driver drowsiness detection in new vehicle approvals. Similar frameworks issued by the UN Economic Commission for Europe are prompting alignment in Asia and the Americas. Insurers now demand video-verified ADAS data to confirm liability, converting dashcams from discretionary tools into compliance necessities. The requirement for continuous driver-distraction warnings pushes fleets toward multi-camera installations that integrate with telematics dashboards. As regional rollouts widen, vendors that deliver off-the-shelf compliance packages gain a first-mover advantage. The cascading effect extends to aftermarket retrofits because mixed-age fleets must retrofit older vehicles to meet contract terms with shippers and logistics brokers.

Increasing adoption of fleet telematics-integrated video solutions

Fleet managers once balanced separate contracts for location tracking, maintenance scheduling, and video safety. Integrated video telematics platforms now bundle these functions under a single subscription, streamlining workflows and reducing false alerts by correlating speed, location, and video evidence. When GPS data validates harsh-brake events and cameras confirm distraction, driver acceptance rates improve and safety coaching becomes real time. Predictive maintenance also benefits, as AI video detects driver behavior that accelerates vehicle wear and combines it with sensor diagnostics. OEM-embedded telematics, standard on 75% of new cars sold in 2023, further propels system integration because camera-ready wiring harnesses simplify installation. Cloud deployment dominates, letting mixed fleets scale analytics without on-premise servers.

Privacy and data-protection compliance hurdles

GDPR rules require explicit consent for biometric data, right-to-erasure workflows, and secure anonymization, forcing fleets to deploy complex data-governance architectures. Cross-border operations further complicate storage because certain jurisdictions restrict cloud locations, raising infrastructure costs. Privacy obligations can clash with safety mandates that favor always-on recording, leading to geofenced masking and real-time face blurring that add processing overhead. Vendors able to deliver turnkey compliance toolkits gain a pricing premium, while smaller providers struggle to fund the necessary development. Ongoing legislative reviews in multiple regions keep compliance targets moving, prompting continuous software updates and legal consultations.

Other drivers and restraints analyzed in the detailed report include:

- Falling camera and edge-AI costs

- Growing safety-compliance focus among commercial fleets

- High hardware and installation costs for SMB fleets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Integrated systems controlled 57.10% of the video telematics market in 2025 and are expanding at an 7.89% CAGR as fleets consolidate platforms for safety, maintenance, and routing. The coupling of telematics data with video evidence increases detection accuracy, improving coaching while reducing alert fatigue. OEM partnerships accelerate uptake by factory-installing camera-ready harnesses that cut retrofitting labor. In contrast, standalone cameras persist among cost-constrained operators that need basic recording but lack resources for full telematics integration.

Deployment momentum favors subscription economics tied to software add-ons rather than hardware margins. Embedded connectivity supports over-the-air updates that unlock new analytics without swapping devices. As a result, the lifetime value of an integrated subscriber outpaces a one-off camera sale, motivating vendors to bundle services. M&A activity shows telematics firms buying vision specialists to close capability gaps and secure recurring revenues.

Heavy trucks captured 35.92% of the video telematics market share in 2025, anchored by well-established ROI through litigation defense and premium discounts. Regulatory bodies mandate ELD-integrated cameras for hours-of-service compliance, cementing penetration in long-haul fleets. Buses maintain steady uptake as municipalities adopt Vision Zero targets that prioritize passenger safety. Light commercial vehicles experience moderate growth as e-commerce couriers adopt video coaching to reduce fender-benders in dense urban routes.

Passenger cars post the steepest rise at a 7.29% CAGR, propelled by rental and leasing companies that tie damage-waiver fees to real-time driver behavior monitoring. Usage-based insurance pilots embed cameras to validate telemetry and curb fraud, broadening consumer exposure. Despite price sensitivity, smartphone-linked camera dongles lower barriers, allowing personal-line policyholders to trial video without permanent installations, priming a future upsell path to integrated hardware as benefits become evident.

The Video Telematics Market Report is Segmented by Type (Integrated Systems, and Stand-Alone Systems), Vehicle Type (Heavy Trucks, Buses and Coaches, Light Commercial Vehicles, and Passenger Cars), Deployment Model (Cloud-Based, and On-premises/Hybrid), Component (Hardware [Cameras, and More}, Software and Analytics, and Services [Installation, and More]), and Geography. The Market Forecasts are Provided in Terms of Value (Units).

Geography Analysis

North America retained 38.30% share in 2025 on the back of mature telematics ecosystems and strong insurer engagement. Carriers link premium savings to documented safe driving, encouraging even small haulers to add cameras. Regulatory clarity on data usage streamlines rollouts, and 5G coverage in high-traffic corridors allows real-time video transfer for near-instant claims processing. Competitive pressure now pivots away from installation counts toward advanced analytics, where machine learning identifies predictive risk patterns before incidents occur.

Europe shows brisk uptake following GSR2, as compliance deadlines leave fleets little choice but to install driver-monitoring hardware. The strict GDPR regime simultaneously elevates the importance of robust privacy safeguards, rewarding providers with in-platform anonymization and secure data pipelines. Integrated solutions prosper because operators prefer single dashboards that satisfy both safety mandates and business optimization imperatives. Increasing investment in clean transport corridors places further emphasis on technology that validates eco-driving credentials for green freight certification.

Asia Pacific posts the fastest growth at 7.38% CAGR to 2031, fueled by large-scale electrification incentives and ambitious smart-city programs. China's electric logistics fleets require combined monitoring of battery health, charging patterns, and driver behavior, generating incremental demand for video analytics tailored to EV dynamics. India's mandate for vehicle location tracking on school buses and public transport similarly broadens addressable volumes. Cost-efficient hardware produced in regional supply chains further lowers barriers, enabling smaller operators to leapfrog to cloud analytics without legacy equipment constraints.

- SmartWitness (Sensata Technologies)

- Verizon Connect (Verizon Communications Inc.)

- Omnitracs (Solera Holdings Inc.)

- FleetCam (Pty) Ltd

- VisionTrack Ltd

- Lytx Inc.

- Nauto Inc.

- SureCam (Europe) Limited

- LightMetrics Inc.

- NetraDyne Inc.

- Geotab Inc.

- ATandT Inc.

- Fleet Complete Inc.

- Samsara Inc.

- Octo Group SpA

- Motive Technologies Inc.

- One Step GPS LLC

- MiX Telematics Ltd

- Trimble Transportation (Trimble Inc.)

- Streamax Technology Co. Ltd

- Howen Technologies Co. Ltd

- Micronet Ltd

- PFK Electronics (Pty) Ltd

- Blackvue (Pittasoft Co. Ltd)

- Garmin Ltd

- Zonar Systems Inc.

- Azuga Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing adoption of fleet telematics-integrated video solutions

- 4.2.2 Regulatory mandates for driver-monitoring and ADAS data logging

- 4.2.3 Falling camera/edge-AI costs

- 4.2.4 Growing safety-compliance focus among commercial fleets

- 4.2.5 Usage-based-insurance shift to video-verified claims

- 4.2.6 Road-image data monetisation and smart-city partnerships

- 4.3 Market Restraints

- 4.3.1 Privacy and data-protection compliance hurdles

- 4.3.2 High hardware and installation costs for SMB fleets

- 4.3.3 Bandwidth / storage burdens for HD and 4K streaming

- 4.3.4 Lack of open standards for video-analytics interoperability

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (UNITS)

- 5.1 By Type

- 5.1.1 Integrated Systems

- 5.1.2 Stand-alone Systems

- 5.2 By Vehicle Type

- 5.2.1 Heavy Trucks

- 5.2.2 Buses and Coaches

- 5.2.3 Light Commercial Vehicles (LCV)

- 5.2.4 Passenger Cars

- 5.3 By Deployment Model

- 5.3.1 Cloud-based

- 5.3.2 On-premises / Hybrid

- 5.4 By Component

- 5.4.1 Hardware (Cameras, DVR/NVR, Sensors)

- 5.4.2 Software and Analytics

- 5.4.3 Services (Installation, Subscription, Support)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 South America

- 5.5.3 Europe

- 5.5.4 Asia Pacific

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Vendor Market Share and Positioning

- 6.4.1 Global Vendor Share

- 6.4.2 North America Vendor Ranking

- 6.4.3 Europe Vendor Ranking

- 6.5 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.5.1 SmartWitness (Sensata Technologies)

- 6.5.2 Verizon Connect (Verizon Communications Inc.)

- 6.5.3 Omnitracs (Solera Holdings Inc.)

- 6.5.4 FleetCam (Pty) Ltd

- 6.5.5 VisionTrack Ltd

- 6.5.6 Lytx Inc.

- 6.5.7 Nauto Inc.

- 6.5.8 SureCam (Europe) Limited

- 6.5.9 LightMetrics Inc.

- 6.5.10 NetraDyne Inc.

- 6.5.11 Geotab Inc.

- 6.5.12 ATandT Inc.

- 6.5.13 Fleet Complete Inc.

- 6.5.14 Samsara Inc.

- 6.5.15 Octo Group SpA

- 6.5.16 Motive Technologies Inc.

- 6.5.17 One Step GPS LLC

- 6.5.18 MiX Telematics Ltd

- 6.5.19 Trimble Transportation (Trimble Inc.)

- 6.5.20 Streamax Technology Co. Ltd

- 6.5.21 Howen Technologies Co. Ltd

- 6.5.22 Micronet Ltd

- 6.5.23 PFK Electronics (Pty) Ltd

- 6.5.24 Blackvue (Pittasoft Co. Ltd)

- 6.5.25 Garmin Ltd

- 6.5.26 Zonar Systems Inc.

- 6.5.27 Azuga Holdings Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment